In the Canadian insurance world, a custom insurtech solution is more than just another piece of software. It's a purpose-built platform designed to address the specific challenges that insurers, brokers, and MGAs encounter daily. Think of it as the difference between an off-the-rack suit and a bespoke one; it's made to fit your company's unique workflows, from automating underwriting to modernising the entire claims process. This is especially critical in Canada, where you must navigate a complex web of regulations, including the federal PIPEDA, alongside distinct provincial privacy laws.

Laying a Strong Foundation for Your Insurtech Project

Before a single line of code gets written, the fate of your insurtech project is already being decided. It's all in the planning. I've seen too many companies rush into development, excited by the tech, only to face budget blowouts and a final product that doesn't quite hit the mark. The initial phase isn't about the technology; it's about asking the hard questions to make sure what you build will deliver real, tangible business value.

This all starts with a deep dive into your current operations – a proper needs analysis. Don't just skim the surface and identify problems. You need to dig for the root causes of friction. Is your claims team really spending 60% of their time on mind-numbing manual data entry? Are your underwriters juggling five different systems just to get a clear picture of risk? Pinpointing these specific bottlenecks is the only way to define a solution that actually solves something meaningful.

Defining Clear and Measurable Goals

Goals like "improve efficiency" are well-intentioned but ultimately useless. They're not actionable. Instead, you need to set sharp, measurable targets that will act as your north star for the entire project. This brings focus to the development team and makes it possible to prove the project's success down the line.

Here’s what I mean by tangible goals:

Slash claim processing time from an average of 15 days down to 10 within six months of going live.

Boost customer self-service adoption for policy renewals by 40% in the first year.

Cut manual underwriting errors by 25% by automating routine data verification.

Accelerate broker submission-to-quote speed from a frustrating 48 hours to under 4 hours.

These aren't just IT metrics. They’re business outcomes. When you frame your goals this way, you transform the project from a tech expense into a strategic investment with a clear return. If you're just getting started, taking a look at a broader guide to Canadian insurance technology can give you some valuable context on what's possible.

Aligning Technology with Business Objectives

A brilliant piece of tech that doesn't align with your company's strategic goals is, frankly, a waste of money. Your custom solution has to be a direct extension of your business plan. For example, if your five-year vision is to dominate a new niche market, then your platform needs to be built with the scalability and flexibility to handle that growth from day one.

One of the most common pitfalls I see is when projects are viewed purely through a technology lens. The home runs are always the ones where IT and business leaders are joined at the hip from the very beginning, ensuring the solution solves a genuine business problem and contributes directly to the bottom line.

Getting early buy-in from key stakeholders is non-negotiable. You need the heads of claims, underwriting, finance, and compliance in the room and on board. When everyone understands the 'why' and can see how this will make their lives easier and the company stronger, you build powerful internal champions. That shared ownership is what will carry you through the inevitable bumps in the road during implementation and drive adoption once you launch.

Navigating Canadian Insurance Regulations and Compliance

Building a powerful custom insurtech solution in Canada isn't just about sharp code and a slick user interface. The real challenge and the key to long-term success is navigating the country's complex web of regulations. This isn't a box-ticking exercise; it’s about weaving compliance into the very fabric of your platform. Get this right, and you protect your customers, your partners, and your business from serious legal and financial heat.

The regulatory landscape can feel like a maze at first, but it becomes much clearer once you know the main players. It all starts at the federal level with the Personal Information Protection and Electronic Documents Act (PIPEDA). This is the baseline for how any private company in Canada collects, uses, and shares personal information. For your platform, this has real-world consequences for everything from how you design your sign-up forms to where you store customer data.

Thinking about PIPEDA isn't just for your lawyers; it directly shapes the user experience. For example, when a new customer buys a policy through your app, you need their explicit, informed consent. That means no more pre-ticked boxes hidden away in a wall of text. Your platform has to clearly explain in plain English what data you're collecting, why you need it, and how it's going to be used.

Understanding the Provincial Patchwork

While PIPEDA sets the national standard, compliance doesn't end there. You have to contend with a patchwork of provincial rules, which often go a step further. If you're planning to operate across the country, your solution needs to be nimble enough to handle the distinct requirements in key markets.

