AI-powered tools in financial services are essentially sophisticated technologies that automate and sharpen everything from spotting fraud to delivering personalised customer support. For Canadian financial firms, getting these tools into the mix isn't just a "nice-to-have" anymore; it's a must-do for staying competitive, running a tighter ship, and finding new ways to grow in a constantly shifting market.

The New Competitive Edge in Canadian Finance

For a lot of Canadian financial institutions, AI has gone from a futuristic idea to a present-day necessity. The best way to think about it is as a digital central nervous system for your business. It’s an intelligent layer that senses what's happening, processes the information, and reacts to market movements, client needs, and internal risks with incredible speed and accuracy.

This system gets right to the heart of what often holds businesses back, like operational gridlocks and the constant headache of trying to scale services without breaking the bank. Instead of getting bogged down by manual work that’s both slow and error-prone, companies can use AI to handle complex tasks automatically and pull out insights from data that guide smarter decisions. To get a real feel for how big this change is, it helps to understand the ongoing AI banking revolution and see how machine learning is truly rewriting the rules of the industry.

Remaking Key Business Functions

AI's influence is being felt everywhere in the financial services world. This isn't about replacing people; it's about amplifying their expertise so your team can focus on strategy and high-level work that really moves the needle. By bringing AI into the fold, organisations are seeing real, measurable improvements across the board.

Here are a few key areas where AI is already making a difference:

Advanced Fraud Detection: AI algorithms can sift through thousands of transactions a second, catching subtle patterns of fraud that would be nearly impossible for a human to spot. This proactive defence cuts down on financial losses and keeps customer accounts secure.

Hyper-Personalised Customer Experiences: Forget one-size-fits-all service. AI allows you to offer financial advice, product suggestions, and support that are specifically tailored to each client. Smart chatbots and virtual assistants deliver instant, 24/7 service, which goes a long way in building customer satisfaction and loyalty.

Streamlined Regulatory Compliance: AI can take over the monotonous job of monitoring transactions and preparing compliance reports. This ensures you're staying on the right side of regulations like PIPEDA without the heavy administrative lift.

By tackling inefficiencies head-on and enabling smarter, faster decisions, AI solutions give financial service firms a serious competitive advantage. They help companies run leaner, jump on opportunities quicker, and forge stronger, more meaningful relationships with their clients.

This guide is designed to give you a clear roadmap for getting a handle on these powerful tools. As we’ll explore, the move toward AI adoption in Canadian enterprises is picking up steam, pointing toward a future built on greater efficiency and smarter innovation.

Understanding the Core AI Technologies

To really get a handle on AI solutions for financial services, you first need to understand the key technologies making it all happen. These aren’t just buzzwords; they're practical tools, each with a specific job to do. Think of them as specialists on a team, each one bringing a unique skill that solves a particular business problem.

Once you see the clear distinction between them, you can start mapping the right technology to real-world business outcomes. By knowing what each tool does best, you can pinpoint the most valuable opportunities for AI in your own operations, whether that’s tightening up security or creating a better client experience.

Machine Learning: The Digital Apprentice

Machine learning (ML) is the engine behind most AI solutions today. At its heart, ML is about training computer systems on huge amounts of historical data. This allows them to learn patterns, spot connections, and make predictions without someone needing to write code for every single possibility.

Think of an ML model as a digital apprentice. You show it thousands of past loan applications, some that were approved and paid back, others that defaulted. Over time, it learns to spot the subtle warning signs of a high-risk applicant far more accurately and consistently than a human ever could.

This predictive power is a game-changer in finance. It’s the tech that runs sophisticated fraud detection systems, predicts stock market movements, and assesses credit risk with incredible precision. The apprentice learns from the past to help you make smarter decisions about the future.

Natural Language Processing: The Universal Translator

While machine learning is great with numbers and structured data, Natural Language Processing (NLP) is built to understand the messiness of human language. It gives computers the ability to read, interpret, and respond to text and speech in a way that feels surprisingly human.

Imagine NLP as a universal translator for your business. It can sift through thousands of customer emails or support chat logs to gauge sentiment, identifying widespread issues or opportunities for improvement before they blow up. It's the technology that powers intelligent chatbots, allowing them to understand a client's question and provide a relevant, helpful answer right away.

For financial firms, this means you can automate document analysis for compliance, pull key details from contracts, and offer 24/7 customer support through virtual agents that actually get what your clients are asking for.

