Generative AI is doing more than just tweaking the insurance industry; it’s rebuilding it from the inside out. For decades, the sector has been bogged down by slow, manual processes. Now, this technology is sparking a move toward dynamic, intelligent operations. It’s the engine behind a complete reinvention of core functions like underwriting, claims management, and customer service, allowing insurers to automate complex work, personalize customer interactions, and simply make better decisions, faster.

How Generative AI is Redefining Insurance

The shift to generative AI in insurance industry is a fundamental change in how the business of insurance gets done. Think of it like a cartographer swapping an old paper map for a real-time, satellite-fed GPS. The destination hasn’t changed; it’s still about providing coverage and managing risk, but the tools to navigate that landscape are infinitely more efficient, precise, and user-friendly. This is all possible because of AI’s ability to sift through, understand, and even create content from massive pools of unstructured data, from customer emails and call transcripts to complex accident reports.

This isn’t some far-off theory; it’s happening right now, and the investment numbers back it up. The North American generative AI market in insurance is projected to leap from USD 1.09 billion in 2025 to an incredible USD 14.30 billion by 2034. That kind of explosive growth is a direct result of AI’s power to handle the repetitive, time-consuming tasks that have historically tied up skilled professionals.

The Core of the Change

At its heart, this change is all about creating more value at every step of the insurance process. To really get a handle on the scale of this shift, it helps to understand what Generative BI is and how it fuels smarter, data-backed insights. It’s what helps insurers move from simply reacting to problems to proactively shaping their strategy.

We’re seeing this reinvention play out in a few key areas:

- Smarter Underwriting: Instead of relying on limited data sets, AI can analyze thousands of different points to assess risk far more accurately. This dramatically cuts down the time underwriters spend on administrative grunt work.

- Faster Claims Processing: Generative AI can instantly summarize complex claims reports, flag patterns that suggest potential fraud, and even automate communications with customers. Suddenly, a process that took weeks can be done in a matter of hours.

- Personalized Customer Engagement: Insurers can now create policy recommendations, marketing campaigns, and support responses that are genuinely tailored to what an individual customer actually needs.

To give you a clearer picture, here’s a quick breakdown of how these solutions are directly addressing long-standing industry challenges.

Generative AI Impact Across Core Insurance Functions

| Insurance Function | Traditional Challenge | Generative AI Solution |

|---|---|---|

| Underwriting | Manual data entry and subjective risk assessment | Automated data analysis from diverse sources for precise risk scoring and policy pricing. |

| Claims Processing | Slow, paper-intensive, and prone to human error | Automated claims intake, fraud detection, and generation of settlement summaries. |

| Customer Service | High call volumes, long wait times, and generic responses | 24/7 intelligent chatbots, personalized email generation, and proactive support. |

| Marketing & Sales | Broad, one-size-fits-all campaigns with low engagement | Hyper-personalized marketing content and product recommendations based on individual data. |

This table really highlights the direct line from problem to solution that generative AI provides, turning traditional bottlenecks into opportunities for efficiency and better service.

By automating up to 29% of working hours in the insurance sector, generative AI elevates human talent. Professionals are freed from mundane tasks to focus on complex problem-solving and building stronger client relationships.

Of course, this shift also means that digital defences have to be stronger than ever. As these advanced AI systems are fuelled by sensitive data, robust cybersecurity is non-negotiable. Building this new operational model requires a solid foundation of both innovative technology and a firm commitment to security and ethical governance.

Putting Generative AI to Work in Your Agency

The buzz around generative AI is one thing, but seeing it solve real-world problems in an insurance agency is where its true value shines. This isn’t some far-off concept anymore; it’s a practical tool that’s already being used across the entire insurance value chain. It’s tackling persistent headaches, from sluggish underwriting to impersonal customer service, by automating and assisting with core tasks. For agencies, this means a massive boost in productivity and more time to focus on what really matters: the client.

This shift is picking up speed fast. In the Canadian insurance sector, adoption is accelerating. A recent PwC Canada survey found that 52% of Canadian insurance CEOs are confident that generative AI will increase their company’s profitability this year. This isn’t just talk; it’s leading to real investment as insurers work to make their operations smoother and deliver personalized experiences on a scale we’ve never seen before. You can explore the full PwC Canada findings to get a deeper look at this trend.

