Think about navigating a new city with an old, folded paper map versus using a live GPS on your phone. That’s the kind of leap we're seeing as AI enters the insurance world. Artificial intelligence isn't just some far-off concept anymore; it's become a practical, must-have tool for any modern insurer.

How AI Is Redefining the Insurance Landscape

Artificial intelligence is fundamentally changing the DNA of the insurance sector. Think of it as a powerful analytical engine that lets companies sift through massive amounts of data with incredible speed and accuracy. This allows for smarter, faster decisions in every corner of the business, from pricing a policy to paying out a claim.

The very heart of insurance—managing risk—is getting a complete overhaul. For decades, insurers relied on historical data and broad demographic buckets. Now, AI brings predictive power to the table. It can spot subtle patterns and forecast what might happen next, paving the way for a much more forward-thinking approach to risk. This isn’t just about making old processes better; it’s about inventing entirely new ways to protect people and serve them more effectively.

From Reactive to Proactive Operations

Historically, insurance has always been reactive. An accident or disaster happens, and the insurer responds. AI is flipping that model completely on its head.

Smarter Underwriting: AI algorithms can analyze thousands of data points in seconds, creating risk profiles that are far more precise and tailored to the individual.

Faster Claims: Automated systems can now assess vehicle damage from a few photos, instantly check policy details, and get payments out the door in minutes, not weeks. This is a game-changer for customer satisfaction.

Enhanced Fraud Detection: Machine learning is brilliant at spotting suspicious patterns in claims that a human analyst could easily miss, saving the industry billions and helping keep premiums more affordable for everyone.

With AI, the industry is moving from a "detect and repair" mindset to a "predict and prevent" strategy. This shift helps insurers by cutting down on losses, but it also benefits policyholders through better safety and, ideally, lower costs.

To really get a sense of how significant this change is, it helps to first understand the foundations of the insurance industry itself. When you see how things have traditionally been done, the true scale of AI’s impact becomes crystal clear.

Transforming Risk Assessment with AI Underwriting

Underwriting has always been the heart of the insurance industry—the careful process of evaluating and pricing risk. For years, underwriters worked like detectives, poring over case files to build a picture of a client’s potential risk. AI doesn't replace the detective; it hands them a supercomputer that can cross-reference millions of similar cases in the blink of an eye.

Today, machine learning algorithms can dig into vast and varied datasets that were simply too big to handle before. We're talking about everything from real-time telematics data streamed from a car to alerts from smart home sensors and even complex climate models that forecast weather patterns. This allows a shift away from lumping people into broad, static categories and toward creating dynamic, personalized premiums that actually reflect an individual's unique situation.

A Shift to Predictive Analytics

This move toward predictive analytics isn't just a minor upgrade; it's a complete rethink of how we understand and manage risk. Instead of looking only at what has happened in the past, AI models can now forecast potential outcomes with incredible accuracy. This data-first approach lets insurers spot high-risk scenarios before they ever become a problem.

This newfound foresight delivers some major benefits:

- Fairer Pricing: Premiums are a direct reflection of a person's or business's specific risk factors, not just broad—and sometimes unfair—demographic assumptions.

- Improved Profitability: By pricing risk more accurately, insurers can avoid undercharging for high-risk policies while staying competitive on lower-risk ones. This leads to a much more stable and profitable portfolio.

- Greater Resilience: Being able to see emerging risks on the horizon, like new cyber threats or localized climate impacts, helps insurers adapt their products and build a more resilient business.

This level of precision is a win-win. Insurers get a much clearer view of their exposure, and customers get pricing that is truly aligned with their circumstances. The same AI-driven principles are making a big difference in other areas, too. You can see just how much AI is changing insurance claims processing in our in-depth guide.

The New Standard for Underwriting

It's clear that AI in underwriting is quickly moving from a "nice-to-have" to the industry standard. In fact, it's expected that artificial intelligence will soon be part of over 80% of underwriting workflows at major insurance companies. This signals a permanent shift from old-school manual processes to a dynamic, data-centric way of assessing risk.

