When you’re staring down a list of chargebacks and flagged orders, it’s easy to focus on the immediate financial hit. But that’s just the tip of the iceberg. The real cost of ecommerce fraud is a slow burn, quietly eating away at your business from the inside out. It's not just about the value of the stolen goods; it's about lost time, frustrated customers, and a tarnished reputation.

The Hidden Costs of Ecommerce Fraud

For most online store owners, a chargeback is the most obvious sign of fraud. But behind every single fraudulent transaction, there’s a chain reaction of hidden costs that can hamstring your operations and stunt your growth. The old way of doing things, relying on simple, rule-based security, just doesn't cut it anymore against today's sophisticated fraudsters.

In fact, those outdated systems often cause more harm than good. They can be too rigid, accidentally blocking legitimate customers and creating a clunky checkout experience that leads to abandoned carts. At the same time, clever criminals have learned how to dance around these simple rules, making them largely ineffective. This is precisely why a smarter, more dynamic defence is no longer a "nice-to-have."

Beyond the Transaction Loss

Think about what happens after a fraudulent order is placed. The loss isn't just the price of the product. Your team has to spend valuable hours manually reviewing flagged transactions, pulling them away from focusing on customer service, marketing, or developing new products. Every minute spent on a suspicious order is a minute you're not investing in growing your business.

This is where AI fraud detection for ecommerce shifts from being a simple security tool to a core business strategy. It’s about more than just stopping bad guys; it’s about freeing up your team to focus on what they do best.

Let's break down some of the most damaging hidden costs:

Operational Waste: The time and salaries of your team members stuck doing manual reviews add up fast. It’s a huge drain on resources that could be better used elsewhere.

Customer Insult Rate: Have you ever had your card declined for no reason? That's what happens when overly cautious, non-AI systems flag a good customer by mistake. These "false positives" are insulting and can send loyal shoppers straight to your competition.

Reputational Damage: Word travels fast. A reputation for a difficult checkout process or, worse, a security breach, can destroy the trust you've worked so hard to build.

Increased Fees: Payment processors don't like high chargeback rates. They can hit you with higher fees or even threaten to close your merchant account altogether.

The Scale of the Problem in Canada

This isn't just a theoretical problem; it’s happening right here, right now. In 2024 alone, the Canadian Anti-Fraud Centre (CAFC) fielded 108,878 fraud reports, tallying up over $638 million in reported losses. Merchandise fraud, a classic ecommerce scam, was a huge part of that, costing thousands of victims millions of dollars. You can dig into the numbers yourself in the full report on the rising threat of digital fraud.

This data paints a clear picture: relying on outdated defences is like bringing a padlock to a digital heist. An intelligent, adaptive security posture is no longer optional for survival and growth.

Protecting your business means thinking ahead. Solid security needs to be woven into the fabric of your business plan, a philosophy we live by in our ecommerce strategy & consulting services. As a leading software development company, we know that a strong foundation is the only way to build lasting success. By bringing in AI, you stop playing defence and start proactively protecting both your bottom line and your brand.

Decoding Modern Ecommerce Fraud Tactics

To build a solid defence, you first have to get inside the attacker's head. Fraudsters are always cooking up new schemes, and their methods go way beyond simply using a stolen credit card number. Getting a handle on these modern ecommerce fraud tactics is the first real step toward putting a smart AI fraud detection for ecommerce strategy in place.

Forget the stereotype of a technical genius in a dark room. Today's criminals are more likely to exploit human psychology and poke holes in system processes. They play a game of speed and volume, often hitting dozens of stores before a human review team has even had their morning coffee. This is precisely why you need to know the tell-tale signs of each attack.

The Classic Schemes with a Modern Twist

The oldest tricks in the book have been updated for the digital age, making them incredibly tough to catch with old-school, rigid rules. A purchase from a new IP address could be a tourist on holiday or a fraudster with a stolen card. Context is everything, and that’s where AI really shines. As we’ve explored in our guide to artificial intelligence for threat detection, AI models can weigh hundreds of different data points at once to see the complete picture, not just one suspicious signal.

Here are the main types of fraud that online stores are up against right now:

Payment Fraud: This is the one everyone knows. A criminal gets their hands on stolen credit or debit card details and uses them to buy stuff from your store. They’re usually after high-value items that they can easily sell off before the real cardholder even notices the charge on their statement.