Powering Up Underwriting and Distribution

Underwriting has always been a major bottleneck. Professionals often get bogged down in administrative work instead of spending their time on high-value risk analysis. Generative AI steps in here as an incredibly efficient assistant, changing the entire workflow.

Think about an underwriter who gets hundreds of broker submissions in their inbox. Instead of slogging through each one manually, a generative AI tool can jump in and instantly:

- Extract Key Data: It intelligently scans unstructured documents like emails and PDFs, pulling out the critical information and neatly organizing it.

- Summarize Risk Profiles: The AI creates quick, clear summaries for each submission, flagging key risk factors and potential issues right away.

- Enrich Information: It can also check submission details against third-party data sources, giving the underwriter a much more complete picture for their assessment.

It’s been shown that underwriters can spend up to 40% of their time on non-core administrative tasks. Generative AI can take over much of this work, freeing them up to concentrate on complex decisions and strategic thinking.

This level of automation means underwriters can handle more submissions with greater accuracy and speed. The result? Faster quotes for brokers and, most importantly, a much better experience for the end customer.

Reshaping Claims Processing

Claims processing is another area just waiting for this kind of innovation. The path from a first notice of loss to a final settlement can be long and complicated, involving a mountain of documents, back-and-forth communication, and detailed assessments.

Generative AI models can take in massive amounts of claims-related data, everything from photos and adjuster notes to medical reports and legal papers. From there, they can summarize the key details, spot inconsistencies that might point to fraud, and even draft initial settlement offers for a human to review. We’ve covered this in more detail before; you can learn more about how AI is transforming insurance claims processing in our dedicated guide.

This drastically shortens the claims cycle, turning a process that used to take weeks into something that can be handled in days or even hours. Faster resolutions don’t just cut down on operational costs; they make a huge difference in policyholder satisfaction during what is often a very stressful time.

Personalizing Marketing and Customer Engagement

Finally, generative AI is completely changing how insurers talk to their clients. Gone are the days of generic, one-size-fits-all marketing. Now, AI can help create highly personalized content that truly connects with specific customer groups.

For example, an AI can sift through customer data to generate targeted email campaigns for new insurance products, write personalized policy renewal reminders, or develop scripts for chatbots that provide instant, helpful answers to common questions. This approach makes every interaction feel relevant and valuable, which goes a long way in building stronger customer loyalty and trust.

Unlocking the Real Business Benefits of AI

Let’s move past the technical jargon for a moment. The real test for generative AI isn’t what it can do, but what tangible results it delivers to the business. Adopting this technology is less about chasing the latest trend and more about finding measurable ways to improve efficiency, keep customers happy, and boost profitability.

When we break it down, the return on investment becomes crystal clear. We’re talking about high-impact wins that directly address the core challenges insurers face every day.

From streamlining back-office grunt work to completely rethinking how new products are launched, strategically applying AI creates a powerful ripple effect. The potential to make a serious dent in combined ratios is huge, with the biggest gains often showing up in underwriting and claims.

Radical Operational Efficiency

One of the first and most obvious wins is a massive jump in operational efficiency. AI models are brilliant at automating the repetitive, soul-crushing tasks that tie up your most skilled people. This frees them up to focus on the complex decisions and strategic work where their expertise truly matters.

Take claims processing. It’s a notoriously slow and paper-heavy part of the business. By bringing in AI, some insurers are seeing a staggering 70% reduction in claims processing time. An AI can read, analyse, and summarize thousands of pages of documents in seconds, flagging key details and potential fraud indicators for a human adjuster to review.

Think about what that means. A claim can be assessed and settled in hours or minutes, not days or weeks. This drastically lowers operational costs and gets money into the hands of policyholders when they need it most.

The same idea applies to underwriting. AI can automate the intake of broker submissions and pull in data from other sources, letting underwriters skip the administrative slog and get straight to high-value analysis. The result is a much leaner, more agile operation that can handle more business with greater accuracy.

Superior Customer Experiences

In a crowded market, the experience you provide is what sets you apart. AI is opening the door to a new kind of hyper-personalized service that builds real loyalty. Instead of one-size-fits-all interactions, you can offer support and products that feel like they were made for each customer.