Quebec’s Bill 64 (now Law 25) is the one everyone is talking about. It’s a game-changer, bringing in some of the toughest privacy protections in North America, much like Europe's GDPR. The law requires you to conduct privacy impact assessments for new projects and gives customers powerful new rights, like the ability to have their data deleted. Your platform needs the built-in functionality to handle these requests without a fuss.

And it’s not just Quebec. Other provinces have their own rules you can't afford to ignore:

Ontario: The Financial Services Regulatory Authority (FSRA) is focused on consumer protection and fair treatment, and they have specific guidance on managing technology and cyber risks.

British Columbia: The province has its own Personal Information Protection Act (PIPA) that applies to provincially regulated businesses.

Alberta: Just like B.C., Alberta has its own PIPA that takes precedence over the federal PIPEDA for most private-sector dealings within the province.

A one-size-fits-all approach to compliance is simply doomed to fail in Canada. You need to build a flexible architecture that can adapt to these regional differences. To get a better feel for how these evolving rules are shaping the market, you can read our article about the top insurtech trends in Canada for 2026.

Actionable Guidance from Federal Bodies

Beyond the letter of the law on privacy, it’s smart to look to federal bodies like the Office of the Superintendent of Financial Institutions (OSFI). They set the standards for federally regulated financial institutions. Even if your insurtech startup doesn't fall directly under OSFI’s watch, its guidelines on technology and cyber risk are the gold standard. Following them is a best practice that builds immediate trust with customers and big-name partners.

The core principle is simple: treat regulatory compliance not as a barrier to innovation, but as a framework for building a more secure, trustworthy, and resilient product. A platform that respects user data and is built on a solid risk management foundation is a platform built for long-term success.

The Canadian insurance market, on track to grow at a CAGR of over 4% through 2033, is hungry for custom solutions that can handle these complexities. This growth is being fuelled by a demand for more personalised products and the adoption of tech like AI-powered underwriting. In this environment, solid compliance isn't just a requirement – it's a massive competitive advantage. You can discover more insights about the Canadian insurance market on DataInsightsMarket.com.

At the end of the day, understanding the rules is just the start. The real work lies in implementing robust solutions for compliance liability control to ensure you can operate successfully. A proactive approach is the only way to make sure your innovative platform is not just powerful, but built to last.

Choosing Your Path: Build In-House or Partner with a Vendor?

One of the first, and most important, forks in the road you'll face is deciding how to build your solution. Should you assemble an internal team, or is it smarter to partner with a specialist? This choice will shape everything that follows – your budget, your timeline, and the long-term agility of your new platform.

There's no magic formula here. The right answer is deeply tied to your company’s unique resources, in-house expertise, and the strategic goals behind your push for custom insurtech solutions in Canada.

Going the in-house route gives you the ultimate prize: total control. You own every line of code, dictate the entire development roadmap, and can fine-tune the platform to your precise business needs. The catch? It requires a significant investment in specialised talent and infrastructure, a hurdle many Canadian insurers and SMEs find daunting.

On the other side of the coin, partnering with an experienced vendor gets you immediate access to a team that’s been down this road before. This can dramatically shorten your time to launch and usually comes with a more predictable price tag. The trade-off, of course, is a bit less customisation and a reliance on your partner for future support and evolution.

The Hard Reality of an In-House Build

The idea of building from scratch is incredibly compelling, especially for organisations aiming to create a one-of-a-kind competitive advantage. When your own team builds it, they have an intimate, ground-level understanding of your business logic.

But let's be realistic – this is a massive undertaking. You aren't just hiring a couple of developers. You need to build a full-fledged product team:

Project Managers to keep everyone aligned and the project on schedule.

UI/UX Designers who can craft an intuitive and modern user experience.

Backend and Frontend Developers fluent in secure, scalable coding practices.

Quality Assurance (QA) Engineers to hunt down bugs and security holes.

DevOps Specialists to manage the technical infrastructure and deployments.