The push for this technology is accelerating. Recent data shows that expected AI usage in Canadian finance and insurance businesses is set to jump from 17.9% in Q3 2024 to 31.5% by Q3 2025. Among these firms, 35.1% plan to use virtual agents or chatbots, highlighting the massive demand for NLP. You can find more insights about AI adoption trends in Canadian finance from Statistics Canada.

Generative AI: The Creative Strategist

Generative AI is a newer, more powerful branch of AI that doesn't just analyse data; it creates something entirely new. Based on the patterns and information it has learned, generative AI can produce original text, images, or even computer code.

Picture generative AI as your creative strategist. It can draft personalised financial advice for a client based on their unique portfolio and life goals. It can generate detailed compliance reports, summarise complex market analysis into easy-to-read briefings, or even help developers write code for new financial apps.

For business leaders, generative AI offers a powerful way to scale expertise. It can create hyper-personalised marketing materials, automate the first draft of internal communications, and provide your team with a strategic assistant that accelerates content creation and decision-making.

The following table breaks down these core technologies and shows where they fit in the financial world.

Key AI Technologies and Their Financial Service Applications

| AI Technology | Core Function (Analogy) | Primary Use Case in Finance | Business Impact |

|---|---|---|---|

| Machine Learning | The Digital Apprentice: learns from past data to make predictions. | Fraud detection, credit scoring, algorithmic trading, and risk assessment. | Improves accuracy, reduces human error, and manages risk more effectively. |

| Natural Language Processing (NLP) | The Universal Translator: understands and responds to human language. | Chatbots, sentiment analysis of customer feedback, and compliance document review. | Enhances customer experience, automates support, and speeds up regulatory checks. |

| Generative AI | The Creative Strategist: creates new, original content and analysis. | Personalised financial advice, automated report generation, and marketing content creation. | Scales expertise, provides hyper-personalisation, and boosts team productivity. |

By understanding these three pillars, the predictive apprentice (ML), the linguistic translator (NLP), and the creative strategist (Generative AI), you can start to build a well-rounded AI strategy. Together, they can address nearly every facet of your business, driving both efficiency and growth.

Practical AI Use Cases Transforming Operations

Knowing the tech is one thing, but seeing it deliver real business value is what truly matters. The real power of AI solutions for financial services shines when you apply them to solve the specific, day-to-day headaches that slow you down. Let's move past the theory and look at how these tools drive real efficiency, security, and growth.

These aren't just abstract ideas; they're practical solutions designed to smooth out the friction points in a financial institution. Whether it's shielding your business from sophisticated threats or making every customer interaction better, AI offers a direct line to smarter, faster, and more dependable operations.