Generative AI-powered chatbots and virtual assistants can provide 24/7 support, instantly answering common questions and smoothly handing off more complex issues to a human agent. That immediate response makes a huge difference. In fact, companies that get their AI-driven customer service right have seen their Net Promoter Score (NPS) jump by as much as 30 points. The secret isn’t just speed; it’s about providing quality, personalized help. To get a better feel for this, you can learn more by reading about how to create an exceptional AI-driven customer experience in insurance.

Smarter Risk Management

At its heart, insurance is a business of managing risk. AI gives us the tools to assess, price, and mitigate that risk with a precision we’ve never had before. By sifting through massive and diverse datasets, everything from historical claims to real-time weather patterns, AI models can spot subtle patterns and connections that a human analyst could easily miss.

This deeper insight leads to more accurate underwriting and pricing. You reduce premium leakage and make sure policies are priced correctly for the risk you’re taking on. Of course, as insurers rely more on these sophisticated digital tools, the need for top-notch security grows right along with it.

Accelerated Product Innovation

Finally, generative AI is a massive catalyst for innovation. It helps insurers design and launch new products much faster than the old way of doing things. By analysing market trends and customer behaviour, AI can pinpoint unmet needs and spark ideas for entirely new types of coverage.

The development cycle itself gets a major speed boost. AI can help draft policy documents, generate marketing copy, and build pricing models. This can lead to a 50% faster launch time for new, customized insurance products, letting carriers respond to market shifts in real-time and grab a significant competitive advantage.

Navigating the Hurdles of AI Implementation

While the potential of generative AI is exciting, getting it right isn’t a walk in the park. Jumping into this technology means having a realistic grasp of the challenges ahead, from keeping data safe and navigating tricky regulations to avoiding hidden biases in the algorithms. To truly tap into the power of generative AI, you have to meet these issues head-on.

The upfront costs can feel steep. You’re not just buying software; you’re often investing in new infrastructure and the skilled people needed to run it. But when you weigh that against the long-term wins in speed and accuracy, the business case for moving forward becomes pretty clear.

