AI is no longer a sci-fi concept; it’s the engine powering Canadian finance right now. Imagine it as a skilled co-pilot for financial experts, sifting through mountains of data in moments to spot trends a human might easily miss. The impact of AI in finance industry is already huge, touching everything from our daily banking to major investment decisions.

The New Financial Frontier: How AI is Reshaping Banking

This guide will walk you through exactly how this technology is being used in the real world, from the chatbot that answers your banking questions to the complex systems that stop fraud in its tracks. We’ll start with the basics and build from there, showing you the real-world impact of AI on everything from personalized banking to market predictions. Think of this as your practical map to the new world of finance.

The financial sector is in the middle of a massive shift, and artificial intelligence is the driving force. Institutions that once leaned heavily on manual work and historical analysis are now deploying intelligent systems to make faster, sharper decisions. This isn’t just about doing old tasks quicker; it’s about unlocking entirely new capabilities that were once out of reach.

For the average Canadian, this means a banking experience that feels more intuitive, helpful, and secure. For the institutions themselves, it’s a chance to get a better handle on risk, slash operational costs, and find new ways to grow. In fact, Business Insider projects that AI could save the global banking industry a staggering $1 trillion by 2030.

Understanding the Core Transformation

At its heart, AI’s role in the finance industry is about making sense of an overwhelming amount of information. Every transaction, market swing, and customer chat generates data. AI algorithms are built to process this data at a scale and speed far beyond human capability.

You can see this transformation playing out in a few key areas:

- Dramatically Better Efficiency: AI takes over routine work like data entry, compliance checks, and basic customer service questions. This frees up human employees to focus on more complex, strategic work where they can add the most value.

- Smarter Risk Management: By spotting patterns and flagging anything that looks out of place, AI can detect potential fraud, assess credit risk with more accuracy, and model market volatility with incredible precision.

- Truly Personal Customer Experiences: AI helps banks understand what individual customers actually do and need, allowing them to offer product recommendations, financial advice, and support that feel genuinely helpful.

The true value of artificial intelligence in finance isn’t just about raw computing power. It’s about its ability to enhance human expertise. The technology delivers the insights, and the people provide the judgement.

This partnership between human intelligence and machine efficiency is redefining what’s possible. Financial experts can now zero in on high-level strategy and building client relationships, knowing they’re backed by solid, data-driven insights. As we dig deeper, you’ll see how this synergy is building a more resilient, responsive, and intelligent financial system for everyone.

A Look Under the Hood: The Core AI Technologies in Finance

To really get what’s happening with AI in finance industry, we need to pop the hood and see what makes it all run. These aren’t just abstract ideas; they’re the actual tools solving real financial puzzles every single day. Think of them as the specialist members of a super-efficient digital crew.

At the heart of it all, you’ll find three key technologies: Machine Learning (ML), Natural Language Processing (NLP), and Predictive Analytics. Each has a unique job, but they work together to create a smarter and more responsive financial world. Let’s break down what each one actually does.

Machine Learning: The Brain of the Operation

Machine Learning is the engine powering most AI you see in finance today. Instead of being spoon-fed a rigid set of rules for every possibility, an ML model learns by sifting through massive amounts of historical data. It teaches itself to spot patterns, connections, and things that just don’t look right.

Picture a rookie fraud analyst manually checking thousands of transactions. After a while, they start to get a gut feeling for what looks fishy. Machine Learning does the same thing, but on a colossal scale, poring over millions of data points in a heartbeat to make incredibly sharp judgments.

This ability to learn on the job is its real superpower. The more data it sees, the smarter and more accurate it gets, constantly sharpening its understanding of financial behaviour.

Natural Language Processing: The Communication Expert

If Machine Learning is the brain, then Natural Language Processing is the ears and mouth of the system. NLP is what gives computers the knack for understanding, interpreting, and even generating human language, from written text to spoken words.

Just think about all the unstructured text floating around in finance customer emails, chat logs, market analysis reports, and news headlines. NLP algorithms can read and make sense of it all. They can gauge the tone of a customer complaint, pull key details from a mortgage application, or even run the voice-activated banking assistant on your phone.