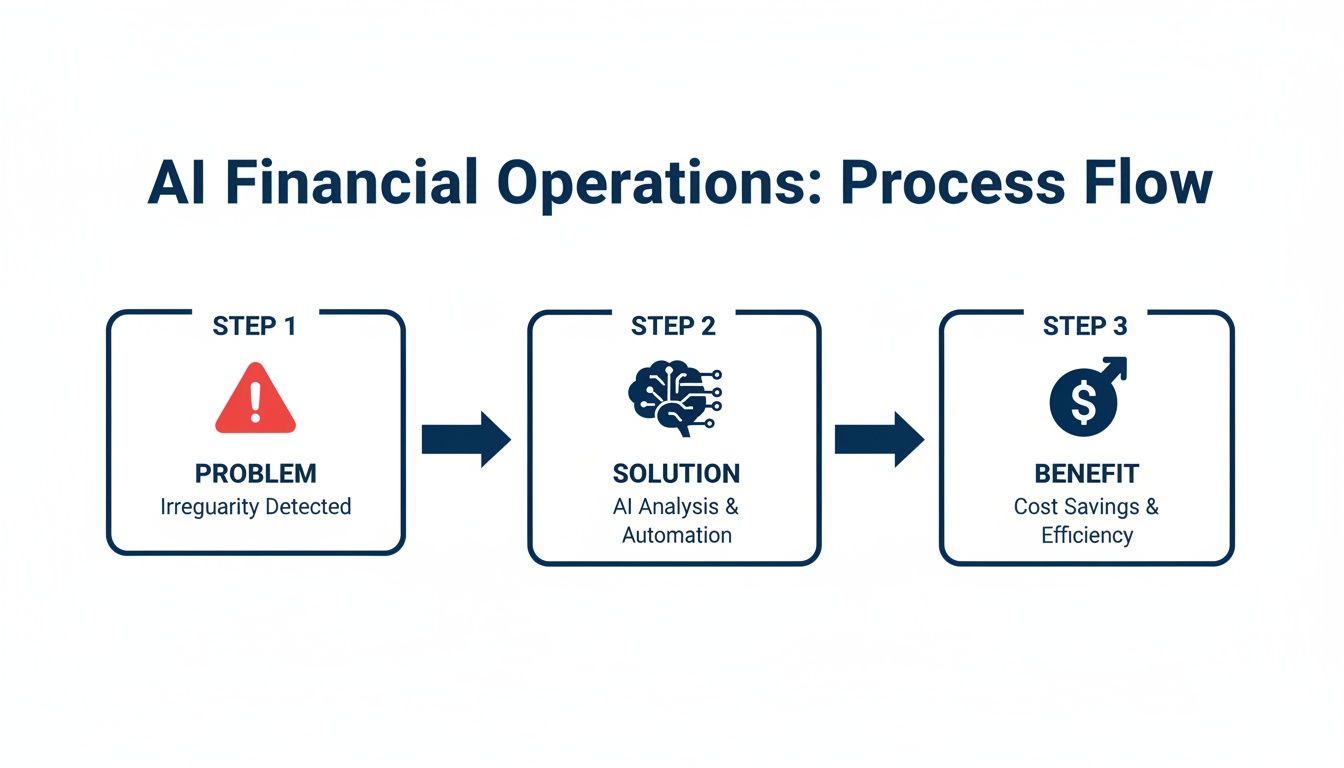

Let’s dig into a few high-impact use cases. We'll look at the problem, the AI fix, and the clear business win.

Automated Fraud Detection

Picture a local Canadian credit union handling thousands of transactions every day. Their old system relies on a simple set of rules to flag anything suspicious, like a big withdrawal from an odd location. But what happens when a fraud ring launches a quiet attack? They use a series of small, unrelated-looking e-transfers across dozens of accounts, each one just small enough to fly under the radar.

This is exactly where a machine learning model completely changes the game. Instead of just following rigid rules, the AI has been trained on millions of past transactions, so it knows what normal customer behaviour looks like. It can spot the incredibly subtle patterns connecting these tiny transfers, flag the whole operation as a high-risk anomaly, and freeze the transactions instantly.

The Result: The credit union prevents a $250,000 loss that its traditional system would have missed completely. This move doesn't just protect assets; it builds member trust by showing them their money is safe. This kind of proactive defence is now essential, and you can learn more about it by exploring AI-powered fraud detection in FinTech.

AI-Powered Risk Management

Now, think about an investment firm in Toronto managing a diverse range of client portfolios. In a shaky market, their analysts are scrambling to keep up. They're trying to monitor economic news, social media sentiment, and company reports to make smart adjustments, but the sheer amount of data makes it impossible to react to everything at once. This delay creates real risk.

By bringing in a predictive analytics solution, the firm can process enormous amounts of data as it happens. The AI sifts through everything from global news feeds to tiny shifts in trading volumes, looking for early warning signs of a market dip or trouble in a specific sector. When the system detects a high chance of a downturn, it instantly alerts portfolio managers with suggestions for rebalancing.

Problem: Human analysts just can't keep pace with the speed and volume of market data.

AI Solution: Predictive models constantly analyse diverse datasets to get ahead of market risks.

Business Benefit: The firm adjusts portfolios proactively, cutting potential losses by 15% during a market correction and boosting client confidence with top-tier risk management.

Personalised Customer Service with Chatbots

Let's say a mid-sized bank wants to step up its customer service game without hiring a whole new call centre team. Customers are often calling with simple questions about their balance, recent transactions, or branch hours, but long hold times are causing frustration. The bank needs a way to handle these common queries instantly, so human agents can focus on more complicated problems.

The bank rolls out an NLP-powered chatbot on its website and mobile app. This isn't one of those clunky, basic bots. It understands natural, everyday language, can securely verify a user's identity, and delivers personalised information on the spot. When a customer types, "How much did I spend on groceries last month?" the chatbot pulls the data and gives them a clear answer in seconds. If a question is too complex, it smoothly hands the conversation, along with the chat history, over to a human agent.

This is just one way AI is making a huge difference in finance. You can see similar impacts across the board, including in AI in accounting, where it's automating tedious tasks and ensuring greater accuracy.

