When we talk about "custom insurtech solutions" in Canada, we're really talking about building software from the ground up to solve very specific problems for Canadian insurers and brokers. This isn't about buying an off-the-shelf product. It’s about creating tools that automate claims, deliver personalised customer experiences, or sharpen underwriting accuracy – all while navigating our country's unique data privacy laws like PIPEDA.

Get this right, and you've got a serious competitive advantage in a market that's changing fast.

Defining Your Insurtech Strategy in Canada

Before a single line of code gets written, every successful insurtech project starts with a solid, focused strategy. I’ve seen it time and again: companies get excited about the tech and jump straight into development without nailing down the "why." This is a classic misstep.

You have to move past vague goals like "improving efficiency." The real work begins with a deep dive into your current operations to find the exact bottlenecks a custom platform can fix. Is your claims team drowning in manual data entry? Are your underwriters stuck using outdated risk models? Mapping these pain points is the first, most critical step toward building something that actually delivers value.

Pinpointing Specific Business Challenges

Instead of trying to boil the ocean, focus on solving specific, measurable problems. When your tech investment is tied directly to a tangible outcome, you're set up for a win. A well-defined problem almost always leads to a well-defined solution.

Think about common pain points where custom software can make a real difference:

Sluggish Claims Processing: Too much paperwork, manual verification steps, and endless hand-offs between departments frustrate customers and delay settlements.

Outdated Underwriting Methods: Relying on limited, old-school data sets leads to mispriced risk and missed opportunities for growth.

Fragmented Customer Data: When policyholder information is scattered across a dozen different systems, you can't get a single, clear view of your customer.

Inefficient Broker and Agent Portals: Clunky, slow interfaces are a massive source of frustration for your most important partners and can seriously slow down new business.

Setting Clear and Measurable Objectives

Once you've zeroed in on the core problems, you need to set clear objectives. These goals have to be specific, measurable, achievable, relevant, and time-bound (SMART). This isn't just business jargon; it's what separates successful projects from expensive failures.

For instance, "speed up claims" is a wish, not a goal. A SMART goal sounds like this: "reduce the average claims settlement time for low-severity auto claims by 40% within 12 months of the new platform going live." Now you have a clear target that your development and business teams can rally around. To see what's on the horizon, it's always a good idea to stay informed on the top insurtech trends in Canada for 2026.

A well-crafted strategy acts as your project's North Star. It guides every decision, from feature prioritisation to technology selection, ensuring that your final product is not just a piece of software, but a genuine competitive advantage.

Understanding the Canadian Regulatory Framework Early

Finally, you absolutely must bake the Canadian regulatory environment into your strategy from day one. Compliance can't be an afterthought. Federal laws like the Personal Information Protection and Electronic Documents Act (PIPEDA) dictate how private-sector companies collect, use, and disclose personal information.

On top of PIPEDA, you have to contend with even stricter provincial laws in Quebec, British Columbia, and Alberta. These regulations set firm rules for data handling and consent. Ignoring them at the strategic stage is a recipe for costly redesigns and legal headaches down the road.

The opportunity here is massive. The Canadian insurtech market is projected to skyrocket from around USD $206 million to USD $3.53 billion by 2033. That growth is being driven by insurers adopting AI and machine learning to finally modernise their core operations. A well-planned, compliance-aware strategy is more critical than ever to claim your piece of that pie.

Navigating Canadian Regulatory and Compliance Waters

When you're building a custom insurtech solution in Canada, it's easy to get caught up in the technology – the cool features, the slick UI. But here’s a hard-won piece of advice from the trenches: treat regulatory compliance as a core design principle, not a checkbox to tick off at the end.

The Canadian legal landscape is a unique mosaic of federal and provincial rules. Getting this wrong from the start can lead to painful project delays, expensive rework, and a hit to your reputation you really don't need.

At the federal level, everything starts with the Personal Information Protection and Electronic Documents Act (PIPEDA). Think of it as the foundational layer for any platform handling client data. It dictates how private-sector companies can collect, use, and share personal information, setting the baseline for things like getting meaningful consent.

But here’s where many projects go off the rails. PIPEDA is just the starting point. The real complexity and the real risk lie in the patchwork of provincial laws, which can be much stricter.

The Provincial Privacy Puzzle

Canada gives its provinces the power to create their own privacy laws, and for businesses operating there, those local rules often trump PIPEDA. This means your insurtech solution has to be flexible enough to handle different requirements if you plan to operate nationwide.

