In Canada, the insurance industry is making a decisive shift away from old-school manual processes and embracing a smarter, data-driven future. We're talking about building intelligent systems that can automate tedious tasks, sharpen risk assessment, and create truly personal experiences for customers. This isn't some far-off idea any more; it's happening right now.

The New Reality of Canadian Insurance

The ground is shifting beneath the Canadian insurance sector. For generations, the industry has relied on historical data and human intervention. Now, it’s moving toward a more predictive and agile model, all thanks to artificial intelligence.

Think of it like swapping a well-worn road atlas for a real-time GPS that reroutes you around traffic jams you can't even see yet. This isn't just about getting new gadgets; it's a critical adaptation to a market that’s demanding much, much more.

Evolving Customer Demands

Modern policyholders have come to expect instant, digital-first service in every part of their lives, and insurance is no exception. They want the same seamless experience they get from their favourite apps. This pressure is forcing insurers to innovate quickly or get left behind.

This shift in expectations means customers now demand:

24/7 Accessibility: They want to manage their policies, file a claim, or get a question answered on their schedule, not just during business hours.

Personalised Products: The one-size-fits-all policy is dead. People want coverage tailored to their specific lives and unique risks.

Faster Resolutions: Nobody likes a long, drawn-out claims process. AI is a game-changer for shortening these timelines dramatically.

AI isn't just a tool for back-office efficiency; it's the engine driving the industry toward meeting modern customer expectations head-on. By handling routine tasks and digging up powerful insights, it frees up your team to focus on complex situations where a human touch: empathy and expertise, really matters.

The Need for Better Risk Modelling

At the same time, the very nature of risk is getting more complicated. Things like climate change, ever-present cyber threats, and unpredictable economic swings are creating challenges that traditional systems just can't model accurately. AI gives insurers the analytical firepower to see through this fog.

If you're looking ahead, you can learn more about key insurtech trends in Canada for 2026 in our detailed article.

From underwriting to claims, AI is already reshaping how the core functions of insurance get done. It’s quickly becoming an essential partner for any insurer looking to grow and build resilience in this new era.

How AI Is Making Insurance Work Better

Artificial intelligence isn't some far-off concept any more; it's already on the ground, actively overhauling core operations for Canadian insurers. From the first quote to the final claim settlement, AI is bringing a new level of speed and accuracy to processes that were once bogged down by manual work. This isn't just about doing things faster; it's about fundamentally changing how insurance gets done.

Think about a routine car insurance claim. Instead of taking weeks, an AI can process it in minutes. By analysing photos of vehicle damage and checking them against policy details, the system can approve a payout almost on the spot. This is happening right now, and it’s a massive win for customer satisfaction while freeing up human adjusters to focus on the truly complex cases.

The result is an insurance ecosystem that’s smarter and more responsive. For insurers, that means better decisions and lower operating costs. For customers, it means faster service, fairer prices, and a much clearer process.

Supercharging Claims Processing

The claims process has always been a bit of a headache for everyone involved, filled with paperwork and long waits. AI-powered systems are tackling this head-on by automating the most tedious steps.

Imagine a homeowner submitting photos of a storm-damaged roof through an app. An AI, trained on thousands of similar images, can instantly gauge the damage, estimate repair costs, and flag the claim for immediate payment. It’s a simple, elegant solution to an old problem.

This kind of automation delivers some serious benefits:

Speed: Simple claims can now be settled in hours, not weeks.

Accuracy: AI minimises the risk of human error in data entry and assessment.

Consistency: Every claim is evaluated using the same objective criteria, ensuring fairness.

The industry is jumping on board for good reason. By 2025, it's expected that over 90% of insurance companies in Canada will have AI integrated into their core operations. This shift is already slashing claims processing times by up to 70%, leading to massive annual savings and happier customers.

Smarter Underwriting and Risk Assessment

Underwriting is the very foundation of the insurance business. With AI, that foundation is becoming stronger and far more precise. Traditionally, underwriting relied on broad demographic data, which often resulted in one-size-fits-all pricing.