Account Takeover (ATO) Fraud: This one is far more personal and damaging. Scammers use stolen usernames and passwords, often scooped up from data breaches on other, less secure websites, to hijack a real customer's account. Once inside, they can place orders, burn through loyalty points, and steal sensitive information. This doesn't just hurt the customer; it can seriously tarnish your brand's reputation.

Chargeback or 'Friendly' Fraud: This happens when a legitimate customer buys something, receives it, and then calls their bank to dispute the charge. They might claim they never got the item or that the transaction was fraudulent. While it can be an honest mistake, it's often done on purpose to get both the product and a full refund.

The Rise of Synthetic Identities

One of the sneakiest and most difficult schemes to stop is synthetic identity fraud. This is where criminals stitch together a brand-new, fake identity using a mix of real and fabricated information – think a real, stolen SIN number combined with a made-up name and address.

Because these fake identities are built with legitimate bits of data, they can often sail right through basic identity checks. Fraudsters use these "synthetic" people to open accounts, build up a good credit history over time, and then "bust out" – maxing out every available line of credit before vanishing completely.

This complex method perfectly illustrates why manual reviews and simple "if-then" rules just don't cut it anymore. An AI-powered system, on the other hand, is built to find the faint, non-obvious links and oddities that give away a synthetic identity. It's a critical defence layer for any modern ecommerce operation.

To give you a clearer idea of what you’re up against, this table breaks down the most common fraud schemes.

A Snapshot of Common Ecommerce Fraud Schemes

This table compares the most prevalent fraud tactics, detailing their methods, typical warning signs, and how they impact your business.

| Fraud Tactic | How It Is Executed | Key Red Flags to Watch For | Potential Business Impact |

|---|---|---|---|

| Payment Fraud | Uses stolen credit/debit card details to make unauthorised online purchases. | Mismatched billing and shipping addresses, unusually large orders, or multiple rapid-fire transactions. | Immediate financial loss, chargeback fees, and potential penalties from payment processors. |

| Account Takeover | Gains access to a real customer's account using stolen login credentials. | Sudden changes to account details (email, password, address), logins from new devices or locations. | Reputational damage, loss of customer trust, and financial liability for fraudulent orders. |

| 'Friendly' Fraud | A legitimate customer disputes a valid charge with their bank, falsely claiming fraud. | A customer who frequently disputes charges; claims of non-delivery despite tracking confirmation. | Lost revenue, lost product, and increased chargeback rates that can jeopardise your merchant account. |

| Synthetic Identity | Combines real and fake information to create a new, fraudulent identity to make purchases. | Inconsistent personal data, new accounts making large purchases, use of mail-forwarding addresses. | Significant financial losses, as these accounts often appear legitimate for a long period before "busting out". |

Getting to know these tactics is the foundation of a strong defence. Once you can recognise their signatures, you start to see why an adaptive AI system is no longer a "nice-to-have" but a core necessity that static rules simply can't provide.

How AI Learns to Outsmart Criminals

Think of a seasoned detective who can spot a lie from a mile away. That’s essentially what AI fraud detection for ecommerce brings to your store. It's not about a simple checklist of rules that fraudsters can easily learn to bypass. Instead, it uses intelligent, self-improving systems to sniff out suspicious activity as it happens. We're moving from playing defence to actively predicting the criminal's next move.

This isn't some futuristic fantasy; it’s driven by machine learning. The AI learns from your data, developing an intuition for what's legitimate and what's not. It sifts through mountains of information – far more than any human team could handle – connecting seemingly random dots to uncover even the most cleverly disguised fraud attempts.