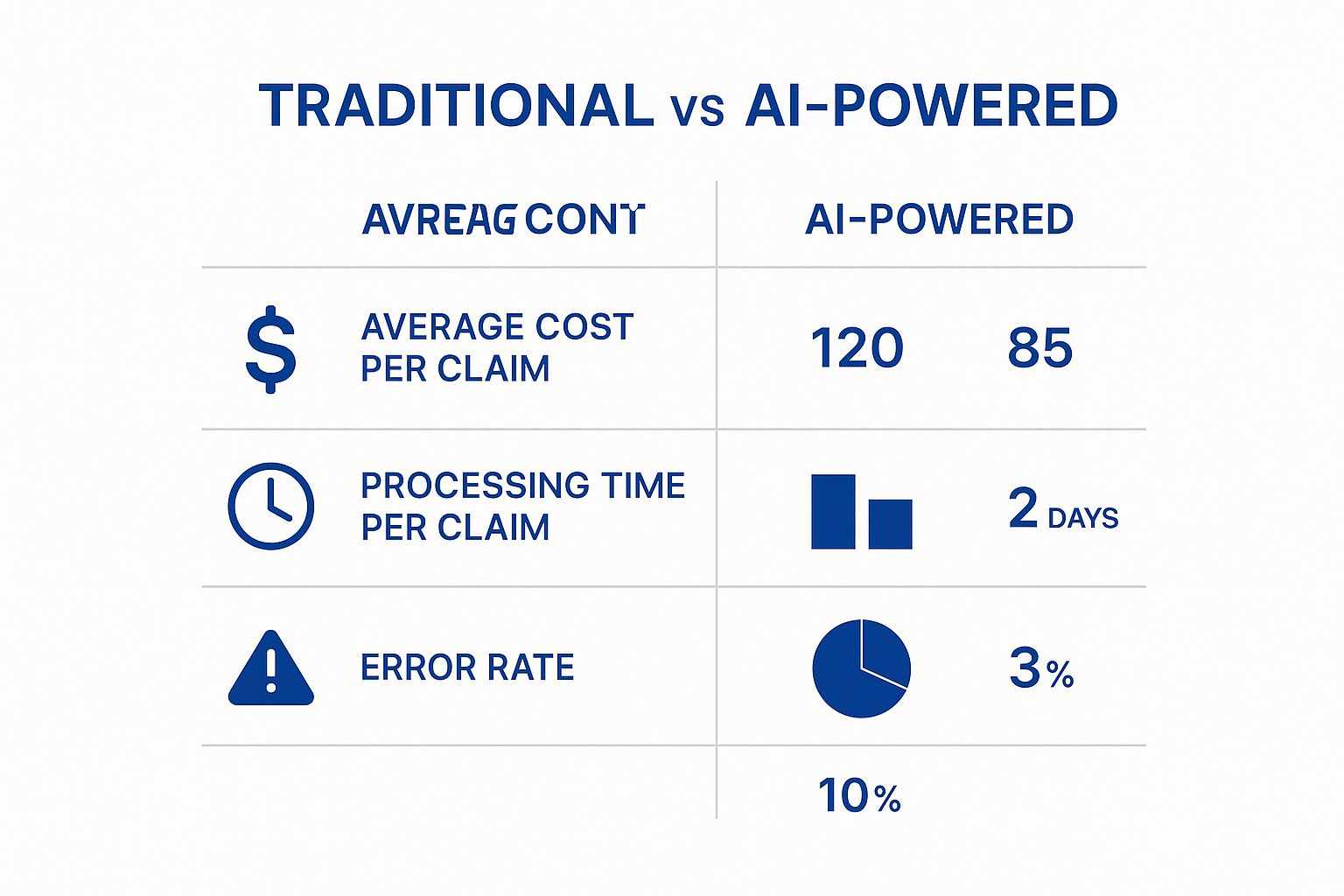

The infographic below really puts the difference between old-school methods and AI-driven systems into perspective.

As you can see, the numbers speak for themselves. The significant drop in claim costs and processing times, paired with fewer errors, more than justifies the effort to get these systems in place.

The Challenge Of Data Privacy And Security

Insurance companies are guardians of a massive amount of personal information, which puts privacy and security at the top of the list. Large language models are trained on huge datasets, raising tough but fair questions about how that information is handled, stored, and kept secure. An AI-related data breach could be devastating, shattering customer trust and damaging a company’s reputation for years.

This is exactly why strong data governance is non-negotiable. It means setting up crystal-clear rules for data handling, anonymizing personal details wherever possible, and deploying top-tier security to lock everything down. It’s also crucial to have a solid plan from the start, which you can learn more about in our guide on AI and data privacy in insurance explained.

Navigating a Complex Regulatory Landscape

The rulebook for AI in the Canadian insurance sector is still being written, which can feel like trying to navigate without a map. There isn’t a single federal law governing it all just yet, but regulators are definitely paying closer attention.

Provinces like Québec, Ontario, and Alberta are already moving ahead with their own privacy laws that have a direct impact on how AI can be used. This patchwork of regulations means insurers have to be incredibly careful to stay compliant across different provincial lines, which adds another layer of work to any AI project.

Mitigating Algorithmic Bias

One of the thorniest ethical problems with AI is the risk of algorithmic bias. These models learn from the data we give them. If that historical data contains biases from past underwriting or claims decisions, the AI will not only learn them but could actually make them worse.

This can lead to unfair outcomes for certain groups of people, opening the door to serious legal and ethical headaches. For a deeper dive, it’s worth understanding the risks of Generative AI before you get too far down the road.

Getting ahead of these implementation risks is critical for any insurance company looking to adopt generative AI responsibly. The table below outlines some of the most common challenges and practical ways to manage them.

Common Generative AI Implementation Risks And Mitigation Strategies

| Risk Category | Description of Challenge | Recommended Mitigation Strategy |

|---|---|---|

| Data Privacy & Security | Training AI models often requires access to sensitive customer data, creating significant risks of breaches or misuse. | Implement robust data anonymization and encryption. Enforce strict access controls and conduct regular security audits. |

| Regulatory Compliance | The legal framework for AI is fragmented and evolving, especially across different Canadian provinces, making it hard to ensure compliance. | Establish a dedicated compliance team to monitor regulatory changes. Build flexible AI systems that can be easily updated to meet new rules. |

| Algorithmic Bias | AI models trained on historical data can inherit and amplify existing biases, leading to discriminatory outcomes in underwriting or claims. | Curate and clean training datasets to remove biases. Regularly audit models for fairness and performance across different demographic groups. |

| “Black Box” Problem | Many complex AI models, especially deep learning networks, are difficult to interpret, making it hard to explain their decisions to customers or regulators. | Favour explainable AI (XAI) models where possible. Implement a ‘human-in-the-loop’ system for reviewing and validating critical AI-driven decisions. |

| Implementation Costs | The initial investment in AI technology, infrastructure, and specialized talent can be substantial and difficult to budget for. | Start with smaller, high-impact pilot projects to prove ROI. Explore phased rollouts and cloud-based AI services to manage upfront costs. |