Automated Underwriting

Finally, consider an insurance company trying to speed up its underwriting process for life insurance. The traditional way is slow, involving a manual review of applications, medical files, and lifestyle forms that can take weeks. This long wait often leads to a poor customer experience and people giving up on their applications altogether.

With an AI-driven underwriting platform, the company can automate most of this work. The system uses machine learning to analyse an applicant's data against historical records, letting it assess risk and calculate a premium almost instantly. It can crunch thousands of data points, from medical history to driving records, in just a few minutes.

Thanks to this automation, 80% of standard applications get approved in hours, not weeks. This massive speed-up makes customers happier and frees up human underwriters to use their expertise on the most complex, high-value cases, making the entire operation more efficient and profitable.

Your Strategic Roadmap for AI Implementation

Bringing AI into your financial operations can feel like a massive undertaking, but it doesn't have to be. The key is to have a clear, practical map. A smart roadmap breaks the entire process down into manageable phases, making sure each step builds on the one before it.

This approach stops your team from getting bogged down in the technology itself. Instead, it keeps everyone focused on what truly matters: solving real business problems. By starting with a specific goal and proving the concept with a smaller pilot project, you build the momentum and internal buy-in you need for bigger, more ambitious AI initiatives.

The whole process boils down to identifying a challenge, applying an AI solution, and then seeing the tangible benefits unfold.

This flow highlights a simple but powerful truth about any AI project: it has to start with a business problem and end with a result you can actually measure.

Phase 1: Define Your Business Objectives

Before anyone even thinks about writing code, the first question has to be: "What problem are we actually trying to solve?" The most successful AI projects are always tied to clear business goals, not just the excitement of using new tech.

Start by picking a specific, high-impact area for a pilot project. Maybe your goal is to reduce the time it takes to process loan applications by 30%, or to slash the number of false positives from your fraud detection system. A well-chosen pilot project acts as your proof of concept, showing real value quickly and building confidence across the entire organisation.

Phase 2: Prepare Your Data Foundation

Data is the fuel for any AI model. Think of it this way: you wouldn't expect a master chef to create a world-class meal with subpar ingredients. It's the same with AI. If you feed a system messy, incomplete, or biased data, you're going to get unreliable results.

This phase is all about getting your data in order. It involves a few key steps:

Data Collection: Pulling together relevant information from all your sources, transaction histories, customer interactions, market feeds, you name it.

Data Cleansing: This is the cleanup work. You're correcting errors, getting rid of duplicates, and figuring out what to do with missing values to make sure the data is accurate.

Data Governance: You need clear rules about who can access, use, and manage your data. This is crucial for keeping information secure and compliant with regulations like PIPEDA.

A solid data foundation isn't just nice to have; it's non-negotiable.

Phase 3: Choose the Right Model

Once your data is clean and ready, you face a big decision: build a custom AI model from the ground up, or buy a ready-made solution from a vendor? There’s no single right answer here. The best choice really depends on your specific needs, your team's resources, and how quickly you need to move.

Building an AI model gives you complete control and a solution tailored perfectly to your unique processes. The trade-off? It requires a serious investment in specialised talent, time, and money. On the other hand, buying a solution from a vendor gets you to market much faster and usually comes with expert support, but it might not be as flexible.

For a lot of firms, a hybrid approach hits the sweet spot. You might use a vendor's platform as a base, but customise it for your specific operational needs. If you're heading down this path, getting familiar with the world of custom fintech software development can give you some valuable perspective.

Phase 4: Integrate and Deploy Thoughtfully

An AI tool is only useful if it actually works with the systems you already have. This integration phase is about connecting the new AI model to your core banking platforms, CRM software, and other day-to-day tools. The goal is to make the AI feel like a natural part of your workflow, not some clunky add-on.

When it comes to deployment, start small. Roll it out to a limited group of users or a single business unit first. This lets you gather feedback, iron out any bugs, and make sure the system performs as expected in the real world before you launch it company-wide.

Phase 5: Monitor, Scale, and Realise Your ROI

Getting your AI solution live is just the beginning. You need to constantly monitor its performance to track accuracy and, most importantly, measure its impact on the business goals you set back in Phase 1. This ongoing oversight is what allows you to refine the system and get more value from it over time.