By translating human language into structured data, NLP closes the gap between how we talk and how machines think. It unlocks a treasure trove of insights that used to be buried in piles of text.

For example, an NLP model can scan thousands of app store reviews to pinpoint common frustrations with a new banking feature, giving developers a clear, actionable to-do list.

Predictive Analytics: The Crystal Ball

Predictive Analytics is all about looking ahead. It uses data, fancy statistics, and machine learning to forecast what’s likely to happen next based on what’s already happened. It’s the forward-thinking part of AI, acting as a financial firm’s own crystal ball.

This is essential for managing risk and jumping on new opportunities. By digging into past trends and current data, these models can anticipate everything from market shifts to individual customer behaviour. You can see how these predictions fit into a bigger picture in our guide on business intelligence in financial services.

Here’s where you can see predictive analytics in action:

- Credit Scoring: It can calculate the odds that someone will default on a loan, which leads to fairer and more accurate lending.

- Market Trends: Investment firms use it to forecast stock movements or spot the next big market trend by analyzing complex economic signals.

- Customer Churn: A bank can identify customers who might be thinking of leaving, giving them a chance to step in with a better offer or improved service.

Put them all together, and these three technologies create the bedrock of modern AI in the finance industry. Machine Learning supplies the raw intelligence, NLP handles all the communication, and Predictive Analytics provides the foresight. It’s a powerful trio that is fundamentally reshaping how finance works.

Putting AI to Work in Canadian Banking

The real power of AI isn’t just theory; it’s what happens when these systems get to work solving actual problems in our financial institutions. Across Canada, we’re seeing banks move past the experimental stage and weave intelligent technology directly into their daily operations. This is where concepts like machine learning and predictive analytics stop being buzzwords and start delivering real value for both the banks and their customers.

The numbers tell a story of rapid adoption. A staggering 98% of Canadian banks now consider themselves AI-ready, and 63% are already actively using AI solutions. This isn’t happening in a vacuum; it’s backed by a strong government push for responsible innovation, with a sharp focus on governance and cybersecurity, especially as new threats like deepfakes emerge.

To get a clearer picture, let’s look at how AI is being applied across Canadian financial services.

AI Use Cases Across Canadian Financial Services

| Use Case | Primary AI Technology | Key Benefit |

|---|---|---|

| Fraud Detection | Machine Learning, Anomaly Detection | Instantly flags unusual transactions, reducing financial losses and protecting customer accounts. |

| Algorithmic Trading | Natural Language Processing (NLP), Predictive Analytics | Executes trades at high speed based on market data and sentiment analysis, maximizing returns. |

| Personalized Banking | AI-driven Recommendation Engines | Offers customers tailored financial advice and product suggestions based on their spending habits. |

| Credit Scoring | Predictive Modelling, Alternative Data Analysis | Provides a more accurate and inclusive assessment of creditworthiness, opening access to credit. |

| Customer Support | Conversational AI (Chatbots) | Delivers instant, 24/7 answers to common customer queries, improving service efficiency. |

These examples show just how deeply AI is being integrated, shifting how financial institutions operate from the back office to the front lines of customer interaction.

Real-Time Fraud Detection and Security

One of the most powerful uses of AI in the finance industry is in the never-ending battle against fraud. Old-school security systems were built on static rules, which clever criminals could eventually figure out and sidestep. AI models, on the other hand, are constantly learning.

For every transaction, these systems analyze thousands of data points, including the time, location, purchase amount, device, and more, to build a unique behavioural fingerprint for each customer. If a new transaction doesn’t fit that pattern, the system flags it in milliseconds. That’s a speed no human team could ever hope to match.

The real magic is that AI doesn’t just look for known threats. It spots new, strange patterns that could signal the next big fraud tactic, helping banks stay one step ahead.

Algorithmic Trading and Investment

In the world of financial markets, every fraction of a second counts. Algorithmic trading platforms use AI to execute trades at a pace and volume that is simply beyond human capability. These systems sift through immense amounts of market data, news reports, and economic indicators to spot opportunities and act on them instantly.

For investment managers, AI is like having a super-powered analyst on the team. Hedge funds and asset managers are using it to:

- Dig through complex datasets to find undervalued assets or get a jump on market shifts.