You absolutely have to know the rules in three key provinces:

British Columbia: BC’s Personal Information Protection Act (PIPA) looks a lot like PIPEDA on the surface, but it has some specific quirks around employee information and data residency. This can directly influence your decisions on where you host your data, especially if you're using cloud services.

Alberta: The province also has its own Personal Information Protection Act (PIPA). Again, it shares principles with the federal law, but it has its own enforcement body and unique interpretations you can’t ignore.

Quebec: This is the big one. Quebec's Bill 64 (now known as the Act to modernise legislative provisions as regards the protection of personal information) has brought in some of the most stringent privacy rules in North America. We're talking explicit, informed consent and new rights for individuals, like data portability. If you're building custom insurtech solutions in Canada with an eye on the Quebec market, complying with these rules is non-negotiable.

Beyond Privacy: OSFI and Technology Risk

For insurers, it's not just about customer data privacy. You also have to contend with the Office of the Superintendent of Financial Institutions (OSFI), which sets critical guidelines for managing technology and cybersecurity risks.

While OSFI’s main job is to supervise federally regulated financial institutions, its guidelines have become the gold standard for operational resilience across the entire Canadian financial sector.

Expert Tip: Make OSFI's Guideline B-13 (Technology and Cyber Risk Management) your bible. It lays out what regulators expect for everything from your overall tech strategy to how you handle cyber incidents and manage third-party vendors. Following these standards isn't just about ticking a compliance box; it's about building a platform that's secure, resilient, and worthy of your clients' trust.

What does this mean in practice? It means weaving rigorous security protocols into your development process from day one. You'll need to show you have a handle on data governance, implement robust access controls, and have a clear, actionable incident response plan ready to go. OSFI’s primary concern is that new technology doesn’t introduce unacceptable risks to your institution or the financial system as a whole.

Putting a Practical Compliance Framework in Place

The only way to manage all these overlapping rules is with a structured approach, right from the project’s kickoff. The most effective strategy I've seen is embedding 'privacy by design' into your development lifecycle. This means privacy isn’t an afterthought; it’s baked into every feature, every workflow, every line of code.

Here are a few practical actions to get you started:

Run a Privacy Impact Assessment (PIA): Before a single line of code is written, a PIA is a must. This process forces you to map out exactly how data will flow through your system, identify potential privacy risks, and figure out how you’ll mitigate them. It’s your blueprint for responsible data handling.

Set Up a Clear Data Governance Model: You need to define who owns the data, who is responsible for its quality, and who can access it. Your insurtech platform needs built-in tools to enforce these rules, like role-based access controls and detailed audit logs that show who did what, and when.

Nail Your Consent Management: Your user interface has to be crystal clear when asking for consent to collect and use data. Vague language won’t cut it anymore, especially under Quebec's tough laws, where implied consent is rarely good enough.

By tackling Canadian regulatory requirements proactively, you do more than just avoid fines. You build a platform on a solid foundation of trust and security – one that protects your customers, safeguards your business, and is ready for whatever comes next.

In-House Build or Vendor Partnership: Making the Right Call

With your strategy and compliance homework done, you've hit a major crossroads: Do you build this thing yourself, or bring in the experts? This isn't just a question of who does the work. It’s a decision that will define your project’s budget, timeline, and what it looks like years down the road.

Honestly, there’s no magic formula here. The right choice depends on what your organisation looks like on the inside – your team's skills, your big-picture goals, and how much risk you're comfortable with.

Going the in-house route gives you the ultimate say over every detail, but don't underestimate the commitment. It’s a massive investment in people, tech, and ongoing support. On the flip side, teaming up with a seasoned Canadian insurtech vendor can get you to the finish line much, much faster. They come with ready-made experience and frameworks, but you’ll need to do some serious vetting to make sure they’re the right fit and that their security is rock-solid.

Taking a Hard Look at Your Internal Team

First things first, be brutally honest about your team's capabilities. Do you genuinely have the talent in-house to not only build but also maintain and grow a sophisticated software platform? Building custom insurtech solutions in Canada takes more than just a couple of smart coders.

A top-notch in-house team needs a very specific mix of talent:

Software Architects to design a system that won’t fall over when you scale.

Full-Stack Developers who are fluent in today's tech.

UX/UI Designers who actually get how brokers, agents, and customers work.

