When we talk about artificial intelligence in insurance claims, we're really talking about using machine learning and smart automation to overhaul a traditionally slow process. It’s a fundamental shift away from manual reviews and paperwork towards a faster, data-driven system. The result? Quicker payouts for customers and significant cost savings for insurers. This technology touches every part of the claims journey, from the first notice of loss to rooting out potential fraud.

The Reality of Modern Claims Processing

For decades, filing an insurance claim has been a universally dreaded experience. Think about the classic fender-bender: it often kicks off a marathon of filling out paperwork, making endless phone calls, and then waiting an agonizingly long time for a resolution. Every day that cheque is delayed just adds more stress to an already tense situation.

This old-school model isn't just a headache for customers; it’s also a massive operational drain for insurance companies. Adjusters get bogged down in manual data entry, sifting through documents, and playing phone tag. All of this manual effort drives up costs and creates frustrating bottlenecks for everyone involved.

A Tale of Two Claims Experiences

To really get a feel for AI's impact, let's compare two scenarios. In the "before" picture, a customer has to print forms, mail in documents, and chase an adjuster for weeks just to get an update. The whole process feels slow and completely out of touch with the instant, digital world we live in.

Now, let's look at the "after" scenario, driven by AI in insurance claims processing. A policyholder snaps a few photos of the damage on their smartphone right at the scene. An AI-powered app analyzes the images, checks their policy details, and gets the claim started, all in a matter of minutes.

This shift isn't just about doing things faster. It's about turning a historically painful process into one that's smooth, transparent, and built around the customer's needs. AI can provide real-time updates and, for straightforward claims, even approve and send the payment almost instantly.

Augmenting Human Expertise, Not Replacing it

This jump in technology doesn't mean human adjusters are heading for the door. On the contrary, it supercharges their abilities. By taking over the repetitive, data-heavy lifting, AI frees up adjusters to focus on the work that truly requires a human touch, managing complex cases, offering empathetic support, and making those tough judgment calls.

This partnership between people and technology creates a claims system that is far more efficient and accurate. Before we dive into the specific ways AI is used, it's important to remember the complexities adjusters already deal with, like navigating intricate diminished value claims, which require incredibly detailed assessments.

AI is the tool that helps manage these details at scale, becoming a cornerstone of the wider digital transformation in insurance that is currently reshaping the entire industry. The end goal is an ecosystem where technology handles the predictable, and humans manage the exceptional.

How AI Transforms Claims Workflows

Think of artificial intelligence less as a futuristic concept and more as a highly skilled digital assistant, plugging directly into the insurance claims lifecycle. By taking over the repetitive, data-heavy lifting, AI completely reshapes how a claim travels from its first report to the final settlement. This frees up your human adjusters to focus on what they do best: handling the complex, nuanced, and empathetic parts of the job.

The process kicks off the second a policyholder reports an incident, a step known as the First Notice of Loss (FNOL). Instead of being stuck on hold, customers can now use intelligent chatbots to file their initial report anytime, day or night. These bots guide them through the process, gathering all the essential details in a structured way. At the same time, AI-powered photo analysis can assess initial damage from pictures uploaded straight from a smartphone, generating a preliminary damage report almost instantly.

But this initial data capture is just the beginning. The real magic of AI in insurance claims processing lies in its ability to make sense of massive amounts of information that would simply overwhelm a person.

Automating Data Interpretation and Triage

Once a claim is in the system, AI algorithms immediately start scanning and interpreting every related document. We’re talking about everything from police reports and witness statements to complicated medical records and repair invoices. Using Natural Language Processing (NLP), the AI can actually read and understand unstructured text, automatically spotting and flagging critical information like injury severity, liability clues, and policy coverage limits.

This automated triage system sorts claims with incredible speed and accuracy.

Simple, low-risk claims can be fast-tracked for automated approval, often getting settled in minutes instead of weeks.

Complex or high-value claims are flagged and sent directly to experienced human adjusters, along with a neat summary of all the key data.

Potentially fraudulent claims that show suspicious patterns are immediately flagged for a specialized review, stopping losses before they even happen.

This instant categorization ensures your team's expertise is directed exactly where it’s needed most.