- Stress-test portfolios by running constant simulations of different economic scenarios.

- Automate compliance checks to make sure every trade sticks to the letter of the law.

These capabilities are now a core component of modern fintech software development, making investment platforms smarter and more agile.

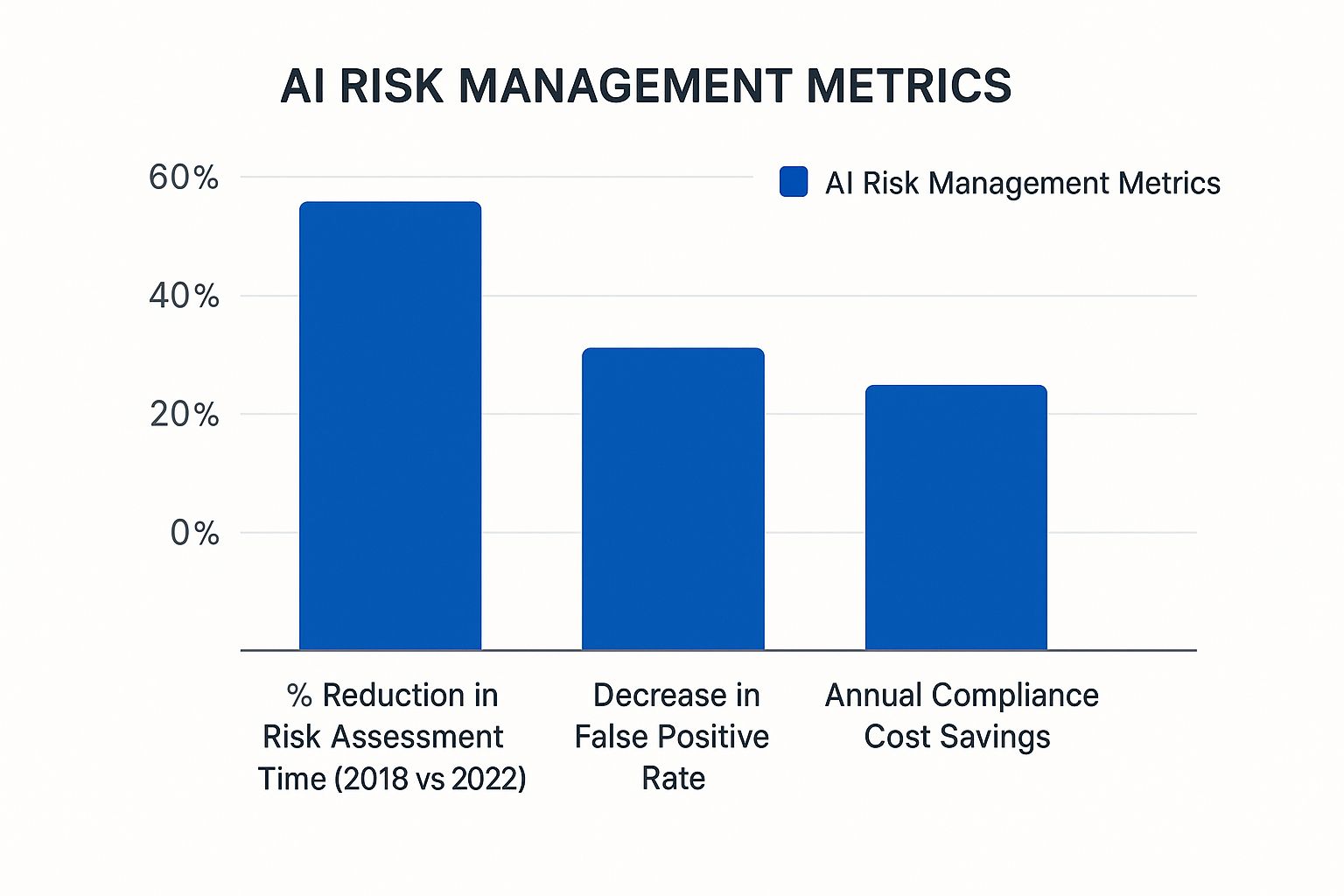

The chart above shows just how much of a difference AI makes in managing risk. You can see a clear trend over four years: as AI was integrated, risk assessment times plummeted, compliance costs dropped, and fraud detection became far more accurate.