DevOps Engineers to handle the cloud and deployment side of things.

Cybersecurity Specialists to bake security in from the very beginning.

Project Managers who live and breathe Agile development.

If you’re a larger insurer with a well-established IT department, building in-house might just be the next logical step. For most SMEs and brokerages, though, putting a team like this together from scratch is a huge, costly, and slow-moving task. It's often helpful to see what established insurance software solutions in Canada look like to get a sense of what a vendor can bring to the table.

Speed to Market vs. Long-Term Control

At its core, this decision often comes down to a classic trade-off: do you want speed or control?

Working with a vendor can get a working product – a minimum viable product (MVP) – out the door in months, not years. That means you can start getting real user feedback, making improvements, and seeing a return on your investment way sooner.

Building it yourself is slower, no doubt. But you own everything. The intellectual property is yours, and you have complete control over the product's future. You can add features or integrate with other systems on your own terms, without waiting on a vendor. When you're looking at external partners, it's wise to get some insights on cybersecurity in fintech and pentesting partnerships to learn how to properly vet their security practices.

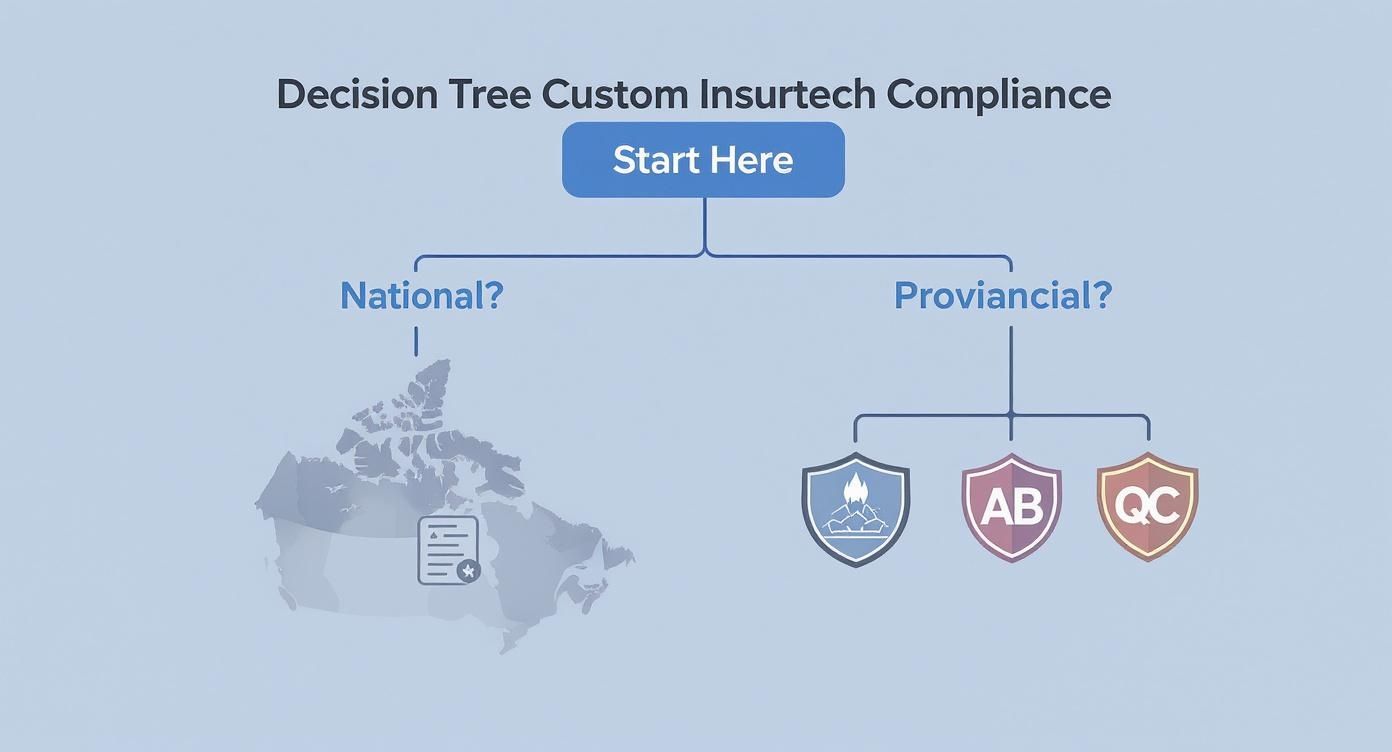

This decision tree illustrates how your operational footprint directly impacts which privacy regulations, like PIPEDA, you'll need to focus on.