AI models, on the other hand, can dig into massive, diverse datasets in real-time. We're talking about everything from satellite imagery for property insurance to telematics data from a vehicle. This allows for a much more detailed and personalised look at risk.

Take flood risk, for example. An AI underwriting platform can analyse historical weather patterns, topographical data, and even local drainage system records for a specific property. The result is a policy priced with an accuracy that was simply out of reach before.

This incredible level of detail allows insurers to offer fairer, more competitive pricing that actually reflects a person's or business's unique risk profile. It’s a move away from generalisations and toward truly personalised coverage.

Improving the Customer Experience with AI

Beyond the back-office functions, AI is also changing how insurers talk to their customers. Conversational AI – chatbots and virtual assistants – is quickly becoming the new standard for providing instant help. These bots can answer common policy questions, walk a customer through filing a claim, or generate a quote 24/7.

This does more than just make customers happy; it makes business sense. Human agents are freed up to handle the complex, emotionally charged issues where a human touch is essential. To see how this is playing out in a related sector, look at how chatbots in banking are elevating customer support. This growing focus on AI insurance software development in Canada is how the industry is keeping up with modern demands for fast, accessible service.

Navigating Canadian Regulations and Data Privacy

Building sophisticated AI insurance software in Canada is about more than just slick code. It requires a solid grasp of the country's specific legal and ethical rules. Getting this right isn't just a box-ticking exercise; it's the bedrock of customer trust and the key to your project's long-term viability.

The main player on the federal stage is the Personal Information Protection and Electronic Documents Act (PIPEDA). This law dictates how private companies can collect, use, and share personal information in their commercial dealings. For anyone developing AI, PIPEDA's rules are not just suggestions – they are mandatory.

Think of PIPEDA as the ground rules for handling sensitive customer data. Its goal isn't to stifle innovation but to make sure it happens responsibly. It means insurers have to be crystal clear about how their AI models use personal data and get proper consent before any of that data is touched.

Getting to Grips with PIPEDA's Core Principles

PIPEDA is founded on ten fair information principles, and they have a direct impact on how you build AI software. Accountability is a big one. It means your company is on the hook for the personal information you manage, even if a third-party AI vendor is the one processing it. You need clear, documented policies to prove you're protecting that data.

Another cornerstone is consent. You can't just shovel customer data into a new AI model without getting their clear and informed permission. This involves explaining in simple terms what data you're using, how the AI works, and why you're doing it; for instance, to generate a more accurate insurance quote.

“Compliance is not a one-time checkbox; it is an ongoing commitment. For AI in insurance, this means embedding privacy considerations into every stage of the development lifecycle, from initial data collection to model deployment and monitoring.”

On top of that, PIPEDA insists that you only collect data that is absolutely necessary for the purpose you've identified. This stops companies from hoarding data "just in case" and forces a more disciplined approach, making you think hard about what information your AI truly needs to do its job.

Weaving Through the Provincial Privacy Maze

While PIPEDA provides the federal baseline, Canada’s privacy rules are a patchwork of provincial laws. If you operate in certain provinces, you have to follow their local laws, which can be even tougher than the federal ones. This is a critical point to remember for any AI insurance software development Canada initiative.

Three provincial laws stand out:

Quebec's Law 25: Formally known as An Act to modernise legislative provisions as regards the protection of personal information, this is arguably Canada’s strictest privacy law. It brings in new rules for privacy impact assessments, stronger consent requirements, and hefty fines for breaking the rules.

Alberta's PIPA (Personal Information Protection Act): This law manages how private-sector organisations in Alberta handle personal information and is generally seen as very similar to PIPEDA.

British Columbia's PIPA (Personal Information Protection Act): Much like Alberta's law, BC's PIPA lays down the rules for private organisations handling personal data within the province.

These provincial laws generally echo PIPEDA's main ideas but often have their own unique requirements. Quebec's Law 25, for example, puts a major focus on data governance and requires a designated Privacy Officer.

Building a compliant AI solution means creating a system that can meet both federal and provincial standards at the same time. Managing this dual compliance is a major challenge, but also a critical factor for success. You can find a more detailed breakdown in our guide explaining AI and data privacy in insurance. Laying this legal groundwork from day one ensures the innovative tools you build are not only powerful but also trustworthy.