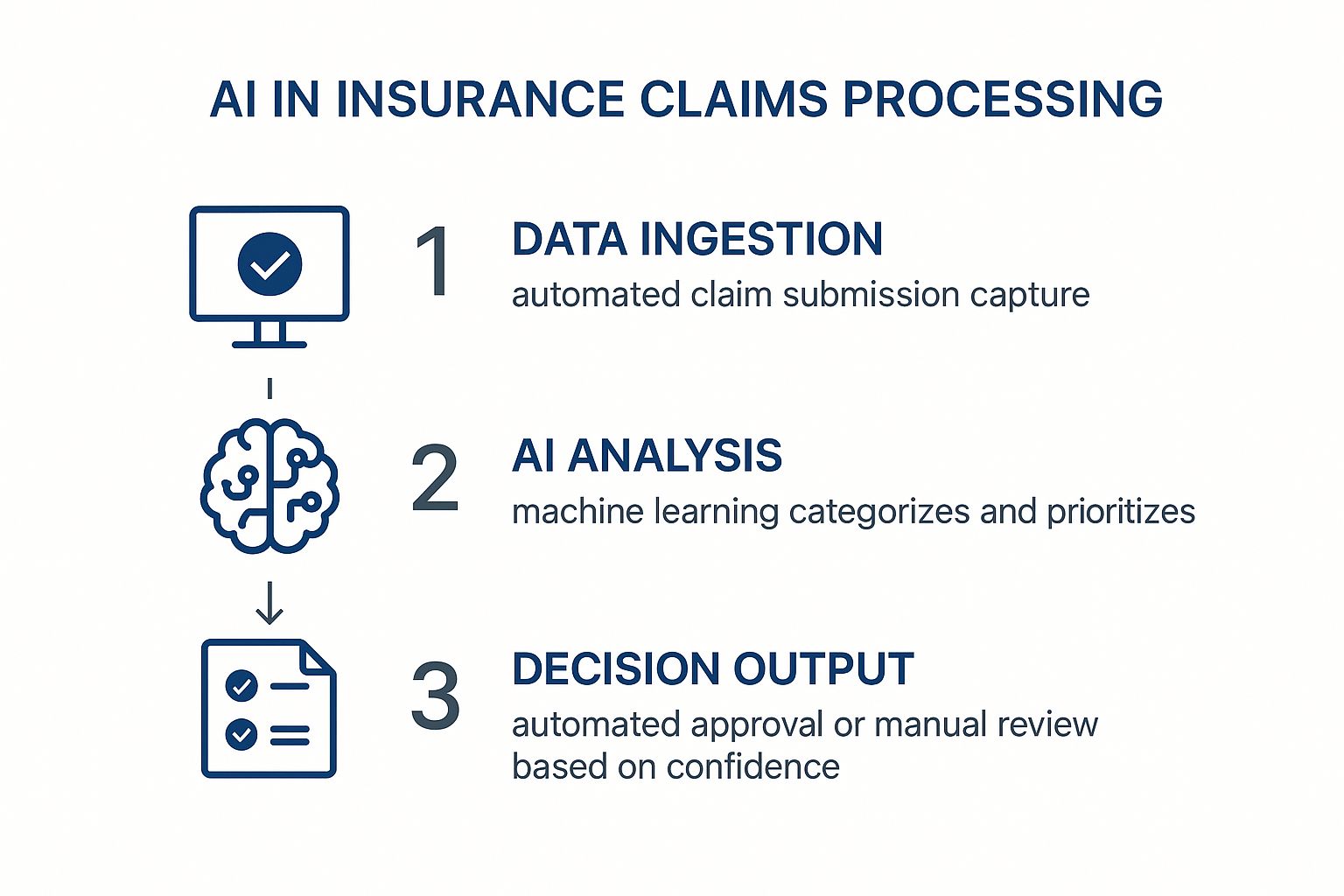

The infographic below shows just how much smoother this journey becomes when AI is involved, moving from data intake to a final decision.

As you can see, the workflow shifts from manual data entry to intelligent analysis and then to a clear decision, creating a far more efficient system than the old way of doing things.

