Insurance software in Canada is essentially a set of specialised digital tools built to help brokers, agencies, and carriers run their businesses more smoothly. These platforms are designed to automate the heavy lifting of day-to-day operations – think policy administration, claims processing, and managing client relationships – all while making sure you're playing by Canadian rules.

The Future of Canadian Insurance Is Digital

The Canadian insurance industry is turning a corner. The era of overflowing filing cabinets, tedious manual data entry, and slow-moving, paper-heavy processes is officially on its way out. Clients today have new expectations; they want instant quotes, easy communication, and claims settled quickly. Old-school, legacy systems just can't keep up.

Imagine an old insurance agency as a library still using a physical card catalogue. It gets the job done, but finding what you need is slow, clunky, and leaves a lot of room for human error. For anyone used to the speed of a Google search, it's a frustrating experience. Modern insurance software acts as the digital command centre for a modern agency, linking every person and process into one smart, unified system.

Why Going Digital Is No Longer an Option

This shift isn't just a fleeting trend; it’s now a core requirement for staying competitive and relevant. The market data tells a clear story. The insurance agency software market in Canada is on a strong growth trajectory, expected to hit an estimated value of CAD 180 million by 2025. That's a significant jump from CAD 135 million in 2020, driven entirely by insurers and brokers actively looking to modernise.

Here's a breakdown of the primary reasons Canadian insurance businesses are making the switch to modern software solutions.

Key Drivers for Adopting Insurance Software in Canada

| Driver | Impact on Business Operations | Example |

|---|---|---|

| Client Expectations | Insurers must offer instant quotes, self-service portals, and fast claims processing to retain clients. | A client uses a mobile app to file a claim with photos right at the scene of an accident, receiving an update within hours. |

| Operational Inefficiency | Manual, paper-based workflows are slow, error-prone, and costly, hindering growth. | Automating policy renewal notifications frees up brokers to focus on advising clients instead of doing paperwork. |

| Regulatory Demands | Navigating PIPEDA and provincial privacy laws requires robust, secure data management that legacy systems lack. | Software automatically flags and secures sensitive client data according to federal and provincial compliance rules. |

| Competitive Pressure | Insurtech startups and digitally savvy competitors are raising the bar for service and speed. | A small brokerage uses a modern CRM to offer personalised service that rivals what larger, tech-enabled firms can provide. |

Ultimately, adopting modern tools is about fundamentally changing how your business operates; moving from simply processing transactions to building lasting relationships and creating value.

This guide will break down how these platforms help Canadian insurance professionals not just survive, but thrive. We’ll look at how they solve real-world problems:

Boosting Operational Efficiency: Automating routine tasks like invoicing and data entry gives your team more time to focus on what really matters – your clients.

Building Stronger Client Relationships: Having all client information in one place gives you a complete picture, allowing for more personal, responsive service that builds loyalty.

Maintaining Strict Regulatory Compliance: Modern software is built with Canada’s complex legal landscape in mind, helping you manage data securely under PIPEDA and provincial privacy laws. For a closer look at this, see our guide to Canadian insurance technology.

The real win with modern insurance software is shifting your agency from a reactive, process-heavy operation to a proactive, client-focused business ready for long-term growth.

In the end, this isn't just about a tech upgrade. It's about future-proofing your business. By adopting these solutions, Canadian insurers can simplify their workflows, strengthen client trust, and build a solid foundation for success in a market that's only getting more competitive.

The Building Blocks: What's Inside Modern Insurance Software?

If you think of modern insurance software solutions Canada as the engine that powers a successful insurance business, then the core modules are its most critical parts. Each module has a specific job to do, from managing policies to handling claims, but their real power comes from how they work together. Understanding these components is key to seeing how the right software can automate your daily grind, slash errors, and ultimately grow your bottom line.

It's a bit like a well-oiled machine. Every gear and piston has a distinct function, but they're all designed to mesh perfectly. When they do, the whole operation runs smoothly and efficiently. Your insurance software orchestrates this, making sure every part of your business works in sync.