Choosing Your Technology Stack and Architecture

Think of building a new AI platform like constructing a custom-designed building. You wouldn't start pouring a foundation without a detailed blueprint. Choosing the right technology stack and architecture is exactly that – creating the blueprint that will ensure your AI system is strong, scalable, and ready for the future. For any AI insurance software development in Canada, this means carefully selecting the right mix of cloud platforms, data tools, and AI technologies that all click together.

A well-designed architecture is the bedrock of everything you want to achieve. It dictates how quickly you can introduce new features, how much data your system can chew through, and how reliably it performs as your business scales. Getting this right from day one is non-negotiable for a successful project.

The process involves weighing your options for cloud infrastructure, figuring out the best way to store and manage your data, and settling on the programming languages and frameworks that will bring your AI models to life. Each choice plays a critical role in building a powerful, long-lasting system.

Building a Modern Architectural Blueprint

Gone are the days of building software as one giant, tangled block of code. The modern approach, and frankly the only one you should consider, is a microservices architecture.

Imagine building with LEGOs instead of carving a statue from a single block of marble. Each LEGO brick is a small, independent service that handles one specific job, like processing a claim, calculating a premium, or running a fraud check.

This modular approach has some massive advantages:

Scalability: If your claims processing service suddenly gets hit with a surge of activity, you can scale just that service without touching anything else. It's efficient and cost-effective.

Flexibility: Different teams can work on different services at the same time, using the best tool for their specific task. This seriously speeds up development.

Resilience: If one microservice stumbles, it doesn’t take the whole application down with it. The rest of the system keeps running smoothly.

This structure is what makes software agile and adaptable. To get a better sense of how these pieces fit together in the real world, it’s worth digging into common enterprise application architecture patterns to see how they support complex business operations.