Empowering Adjusters with Data-Driven Insights

AI isn't just a workflow manager; it’s a powerful analytical partner for your adjusters. AI solutions are at the centre of advanced predictive and prescriptive analytics, helping shift claims processing from a reactive task to a proactive strategy. An AI model can sift through historical claims data to predict the likely total cost of a new claim, helping set accurate financial reserves from day one.

This forward-looking ability is already seen as a major catalyst for change. A recent study found that more than 60% of Canadian insurers in the Credit Protection Insurance sector believe AI will have a major impact on their underwriting and claims processing within the next three to five years. This shift is all about delivering faster approvals and more accurate risk assessments by modernizing traditionally slow processes.

To illustrate the difference, let’s compare the old and new ways of handling a claim.

Traditional vs AI-Powered Claims Processing

The table below breaks down the stages of a claim, contrasting the classic manual approach with the faster, smarter workflow that AI makes possible.

Claims Stage | Traditional Process (Manual) | AI-Enhanced Process (Automated & Augmented) |

|---|---|---|

FNOL & Data Entry | Customer calls, waits for an agent. Staff manually enter data from forms. | Customer uses a 24/7 chatbot or app. AI extracts data from photos & documents. |

Damage Assessment | An adjuster must physically inspect the site or vehicle, which takes days. | AI analyzes uploaded photos/videos for an instant preliminary damage estimate. |

Document Review | Adjuster manually reads through police reports, medical files, and invoices. | NLP scans all documents in seconds, flagging key information and inconsistencies. |

Triage & Assignment | A supervisor manually reviews new claims to assign them to the right adjuster. | AI automatically categorizes claims by complexity and assigns them to the best-suited team. |

Fraud Detection | Relies on adjuster’s intuition and manual checks against known fraud indicators. | AI models analyze claim data for suspicious patterns, flagging high-risk claims in real-time. |

Settlement | It can take weeks or months due to manual reviews, back-and-forth communication. | Simple claims are approved and paid in minutes. Complex claims are routed with full data summaries. |

This side-by-side comparison makes it clear: AI doesn't just speed things up; it introduces a new level of intelligence and precision to every step.

Ultimately, this is about creating a smarter, more responsive system. It turns the claims process from a slow, linear sequence of manual tasks into a dynamic, data-rich workflow. This augmented approach not only makes your internal operations more efficient but also delivers the fast, transparent, and seamless experience modern customers have come to expect.

Unlocking the Business Benefits of AI

While speed is a great start, the real story behind AI in insurance claims processing is much bigger. The benefits don't just stay in the claims department; they ripple out across the entire business, boosting everything from day-to-day workflows to long-term customer relationships.

Think of it like three interconnected pillars that, when strengthened together, build a far more resilient and competitive insurance company. By looking at how these pillars support each other, you can see the true strategic value AI brings; it’s not just about doing things faster, but doing them smarter.

Achieving Operational Excellence

The first and most noticeable changes happen on the operational front. AI gets right to work on the classic pain points of manual data entry, document reviews, and initial claim sorting. Automating these repetitive tasks frees up an incredible amount of time and resources. We’re not talking small gains here; some insurers have seen processing costs drop by as much as 50-65%.

The secret is eliminating the bottlenecks. AI doesn't need a coffee break. It works around the clock to sort, validate, and route claims consistently and accurately.

This allows claims handlers to step away from the administrative grind and focus their expertise where it truly matters: on complex cases that require nuanced judgment and a human touch. The entire department becomes leaner and more effective.

In Canada, this acceleration is already making a difference, especially with professional liability claims. AI algorithms can sift through data exponentially faster than a human adjuster, shrinking review times from days or weeks down to just a few hours. This leads to quicker resolutions, less paperwork, and happier policyholders, a major win you can read more about in these insights on AI in liability claims.

Strengthening Financial Performance

Beyond just saving money on operations, AI actively protects an insurer's bottom line. It does this by tackling two of the industry's biggest financial headaches: fraud and claims leakage. Claims leakage, the money lost through overpayments, processing errors, or missed recovery opportunities, can be dramatically cut down by AI's analytical muscle.

AI models are brilliant at spotting inconsistencies and suspicious patterns across massive datasets, things a human would almost certainly miss. This creates a much tougher line of defence against fraud.

