At its core, business intelligence in insurance is about turning mountains of raw data into clear, actionable insights. Think of it as a powerful radar system for insurers, cutting through the noise of complex information to help them make smarter, faster, and more profitable decisions. This approach allows companies to move beyond reacting to yesterday's news and start anticipating tomorrow's trends.

The New Competitive Edge for Insurers

Trying to navigate today's insurance market with spreadsheets is like steering a modern cargo ship with a paper map. It might keep you afloat, but you’re left vulnerable to sudden storms and blind to what’s just over the horizon. In this environment, business intelligence in insurance isn't a luxury; it's the essential navigation system for staying competitive.

BI marks a fundamental shift from being a historical record-keeper to a forward-looking forecaster. Instead of just documenting past claims and losses, insurers can now analyze huge datasets to predict future patterns, spot emerging risks, and understand what customers really need with stunning clarity. This is the key to solving real business problems.

From Reaction to Proactive Strategy

The real magic of BI is how it changes an insurer's entire operational mindset. Rather than just reacting when claim volumes spike or market conditions shift, organisations can see these changes coming and prepare for them. This foresight leads to more agile and well-informed decisions across every department.

For example, BI can shine a light on tangled internal processes that create bottlenecks and drive up operational costs. It gives leaders a clear view of where the inefficiencies are hiding, allowing them to fix small problems before they balloon into major financial headaches.

Business intelligence isn't just about generating reports. It’s about building a culture of curiosity where data drives inquiry and leads to smarter, more profitable actions. It's the framework that turns information into a genuine competitive advantage.

Solving Real-World Insurance Challenges

This move toward proactive decision-making hits right at the core challenges modern insurers face. It provides the tools needed to handle volatile markets, adapt to changing consumer expectations, and protect profitability in an incredibly competitive field. The emergence of integrated platforms like the Bank Intelligence and Action System (BIAS) shows just how central advanced BI is becoming in the wider financial services industry.

Ultimately, adopting BI means getting confident answers to critical questions:

Customer Behaviour: Who are our most profitable policyholders, and what do they actually care about?

Market Volatility: How do we need to adjust our risk models for new climate patterns or economic shifts?

Operational Efficiency: Where are the hidden delays in our claims process that are damaging customer satisfaction?

By answering these questions with data, business intelligence in insurance becomes more than just a piece of technology. It becomes the central pillar of a resilient, modern, and truly competitive organisation.

How BI Drives Real ROI in Insurance

The true test of any technology is its return on investment (ROI), and this is where business intelligence in insurance really shines. Moving beyond theory, BI delivers clear, measurable results by sharpening core operations, plugging financial leaks, and cementing customer loyalty. It turns data from a simple business byproduct into a powerful asset for growth.

Instead of relying on historical averages or simple gut feelings, insurers can finally make decisions backed by hard evidence. This data-driven approach has a direct impact on the bottom line, optimizing everything from individual policy pricing to broad strategic planning. The financial benefits aren't just an idea—they show up as lower costs and higher revenues.

Sharpening Underwriting Precision

Profitable insurance is built on the foundation of accurate underwriting. Business intelligence gives underwriters a panoramic view of risk, pulling together data from dozens of sources to build a complete profile. This allows them to price policies with far greater accuracy, making sure premiums truly reflect the risk involved.

This level of precision is especially vital for complex or high-value policies, where even small miscalculations can lead to huge losses. By analyzing historical claims data alongside external factors like weather patterns or economic trends, BI helps underwriters shift from reactive pricing to proactive risk management. That's a direct line to protecting profitability.

Accelerating Claims and Reducing Fraud

The claims process is a make-or-break moment for both the customer experience and your operational efficiency. BI tools provide real-time dashboards that monitor the entire claims lifecycle, instantly flagging bottlenecks or unusual activity. This kind of visibility leads to much faster settlement times, a key driver of customer satisfaction and retention.

At the same time, these systems are a powerful weapon in the ongoing fight against fraud. Advanced analytics can spot suspicious patterns in claims data that a human analyst would almost certainly miss.