Finding, hiring, and most importantly, retaining this kind of talent in Canada's fiercely competitive tech market is a major challenge in itself. The ongoing costs of salaries, benefits, and software licences can quickly balloon past what you'd pay a vendor.

The Upside of a Vendor Partnership

For most small to medium-sized insurers, bringing in a specialised development firm is simply the more practical path. It lets you tap into a deep well of experience without taking on the long-term overhead of a full-time, in-house team. A great partner brings more than just coding skills; they bring invaluable industry insights from dozens of other projects.

When you do go the partnership route, a robust Third-Party Risk Management (TPRM) process is non-negotiable. It's your key to ensuring compliance and operational security. This framework helps you verify that your chosen vendor meets your standards for data protection and stability, protecting both your business and your clients' sensitive information.

Choosing a partner isn't just about outsourcing the work. It's about finding an extension of your own team – a group that understands the Canadian insurance market and can guide you through the technical and regulatory complexities with confidence.

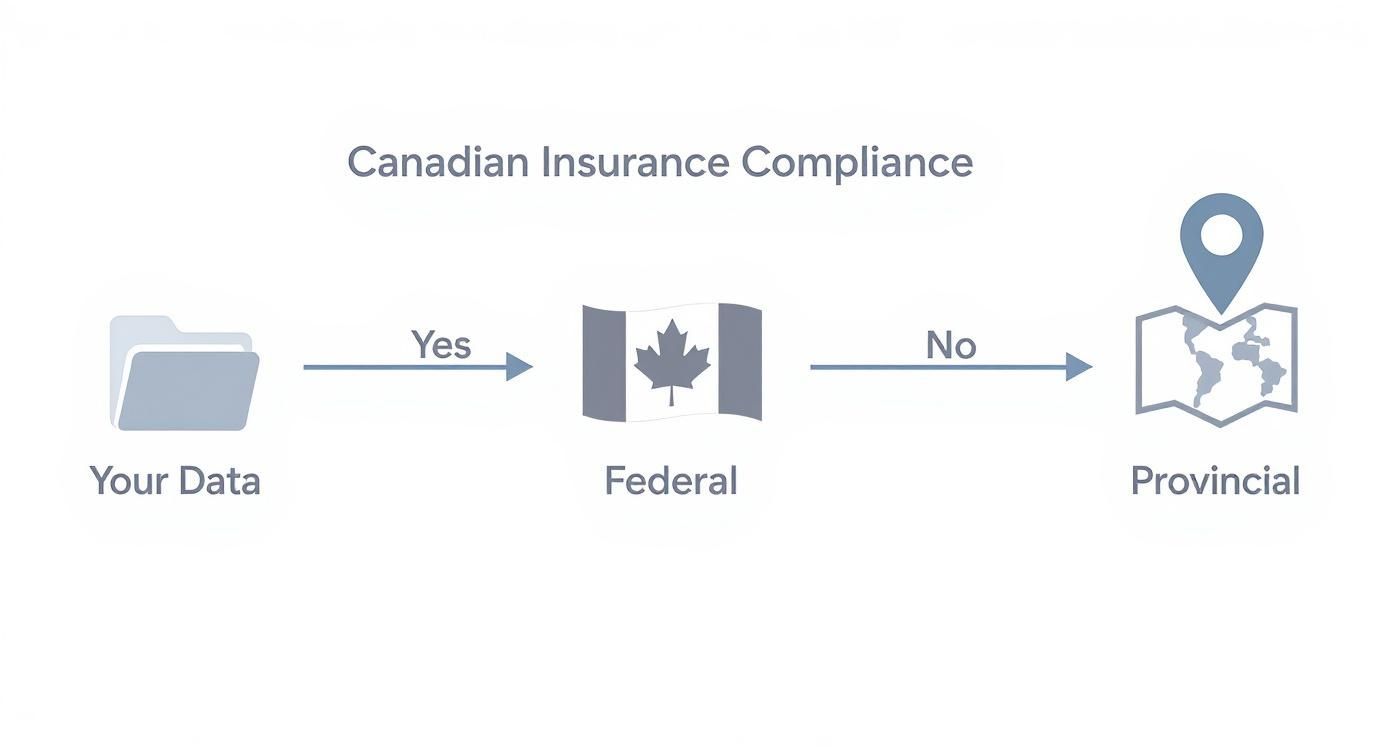

The infographic below helps visualise a critical piece of that puzzle: data compliance. It shows the layers of regulation in Canada that any solution, whether built in-house or with a partner, must navigate.