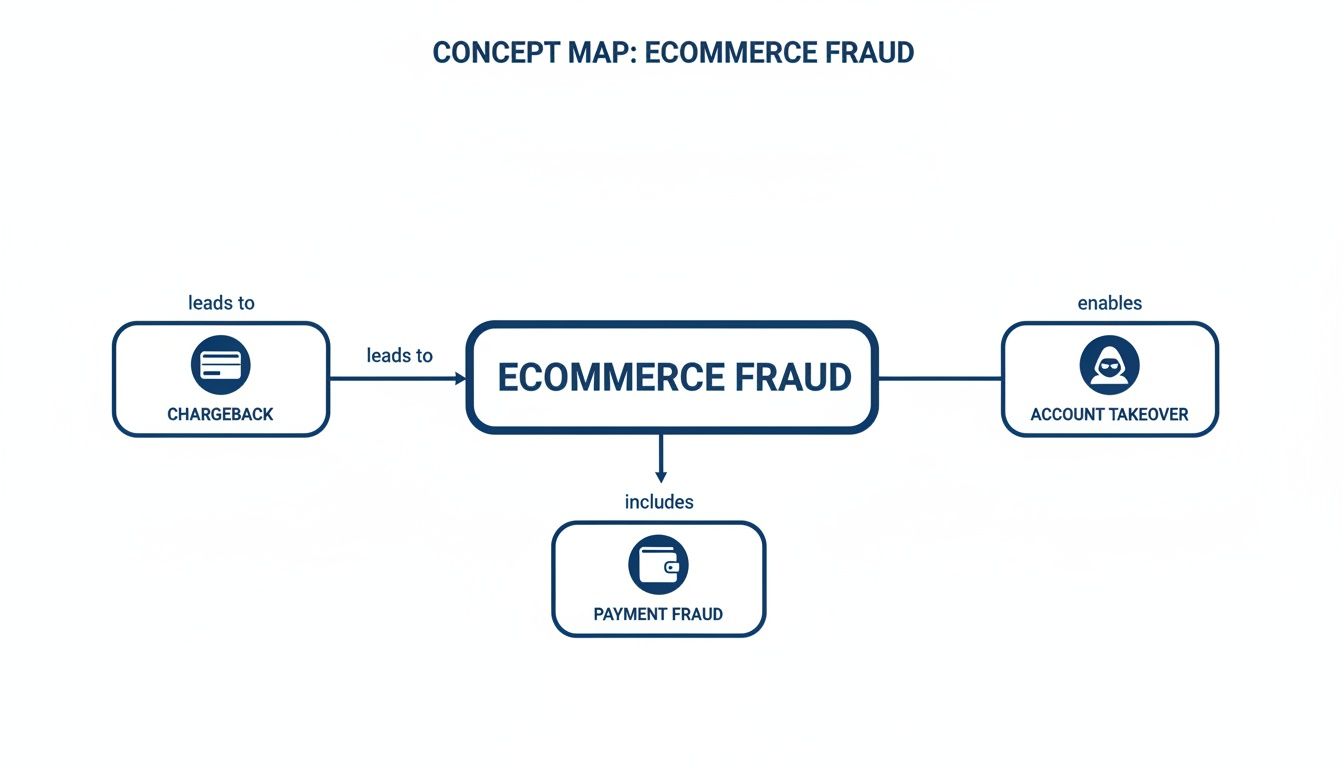

The image below lays out some of the most common threats AI is trained to spot, from costly chargebacks and account takeovers to straightforward payment fraud.

As you can see, the threats are varied and attack your business from all sides. This is precisely why a smarter, multi-layered defence is no longer a luxury; it’s a necessity.

The Two Main Ways AI Learns

AI doesn't just follow one set of instructions. It learns and adapts using different methods, which is key to staying ahead of evolving threats. In fraud detection, the two main approaches are supervised and unsupervised learning. Each has a unique role to play in protecting your business.

Supervised Learning: The Digital Apprentice

Imagine training a new employee. You'd show them examples of good work and bad work until they learn to tell the difference. That's supervised learning in a nutshell. We feed the AI model a massive dataset of past transactions that have already been clearly labelled as either "legitimate" or "fraudulent."

The AI studies these examples to learn the classic signatures of fraud. It starts to recognise tell-tale signs like:

A billing address in Vancouver and a shipping address in another country.

A string of failed payment attempts suddenly followed by a successful one.

A brand-new account placing an unusually large order right out of the gate.

After analysing millions of these data points, the model gets incredibly good at spotting these familiar patterns. When a new transaction comes in, it instantly compares it against everything it's learned and assigns a risk score. This approach is fantastic for catching the common, well-known types of fraud.