Personalized Customer Banking

Canadians today expect their bank to know them, much like their favourite streaming service knows what they want to watch. AI is what makes that level of personalization possible. By analyzing a customer’s transaction history and savings patterns, banks can finally offer advice that actually feels relevant.

Instead of generic, one-size-fits-all messages, banks can now deliver:

- Proactive Budgeting Tips: AI-powered apps can spot where you’re overspending and suggest ways to save.

- Customized Product Offers: If the system sees you saving for a down payment, it can offer timely info on mortgages.

- 24/7 Support with Chatbots: Smart chatbots can handle simple questions anytime, day or night, so human agents can focus on the tough stuff.

Automated Credit Scoring

Traditionally, getting a loan has been tough for people with a thin credit file, like young adults or new Canadians. The old scoring models relied on a narrow set of historical data. AI is changing that by making the process fairer and more complete.

AI models can look at a much broader range of information, like regular rent payments or even business cash flow, to get a true picture of an applicant’s financial reliability. This helps banks make better, more equitable lending decisions. They can reduce their own risk while also giving a chance to good candidates whom the old system would have ignored. Many practical bookkeeping AI solutions are already demonstrating how these data-driven approaches work in the real world.

Weighing the Upside and the Obstacles of AI Adoption

Bringing artificial intelligence into the world of finance opens up a world of new possibilities, but it’s not a journey without its share of roadblocks. For any institution thinking about making this leap, it’s absolutely critical to look at both sides of the coin. The potential rewards point to a future that’s more efficient, intelligent, and focused on the customer, but the challenges demand some serious strategic thinking and planning.

It’s this balanced view that really matters for Canadian financial institutions today. Getting a firm grip on both the powerful advantages and the real-world hurdles is the first step toward putting AI to work successfully and responsibly.

The Clear Advantages of Financial AI

The main reason everyone is so keen on AI in the finance industry is the incredible value it brings to the table. The biggest wins are in operational efficiency, where AI takes over the routine, data-heavy tasks that used to eat up countless hours of human effort. This frees up your experts to focus on what they do best: high-level strategy and building client relationships. You can get a deeper look into the benefits of business automation and see how this plays out.

But it’s not just about speed. AI also provides a much sharper way to manage risk. It can sift through massive datasets in real-time, spotting potential fraud or making more accurate credit assessments almost instantly. On top of that, AI is the engine behind hyper-personalized customer experiences, using data to offer genuinely helpful advice and product suggestions that build real, lasting loyalty.

These aren’t just theoretical benefits; they’re driving real change. The momentum across the Canadian business landscape is undeniable, showing a growing trust in what AI can do. In fact, 12.2% of Canadian businesses now use AI to deliver services, a huge jump from just 6.1% the year before. This report on Canadian AI adoption from Statistics Canada has all the details.

Confronting the Real-World Hurdles

Despite all the clear upsides, the path to integrating AI is a complex one. Right off the bat, one of the biggest obstacles is the significant upfront investment needed. Building or buying AI systems comes with a hefty price tag for the technology, the infrastructure, and the specialized talent to run it all.

That brings us to the next major hurdle: the talent gap. The competition for skilled data scientists, machine learning engineers, and AI strategists is fierce. For many financial institutions, simply finding and keeping people with the right expertise is a constant battle.

The “black box” problem is another critical concern. Some advanced AI models make decisions in ways that are not easily explainable, even to their creators. This lack of transparency can create significant compliance and ethical issues in a highly regulated industry like finance.

Finally, there’s the tangled web of data privacy regulations. Financial institutions handle incredibly sensitive customer data, and they have to make sure their AI systems are fully compliant with rules like PIPEDA in Canada. Keeping that data secure is non-negotiable, which is why having strong strategies to enhance fintech app security is essential.

Here’s a quick summary of the key challenges financial institutions are up against:

- High Initial Costs: A significant financial outlay is needed for technology, infrastructure, and the whole implementation process.

- Talent Shortage: It’s tough to hire and hold onto experts with specialized AI and data science skills.

- Regulatory Compliance: The need to follow strict data privacy and consumer protection laws is paramount.