Pattern Recognition: AI can connect the dots between seemingly separate claims that all share a suspicious element, like using the same auto shop or medical clinic.

Anomaly Detection: The system quickly learns what a "normal" claim looks like and instantly flags any that deviate from that baseline, sending them for a closer look.

Predictive Scoring: Every new claim gets a real-time fraud risk score, helping investigators prioritize their efforts on the cases that need it most.

By catching fraud early and ensuring payouts are accurate, AI plugs the financial leaks. This leads to healthier loss ratios and gives the entire company a more stable and predictable financial footing.

Building Lasting Customer Loyalty

For most people, the claims experience is the moment of truth with their insurance provider. A slow, confusing process can send a customer running to a competitor. A smooth, transparent one can create a loyal advocate for life. AI is the key to delivering that exceptional experience.

The most obvious win is faster payouts. When a straightforward claim is settled in minutes instead of weeks, it removes a huge amount of stress for the policyholder and builds incredible goodwill. That positive feeling is a powerful way to stand out. In fact, some reports link AI integration to a stunning 95% improvement in customer experience.

It also offers 24/7 accessibility. AI-powered chatbots and virtual assistants let customers file a claim or check its status whenever they want, not just during office hours. This kind of self-service gives people control and delivers the instant answers they've come to expect. By making the whole process quicker, clearer, and more convenient, AI turns a moment of crisis into a chance to demonstrate value and earn a customer's loyalty for years to come.

AI in Insurance Claims Processing in Action

It’s one thing to talk about AI in theory, but where does the rubber really meet the road? The true impact of AI in insurance claims processing comes to life when you see how it solves real, everyday problems. Across the industry, this technology isn’t just about incremental improvements; it's completely reshaping how claims are handled from start to finish.

Let's dive into a few examples to see what this looks like in practice. We'll look at a common headache in each insurance sector, see how AI provides the remedy, and check out the tangible results.

Auto Insurance Damage Analysis

One of the biggest drags on auto insurance claims has always been the repair estimate. A customer has a fender bender and then has to wait. They schedule an appointment, an adjuster drives out to inspect the car, and days, sometimes weeks, pass before there's a clear estimate. The entire process gets bogged down from the very beginning.

Enter computer vision. This is the AI tech that gives machines the ability to "see" and make sense of images. Now, instead of waiting for an adjuster, the customer just pulls out their phone.

They snap a few pictures of the damage, upload them through an app, and the AI takes over instantly.

Spotting the Damage: The AI model identifies every dent, scratch, and broken part, from a crumpled bumper to a shattered taillight.

Gauging the Severity: It then determines how bad the damage is, whether it can be repaired, or does the whole part needs to be replaced.

Calculating the Cost: By tapping into a huge database of part prices and local garage labour rates, the AI spits out a reliable repair estimate in seconds.

The result? What used to be a week-long ordeal is now practically immediate. Some insurers can now generate a quote and approve repairs within minutes of a claim being filed.

This isn't about replacing people. It’s about reallocating their expertise. Human adjusters are freed from routine inspections to focus on more complicated cases, like those involving major accidents or liability disputes.

Property Insurance Catastrophe Response

When a wildfire, hurricane, or major flood hits, the wave of property claims is immense. Insurers face the logistical nightmare of getting adjusters safely into a disaster zone. With thousands of claims pouring in at once, it’s simply impossible to assess every home quickly, leaving families in a terrible state of uncertainty.

This is where AI, paired with aerial imagery, has become a game-changer. Insurers now use high-resolution images from satellites, planes, and drones taken right after an event.

An AI model, trained on countless images of property damage, scans this new footage. It can rapidly assess the damage to thousands of individual homes across a wide area, sorting them by severity. This gives insurers an immediate, clear picture of the devastation.

The outcome is a faster, more effective response when people need it most. Insurers can triage claims at scale, proactively reaching out to the hardest-hit policyholders, sometimes before they’ve even had a chance to file a claim. This has been critical for getting money into the hands of displaced families right away. Crafting these advanced models is a specialized skill, which is why many insurers look to data science and AI development services to build solutions tailored to their needs.