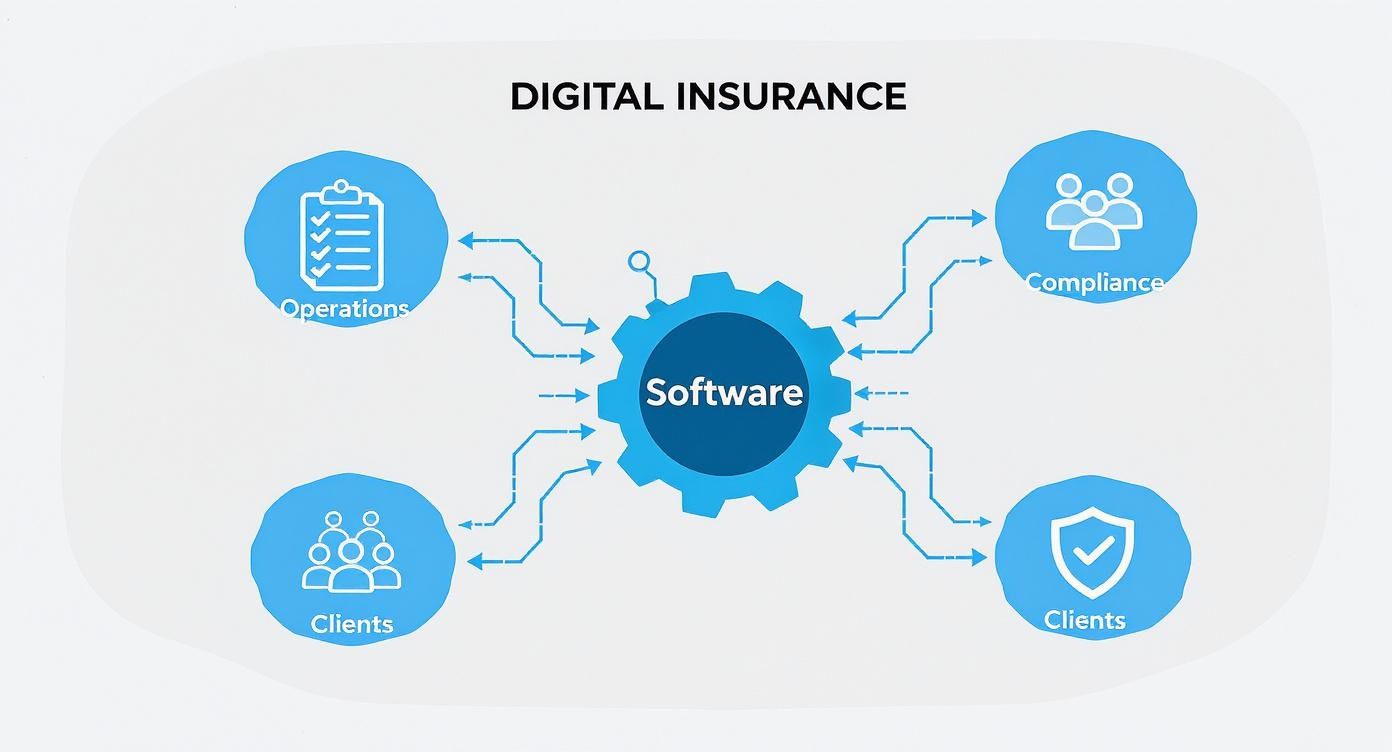

This infographic gives a great visual overview of how software acts as the central hub, connecting everything from day-to-day operations and client management to the nitty-gritty of compliance.

As you can see, it’s not just about doing one thing well; it's about integrating every key function to create a truly cohesive business.

The Core Engine: Policy Administration Systems

At the very heart of any insurance platform lies the Policy Administration System (PAS). This is your command centre, the single source of truth for every policy you manage. The PAS handles the entire journey of a policy, from the initial quote and underwriting right through to issuance, endorsements, and eventually, renewal or cancellation.

A solid PAS takes countless administrative headaches off your plate. Instead of your team manually tracking renewal dates and chasing clients for paperwork, the system does it automatically. This frees up your brokers to do what they do best: provide expert advice and build relationships, not push paper.

Making Claims Painless: Claims Management

The claims process is the moment of truth. It's where your agency’s reputation is made or broken. A dedicated Claims Management module is designed to make this experience as seamless as possible for everyone involved. It organises and automates every step, from the first notice of loss (FNOL) all the way to investigation, settlement, and payment.

This level of automation dramatically cuts down processing times. Imagine a client uploading photos of an accident from their phone, which instantly kicks off a workflow that assigns an adjuster and schedules the next steps. Not only does this get claims settled faster, but it also minimises the risk of costly human errors, which leads to happier clients and healthier margins.