As you can see, your solution has to be built with both federal (PIPEDA) and provincial rules in mind from day one.

Making the Right Call for Your Business

To make a clear-eyed choice, you have to weigh these critical factors against your own unique situation. A large national insurer with a well-established IT department and deep pockets might lean towards an in-house build. In contrast, a regional MGA looking to modernise quickly will almost certainly find a partnership more effective.

To help you think through this, here’s a decision matrix that lays out the key considerations side-by-side.

Decision Matrix: In-House Build vs. Vendor Partnership

| Factor | In-House Development | Vendor Partnership |

|---|---|---|

| Speed to Market | Slower, bogged down by hiring and team formation. | Faster, with an experienced team ready to hit the ground running. |

| Initial Cost | High capital expenditure on salaries, recruitment, and tech. | Lower upfront cost, typically defined by the project scope. |

| Long-Term Cost | Ongoing operational expenses for salaries, benefits, and tools. | Predictable recurring fees or project-based costs. |

| Control & IP | You have 100% control and own all intellectual property. | Control is shared; IP ownership is a key negotiation point. |

| Expertise | Limited to the skills of the team you can hire and retain. | Access to a broad, diverse pool of specialised skills. |

| Scalability | Scaling depends entirely on your ability to hire more staff. | Much easier to scale resources up or down as project needs change. |

Ultimately, this all comes down to an honest assessment of your organisation's strengths, weaknesses, and strategic goals. By looking at these factors squarely, you can choose the build path that gives your custom insurtech solution the best possible chance for success in the Canadian market.

Designing a Future-Ready Technical Architecture

The technical architecture you choose is the very DNA of your platform. It’s the blueprint that determines not just how your solution works today, but how it will grow, adapt, and defend itself in the years to come. Thinking of this as just an IT task is a rookie mistake; it’s a critical business decision that directly impacts your ability to scale in the Canadian market. A poorly planned architecture will saddle you with technical debt that stifles innovation for years.

The first big choice you’ll face is the classic debate: monolithic versus microservices. A monolithic architecture is the traditional, all-in-one approach. While it can feel simpler to get off the ground, it quickly becomes a tangled mess when you need to update one small feature without breaking the whole system.

A microservices architecture, on the other hand, breaks your application into a collection of smaller, independent services. Think of your claims processing, policy administration, and user authentication as separate, communicating modules. This approach makes the entire system more resilient and far easier to update – a massive advantage in the fast-moving insurtech world.

Bridging the Gap with Legacy Systems

For most established insurers, the real headache isn't building something new. It's figuring out how to connect that shiny new tool to decades-old legacy systems. These core systems are the heart of the business, holding critical policyholder data, but they often lack modern interfaces. A full "rip and replace" project is usually far too costly and disruptive to be a realistic option.

This is where a smart API (Application Programming Interface) strategy becomes your most valuable tool. APIs act as a secure bridge, allowing your sleek new platform to talk to your old mainframe in a controlled, efficient way.

Think of your legacy system as a historic building with immense value but no modern plumbing. You don't demolish the building; you carefully install new pipes (APIs) that bring modern functionality without compromising the original structure. This approach is fundamental to a successful integration.

By building a robust API layer, you can pull the data you need from your legacy systems without having to untangle their complex internal logic. This decouples your new tech from the old, giving you the freedom to innovate without being held back. To explore this topic further, you can check out our detailed guide to insurtech software development in Canada.

Embedding Security and Compliance by Design

In Canada, data security isn’t an afterthought; it’s a foundational requirement. Your architecture must be designed from day one to protect sensitive customer information and meet the stringent demands of PIPEDA and provincial privacy laws. We call this "security by design."