- The Black Box Problem: A lack of transparency in how complex AI models reach their conclusions can be a major issue.

- Data Security Risks: Ensuring AI systems and the data they use are protected from cyber threats is a constant necessity.

Getting AI right means tackling these issues head-on with a clear, proactive strategy. The goal isn’t just to plug in some new technology, but to build a resilient, ethical, and secure framework that maximizes the benefits while carefully managing the risks.

Navigating Canada’s AI Regulatory Landscape

In the buttoned-down world of finance, you can’t just plug in new AI software and hope for the best. For anyone working with AI in the Canadian finance industry, innovation has to walk lockstep with some serious oversight. This means every single AI-powered tool, whether it’s a simple customer service chatbot or a sophisticated algorithm executing trades, has to function within a clear and responsible framework.

This is about more than just ticking boxes on a compliance form; it’s about building and keeping the public’s trust. As banks and investment firms bring these powerful systems online, you can bet regulatory bodies are watching closely. They need to ensure this technology is being used ethically, transparently, and safely to protect both the financial system and the people it serves.

The Role of Canadian Regulators

Leading the charge here in Canada is the Office of the Superintendent of Financial Institutions, better known as OSFI. Now, OSFI doesn’t hand down rigid, line-by-line rules for every possible AI scenario. That would be impossible. Instead, it offers principles-based guidance. The onus is on the financial institutions to prove they’re managing AI-related risks responsibly.

This approach is smart because the technology is always evolving. Rather than trying to write a new rule for every new development, OSFI focuses on the result. They want to see that banks have strong internal controls, that they actually understand how their AI models work, and that they can explain the decisions those models make.

This kind of collaboration is essential if we’re going to get this right. For example, forums co-hosted by OSFI and the Global Risk Institute (GRI) really drive home the need for a unified game plan for managing AI’s threats and opportunities. It’s worth taking a look at their findings to understand this collaborative approach to AI in finance and see how industry leaders are shaping the playbook.

The EDGE Framework for Responsible AI

To help institutions find their way, a practical framework known as the EDGE principles has become the gold standard. It breaks down the challenge into four essential pillars for using AI responsibly in the financial sector.

- Explainability: Can you actually explain how your AI model concluded? If an AI algorithm denies someone a loan, the bank needs to be able to give a clear reason why. This is all about cracking open the “black box” and demanding transparency.

- Data: Is the data you’re feeding your AI accurate, relevant, and crucially, free from bias? Using flawed or skewed data will inevitably lead to unfair or discriminatory results, which is why data quality is at the very top of the list for regulators.

- Governance: Who is ultimately on the hook for what the AI system does? Strong governance means having crystal-clear lines of responsibility, solid oversight from senior management, and a system for constantly monitoring the AI’s performance.

- Ethics: Does the AI operate in a way that is fundamentally fair and aligns with our ethical standards? This pushes beyond just legal compliance. It forces a look at the bigger picture and the societal impact, making sure AI is truly serving the customer’s best interests.

Sticking to these principles isn’t optional. They are the very foundation of trust between financial institutions, their customers, and the regulators who are tasked with keeping the entire system stable.

By building the EDGE principles right into their DNA, Canadian financial institutions can do more than just satisfy the regulators. They can create AI systems that are not only powerful and efficient but also fair, transparent, and trustworthy. And that responsible approach is the only real way to unlock the full potential of AI in the finance industry while protecting everyone involved.

Here is the rewritten section, crafted to sound like it was written by an experienced human expert.

What’s Next for AI in Canadian Finance?

Looking at the road ahead, it’s clear that AI’s role in finance is about to get a lot bigger and more interesting. We’re moving beyond just speeding up back-office tasks. The real shift is toward AI fundamentally reshaping business strategy and how financial institutions connect with their clients. The next wave of AI is less about simple automation and more about augmentation, giving financial professionals analytical firepower we’ve never seen before.

This change is already kicking off with generative AI. Picture a system that doesn’t just crunch market data but actually creates sophisticated, multi-scenario forecasts, complete with written summaries. These tools could draft the first version of a market analysis report or simulate how a major global event might ripple through an investment portfolio. For a human strategist, that’s a massive head start.