Unsupervised Learning: The Anomaly Detective

Now, what about the new tricks you've never seen before? That's where unsupervised learning comes in. Think of this approach as a detective showing up to a crime scene with a completely open mind. Instead of looking for known clues, they're searching for anything that seems out of place.

This AI model is given a stream of raw, unlabelled transaction data. Its job is to figure out what "normal" looks like for your store and then flag anything that deviates from that baseline.

This method is brilliant at catching new and emerging fraud tactics. It isn’t looking for specific red flags it's been taught; it's looking for anomalies – behaviour that just doesn't fit the established pattern.

For example, it might flag an account that suddenly starts buying things at 3 a.m. after years of only shopping during business hours. Or it could spot a user copy-pasting their personal details into the checkout form instead of typing them out – a subtle but common tactic used by criminals working with stolen lists of information.

From Data to Real-Time Decisions

The real magic happens when AI combines hundreds of data points in a fraction of a second to make a decision. These systems don't just look at one or two things in isolation; they build a complete, contextual picture of every single transaction.

Some of the key data points AI pulls together include:

Device Fingerprinting: Is this the same device the customer usually uses? Do the browser, operating systems, and language setting match their typical profile?

Geolocation Data: Does the user's IP address location make sense when compared to their billing and shipping addresses?

Behavioural Analytics: How is the user interacting with your site? Are they navigating erratically, typing unnaturally fast, or robotically moving their mouse?

Transaction Velocity: Is this user, device, or IP address suddenly making a high number of purchases in a short period?

By weaving all these threads together, the AI generates an accurate, real-time risk score. This predictive power is a game-changer, especially for Canadian businesses. The LexisNexis 2025 True Cost of Fraud Study found that for every dollar lost to fraud, Canadian merchants actually lose $4.52 in associated costs. Yet, only a tiny 3% of them are fully using AI-driven automation to fight back.

Meanwhile, 41% are still stuck with slow, manual reviews, which helps explain why 64% of businesses are seeing lower conversion rates from overly cautious security measures. You can dive deeper into these findings on the real cost of ecommerce fraud.

This adaptive, data-first approach is what sets modern AI security apart. It’s more than just a tech upgrade; it’s a fundamental shift in how online stores protect themselves and their customers – a core principle of our AI-powered ecommerce development.

Putting AI Fraud Detection to Work in Your Store

Understanding the "how" behind AI is one thing, but actually putting that intelligence to work in your day-to-day operations is where the real value lies. The goal here is to move from theory to a practical defence – a system that not only stops fraudsters in their tracks but also makes the buying experience seamless for your genuine customers. This all starts with choosing the right implementation path for your business.

For most ecommerce stores, the journey begins with a choice between two main avenues. You can either plug in an off-the-shelf, third-party solution or go all-in and build a custom system from scratch. Each approach has its own set of pros and cons, and the best fit depends on your business goals, technical capacity, and budget.

Choosing Your Implementation Path

The "buy versus build" debate is a classic one, and for good reason. It’s a strategic decision that shapes your store's security posture for years to come. There’s no single correct answer; what works for a high-volume enterprise might be overkill for a growing Shopify store. Your sales volume, product types, and your team’s technical skills all play a role in making the right call.

Let's break down the two main options:

Third-Party SaaS Solutions: Think of these as ready-to-go platforms that integrate directly with your existing ecommerce setup, like Shopify or WooCommerce. The big wins here are a fast setup, lower upfront costs, and immediate access to a massive data network that’s already been trained on billions of transactions. For most small to medium-sized businesses, this is the perfect starting point.

Bespoke (Custom-Built) Systems: This is the path of creating your own proprietary fraud detection engine, tailored perfectly to your business's unique risks. It’s a heavy lift, demanding a serious investment in time, data science talent, and infrastructure. In return, you get total control and a system optimised for your specific needs. This route is usually best for larger enterprises with very particular requirements.

If you're exploring the custom-build route, you'll need specialised expertise. Our guide on AI ecommerce development services offers a much deeper dive into what that process looks like.

The Implementation Roadmap

Whether you buy or build, implementing AI fraud detection for ecommerce is never a "set it and forget it" project. It’s an ongoing cycle of integration, fine-tuning, and monitoring to make sure your defences keep up with ever-evolving threats.