Keeping the Books Straight: Billing and Invoicing

When it comes to the financials, there's no room for error. The Billing and Invoicing module is your financial quarterback, managing every transaction with absolute precision. It handles everything from generating invoices and processing payments to tracking broker commissions and managing collections.

This module gives you a clear, real-time picture of your agency's financial health. It can support different payment schedules, send out automated reminders, and generate the detailed reports you need to make smart decisions. By taking the manual work out of billing, you reduce errors, improve cash flow, and make sure your brokers are paid accurately and on time.

A truly integrated software platform does more than just connect tasks; it creates an intelligent, unified workflow. It helps your business shift from simply managing data to using that data for a real strategic advantage.

Building Stronger Relationships: Client Relationship Management (CRM)

Last but certainly not least is the Client Relationship Management (CRM) module. This is your toolkit for building and nurturing strong, lasting relationships with your clients. It pulls all client information: contact details, policy histories, communication logs, even personal notes, into a single, easy-to-access profile.

A good CRM helps you deliver a personal touch, even as you scale. Think about the system automatically flagging a client's upcoming policy anniversary, prompting a broker to make a quick, personal check-in call. It can also spot opportunities, like suggesting a travel insurance add-on for a client who just booked a vacation. To get a better sense of how these systems can be customised to fit your needs, you can learn about tailored insurance software solutions.

By bringing these core modules together, insurance software solutions in Canada create a single, powerful platform. They tear down the silos between departments, automate workflows, and deliver the insights you need to run a modern, client-focused, and profitable insurance business.

Navigating Canadian Compliance and Data Security

When you're choosing insurance software solutions in Canada, shiny features and a slick interface are only part of the story. The other, arguably more important, piece of the puzzle is how the software protects sensitive client data and follows Canada’s strict privacy laws, both federally and provincially.

For any insurer, compliance isn't just about ticking a box; it's the bedrock of your clients' trust. One misstep can lead to massive fines, legal headaches, and a reputation that’s tough to rebuild. After all, a single data breach can undo years of goodwill in a flash. That's why any software you consider must have Canadian compliance baked right into its DNA.

Understanding Canada's Privacy Landscape

The main piece of federal legislation you need to know is the Personal Information Protection and Electronic Documents Act (PIPEDA). This law sets the national ground rules for how private businesses collect, use, and share personal information.

PIPEDA isn't a rigid list of dos and don'ts. Instead, it’s based on principles like accountability. It demands that you get consent, use data for reasonable purposes, and protect it with solid security. For an insurance business, this covers everything, from a client’s policy details and claims history to their address and banking info.

But it doesn't stop there. Several provinces have their own privacy laws that are considered "substantially similar" to PIPEDA, and you need to follow them if you operate there.

Quebec's Law 25: This is one of the toughest privacy laws in the country. It brings in new rules around consent, transparency, and how you manage data, with some hefty penalties for getting it wrong.

Alberta's PIPA (Personal Information Protection Act): This governs how private organisations handle personal information within Alberta.

British Columbia's PIPA: Much like Alberta's version, this law applies to private businesses operating in B.C.

The bottom line? Your software needs to be nimble enough to navigate this complex web of federal and provincial rules, keeping you compliant wherever your clients call home.

The Critical Importance of Data Residency

Here’s a huge one for Canadian insurers: data residency. This simply means where your data is physically stored. Many Canadian clients and regulators insist that sensitive personal information stay right here in Canada.

Why? Keeping data on Canadian soil prevents it from falling under the jurisdiction of foreign laws and government agencies, like the U.S. Patriot Act. When you're talking to a potential software vendor, asking where their servers live isn't just a good question – it's a deal-breaker. A provider with data centres located exclusively in Canada gives you a major head start on compliance and a lot more peace of mind.

Essential Security Questions to Ask Your Vendor

Before you sign on the dotted line, you need to put any platform's security under a microscope. Think of it as doing due diligence on a critical business partner. Your vendor should be able to answer these questions clearly and without hesitation.

Key Vendor Security Checklist

Where is my data stored? Get them to confirm, in writing, that they offer Canadian data residency.

What encryption standards do you use? You want to hear about strong, modern encryption for data both in transit (as it moves over the internet) and at rest (when it's sitting on their servers).

Are you SOC 2 compliant? A SOC 2 (Service Organisation Control 2) report is a big deal. It’s an independent audit that confirms a vendor manages client data securely. It's really the gold standard for cloud software providers.

What are your disaster recovery and business continuity plans? If their system goes down or gets hit by a cyber-attack, how quickly can they get you back up and running? They need a rock-solid plan.