This evolution is helping insurers keep up with what customers want while also tackling massive, complex risks like climate change. Of course, this transition isn't without its hurdles. The industry must also thoughtfully navigate new challenges around data privacy and algorithmic bias to ensure the system remains fair for everyone.

Key AI Applications Across the Insurance Lifecycle

While AI-powered underwriting is a massive leap forward, its impact is felt across the entire insurance value chain. The real story of AI in insurance isn't just one big change; it's how it refines every step, from the first time a customer asks for a quote to the moment a claim is paid out. These aren't just ideas on a whiteboard—they're practical tools already at work, making the entire process smoother for everyone involved.

One of the most impressive examples is in claims processing. Think about a typical fender-bender. Not long ago, this kicked off a long chain of events: scheduling an adjuster, waiting for them to inspect the damage, and then a drawn-out approval process. Today, the policyholder can just snap a few photos of the damage with their phone.

In seconds, AI-driven image recognition gets to work. It analyses the photos, compares the damage to a vast library of similar incidents, and can often approve the claim and send the payment almost immediately. What used to take weeks can now be wrapped up in minutes.

A New Era for Customer Service

Customer interaction is another area that has been completely reshaped. AI chatbots and virtual assistants are on call 24/7, ready to answer policy questions, walk customers through basic tasks, or give a quick update on a claim's status. This instant support frees up human agents to apply their skills to more complex or sensitive situations where a human touch really matters.

This creates a smarter, two-tiered service model. Simple queries get instant, automated answers, while tougher problems get the full attention of an experienced professional. The result is happier customers and a much more efficient use of the insurer's resources.

Uncovering Hidden Risks with Fraud Detection

Fraud has always been a multi-billion dollar headache for the insurance industry, ultimately driving up premiums for everyone. While human analysts are skilled at spotting red flags, they're simply overwhelmed by the sheer volume of data. This is where AI algorithms truly shine.

AI systems can sift through thousands of claims at once, picking out subtle patterns and connections that are nearly impossible for a person to see. These can include:

- Network Analysis: Pinpointing rings of individuals, repair shops, and medical providers who consistently pop up in suspicious claims.

- Behavioural Analytics: Flagging when a customer's claim-filing behaviour suddenly changes or deviates from their history.

- Image Inconsistencies: Catching when the same photo of vehicle damage is submitted for multiple, unrelated claims.

This is a clear case of machines augmenting human expertise, allowing fraud teams to focus on the most likely threats.