A solid implementation plan generally follows these five stages:

Data Preparation and Integration: First, you need to connect the AI system to your store’s data streams. This means feeding it customer information, order histories, and payment details. Clean, well-organised data is the fuel that powers any effective machine learning model.

Model Selection and Training: If you’re building a custom solution, your data science team will select and train different machine learning models using your historical transaction data. If you’re using a SaaS tool, this step is more about configuring its pre-built models to match your store’s risk tolerance.

Testing and Validation: You don't want to flip the switch and start blocking real customers by accident. Before going live, the system is run in "shadow mode." It analyses real-time transactions and makes decisions without actually taking action, giving you a chance to see how it performs and tweak its settings to avoid false positives.

Deployment and Go-Live: Once you're confident in the system's accuracy, it's time to deploy it fully. From this point on, it will actively score every transaction in real-time – approving, flagging for manual review, or blocking them based on the rules you’ve set.

Continuous Monitoring and Refinement: Fraudsters are creative and relentless; your defences have to be, too. This final stage is all about keeping the system sharp. Learning from transaction monitoring insights helps you spot new patterns and suspicious activities. You’ll need to regularly review the AI’s performance, retrain models with new data, and adjust your rules to stay ahead of the curve.

This iterative process is what ensures your security evolves. An AI system that isn’t constantly learning from new data will quickly become obsolete, leaving your store exposed to the latest schemes.

Following a structured approach like this turns AI from an abstract idea into a powerful, practical tool. By carefully picking your path and committing to ongoing refinement, you can build a resilient defence that protects both your revenue and your hard-earned reputation.

Measuring What Matters for Fraud Prevention

So, you've put an AI system in place. That's a huge step, but how do you actually know if it's working? To see the real impact of your investment in AI fraud detection for ecommerce, you need to look past a single, simple fraud rate. True success is found in a handful of key performance indicators (KPIs) that tell the whole story about your security and, just as importantly, your customer experience.

The goal isn't just to block more transactions. It's about finding that sweet spot – tightening the screws on fraudsters while making sure your legitimate customers can buy from you without a hitch. This is where a data-first approach lets you fine-tune your strategy, prove its value, and build a more resilient business.

Key Metrics to Track

To get a clear picture of your AI's performance, you need to be watching a few critical metrics. Think of them as a dashboard for your fraud prevention engine. They work together to show how well your system is doing, not just at stopping fraud but at protecting revenue and keeping your operations running smoothly. As we covered in our guide to ecommerce analytics and KPIs, tracking the right data is everything.

Here are the essential numbers to have on your radar:

Chargeback Rate: This is the percentage of your transactions that get reversed by the bank due to a customer dispute, often because of fraud. It's a direct measure of how much bad stuff is getting past your defences. If this number is steadily dropping, your AI is doing its job.

False Positive Rate: This might be the most important metric for your customer relationships. It tracks how many perfectly good, legitimate orders are mistakenly flagged as fraud and declined. A high rate here means you're frustrating good customers and leaving money on the table. You want this as close to zero as humanly possible.

Manual Review Rate: This is the slice of orders your team has to manually check. A smart AI should shrink this queue dramatically, freeing up your people to focus on more important work instead of staring at order details all day. This directly translates to lower operational costs.

Calculating Your Return on Investment

Figuring out the Return on Investment (ROI) for your AI fraud system isn't as simple as adding up the value of blocked fraudulent orders. A proper ROI calculation looks at the bigger picture, factoring in both the direct costs you've avoided and the new revenue you've unlocked.

A complete ROI analysis should account for not only the money saved from prevented fraud but also the value of reclaimed operational hours and the increased revenue from confidently approved orders that a rigid, rule-based system might have blocked.

This is especially true in the Canadian market. Recent data shows that while some types of fraud are down, third-party credit card fraud in ecommerce is exploding. This is exactly where AI shines. In fact, Canadian platforms using AI are detecting over 90% of these anomalies by analysing customer behaviour. As detailed in TransUnion's 2025 fraud study, AI's knack for spotting subtle signs of impersonation is a massive advantage.