How do you manage access controls? The software must let you set up role-based access so that employees can only see the information they absolutely need to do their jobs.

Knowing the regulations is step one, but it’s just as important to explore strategies to eliminate data breach risks in BFSI to build a defence-in-depth approach. The security measures your vendor has in place are every bit as important as your own internal ones. For a deeper dive, you can learn more about the challenges of cybersecurity in the insurance industry. Ultimately, choosing a secure and compliant software solution is your first and best line of defence in protecting both your clients and your business.

Choosing Your Platform: Cloud vs. On-Premise

One of the biggest forks in the road when choosing insurance software solutions in Canada is the deployment model. Are you going with a cloud-based system, often called Software-as-a-Service (SaaS), or a traditional on-premise setup? This isn't just a technical detail; it fundamentally shapes your budget, IT needs, and how your business will operate for years to come.

Let's break it down with an analogy.

An on-premise solution is a lot like buying a house. You own the building and the land it sits on. You have total control – you can paint the walls any colour, renovate the kitchen, and set up your own security system. But you're also on the hook for everything: the mortgage, the property taxes, fixing a leaky roof, and mowing the lawn. It’s a major upfront investment, but the control is absolute.

A cloud-based solution, on the other hand, is like leasing a unit in a premium, fully managed condo building. You pay a predictable monthly fee, and in return, you get 24/7 security, a maintenance team on call, and access to a state-of-the-art gym you couldn't afford on your own. If you need more space, you can simply move to a bigger unit. It offers flexibility and lets you focus on living, not just upkeep.

The On-Premise Approach

With an on-premise system, you buy the software licenses and install everything on your own servers, right in your own office. For organisations with very specific, complex security requirements or a deep need for custom integrations, this level of control can be compelling. You own it all.

But that ownership comes with a heavy dose of responsibility. You’re the one who has to handle:

Hefty Upfront Costs: Buying the servers, networking gear, and the software licenses can be a massive capital expense.

Constant Maintenance: You’re in charge of keeping the servers running, installing security patches, and managing all software updates.

Specialised IT Staff: You need an in-house team with the right skills to manage and troubleshoot the entire stack, from hardware to software.

Scaling Pains: Need more capacity? That means buying more hardware, a process that’s often slow, complex, and expensive.

For decades, this was the only way. But for many small to mid-sized Canadian brokerages, the capital outlay and technical burden are simply too high.

With on-premise, the trade-off is clear: you gain total control over your data and systems, but you also accept full responsibility for keeping them all running and secure.

The Shift to Cloud-Based Solutions

It's no surprise that cloud (SaaS) platforms have become the go-to model for modern insurance software solutions in Canada. The vendor hosts the software, manages the servers, handles security, and pushes out updates automatically. All you need is a web browser.

This model flips your financial commitment from a large capital expenditure (CapEx) to a predictable operational expense (OpEx) – usually a straightforward monthly or annual subscription. This makes incredibly powerful software accessible to businesses that don't have a massive IT budget. Plus, it’s a natural fit for today’s hybrid and remote workforces; your team can securely access the system from anywhere with an internet connection.

This table really highlights the key differences and can help you weigh what matters most for your Canadian insurance business.

Cloud vs. On-Premise Software Comparison for Canadian Insurers

A direct comparison of key factors to consider when choosing between cloud-based and on-premise insurance software solutions.

| Feature | Cloud-Based (SaaS) | On-Premise |

|---|---|---|

| Initial Cost | Low (subscription-based) | High (licenses & hardware) |

| Maintenance | Handled by the vendor | Your responsibility |

| Scalability | Easy and fast (adjust subscription) | Difficult and slow (buy hardware) |

| Accessibility | Accessible from anywhere | Limited to your network |

| Data Security | Vendor-managed, SOC 2 compliance | Your responsibility |

| IT Resources | Minimal in-house IT needed | Requires dedicated IT staff |

So, which path is right for you? It really comes down to your specific situation – your budget, your team's technical expertise, and your vision for growth. For the vast majority of Canadian agencies and brokerages today, the flexibility, lower upfront cost, and future-ready nature of cloud-based solutions make them the clear winner.

Getting Your New Software Up and Running

Picking the right platform is a huge step, but the real work begins when it's time to bring it online. A successful launch is about much more than just flicking a switch; it's a well-planned project that lays the groundwork for how your business will use its new insurance software solutions in Canada for years to come. Getting this part right means avoiding headaches, getting your team on board quickly, and seeing a return on your investment right from the start.