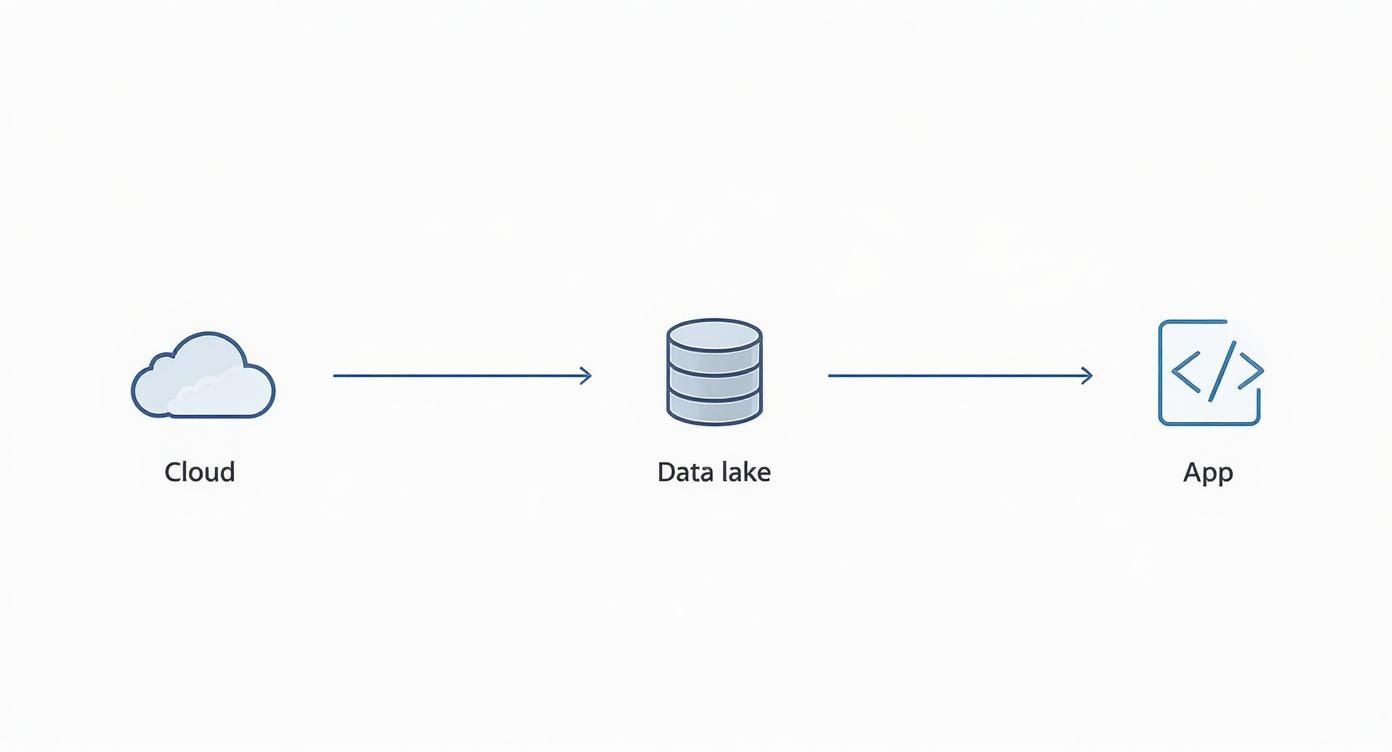

Cloud platforms like Amazon Web Services (AWS) and Microsoft Azure are the natural home for this type of architecture. They offer all the tools you need to manage microservices effectively, plus robust data storage solutions. At the centre of this is the data lake – a massive, centralised repository that can hold all the structured and unstructured data your AI models need to learn and grow.

Key AI Technologies and Tools

Once your architectural foundation is solid, it's time to pick the specific AI tools for the job. Not all AI is created equal, and different insurance functions call for different technologies. For instance, Natural Language Processing (NLP) is absolutely essential for making sense of unstructured text from claim forms, customer emails, and dense policy documents.

On the other hand, computer vision gives your AI the ability to "see" and interpret images. This is a game-changer for assessing property damage from photos or analysing satellite imagery to inform underwriting decisions. These technologies are powered by specific programming languages and frameworks.

The goal is to select a tech stack that is not only powerful today but also supported by a strong community, ensuring it remains relevant and maintainable for years to come. This focus on long-term viability is a hallmark of strategic AI development.

To help make sense of the options, let's break down some of the most popular technologies used in building AI insurance software today.

Comparison of Key Technologies for AI Insurance Software

This table compares popular technology choices for building AI insurance platforms, highlighting their primary use-cases and key strengths within a Canadian context.

| Technology Category | Popular Options | Primary Insurance Use-Case | Key Strengths |

|---|---|---|---|

| Programming Language | Python | Model development, data analysis, and automation. | Extensive libraries (like Pandas and NumPy) and a massive developer community make it the top choice for AI. |

| AI/ML Frameworks | TensorFlow, PyTorch | Building and training neural networks for fraud detection, underwriting, and NLP. | Offers high-level APIs for rapid prototyping and scalable tools for deploying models in production. |

| Cloud Platforms | AWS, Microsoft Azure | Hosting infrastructure, data lakes, and managed AI services. | Provides secure, scalable, and compliant environments essential for handling sensitive Canadian data. |

| MLOps Tools | MLflow, Kubeflow | Managing the end-to-end machine learning lifecycle, from experiment tracking to model deployment. | Ensures model development is repeatable, traceable, and efficient, which is vital for regulatory compliance. |

Ultimately, the technologies you choose will shape what’s possible. By pairing a modern microservices architecture with the right AI frameworks and a secure cloud platform, you're not just building software, you're building a strategic asset for your business.

Your Practical Roadmap for AI Implementation

Jumping into AI software development isn't something you do on a whim. It needs a thoughtful, step-by-step plan to keep the project on track and manage the inherent complexity. A clear roadmap turns a big idea into a manageable series of actions, guiding your team from the initial whiteboard session all the way to a full-scale rollout. Think of it as de-risking your investment while ensuring everything you build is tied directly to real business goals.

It’s tempting to dive straight into the tech, but the journey always starts with conversation, not code. A solid strategy is the foundation for everything that follows.