Health Insurance Billing Verification

The world of health insurance is a labyrinth of medical codes, complex billing rules, and a high risk of errors and fraud. Manually reviewing every single line on a medical claim is a herculean effort that slows down payments for everyone, patients and providers alike.

AI steps in here as an incredibly sharp digital auditor. Using machine learning and Natural Language Processing (NLP), it can read and understand complicated medical bills and patient records at superhuman speed.

The AI instantly flags common problems that would take a human reviewer hours to find.

Coding Accuracy: It confirms that the medical codes (like CPT and ICD-10) match the procedures performed.

Billing Anomalies: The system spots red flags like duplicate charges, services that don't align with a diagnosis, or costs that are way out of line with the norm.

Policy Compliance: It cross-references everything with the patient's specific plan to ensure all services are actually covered.

By automating this grunt work, AI clears the path for legitimate claims to be approved and paid in a fraction of the time. The system only escalates the small number of claims with real issues to a human expert, making the entire healthcare payment system faster and far more accurate.

Getting Past the Hurdles of AI Implementation

Bringing AI into your claims processing workflow is exciting, but let's be realistic, it's not as simple as flipping a switch. The journey from idea to a fully functioning, effective system has its share of bumps. To truly get the most out of AI, insurers need to tackle a few common but significant challenges head-on.

One of the first roadblocks many companies hit is the clash between old and new technology. A lot of insurers are built on top of dependable, but dated, legacy systems. These core platforms weren't designed to talk to modern AI tools, which can make pulling the necessary data a messy, expensive, and time-consuming affair.

Dealing with Data Privacy and Hidden Biases

Once you get the tech talking, the next big challenge is the data itself. AI models thrive on data, but in insurance, that data is incredibly personal. You're dealing with sensitive information, and you have a massive responsibility to protect it. Staying on the right side of privacy laws like PIPEDA isn't optional. For a more detailed look at this, our guide on AI and data privacy in insurance is a great resource.

Then there's the sneaky problem of algorithmic bias. An AI is only as smart and fair as the data it learns from. If your historical claims data contains unconscious biases from past decisions, the AI will not only learn them but could make them even worse. This could lead to systematically unfair outcomes for certain groups of people, which is a massive legal and reputational minefield.

A responsible AI implementation isn't just about technology; it's about building a framework of fairness and transparency. This means establishing robust data governance, continuously auditing algorithms for bias, and ensuring decisions remain equitable for all policyholders.

Why Humans Still Matter: The "Human-in-the-Loop"

This leads us to what is arguably the most critical strategy for success: keeping a human in the loop. AI is a workhorse, it's brilliant at sifting through mountains of information and finding patterns we might miss. But it doesn't have a gut feeling, empathy, or the real-world wisdom of a seasoned adjuster.

A human-in-the-loop approach creates a powerful partnership where AI does the heavy lifting, but a person is always there to guide it. This means someone is available to:

Review edge cases: Step in for those tricky, unusual claims that don't fit the mould.

Provide oversight: Double-check the AI's recommendations, especially on big or sensitive claims.

Manage customer interaction: Be the empathetic voice a policyholder needs during a stressful time.

This isn't about replacing people; it's about giving them superpowers. It keeps the process fair, accurate, and, most importantly, human.

Despite these challenges, the reasons to push forward are compelling. In Canada, property claims recently jumped by a staggering 36%. Insurers are looking to generative AI as a crucial tool to handle this increase. Getting it right could unlock operational savings of up to 25% by sharpening data analysis and cutting down on claim leakage. You can discover more insights on how generative AI can improve claims management to see the full picture. By taking it one step at a time, focusing on strong governance, and constantly testing their models, insurers can successfully navigate these obstacles and tap into the true power of AI.

Building the Future: A Human and AI Partnership

The road ahead for insurance isn't a completely automated one. Instead, it’s about creating a powerful partnership between human insight and artificial intelligence. The future of claims processing isn't a cold, faceless system, but a dynamic environment where technology crunches the numbers, and people provide the judgment.

Think of AI in insurance claims processing as the ultimate assistant, not the ultimate decision-maker. It’s brilliant at sifting through mountains of data, spotting patterns, and handling routine tasks with incredible speed. This frees up human adjusters from the daily grind of paperwork, allowing them to step into more meaningful roles.