Think of it like building a custom home. You wouldn't just move your old, cluttered furniture in without a plan. You'd carefully sort through everything, decide what’s worth keeping, and arrange it all thoughtfully so the new space works for you. Implementing new software demands the same careful, strategic approach.

This process is especially important given the current market. The Canadian software industry is on a serious growth trajectory, with revenues expected to hit USD 73.3 billion in 2024. The application software segment, which is exactly where these insurance platforms live, is the biggest piece of that pie and is set to expand even more through 2030. You can dig into the specifics in the full Canadian software market outlook. A smooth implementation is your ticket to tapping into this powerful technology.

Nailing Your Data Migration

Your existing data is gold, but getting it from an old system to a new one can be one of the trickiest parts of the entire project. Simply doing a "lift and shift", copying everything over as-is, is almost always a mistake. It just pollutes your shiny new system with old, messy, or irrelevant information.

Instead, a smart data migration plan has a few key phases:

Audit and Cleanse: Before moving a single file, take a hard look at your current data. This is your chance to merge duplicates, fix errors, and archive information that’s no longer needed. Think of it as spring cleaning for your data.

Prioritise and Map: You probably don't need to move every single record from the last decade. Figure out what’s essential, and then map the fields from your old system to the corresponding ones in the new platform. This ensures everything lands in the right spot.

Test, Test, and Test Again: Run several small-scale test migrations. This is where you’ll catch mapping errors or formatting quirks before you commit to moving everything.

A clean data migration is the bedrock of a successful implementation. When your team logs in for the first time to find accurate, relevant data, they'll trust the new system and be able to put it to work immediately.

Picking Your Go-Live Strategy

How you actually launch the software is another major decision point. There are two main ways to go about it, and the right choice really depends on the unique needs of your Canadian insurance business.

Phased Rollout vs. Big Bang Launch

| Strategy | Description | Best For |

|---|---|---|

| Phased Rollout | Introducing the new software in stages – maybe one department or one module at a time. | Larger organisations with complex operations that need to minimise day-to-day disruption and gather user feedback as they go. |

| Big Bang Launch | Switching the entire organisation over to the new system all at once, on a specific date. | Smaller, more agile firms where a clean, decisive break is often more efficient and simpler to manage. |

A phased approach is lower-risk and allows for more focused training, but it can drag out the implementation timeline. The big bang is faster and creates clear momentum, but it demands flawless planning because there’s very little room for error on launch day.

Driving Adoption with Great Training and Support

You can invest in the absolute best insurance software solutions in Canada, but it won't do you any good if your team doesn't know how or doesn't want to use it. Getting people to actually use the new tool is the ultimate measure of success, and that all comes down to great training.

Effective training isn't just a one-off webinar. It should be:

Role-Specific: A broker, a claims adjuster, and an administrator all use the software differently. Training should be tailored to the specific tasks each person performs every day.

Hands-On: We all learn by doing. Give your team a "sandbox" or test environment where they can click around and experiment with sample data without worrying about breaking anything.

Ongoing: The launch isn't the end of the line. Make sure your team has continuous support through a knowledge base, regular check-in sessions, and access to an expert who can answer questions long after go-live.

Working with an implementation partner who truly gets the Canadian insurance market can be a game-changer. They bring the experience needed to guide you through the entire process, from data migration to training, helping you sidestep common traps and achieve a truly seamless transition.

So, you’ve decided to invest in new insurance software. That's a huge step, but the work isn't over. Now comes the real challenge: proving to stakeholders that this shiny new platform is actually paying for itself. How do you show it’s more than just a line item on the budget?

It all comes down to measuring your return on investment (ROI). To build a solid business case for insurance software solutions in Canada, you need to go beyond just a hunch that things are better. You need hard data. This means getting a clear picture of your performance before the switch, so you can draw a direct line to the improvements your new tool delivers.

Tracking Quantitative Gains

The easiest way to prove financial return is with quantitative metrics. These are the black-and-white numbers that speak directly to your bottom line. They’re measurable, comparable, and give you undeniable proof of how the software is impacting day-to-day operations.

Start by getting a baseline for these key performance indicators (KPIs):

Reduced Claims Processing Time: How long does it take, on average, to get from the first notice of loss to a final settlement? A modern system can slash this time, which cuts down on administrative costs and keeps clients happier.