Ultimately, tackling these hurdles isn’t just about deploying new software. It’s about building a responsible AI framework from the ground up: one that’s rooted in solid governance, security, and a firm commitment to ethical practices.

Your Strategic Roadmap to AI Integration

Jumping into AI can feel overwhelming, but the right roadmap breaks the journey down into manageable steps. Success with generative AI in the insurance industry isn’t about one giant leap; it’s about a series of deliberate phases that build on each other. Think of it as a clear framework to guide your firm from initial curiosity to full-scale integration, making sure every move adds real business value.

Instead of trying to overhaul everything at once, this phased approach lets your team learn, adapt, and build confidence. By following a clear path, you can keep costs in check, sidestep common risks, and ensure your AI initiatives are tied directly to your core business goals right from the start.

Phase 1: Discovery and Strategic Planning

Before you write a single line of code, you need to connect AI’s potential with your business’s reality. This discovery phase is all about finding the specific pain points and opportunities where AI in the insurance industry can actually make a difference. It’s a process of asking the right questions to figure out where intelligent automation can solve real, everyday problems.

Start by mapping out your current workflows. Where are the biggest bottlenecks? Are your underwriters bogged down by administrative tasks? Is your claims process lagging behind competitors? Answering these questions helps you set clear, achievable goals for your AI strategy.

To nail this phase, you’ll want to:

- Pinpoint High-Value Use Cases: Look for specific processes like claims summarization or policy document generation where AI can deliver a clear, measurable return on investment.

- Assess Your Data Readiness: Take a hard look at the quality, accessibility, and security of your data. Solid data governance is the foundation of any successful AI project.

- Get Stakeholder Buy-In: Be clear with leadership and key teams about the potential benefits and realistic timelines. You need everyone aligned and on board to make it work.

Phase 2: Pilot Projects and Proof of Concept

With a strategy in hand, it’s time to test your assumptions on a smaller scale. A pilot project is a low-risk, controlled experiment designed to prove that your chosen AI solution can deliver the results you expect. The key is to pick a project that’s both manageable and has the potential for a quick, visible win.

For example, you could start with an AI tool that automates pulling key information from broker submissions. This is a contained problem with a simple success metric: less time spent on manual data entry for underwriters. As we explored in our generative AI adoption guide, starting small is how you build crucial momentum.

A successful pilot is your most powerful proof of concept. It doesn’t just validate the tech; it builds genuine enthusiasm across the organisation, making it much easier to get the resources you need for bigger projects down the road.

This phase is all about learning and refining. It gives you invaluable insights into the practical challenges of implementation, from technical integration to user training, before you commit to a full-scale rollout.

Phase 3: Scaling and Full Integration

Once your pilot projects have proven their worth, it’s time to scale up. This phase involves expanding your AI solution across an entire department or even the whole organisation. It demands careful planning to ensure a smooth transition with minimal disruption, all while maintaining performance as the system handles more volume and complexity.

This is where having expert AI development services becomes absolutely critical. Integration often means connecting the AI model with your core systems, like a claims management platform or underwriting workbench, to create a seamless workflow. Strong project management, clear communication, and thorough employee training are what drive adoption and make sure everyone knows how to use the new tools effectively.

Phase 4: Continuous Optimization and Governance

Putting AI in place isn’t a one-and-done project. This final phase is a continuous cycle of monitoring, optimizing, and governing your AI systems to make sure they stay effective, secure, and compliant for the long haul. As the market and customer expectations shift, your AI models need to adapt right along with them.

This ongoing process involves:

- Performance Monitoring: Regularly tracking key metrics to ensure the AI is delivering the expected ROI and accuracy.

- Model Retraining: Periodically updating models with fresh data to keep them sharp and relevant.