By keeping a close eye on these key metrics, you can clearly show how your AI fraud detection system is more than just an expense; it’s a powerful tool for protecting revenue and growing your business. This data-driven proof is crucial for making smart decisions and staying one step ahead of the next threat.

Building a More Secure Future for Your Business

We've walked through the ins and outs of AI fraud detection for ecommerce, and the key takeaway is clear: this is no longer just a nice-to-have feature. It’s now a core part of running a successful and sustainable online store. Getting started means taking an honest look at your unique risks and picking a solution that won't just solve today's problems but will scale with you tomorrow.

When you bring this kind of technology into your business, you're doing more than just stopping financial losses. You're building a brand that customers can trust, which is the bedrock of genuine loyalty. Taking a proactive stance on security protects your bottom line and cements your reputation in a crowded marketplace.

From Defence to Strategic Growth

The real shift happens when you move from simply reacting to fraud to actively preventing it. A well-integrated security system stops being a cost centre and starts enabling new business opportunities. To really grasp this, it’s helpful to see how the entire payment world is changing. Understanding AI's role in shaping secure payment services gives you a great perspective on this wider evolution.

This is the forward-thinking approach we champion in our ecommerce strategy & consulting services, where we believe security and growth are two sides of the same coin. When you have a secure foundation, you can innovate and focus on creating amazing customer experiences with total confidence.

Implementing AI isn't just a technical upgrade; it's a statement to your customers that you take their safety seriously. It shows you value their trust, turning security from a necessary expense into one of your most powerful brand assets.

Ultimately, having the right technology partner can make or break your success. An expert team helps you cut through the complexity of integration and fine-tuning, making sure your security system is a perfect fit for how you do business. We've seen this time and again, which is why, as we explored in our ecommerce solutions guide, well-designed systems are critical for success.

As a trusted software development company, our goal is to see businesses like yours thrive. We don't just build software; we build long-term partnerships through expert guidance and strategic implementation. If you'd like to learn more about our team and how we work, we invite you to explore our about us page.

Frequently Asked Questions About AI Fraud Detection

We've covered a lot of ground on what it takes to build a smarter defence against online threats. But it's natural to have a few more questions. Let’s tackle some of the most common ones we hear from merchants thinking about AI fraud detection for their ecommerce stores.

Is AI Fraud Detection Affordable for a Small Business?

Yes, it absolutely can be. While building a custom AI system from scratch is a major investment, that’s not the only path. Many third-party SaaS platforms offer flexible pricing that scales with your business, making it accessible even for smaller shops.

The real question is about return on investment. Think about the total cost of just one chargeback; it’s not just the lost product. You also lose the shipping fees and get hit with a penalty. An effective AI tool can easily pay for itself by stopping just a few fraudulent orders every month. It's less of an expense and more of an investment in protecting your revenue.

Will AI Block My Legitimate Customers by Mistake?

That’s a fair and important concern. Nobody wants to turn away a good customer. This issue, known as a 'false positive,' is precisely where modern AI shines compared to older, rigid systems.

A simple rule might automatically block a loyal customer just because they’re on holiday and their IP address doesn't match their billing address. AI, on the other hand, looks at the bigger picture. It analyses hundreds of signals to understand the context, easily telling the difference between a holidaymaker and a fraudster hiding behind a proxy. A properly configured AI system, often a key part of an expert AI-powered ecommerce development project, actually leads to fewer false positives, ensuring a smoother checkout for your best customers.

Are My Platform's Built-In Fraud Tools Enough?

For a brand-new store, the tools built into platforms like Shopify are a great first line of defence. They offer a solid foundation, and you should definitely use them.

But those built-in systems are designed to be a one-size-fits-all solution. As your business scales or if you start selling high-value goods, you'll become a bigger target for more sophisticated fraud that these generic tools can't catch. A dedicated AI solution adds a much deeper, more dynamic layer of security by using advanced machine learning and behavioural analytics. This kind of specialised protection is a vital part of any serious ecommerce strategy & consulting services.

As a leading software development company, we specialise in helping businesses integrate these advanced systems to create a truly resilient operation. You can learn more about our approach and values on our about us page.

Ready to secure your business and unlock growth? Cleffex Digital Ltd offers expert software development services to build a fraud detection strategy that fits your unique needs. Contact us today to get started.