As you can see, a national scope automatically puts PIPEDA front and centre, whereas operating provincially means focusing on the specific rules in BC, Alberta, and Quebec.

The core question you need to ask is: "What matters more to our business strategy right now – getting to market fast or having absolute control?" Your answer will be a huge clue.

To help you weigh the pros and cons, here’s a look at how the two approaches stack up against each other.

In-House Development vs Vendor Partnership for Insurtech

| Factor | In-House Build | Vendor Partnership |

|---|---|---|

| Cost | High initial and ongoing investment in salaries, benefits, and infrastructure. | Predictable, often subscription-based costs. Lower initial outlay. |

| Speed | Significantly slower to market. Requires team assembly and development from scratch. | Much faster. Vendors use existing frameworks and experienced teams. |

| Control | Complete control over features, timeline, and intellectual property. | Shared control. Dependent on vendor's roadmap and technology. |

| Expertise | Requires hiring specialists across multiple domains (UX, security, DevOps). | Instant access to a specialised, experienced team with deep industry knowledge. |

| Risk | High risk. Success depends entirely on the quality of your internal team and management. | Lower project risk. Vendor's reputation is on the line, and they have proven processes. |

| Maintenance | Your team is responsible for all ongoing maintenance, updates, and support. | Vendor handles all maintenance, security patches, and platform updates. |

Thinking through these factors should give you a much clearer picture of which path is the smarter bet for your organisation's specific needs and long-term vision.

Architecting a Future-Proof Insurtech Platform

A powerful insurtech solution is only as strong as its technical foundation. Getting the architecture right from the start is the difference between a platform that grows with you and one that becomes a costly technical burden in just a few years. This is your blueprint for the critical architectural decisions that will define your project's future.

The choices you make here, from how the software is structured to how it connects with your existing systems, will directly impact its scalability, security, and ability to adapt. Let's break down the core components of building a platform that’s truly ready for tomorrow's challenges.

Microservices vs. Monolithic Architecture

One of the first big forks in the road is deciding between a monolithic and a microservices architecture. It’s a foundational choice. A monolithic application is built as a single, unified unit. Think of it like a traditional all-in-one printer; it’s often simpler to develop and deploy initially because everything is contained in one place.

But that initial simplicity can become a major hurdle as you grow. Updating one small part of a monolith often requires redeploying the entire application, a slow and risky process. Worse, if one component fails, it can bring the whole system crashing down.

A microservices architecture, on the other hand, breaks the application into a collection of smaller, independent services. Each service handles a specific business function, like claims processing, policy management, or user authentication, and they all talk to each other through well-defined APIs. This approach is more complex to set up, but it offers incredible flexibility and resilience down the line. You can update, scale, or even replace individual services without disrupting the rest of the platform.

For most custom insurtech solutions in Canada aiming for long-term growth, a microservices approach is the smarter bet. It allows your platform to evolve one piece at a time, adapting to new market demands without requiring a complete system overhaul.

Integrating With Legacy Systems

Let's be realistic: very few insurtech projects start with a completely clean slate. You almost certainly have existing systems: a core policy administration system (PAS) or a CRM that your new platform needs to talk to. This is where modern APIs and middleware are your best friends.

APIs (Application Programming Interfaces): These are the bridges that allow your new, modern platform to securely communicate with older, legacy systems. A well-designed API acts as a universal translator, enabling data to flow seamlessly between different technologies.

Middleware: This is a software layer that sits between your new application and your legacy systems, handling tasks like data transformation and message queuing. It helps decouple the new platform from the old, making future upgrades much smoother.

The goal here is to avoid a "rip and replace" scenario, which is as disruptive and expensive as it sounds. Instead, we use APIs and middleware to create a flexible ecosystem where new and old technologies can coexist. For a deeper dive, check out this complete guide to insurtech software development in Canada.

Non-Negotiable Data Security Practices

In an industry built on trust, data security isn't just a feature; it's the bedrock. Safeguarding sensitive policyholder information is absolutely non-negotiable, and your architecture must reflect this from day one.

Here are the key security measures that must be built into your platform:

End-to-End Encryption: All data, whether it's sitting in a database (at rest) or being transmitted across a network (in transit), must be encrypted using strong, current algorithms.