Be patient, though. Seeing a clear return on your investment can take time. A recent survey showed that despite high AI adoption rates in Canada, only 2% of business leaders reported an ROI from their generative AI investments so far. But the optimism is there, 61% expect to see returns within the next one to five years. This just underscores the need for a long-term strategic view.

Once your pilot project proves its worth, you'll have the evidence and confidence you need to scale the solution to other parts of the business.

Here is the rewritten section, crafted to sound completely human-written and natural.

Measuring Success and Demonstrating AI's ROI

So, you’ve invested in a new AI platform. That’s the easy part. The real challenge? Proving it’s actually making a difference to your bottom line. When it comes to AI solutions for financial services, success isn't about fancy algorithms; it's about real, tangible business results. Without the right metrics, an AI project can quickly go from a strategic investment to a very expensive science experiment.

The key is to move past the hype and tie every single AI initiative to a specific, measurable Key Performance Indicator (KPI). You need to build a rock-solid business case that justifies the initial spend and, just as importantly, tracks the value it delivers over time.

Defining Your Key Performance Indicators

The right KPIs are never one-size-fits-all; they have to match the problem you’re trying to solve. A metric that’s perfect for a customer service chatbot would be completely useless for a risk assessment model. Your measurement strategy has to be directly linked to the business function you’re looking to improve.

Let's look at a couple of common scenarios:

AI for Fraud Detection: This is where the numbers really do the talking. You'd track the reduction in fraudulent transaction value to see the direct financial savings. Another critical metric is the decrease in false positive rates, because nothing frustrates a good customer more than having their legitimate purchase flagged as fraud.

AI for Customer Service: If you're rolling out a chatbot, your focus will be on efficiency and customer happiness. You'll want to measure things like improved Customer Satisfaction (CSAT) scores from surveys and a noticeable reduction in call centre volume for simple questions. This frees up your human agents to handle the tough stuff.

As you can see, the most effective KPIs are always business-centric. They translate what the AI is doing into a language that your executive team understands: dollars saved, time given back, and customers who stick around.

Building a Compelling Business Case for AI

Showing a real return on investment (ROI) starts way before you write a single line of code. A strong business case needs to forecast the potential returns and set clear expectations from day one. It's all about comparing the expected impact of your new AI solution against how you operate today.

Think of it like putting together a financial forecast for your technology. If you're automating parts of your underwriting process, you can calculate the hours your team currently spends on manual reviews and then project the savings based on, say, a 70% automation rate. Or, if you're using AI for personalised marketing, you could model a potential 5-10% lift in conversion rates.

By creating these upfront estimates, you change the conversation. AI stops being a technology expense and starts being a strategic investment with a return you can actually predict and track. This is absolutely essential for getting buy-in and making sure your project succeeds.

In the highly competitive Canadian financial sector, this is already happening. The Royal Bank of Canada (RBC), for instance, has become a leader in this space, ranking third globally in the 2025 Evident AI Index. What’s really telling is RBC's transparency; it's one of only eight banks on the index that actually discloses its AI ROI estimates. During its March 2025 Investor Day, RBC announced it expects to generate up to $1 billion in enterprise value from AI by 2027. Learn more about RBC's AI strategy and its expected impact.

A Hypothetical ROI Scenario

Let’s walk through a quick example. Imagine a mid-sized Canadian investment firm decides to implement an AI-powered risk management system.

Initial Investment: $150,000 for the software licence and integration work.

The Problem: Their manual risk analysis was painfully slow. This meant delayed portfolio adjustments, which they estimated cost them about 2% in preventable losses on their $50 million in assets under management during volatile periods.

The AI Impact: The new system sends out real-time alerts, letting the team make proactive changes. In the first year alone, it helps them sidestep $750,000 in potential losses.

The Calculated ROI: Once you subtract the initial cost, the firm has a net benefit of $600,000. That's a 400% ROI in the first year.

With clear, simple numbers like that, the value of AI becomes impossible to ignore.

Navigating Challenges and Future-Proofing Your Strategy

Bringing AI into your financial services firm isn't as simple as flicking a switch on new software. It’s a major shift that comes with its own set of very real challenges, especially here in Canada. To succeed in the long run, you need a smart, forward-looking plan that anticipates everything from navigating our strict regulatory landscape to dealing with the global shortage of AI talent.

Think of these hurdles not as stop signs, but as guideposts. They point the way toward building a more solid, responsible AI program. If you tackle them head-on, you'll end up with a system that's not just powerful, but also compliant, ethical, and built to last.