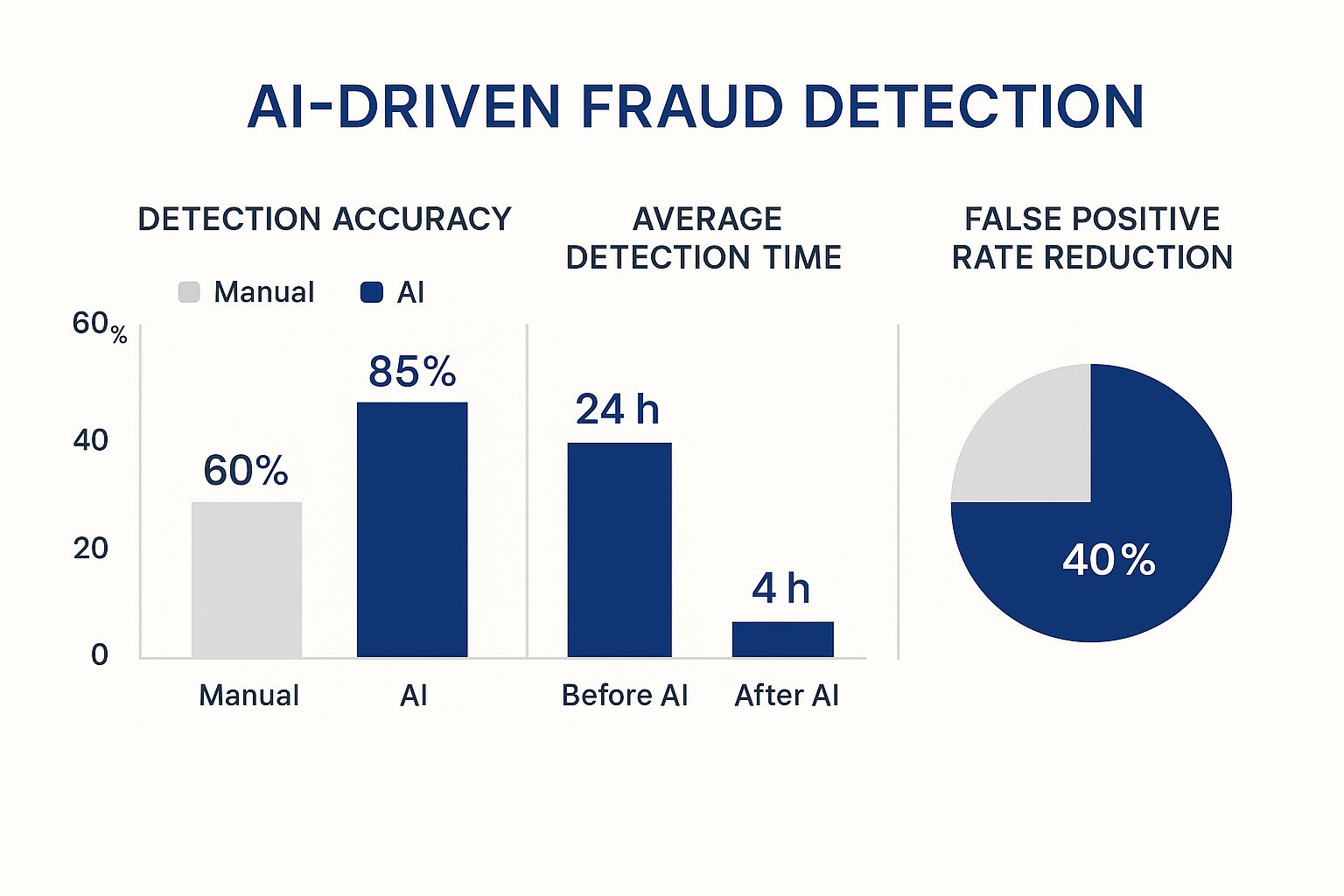

The numbers speak for themselves: AI not only detects more fraud (with 85% accuracy compared to 60% manually) but does it six times faster. It also dramatically cuts down on "false positives," meaning fewer legitimate claims get flagged by mistake. These benefits also spill over into administrative and legal work. For instance, processes like AI legal document review show how legal teams can accelerate their own analysis of policies and claims.

The table below summarises how these AI applications are being deployed across different parts of the insurance business.

Table: AI Use Cases in the Insurance Sector

| Insurance Function | AI Application | Primary Benefit |

|---|---|---|

| Underwriting | Predictive analytics, risk modelling | More accurate risk assessment and pricing |

| Claims Processing | Image recognition, natural language processing | Faster claim settlement and reduced manual effort |

| Customer Service | Chatbots, virtual assistants | 24/7 support and quicker response times |

| Fraud Detection | Pattern recognition, network analysis | Increased accuracy in identifying fraudulent claims |

| Marketing & Sales | Customer segmentation, personalized offers | Higher conversion rates and customer retention |

As you can see, AI isn't just a single tool but a versatile set of capabilities that strengthens each link in the insurance chain.

Connecting AI Adoption to Broader Business Trends

The move to bring AI into the insurance world isn't happening in a vacuum. It's actually a core part of a much bigger story: the massive digital shift that's changing how every modern business works. Companies everywhere are waking up to the fact that to stay competitive, they need to put data at the heart of their operations.