Phase 1: Discovery and Strategy

Before anyone writes a single line of code, the first and most critical step is to agree on what success actually looks like. This is all about asking the right questions. What specific problem are we trying to solve? Which KPIs will tell us if we're winning? You need to pinpoint high-impact opportunities, whether that’s automating the tedious parts of claims verification or giving your underwriters a sharper, data-driven edge.

This is also the time for a bit of honest self-assessment. Does your team have the skills to pull this off, or do you need to bring in a specialised development partner? Getting this right from the start puts your project on solid ground.

Phase 2: Data Preparation and Governance

Data is the fuel for any AI engine. This phase is all about gathering, cleaning, and structuring the information your AI models will learn from. For any Canadian insurer, this process comes with a huge responsibility: ensuring every piece of data is handled in strict compliance with PIPEDA and provincial privacy laws like Quebec's Law 25.

Getting your data governance right involves a few key steps:

Data Cleansing: This means hunting down and fixing inaccuracies, duplicates, and inconsistencies. You're aiming for a dataset you can truly rely on.

Anonymisation: Wherever possible, strip out personally identifiable information to protect customer privacy.

Secure Storage: Set up a secure data lake or warehouse. This isn't just a database; it's a fortress for your most valuable asset.

Phase 3: Development and Testing

With a clean dataset and a clear strategy, the real development work can kick off. This is where your team selects the right algorithms, trains the AI models, and puts them through their paces with rigorous testing. It’s an iterative process of building and refining, teaching the models to spot patterns, make accurate predictions, and handle tasks with precision.

Testing isn’t just a box to be checked; it's a continuous cycle. The models have to be validated against data they’ve never seen before to make sure they’ll perform reliably in the real world, without any hidden or unintended biases.

This diagram gives a simplified look at how the pieces fit together, from the cloud infrastructure and data storage up to the final application.

It really shows how foundational elements, like cloud services and data lakes, are what power the AI application your team and customers will eventually use.

Phase 4: Deployment and Integration

Once a model has been thoroughly tested and validated, it’s time to go live. This means carefully weaving the new AI software into your existing workflows and connecting it to legacy systems. A phased rollout is almost always the best approach. Start with a small pilot group to smooth out the transition and collect priceless feedback before going company-wide.

Phase 5: Monitoring and Optimisation

Launching your AI software isn't the finish line. From here on out, it’s all about continuous monitoring to track performance, measure the actual business impact, and spot opportunities for improvement. AI models can experience "drift" as new data comes in, meaning their accuracy can degrade over time. They need ongoing tweaks and optimisation to stay sharp.

This cycle of monitoring and refining is what ensures your AI insurance software development in Canada delivers lasting value. And the results are worth it. Reports show that AI can slash claims processing times by up to 60%, cutting down on operational headaches while seriously improving fraud detection. You can dig into the numbers in the AI in insurance market research from Technavio.com to learn more.

Charting Your Course in AI-Powered Insurance

We've covered a lot of ground in this guide, and the main takeaway is clear: for any Canadian insurer looking to stay competitive, adopting AI is no longer a question of if, but when and how. The best way to think about AI isn't as some complex, intimidating technology, but as a crucial partner for building a stronger, more sustainable business.

The path forward is all about building on the core benefits we’ve explored. Whether it’s finding new efficiencies in your day-to-day operations, getting incredibly precise with risk assessment, or simply giving your customers a better experience, AI gives you the tools to create a more resilient and responsive insurance company.

From Strategy to Action

Getting an AI insurance software development Canada project off the ground and into production really comes down to a methodical, well-planned approach. We’ve walked through the key milestones, from navigating the complexities of Canadian data privacy laws like PIPEDA to laying out a structured implementation plan that ties your tech investments directly to real business goals.

To recap, a successful journey really boils down to a few key principles:

Prioritise Compliance: Make data privacy and regulatory compliance the bedrock of your project, not an afterthought.

Build a Solid Blueprint: Choose a scalable architecture and a solid tech stack that won’t just solve today’s problems but will grow with you.

Follow a Phased Roadmap: Walk before you run. A logical progression from discovery and data prep to a pilot, deployment, and ongoing improvement is the smartest way forward.

Adopting AI is a journey, not a destination. It’s a commitment to learning and adapting as you go, always making sure the technology serves your core mission: protecting policyholders and driving business value.