Robust Access Controls: Implement a role-based access control (RBAC) system. This ensures users can only access the data and features they absolutely need to do their jobs. This "principle of least privilege" is a cornerstone of good security hygiene.

Secure Coding Practices: Your development team must follow established secure coding standards to prevent common vulnerabilities like SQL injection or cross-site scripting. Regular code reviews and independent security audits are essential.

Harnessing the Power of the Cloud

Modern insurtech platforms are built on the cloud, and for good reason. It provides the scalability, flexibility, and cost-efficiency needed to compete today.

You'll generally encounter a few different service models:

IaaS (Infrastructure as a Service): This gives you the basic building blocks – servers, storage, networking – that you manage yourself.

PaaS (Platform as a Service): This provides the hardware and software tools to develop and deploy applications, so you don't have to worry about the underlying infrastructure.

SaaS (Software as a Service): This is a fully managed application you access online, like a third-party claims management tool.

The Canadian insurance market is substantial, with gross written premiums expected to hit USD 164.73 billion. Within this massive market, technology is the key differentiator. It's what allows insurers to shorten claims cycles from weeks to as little as 24 hours. This kind of leap is driven by a sharp focus on data analytics and cybersecurity, which are essential for staying competitive and compliant. You can find more insights about the Canadian insurance market on mordorintelligence.com.

Driving User Adoption for Real Business Impact

You’ve built a brilliant piece of technology. It’s a major milestone, but let’s be honest; it’s only half the battle. The true test for any custom insurtech solution isn't its feature list; it’s whether your brokers, agents, and customers actually use it. This is where you unlock real value, and it demands a deliberate, human-focused plan.

The goal isn't just to launch a tool. It's to make that tool an indispensable part of everyone's daily work. That means shifting your focus from the build to a thoughtful rollout that drives genuine adoption and, ultimately, delivers a tangible return on your investment.

Managing Change with Agile Principles

Many teams think of Agile as a development methodology, but its real power extends right through to implementation. The iterative nature of Agile – working in small, flexible cycles – is perfect for introducing new workflows. Instead of a single, high-stakes “go-live” event, you get a controlled, adaptive rollout.

This approach keeps the project grounded in reality. As people start using the new system, you can collect their feedback on the fly, fix what’s not working, and make adjustments. The platform evolves to fit their needs, not the other way around.

A Playbook for a Smooth Rollout

A successful launch comes down to a mix of technical prep and smart change management. Rushing this stage is a recipe for failure.

Here’s what a practical adoption strategy looks like:

Phased Rollouts: Forget the "big bang" approach. Start with a pilot group of tech-savvy users or a single, focused department. This lets you iron out the kinks on a smaller scale, minimising disruption and building positive momentum.

Seamless Data Migration: Your data migration needs to be meticulous. Clean and validate everything before you move it. Nothing erodes trust faster than a new system filled with old, inaccurate data.

Effective User Training: Generic manuals are a waste of paper. Training has to be hands-on and tailored to specific roles. Think short video tutorials, interactive workshops, and easy-to-find support resources for when people get stuck.

The Art of Building Internal Champions

Never, ever underestimate the power of a few enthusiastic team members. Find those respected individuals who are genuinely excited about the new platform and turn them into internal champions.

These are the people who will become the go-to experts for their colleagues, answering questions, showing off the benefits, and creating a positive buzz that no corporate memo ever could.

Change management is fundamentally about communication. You have to clearly and consistently explain the 'why' behind the new solution. How will it make their jobs easier? How will it help them serve clients better? When people truly understand the benefits for themselves, they get on board.

The Canadian insurtech market is on a steep upward curve. Projections show revenues of USD 576.2 million are set to explode to nearly USD 11.4 billion by 2030. That’s a compound annual growth rate of 53.2%. To capture a piece of that growth, user adoption isn’t just important – it’s everything.

Measuring Success with the Right KPIs

To prove the ROI of your investment, you need to track the right numbers. Key Performance Indicators (KPIs) give you the hard data to show how the platform is impacting the business.

Here are the essential KPIs you should be monitoring:

User Adoption Rate: What percentage of your team is actively using the system?

Task Completion Time: How long does it take to generate a quote or process a claim now versus before?

Error Rate Reduction: A drop in manual errors means direct cost savings and cleaner data.

Net Promoter Score (NPS): Are your customers and brokers happier with this new way of working?