This whole movement is being driven by big steps forward in cloud computing, sophisticated analytics, and machine learning. Think about it this way: just as a factory might use AI to predict when a machine needs maintenance, an insurer is using it to forecast claim patterns. Investing in AI has stopped being an option; it's now a fundamental part of staying in the game and growing.

Grasping this wider context is key. The innovations we're seeing in insurance aren't just small tweaks. They signal a fundamental change in how companies deliver value. By bringing AI into the fold, insurers aren't just patching up old processes—they're realigning their entire business with a new standard where efficiency and customer experience are everything.

The Accelerating Pace of AI Adoption

The momentum behind AI is picking up speed at an incredible rate. Recent numbers from Statistics Canada reveal that the number of businesses using AI to produce goods or services has nearly doubled in just one year. That kind of growth really highlights how central AI is becoming to business operations across the country, and the insurance sector is a perfect example.

This isn't just about plugging in new technology. It’s about a deeper connection to the core goals that drive successful businesses in any industry.

- Operational Efficiency: AI automates the repetitive, everyday tasks, which cuts costs and, more importantly, frees up talented people to focus on more complex, valuable work.

- Customer Experience Enhancement: Today's customers expect fast, personalized service around the clock. AI makes that possible, delivering quick resolutions and tailored support.

- Adaptive Risk Management: Instead of reacting to problems, insurers can now use predictive analytics to see risks coming and manage them before they ever affect the business or its policyholders.

This strategic pivot ensures that the insurance industry not only keeps pace with other sectors but also builds a more resilient and responsive foundation for the future. It’s a clear signal of the long-term staying power of this technological evolution.

Of course, to connect AI adoption to business goals, you have to understand the real financial benefits. For a closer look at calculating the ROI of AI in customer service, this resource offers some great insights. Being able to clearly measure these returns is what solidifies AI's role as a core business strategy, not just another passing trend.

Navigating the Challenges of AI Implementation

Bringing artificial intelligence into the insurance world opens up some incredible possibilities, but it's certainly not a walk in the park. For every shiny new benefit, there's a hurdle that insurers need to clear. A smart, well-thought-out strategy is crucial to weave AI into your operations without tripping over the potential pitfalls.

One of the biggest obstacles is data privacy and regulatory compliance. Let's be honest, AI models are hungry for data, and in insurance, that data is deeply personal. Insurers have to navigate a maze of strict regulations, like PIPEDA here in Canada, to protect customer information. One misstep can lead to massive fines and, even worse, a complete erosion of customer trust.

The Ethical Dilemma of Algorithmic Bias

Beyond the black-and-white of compliance lies the murky grey area of algorithmic bias. Here's the problem: if an AI learns from historical data that reflects old-school prejudices, it can easily bake those biases right into its decision-making. Sometimes, it even makes them worse.

This could mean certain groups get unfairly quoted higher premiums for reasons that have nothing to do with their actual risk profile. It's a serious ethical minefield.

The real challenge is making sure every AI-driven decision is fair, transparent, and something you can actually explain. Without a human eye on these systems, you risk creating a black box that perpetuates inequality, landing your company in hot water legally and reputationally.

This need for honesty and transparency is popping up everywhere. We're even seeing a surge of AI-generated content in consumer reviews for insurance companies, which makes you question what’s real and what’s not. It's a stark reminder that we need to keep a close watch on these tools to maintain credibility.

Bridging the Technical and Talent Gaps

Many long-standing insurance companies are sitting on a pile of technical debt. Their core IT infrastructure is often a patchwork of legacy systems that just don't play well with modern AI tools. Trying to integrate, or even overhaul, these old systems is a massive undertaking, demanding significant time, money, and expertise. This isn't just an insurance problem; you can see similar issues across the board by exploring AI's role in the broader financial services industry.

And then there's the human element. The talent gap is real. Finding people who are true experts in data science, machine learning, and AI engineering is tough. Insurers are in a battle for talent against every other industry out there. Building an in-house team with the skills to create, manage, and scale these complex AI solutions isn't just a technical challenge—it's a fundamental business priority.