Taking Your Next Step

Now that you have a clear picture of what and how, the only question left is when. And the answer is now. And the answer is now. In an industry that’s moving this quickly, standing still means falling behind.

Your first move doesn't have to be a massive, company-wide overhaul. It can be something much more manageable. Start with an internal readiness assessment – what skills do you have, and where are the gaps? What's the state of your data? Or, you could pick a small, high-impact pilot project, like automating one specific part of the claims verification process. Proving the value on a small scale is a fantastic way to build momentum.

Whatever you choose, the most important thing you can do is start.

Your Top Questions About AI in Insurance, Answered

Thinking about bringing AI into your insurance operations? You’re not alone. It’s a big step, and it’s natural to have questions about the practical side of things – the costs, where to begin, and what roadblocks you might hit.

Let's cut through the noise and tackle some of the most common questions Canadian insurers ask when they're considering a custom AI software project.

What’s the Real Cost of Building Custom AI Insurance Software in Canada?

This is probably the first question on everyone's mind, and the honest answer is: it depends. Asking for the price of AI software without defining the scope is a bit like asking how much it costs to build a house without any plans. A simple proof-of-concept could be a five-figure investment, while a full-blown platform that reimagines core operations will easily run into the hundreds of thousands, or even more.

The final price tag really comes down to a few key things:

Project Complexity: Are we talking about a simple chatbot to answer basic policy questions, or a sophisticated predictive model for underwriting that needs to analyse dozens of complex data sources? The deeper you go, the more resources you’ll need.

Your Data Situation: AI is powered by data. If your data is clean, organised, and ready to go, you're ahead of the game. If it needs a lot of work, like cleaning, labelling, and structuring, that preliminary effort will be a significant part of your budget.

Integration Headaches: Getting your shiny new AI tool to talk to your existing, often older, systems can be tricky. This kind of delicate integration work requires specialised expertise and adds to the cost.

The Team: The biggest line item is often the people. The cost of skilled AI developers, data scientists, and project managers in Canada is a major factor in the overall budget.

We’re a Smaller Insurer. How Can We Even Get Started With AI?

It’s easy to think AI is a game only for the big players, but that's a common misconception. For smaller insurers or MGAs, the secret isn't to try and boil the ocean. It’s about being smart and strategic. Don’t aim for a massive, all-in-one system right out of the gate.

Instead, find one specific pain point where AI could deliver a quick, clear win. Maybe it’s automating a tedious, repetitive task in your claims intake process. Or perhaps it’s building a simple tool to help your brokers quickly match clients with the right products.

For smaller firms, the goal should be to secure an early win. A successful pilot project not only solves a real problem but also builds internal confidence and makes a compelling business case for further AI investment.

This targeted approach lets you test the waters without a massive upfront commitment. You get to learn, adapt, and most importantly, prove the value of AI before you decide to go bigger.

What Are the Biggest Roadblocks in an AI Implementation?

AI offers incredible potential, but the road to a successful implementation has its share of bumps. Knowing what to watch for from the start can save you a lot of headaches down the line.

The single biggest hurdle we see, time and again, is data quality. An AI model is only as smart as the data it learns from. If your historical data is a mess – incomplete, inconsistent, or locked away in different departmental silos – a huge chunk of your initial effort will be spent just getting it ready.

A few other common challenges to prepare for include:

Legacy System Integration: Many insurers are still running on older, monolithic systems that weren't built for the modern, connected world. Weaving new AI software into that legacy fabric without breaking anything is a serious technical challenge.

Getting Your Team on Board: The best technology is useless if no one uses it. You can't just drop a new AI tool on your team and expect them to embrace it. You need a solid change management plan, with clear communication and proper training, to help them trust and adopt the new way of working.

The War for Talent: There’s a reason AI experts are in high demand across Canada. Finding the right in-house talent or a dependable development partner with genuine insurance-sector experience can be a major challenge in itself.

At Cleffex Digital Ltd, we specialise in helping Canadian insurers navigate these challenges to build powerful, compliant, and effective AI solutions. Contact us today to discuss your project.