Tackling Regulatory and Ethical Hurdles

In Canada, data privacy is king. Regulations like the Personal Information Protection and Electronic Documents Act (PIPEDA) set a high standard for how companies must protect customer information. When an AI model is making calls on who gets a loan or how to invest someone's savings, those decisions have to be transparent and fair, a tough ask for complex "black box" algorithms.

This is where Explainable AI (XAI) becomes absolutely essential. XAI is all about making an AI's decision-making process understandable to people. So instead of just getting a "yes" or "no," you get the "why," which is critical for passing compliance audits and, just as importantly, earning your customers' trust.

Your first line of defence is a rock-solid data governance policy. It sets clear, firm rules for data quality, who can access it, and how it’s secured, making sure your AI projects are built on a compliant and ethical foundation right from the get-go.

Bridging the AI Talent Gap

Let's be honest: finding people who are experts in both finance and artificial intelligence is tough. There's a massive demand for data scientists, machine learning engineers, and AI ethicists, but the supply hasn't caught up. This has created an incredibly competitive and expensive hiring market.

For most small to medium-sized firms, building a full in-house AI team from scratch just isn't realistic. That's why forming strategic partnerships is often the smartest move.

Partnering with Specialised Firms: Working with an AI consultancy or a development partner gives you instant access to an entire team of seasoned experts. They already have the technical chops and industry experience to get your project running quickly and correctly.

Focusing on Your Core Business: When you let partners handle the technical heavy lifting, your own team is free to do what it does best: understanding your customers and growing your business.

Preparing for Tomorrow’s Innovations

The AI field is moving at lightning speed. To make sure your strategy doesn't become a relic in a few years, you have to build for agility. The next big thing is already on the horizon: hyper-personalisation. This is where AI will provide financial advice and services that are uniquely crafted for each person's real-time needs and circumstances.

An agile, long-term AI strategy is one that's designed to bend, not break. By starting with a strong governance framework and bringing in expert partners, you create a flexible foundation. This setup makes it much easier to fold in new innovations down the road and scale up your AI capabilities as your business and the technology evolve.

Common Questions About AI in Finance

Getting started with AI always brings up a few practical questions. Moving from an idea to a real-world project means thinking about costs, first steps, and making sure everything is done right. Let's tackle some of the most common questions we hear from business leaders.

How Much Does It Cost for a Small Business To Implement AI?

There’s no one-size-fits-all answer here. Costs can range from a few hundred dollars a month for a ready-made tool to a major investment for a completely custom system. For most small and medium-sized businesses, the easiest way in is through a subscription-based service.

Think of it like any other software you use. Many vendors offer powerful AI tools for things like fraud detection or customer service chatbots for a predictable monthly fee. This route lets you sidestep the massive upfront costs and technical headaches of building something from scratch, putting serious technology within reach. A small pilot project with a vendor is a great way to see real results without breaking the bank.

What Is the Very First Step Our Company Should Take?

Before you even think about the technology, think about the problem. The best first step is always to pinpoint a specific, high-value business challenge you want to solve. Don't start with, "How can we use AI?" Ask yourself, "Where's our biggest bottleneck right now?" or "What's our most pressing risk?"

The perfect starting point is a problem that is both meaningful and easy to measure. You could focus on cutting down manual data entry for compliance reports or making your lead scoring more accurate. By setting a clear goal, you can run a focused pilot project that has a great shot at showing a tangible return on investment.

How Can We Ensure Our AI Models Remain Fair and Unbiased?

Keeping AI fair is an ongoing commitment, not a one-and-done task. It all starts with the data you feed your models. If your historical data reflects old biases, maybe past lending decisions were unfair to certain groups; your AI will learn and even magnify those same patterns.

To prevent this, you need to be proactive. Here’s how:

Data Auditing: Before you even start training, comb through your datasets to find and fix historical imbalances.

Explainable AI (XAI): Use tools and techniques that make your AI's "thinking" transparent. XAI helps you understand why a model made a certain decision, which makes it much easier to catch and correct flawed logic.

Ongoing Monitoring: Once your AI is live, keep a close eye on its performance. You need to make sure its decisions stay fair and equitable over time. This kind of active supervision is essential for meeting ethical standards and staying compliant.

Ready to solve your business challenges with technology that delivers results? Cleffex Digital Ltd builds innovative software solutions that help financial service firms automate operations, enhance security, and drive growth.