Here’s the rewritten section, crafted to sound more human and natural:

Where AI is Taking the Insurance Industry Next

If we look past what AI is doing today, the real excitement lies in where it’s headed. We’re moving beyond just making old processes faster and are starting to see entirely new ways of thinking about risk. This isn't just about tweaking the current system; it's about building a smarter, more responsive, and deeply personal insurance model for everyone.

At the heart of this shift are two big ideas: making insurance truly personal and stopping problems before they start.

The era of generic, one-size-fits-all policies is quickly coming to an end. The future is all about hyper-personalization, where your insurance isn't a fixed document you sign once a year, but a living service that adapts to your life. Think of a car insurance premium that changes each month based on how safely you actually drove, all tracked securely through your car’s telematics.

Shifting from Reaction to Prevention

Even more compelling is the move toward a preventative model. This is where AI teams up with the Internet of Things (IoT) to anticipate and even prevent losses from ever happening. It’s a complete flip in thinking—from paying out after a disaster to helping customers avoid the disaster in the first place.

This isn’t science fiction; it's already starting to happen.

- In Your Home: Imagine a tiny sensor in your basement that detects a slow water leak and pings your phone, letting you fix it before it becomes a flooded mess and a massive claim.

- For Businesses: AI can keep an eye on a commercial building's HVAC system, predicting a potential failure so maintenance can be scheduled before it breaks down during a heatwave.

- With Your Health: Data from a smartwatch could allow your health insurer to offer you personalized tips to improve your well-being, helping you stay healthier and avoid future medical issues.

This isn't just about better business for insurers. It’s about building a more resilient society where insurance acts as a true partner, using technology to help people lead safer, healthier lives.

This whole evolution is being powered by smarter and more capable AI. It promises a future where insurance isn't just a safety net you hope you never need, but an active guardian that's seamlessly woven into the background of your daily life.

Your Questions About AI in Insurance, Answered

As artificial intelligence becomes more common in the insurance world, it’s completely normal to wonder what it means for you, your policy, and the people you work with. Let's break down some of the most common questions.

Will AI Replace Human Insurance Agents?

No, the idea isn't to replace agents but to give them a serious upgrade. Think of it this way: AI is fantastic at tackling the repetitive, data-heavy tasks that can bog an agent down—think sorting through paperwork or answering basic policy questions.

By automating that groundwork, AI frees up human agents to focus on the things that truly matter. This means more time for building relationships, offering nuanced advice on complex coverage situations, and providing the kind of empathetic support that a machine simply can't. AI acts as a powerful co-pilot, not the pilot.

How Does AI Change My Insurance Premiums?

For most people, AI leads to premiums that are more accurate and, frankly, fairer. Historically, insurers had to lump people into broad categories based on general demographic data. AI changes the game by looking at your specific situation.

For instance, telematics data from your vehicle can show you're a safe driver, directly leading to a lower premium. Your rate becomes a reflection of your actual habits, not just your age or postal code. Over time, as AI helps insurers operate more efficiently and catch fraud, those savings can translate into more stable prices for everyone.

At its core, AI helps connect the price you pay directly to your unique circumstances. This shift away from generalized group pricing is one of the biggest wins for consumers.

Is My Personal Data Safe With AI?

Absolutely. Protecting your data is non-negotiable for insurers. In Canada, companies are legally bound by strict regulations like the Personal Information Protection and Electronic Documents Act (PIPEDA), which governs how personal information is handled.

Bringing AI into the mix actually means companies are doubling down on security. They use sophisticated data encryption and tight access controls to protect the information that fuels these systems. Insurers invest a huge amount in cybersecurity, knowing that maintaining your trust is just as important as complying with the law.

Ready to see how intelligent software solutions can transform your business operations? Cleffex Digital ltd builds custom AI-powered applications that drive efficiency and growth. Visit us at https://www.cleffex.com to learn more.