- Ethical Governance: Constantly auditing for bias and ensuring you’re compliant with evolving regulations. This includes maintaining strong cybersecurity services for the insurance industry to protect the sensitive data that fuels your AI.

By embracing this cycle of continuous improvement, you create a living AI ecosystem that grows with your business, solidifying your position as a forward-thinking leader. To pull this off, it helps to work with a team that truly understands this journey. You can learn more about us and our approach to innovation.

What’s Next? A Glimpse into the Future of Insurance

Looking down the road, it’s clear that generative AI is poised to do much more than just speed up a few tasks. We’re talking about a genuine shift in how the insurance business operates at its core. This isn’t just another piece of software; it’s the start of a new chapter where the industry moves from simply reacting to risk to proactively engaging with it.

We’re heading towards a future where an insurance policy isn’t a static piece of paper. Instead, think of it as a living, breathing agreement that constantly adapts to new information.

Imagine a world with hyper-personalized policies. A commercial trucking policy could adjust its premiums in real-time based on route data and driver behaviour. A homeowner’s policy might change based on readings from smart sensors that detect a water leak early. This kind of tailoring is set to become the standard, leading to products that are not only fairer but also far more accurate.

The Road to Full Autonomy

But the evolution doesn’t stop there. The long-term picture for generative AI in the insurance industry points toward fully autonomous systems handling most of the routine work.

Picture a claims process that goes from the first notice of loss to the final payout with almost no human touch. An AI could interpret photos of a damaged car, instantly verify the policy details, and authorize a payment in minutes, not days. This would free up your human experts to focus on what they do best: handling complex cases, showing empathy to customers in distress, and thinking strategically.

Underwriting is on a similar path. It’s becoming a continuous, automated cycle where AI constantly sifts through market data to sharpen risk models and pricing. This isn’t just about efficiency; it’s about keeping carriers nimble and competitive in a market that never stands still.

This journey is a complete reinvention. The future of the AI in the insurance industry isn’t about doing the same things faster. It’s about finding entirely new ways to deliver value, manage risk, and serve customers with a level of precision we’ve never seen before.

Getting this right requires more than just good technology; it demands a smart partner. A team of experts can help you build a solid foundation, weaving in powerful AI development services that truly support your business goals. Real innovation needs both a clear vision and the technical skill to make it happen. To see our commitment to this future, you can find out more about us and how we can help you lead the charge.

Answering Your Questions

Let’s tackle some of the common questions we hear from insurance professionals who are exploring generative AI.

What’s the single biggest impact we’ll see on claims processing?

The most immediate and noticeable change is the sheer speed. Generative AI can take a claims process that used to stretch over weeks and shrink it down to just a few days, or in some cases, even hours.

Think about it: the system can instantly scan and understand claims documents, pull out the key details, and even do an initial damage assessment from photos. It can also flag potential fraud and draft the first message back to the policyholder. This frees up your human experts to handle the complex cases, driving down operational costs and making customers much happier during a stressful time. This is where generative AI in the insurance industry truly shines.

How do we make sure we’re using this ethically and not creating bias?

This is a critical question, and it takes a thoughtful, multi-layered approach to get it right. It all starts with the data you use to train your models. If the data is skewed, your AI’s outputs will be too. You need to be deliberate about using diverse and representative datasets from the very beginning.

Next, you absolutely must keep a “human-in-the-loop” for the big decisions. An AI can suggest a path, but a human expert should always have the final say on things like denying a claim or setting a complex policy premium. This provides a vital layer of oversight.

Finally, you need a strong AI governance framework. This means conducting regular audits to check for fairness and transparency, ensuring the system is operating as intended. Building this structure is fundamental to maintaining trust with customers and regulators and is a core part of responsible AI development services.

We’re a smaller agency. What’s the best way to get started?

Don’t try to boil the ocean. The smartest first step for a smaller firm is to pick one specific, high-value problem and solve it with a pilot project.

Look for a clear pain point. For example, you could automate the answers to frequently asked customer service questions or build a simple tool that summarises long, complicated claims notes for your adjusters. Starting small proves the value of the technology quickly, generates enthusiasm, and lets you learn without a massive upfront investment. As we covered in our generative AI adoption guide, this phased approach is the best way to manage risk and demonstrate a return on your investment early on.