Policy Processing Time: What’s the end-to-end time from application to an issued policy?

Remember, long-term success hinges on keeping the customers you have. It's worth exploring analytics like predictive churn modelling strategies to strengthen your customer base and boost ROI even further. By focusing on these metrics, you can move beyond simply launching a product and start demonstrating its real, measurable impact.

Frequently Asked Questions

When you're diving into custom software development, questions are bound to come up. We get it. This is where we tackle some of the most common ones we hear from Canadian insurers and small to medium-sized businesses thinking about building their own insurtech solution.

Think of this as your practical guide to setting realistic expectations and making smart decisions. We'll touch on everything from budget and timelines to what it really takes to keep your platform running smoothly and compliantly for the long haul.

What’s a Realistic Budget for a Custom Insurtech Solution in Canada?

This is always the first question, and the most honest answer is: it really depends. There's no one-size-fits-all price tag. The budget for a custom insurtech solution in Canada is tied directly to how ambitious and complex your vision is.

For a tightly focused Minimum Viable Product (MVP) aimed at solving one or two critical pain points, you're likely looking at a six-figure investment. But for a full-blown, enterprise-grade platform with complex integrations, predictive analytics, and slick customer portals, that number can easily climb into the multi-million dollar range.

The biggest factors that will shape your budget are:

Integration Headaches: How many legacy systems, like an old Policy Administration System, does your new platform need to talk to? Each one adds a layer of complexity and cost.

Your Feature Wishlist: Are you looking for simple automation or sophisticated features like AI-driven underwriting and fully automated claims processing? The more advanced the tech, the bigger the investment.

Compliance & Security: The level of security needed to satisfy provincial and federal regulations isn't just a suggestion; it dictates the entire security architecture and requires ongoing audits, which all factor into the cost.

How Long Does It Actually Take to Build and Deploy This?

Just like the budget, timelines can vary quite a bit. A well-scoped, smaller-scale solution can often be up and running in 6 to 9 months. That's a solid timeframe for getting an initial version out the door that starts adding real value to your business right away.

If you’re planning a more comprehensive platform designed to overhaul several core parts of your business, you should realistically be planning for a timeline of 18 months or more. Building something truly robust and scalable is an iterative process, and it simply takes time to get it right.

One of the best ways to speed things up is to embrace an Agile development mindset. By focusing on the most critical features first and releasing them in stages, you start seeing a return on your investment much faster than waiting for a single, massive launch. Working with a partner who already has proven frameworks can also shave significant time off the development cycle.

What Are the Biggest Risks I Should Be Watching Out For?

Building custom software is a major undertaking, and it's not without its risks. Knowing what they are from the get-go is the best defence you have to keep your project on the rails.

From our experience, here are the top three pitfalls:

Fuzzy Objectives: Kicking off development without a razor-sharp understanding of the business problem you're trying to solve is the quickest path to building a beautiful piece of software that nobody actually uses.

Ignoring the People Problem: It's a huge mistake to underestimate the human side of a tech rollout. If you don't get buy-in from your team and provide solid training, user adoption will stall before it even starts.

Underestimating Compliance: Treating regulatory requirements like a simple checkbox is a dangerous game. The nuances of provincial data privacy laws, especially in places like Quebec, can throw up major roadblocks if they aren't baked into your plan from day one.

A phased rollout, strong project governance, and a real change management strategy are your best tools for navigating these common challenges.

How Do We Keep the Solution Compliant with Ever-Changing Canadian Regulations?

Compliance isn't a "set it and forget it" task; it's an ongoing commitment. Canadian regulations, particularly around data privacy, are always in motion. Your platform has to be built to adapt.

The secret is to design for flexibility from the very beginning. Hardcoding specific rules directly into the application is a recipe for a massive headache down the road. The goal is to build a system where you can update compliance logic without having to tear the whole thing down and start over.

It's also essential to work with legal and compliance experts who live and breathe Canadian financial services. Regular audits of your platform and internal processes are non-negotiable to ensure you're always aligned with the latest laws. By adopting a "privacy by design" philosophy, adapting to new rules becomes a manageable part of your operations instead of a full-blown crisis.

At Cleffex Digital Ltd, we specialise in building custom software that solves real-world business challenges for Canadian insurers and SMEs. If you're ready to build a platform that boosts efficiency, delights your customers, and gives you a genuine competitive edge, let's talk.

Discover how Cleffex can build your custom insurtech solution