This means weaving security into every layer of your application:

Robust Encryption: All data, whether it’s sitting in a database (at rest) or being transmitted across a network (in transit), must be encrypted using strong, modern algorithms. No exceptions.

Strict Access Controls: Implement role-based access control (RBAC) to ensure people only see and touch the data absolutely necessary for their job. An underwriter simply shouldn't have access to the same system tools as an IT administrator.

Regular Security Audits: Your architecture should make it easy to conduct regular penetration testing and vulnerability scanning. You need to find the weaknesses before someone else does.

The explosive growth of the Canadian insurtech market, projected to jump from USD 576.2 million in 2023 to a staggering USD 11.4 billion by 2030, is built on trust. This growth, representing a compound annual growth rate of 53.2%, proves the market's hunger for secure, data-driven platforms. A future-ready architecture is your ticket to being part of that success story.

Launch Day and Beyond: Your Deployment and Optimisation Playbook

You’ve built it. Now comes the moment of truth: taking your custom insurtech solution live. This transition from a controlled development space to the real world is where the rubber truly meets the road for any Canadian insurer or SME. A great launch isn't about flipping a switch; it's a meticulously planned event designed to get your team on board and delivering value from day one.

Before anyone else sees it, the platform needs to pass its final, most important test: User Acceptance Testing (UAT). This isn't just another bug hunt for the tech team. UAT means putting the software into the hands of the people who will live in it every day – your brokers, underwriters, and claims adjusters. You need them to run it through their actual, messy, real-world workflows. Their feedback is gold; they’ll spot usability issues and process gaps that developers, with their perfect-world view, will almost always miss.

At the same time, you have to get your training in order. A brilliant tool is just an expensive paperweight if your staff can't use it confidently. Don't skimp here. Develop practical training materials, run hands-on workshops (not just boring presentations), and make sure a solid support system is in place for those first few chaotic weeks. When you empower your team, you turn potential critics into your biggest champions.

Ditch the "Big Bang" for a Phased Rollout

For any established insurance operation, launching a new system for everyone, all at once – the "big bang" approach, is just asking for trouble. It creates a massive single point of failure. If one critical thing goes wrong, your entire business could grind to a halt.

A phased rollout is a much smarter, safer path. It lets you learn and fix things in a controlled way.

Here are a few ways we’ve seen this work well:

Go Department by Department: Maybe the claims team gets the new platform first. Once they're up and running and you've ironed out the initial kinks, you can bring the underwriting team on board.

Start with a Pilot Group: Hand-pick a small, tech-friendly group of users to be your pioneers. They'll give you fantastic, detailed feedback and help you refine everything before you go company-wide.

Launch by Feature: If your solution is built in modules, you could roll out the new policy administration system while letting the old claims system run in parallel for a bit longer.

This methodical approach takes the pressure off, turning a high-stakes gamble into a manageable process of continuous improvement.

Define KPIs That Actually Mean Something

Once you're live, your focus has to shift from building to measuring. Vague goals like "improving efficiency" won't cut it anymore. You need to track specific Key Performance Indicators (KPIs) that tie directly back to the business case you made when you started this whole journey.

The real measure of success isn't the shiny new technology. It's the tangible, bottom-line impact it has on your business. Your KPIs need to tell that story clearly.

Get specific with your metrics. Start with these:

User Adoption Rate: What percentage of your team is actually using the new system every day? Be honest.

Time Savings on Manual Tasks: By how many minutes or hours has claims intake or policy renewal sped up? Get the hard numbers.

Error Rate Reduction: How many fewer manual data entry mistakes are you seeing?

Customer Self-Service: What percentage of clients are now using the new portal for things they used to call you for?

A data-driven mindset is non-negotiable, especially now. The Canadian insurtech market is expected to explode from roughly USD 206 million in 2024 to a staggering USD 3.53 billion by 2033, all driven by technology that creates real efficiency. Tracking your performance is how you ensure you're a part of that growth, not a spectator. For a deeper dive into these trends, check out the Canadian insurtech market data from IMARC Group.

Build a Continuous Feedback Loop

Let’s be clear: launch day is the beginning, not the end. The market, your customers' expectations, and Canadian regulations are always in motion. Your custom insurtech solution has to evolve with them.