The Dawn of Hyper-Personalization

The next big thing in customer experience is something we call hyper-personalization. Today’s AI might suggest a product, but tomorrow’s systems will be more like a genuine digital financial planner. They’ll get the whole picture of an individual’s finances, investments, debt, income, and life goals, to serve up holistic, proactive advice.

So, what does that look like in practice?

- Dynamic Financial Plans: Your AI could tweak your retirement plan on the fly in response to a market dip or a pay raise.

- Proactive Debt Management: The system might flag a perfect opportunity to consolidate debt when interest rates drop, showing you exactly how much you’d save.

- Life Event Guidance: It could walk a young family through saving for a down payment, setting up an RESP, and figuring out the right insurance, all through one intuitive platform.

The end game here is to build a true financial partnership where technology anticipates our needs and offers clear, helpful guidance. This will make expert financial advice far more accessible to every Canadian.

Evolving Cybersecurity Threats and Defences

As our financial systems get smarter, so do the people trying to break into them. The future of cybersecurity is shaping up to be a constant cat-and-mouse game between malicious AI and defensive AI. We’ll rely on AI-powered security to spot and shut down new kinds of threats, like deepfake voice scams trying to authorize a transfer or AI-written phishing emails that look terrifyingly real.

When all is said and done, the true potential of AI in the finance industry won’t be realized by technology alone. It hinges on a human-centric approach. The institutions that come out on top will be the ones that nail ethical governance, are transparent about how their AI models work, and maintain smart human oversight. The future isn’t about replacing financial experts; it’s about equipping them with tools to provide smarter, faster, and more empathetic financial services for all of us.

Got Questions About AI in Finance? We’ve Got Answers.

As AI becomes more common in the financial world, it’s completely normal to have questions. Getting a handle on how this technology actually works day-to-day is the best way to see its true potential. Let’s tackle some of the most frequent questions to clear things up.

Are Robots Coming for Our Jobs in Finance?

This is probably the biggest question on everyone’s mind. While it’s easy to imagine AI making human roles disappear, the reality is a lot more interesting. It’s less about replacement and more about a fundamental shift in what financial jobs look like.

AI is brilliant at the heavy lifting, sifting through mountains of data and knocking out repetitive, rule-based tasks with incredible speed and accuracy. This is the kind of work that used to eat up huge chunks of a professional’s day. By automating it, AI frees up human experts to focus where they truly shine: high-level strategy, building strong client relationships, and creative problem-solving. These are things that demand intuition, empathy, and a deep understanding of context, skills that AI just can’t match. The job is shifting from manual data entry to strategic thinking.

Think of AI not as a replacement, but as a powerful partner. It delivers the insights, so financial professionals can apply their judgment and expertise where it matters most.

How Can I Be Sure My Financial Data is Safe with AI?

Data security is, without a doubt, the top priority. In Canada, financial institutions operate under strict data privacy laws like the Personal Information Protection and Electronic Documents Act (PIPEDA). These rules dictate exactly how your information must be collected, handled, and kept safe.

The AI systems used in finance are designed with security at their core. We’re talking about sophisticated encryption, tightly controlled access, and constant monitoring to protect sensitive data from any threats.

In fact, AI is actually one of our best weapons in the fight against cybercrime. Machine learning security systems are incredibly good at spotting and stopping data breaches. They can identify tiny, unusual patterns in network activity that signal a potential attack, often catching threats that older, rule-based systems would miss.

How Exactly Does AI Catch Financial Fraud?

AI’s knack for spotting fraud in real-time is one of its most valuable contributions to finance. It all starts with machine learning algorithms that learn your unique spending habits, where you shop, what you typically buy, and when you’re most active.

Essentially, the AI creates a personalized financial “fingerprint” just for you. From then on, it compares every single new transaction against this pattern in a fraction of a second.

If a transaction seems out of character, say, a huge purchase from a different country in the middle of the night, the system immediately flags it as suspicious. This triggers an instant alert to you and the bank, stopping fraud in its tracks before any real damage is done.

At Cleffex Digital Ltd, we build smart, secure software that helps businesses tackle their toughest problems. If you’re thinking about bringing AI into your financial operations, see how our team can help you succeed by visiting us at https://www.cleffex.com.