Increased Policy Sales Per Agent: When your brokers and agents aren't bogged down by manual admin work, they have more time to focus on what they do best: selling and advising. Track the number of policies each agent sells per month to quantify this boost.

Lower Administrative Costs: Tally up the hours your team spends on repetitive tasks like data entry, invoicing, and generating compliance reports. The automation from the new software should cause a significant drop here, freeing up valuable time and resources.

Assessing Qualitative Benefits

Of course, not every benefit shows up on a spreadsheet. Qualitative gains are just as crucial for building your business case because they reflect the health of your client relationships and your team's morale. They might be trickier to measure, but their impact is huge.

Look for ways to track changes in:

Improved Customer Satisfaction: Tools like the Net Promoter Score (NPS) are perfect for this. Survey your clients to see how they feel about their experience. When service gets faster and errors disappear, those scores almost always go up.

Better Employee Morale: Let's be honest, clunky and outdated systems are a source of daily frustration for staff. A simple employee survey before and after the new software goes live can reveal a lot about job satisfaction and how much easier their workflow has become.

Proving ROI is about telling a complete story. It combines the “what” (the numbers) with the “why” (the improved experiences for both clients and staff) to paint a clear picture of success.

There's a reason the market for these tools is expanding – the results are tangible. The global insurance agency software market is set to grow from $3.82 billion in 2024 to $4.23 billion in 2025. Here at home, over 65% of Canadian agencies are already using specialised software to get ahead. By tracking both the hard numbers and the softer benefits, you can clearly show everyone how your investment is delivering real value. You can dig deeper into these market trends and their impact to see how others are gaining a competitive edge.

Your Questions, Answered

If you're looking into insurance software solutions in Canada, you've probably got questions. That's a good thing. Choosing the right platform is a big decision, so getting clear answers is the first step to making a smart investment for your brokerage.

Here, we'll tackle some of the most common things Canadian insurance professionals ask us, from costs and timelines to making sure a new system can connect with the tools you already rely on.

What's the Typical Cost for a Small Canadian Brokerage?

There’s no one-size-fits-all answer here, because the price really depends on what you need. The biggest fork in the road is whether you go with a cloud-based (SaaS) system or an on-premise one. Cloud software usually means a predictable monthly or annual fee per user, which is often a much better fit for a smaller firm's budget. An on-premise setup, on the other hand, means buying the software licenses and server hardware outright, which is a major upfront cost.

A few things will always shape the final price:

Number of Users: Most cloud pricing is per person, so the size of your team is a direct factor.

Modules and Features: A starter package for policy and client management will be more affordable than a full-blown suite with advanced analytics or marketing tools.

Customisation: If you need the software heavily adapted to your specific way of doing things, expect implementation costs to go up.

For a small Canadian brokerage with 5-10 users, you can generally expect a SaaS subscription to be anywhere from a few hundred to a couple of thousand dollars a month.

How Long Does a Typical Software Implementation Take?

The timeline can be anything from a few weeks to several months. It really hinges on two things: how complex your data is and how big your team is. A small agency with well-organised data and a simple setup could be up and running in as little as 4-6 weeks. In contrast, a mid-sized firm with messy historical data to move and multiple teams to train is probably looking at a 3-6 month project.

Think of implementation as a carefully planned marathon, not a sprint. Rushing it is the fastest way to end up with data errors and a team that doesn't want to use the new system, which defeats the whole purpose.

The step that often takes the longest is data migration. Cleaning up old records, mapping them to the new system, and testing everything to make sure it’s accurate is a painstaking but essential process. A realistic project plan is your best friend here.

Can This Software Integrate with My Other Tools?

Yes, it absolutely should. This is one of the most important questions you can ask. A modern insurance software solution in Canada should act as the central nervous system for your entire business, not just another piece of software sitting on its own.

This all happens through something called an API (Application Programming Interface). Think of an API as a secure translator that lets different software programs speak the same language and share information automatically.

For instance, you could connect your insurance platform to:

Your accounting software, so billing and commission data syncs up perfectly.

An email marketing tool to send out automated renewal reminders or newsletters.

Carrier quoting engines to pull in real-time rates without leaving the system.

A strong, flexible API isn't just a nice-to-have; it's essential. It’s what lets you build a truly connected tech setup that gets rid of tedious manual data entry and makes your whole operation run smoother.

Ready to build a smarter, more efficient insurance business? Cleffex Digital Ltd delivers custom software solutions that solve real-world challenges for Canadian insurers. Discover how we can help you today.