Redefining the Adjuster's Role

Instead of getting bogged down in data entry, adjusters can become what they were always meant to be: investigators, negotiators, and empathetic advisors. Their expertise is amplified, not replaced. They get to focus on the uniquely human parts of a claim, the conversations that build trust and ensure a fair outcome.

This collaborative model plays to everyone's strengths:

AI's Strengths: It can manage initial claim sorting, fraud detection, and data analysis at a scale no human team could ever hope to match.

Human Strengths: People are irreplaceable for handling complex negotiations, showing compassion during a difficult time, and applying critical thinking to grey areas.

Key Takeaways for a Smarter Future

As we look toward this integrated future, a few things become clear. First, AI delivers a massive boost to operational efficiency, slashing processing times and cutting costs. This isn’t just a theory anymore; it's a proven reality for insurers already on this path.

Second, getting this right means being both strategic and responsible. It demands a real commitment to navigating data privacy, tackling algorithmic bias, and always keeping a person in the loop to guarantee accountability.

At the end of the day, the goal of AI here is to enhance what people can do. It's about building a system where technology serves up the insights, and humans make the final, thoughtful decisions, especially when a customer’s well-being is at stake.

The final and most crucial point is that this partnership allows insurers to deliver a truly outstanding customer experience. By combining AI’s speed with a human touch, the industry can turn a moment of crisis into a chance to build genuine, lasting loyalty. This alliance isn't just an upgrade; it's the foundation for a more resilient, responsive, and trusted insurance industry.

A Few Common Questions

As artificial intelligence becomes more common in the insurance world, it’s completely normal to have questions. People want to know how it really works, if they can trust it, and what it means for the future of the industry. Getting a handle on these points is key for both insurers and their customers as we all get used to these new tools.

Here are some straightforward answers to the questions we hear most often about AI in insurance claims.

How Reliable is AI When it Comes to Claim Decisions?

The reliability of an AI system comes down to one thing: the data it learns from. If you train a model on a huge, clean set of historical claims data, it can become remarkably accurate. In some clear-cut cases, like verifying a standard car repair estimate, reports have shown AI can boost accuracy to as high as 99.99%.

But it's not foolproof. AI is fantastic at spotting patterns and handling routine claims that follow predictable rules. When a case is more complicated or involves a sensitive, human element, you absolutely need a person involved. The best approach is what's called "human-in-the-loop," where the AI makes data-backed suggestions, but an experienced professional makes the final decision. This combination gives you the best of both worlds: efficiency and sound judgment.

Will AI Make Human Insurance Adjusters Obsolete?

The short answer is no. Think of AI as a powerful assistant, not a replacement. The goal is to let technology handle the tedious, time-consuming tasks that bog adjusters down every day, things like manually entering data, sorting through piles of documents, and running initial fraud checks.

By taking over that grunt work, AI frees up adjusters to concentrate on what they do best. They can now spend their time on complex investigations, negotiating fair settlements, and providing genuine, empathetic support to customers going through a tough time. The adjuster's job is simply shifting from a data-entry role to that of a strategic expert and trusted advisor.

Can AI Actually Catch and Stop Insurance Fraud?

Absolutely. This is one of the areas where AI truly shines. These systems are brilliant at picking up on tiny details and odd patterns that would be nearly impossible for a person to spot. In a split second, an AI can analyze thousands of data points within a claim and compare them against historical records to flag anything that looks suspicious.

Specifically, AI fraud models are trained to look for:

Contradictions in documents, photos, or testimonies.

Hidden links between claims that appear to be unrelated.

Unusual activity that doesn't fit with normal claim behaviour.

This allows insurers to focus their investigative resources where they're needed most. By catching fraud early, they can prevent illegitimate payouts, which ultimately helps keep insurance premiums more affordable for everyone. In essence, AI serves as an always-on digital watchdog, protecting the integrity of the claims process.

At Cleffex Digital Ltd, we focus on building smart software that tackles real-world business problems. If you're curious about how AI could reshape your own operations, we're here to help. Learn more about our custom development services at Cleffex.