The only way to stay relevant is to establish a continuous feedback loop. This isn't a one-time survey; it's a permanent part of your operations.

Set up regular check-ins with your users. Send out short, targeted surveys. Use the platform's analytics to see how people are really using it. This constant stream of information will uncover new opportunities and guide your development roadmap, making sure the significant investment you just made continues to pay dividends for years to come.

Your Questions, Answered

When you start digging into the idea of a custom insurtech solution, the high-level strategy talk quickly gives way to practical questions. It’s the same every time I talk to insurers and brokers: they want to know about the real-world costs, timelines, and roadblocks they’ll face.

Let's get into the brass tacks. Answering these questions upfront helps set the right expectations and lays a much stronger foundation for a successful project.

What’s the Real Cost and Timeline?

This is always the first question, and the honest answer is: it depends. There’s no standard price tag. The cost and timeline for a custom insurtech solution in Canada can swing wildly based on what you're trying to achieve.

For a smaller, focused project, maybe a Minimum Viable Product (MVP) to handle a single task, you can get started without breaking the bank. Think about an automated claims intake tool. A project like that might land in the CAD $75,000 to $150,000 range and take about four to six months to get up and running. This is a great way to test an idea and see a quick return.

But if you’re dreaming bigger, the investment grows accordingly. A comprehensive platform with AI-driven underwriting, full policy management, and an integrated customer portal is a massive undertaking. We’re talking about projects that can run from CAD $300,000 to well over $1 million, with development stretching anywhere from 12 to 24 months.

What pushes your project one way or the other? A few key things:

How You Build: The choice between an in-house team and a specialised vendor dramatically impacts your budget, both upfront and long-term.

Legacy Systems: The more you need to connect to your old, existing systems, the more time and complexity you add to the project.

Compliance Demands: The specific regulatory hurdles in your target provinces, especially with rules like Quebec's Law 25, will shape the work involved.

How Do We Keep Our Solution Compliant?

Staying compliant with Canada’s privacy and consumer protection laws isn’t a one-and-done task. It's a moving target. The regulations are always evolving, so your platform has to be built to adapt from day one.

The best approach is what we call "compliance by design." This isn't just a buzzword; it means weaving regulatory requirements into every single stage of development. Compliance isn't a box you tick at the end; it's a core consideration from the very first wireframe to the final line of code.

Building a compliant solution is about more than just avoiding fines. It's about building trust with your customers. In the Canadian market, a platform that’s transparent and respectful of user data is a powerful way to stand out.

To make this work long-term, you need a flexible architecture that allows for easy updates. You should also have legal and compliance experts who live and breathe Canadian insurance law (like PIPEDA) on speed dial. And finally, regular audits and risk assessments are non-negotiable. They’re how you spot and fix vulnerabilities before they become problems.

What Are the Biggest Integration Headaches?

For most established insurers, the biggest technical nightmare is trying to connect a sleek new insurtech solution to their clunky legacy systems. These old platforms hold decades of crucial data, but they were never designed to play nicely with modern, cloud-based apps.

You’re likely to run into three major headaches: incompatible data, the risk of system downtime, and glaring security holes. Legacy systems often use ancient data formats and don’t have the modern APIs needed to share information smoothly. It’s like trying to plug a USB-C cable into a floppy disk drive.

To bridge this gap, many firms use middleware – a piece of software that acts as a translator between the old and new systems. Another option is to build a robust API layer that creates a secure, controlled pathway for data to flow. This avoids having to rip out your core legacy system entirely.

Of course, nobody wants to shut down operations during the transition. A carefully planned, phased rollout can be a lifesaver. You could also run the old and new systems in parallel for a while to iron out the kinks. Most importantly, any link between your new platform and your old core system is a potential security risk. It needs to be fortified and tested relentlessly in a safe, sandboxed environment long before it ever touches live customer data.

At Cleffex Digital Ltd, we specialise in developing custom software solutions that solve real-world business challenges for Canadian insurers and SMEs. If you're ready to build a platform that delivers lasting value, we're here to help you navigate every step of the process. Learn more about our approach.