By flagging potential fraud early, business intelligence not only saves insurers millions in payouts but also frees up resources to process legitimate claims faster. It’s a win-win for the company and its honest policyholders.

This dual benefit of speed and security makes BI an indispensable tool for any modern claims department.

Enhancing Customer Relationships and Economic Impact

Beyond the operational victories, BI helps build deeper, more meaningful customer relationships. By truly understanding policyholder behaviour and needs, insurers can craft highly personalized experiences and product offerings. This is a massive differentiator in a crowded market and is crucial for building genuine, long-term loyalty. You can dive deeper into this topic in our guide on the AI-driven customer experience in insurance.

The positive effects don't stop there. In California’s $400 billion insurance market, for instance, data analytics plays a vital role in economic stability. A report from the California Department of Insurance found that insurers using data insights to partner with small and diverse businesses generated $6.7 billion in economic output and supported over 29,000 jobs. This shows just how much strategic data use can contribute to the health of the broader community. You can find more in the full economic impact report.

Putting BI to Work in Core Insurance Operations

This is where the rubber meets the road. Business intelligence isn't just a high-level concept; it's a practical tool that brings real clarity to the most critical parts of an insurance business. It gives teams the ability to make sharp, data-driven decisions where it counts the most, from setting policy prices to settling claims. BI is fundamentally changing how insurers operate day-to-day.

Instead of teams working in silos with bits and pieces of information, BI provides a single, unified view of performance, risk, and what customers are doing. Everyone gets on the same page, turning mountains of raw data into a smart, coordinated strategy.

Precision Underwriting and Dynamic Pricing

At its heart, underwriting is the financial engine of any insurance company. Getting it right means profitability; getting it wrong can be catastrophic. Business intelligence gives underwriters the advanced tools they need to move beyond old-school, static data and adopt a much more dynamic way of looking at risk.

By pulling in and analyzing massive, diverse datasets, think everything from vehicle telematics and property records to regional climate models, underwriters can price policies with surgical precision. This is absolutely critical in high-risk areas or in markets that are changing fast, where traditional models just can't keep up.

The chaotic risk landscape in places like California is a perfect example. The state's insurer of last resort, the California FAIR Plan, saw its total exposure skyrocket to $529 billion, a staggering 217% jump since 2021. This surge is partly because regulations there restrict the use of forward-looking catastrophe models. It forces insurers to rely heavily on advanced analytics and BI to navigate risk and sharpen their underwriting.

A Smoother Claims Management Process

The claims process is the moment of truth for any insurer. It's where you deliver on your promise. A slow, frustrating experience can destroy customer trust for good, while a seamless one can create a loyal customer for life. Business intelligence brings a whole new level of efficiency and transparency to claims management.

With interactive dashboards, managers can watch the entire claims pipeline in real time. They can see exactly where claims are getting stuck, spot bottlenecks, and shift resources to keep things flowing smoothly. This kind of visibility leads directly to faster, fairer, and more consistent settlements for policyholders.

By turning claims management from a reactive paper chase into a proactive, data-guided operation, BI doesn't just cut operational costs, it also gives policyholder satisfaction a major boost.

Advanced Fraud Detection

Insurance fraud is a multi-billion-dollar headache that ends up costing everyone through higher premiums. While human investigators are great at catching obvious red flags, the really sophisticated fraud schemes are designed to slip by unnoticed. This is where business intelligence, supercharged by machine learning, becomes an essential line of defence.

BI systems can scan thousands of claims at once, picking up on subtle patterns and odd connections that a person would never see. These algorithms can flag suspicious activity, such as:

Unusual Claim Frequency: A single provider or policyholder who seems to be filing an unusually high number of claims.

Network Anomalies: Uncovering hidden links between claimants, medical providers, and repair shops that pop up across multiple incidents.

Billing Inconsistencies: Catching duplicate charges or services billed that don't match the reported incident.

By automating this first-pass detection, BI frees up fraud investigation teams to use their expertise on the cases that pose the biggest risk. And it's not just about stopping external threats; these same principles can be applied to internal fraud detection strategies.

This proactive approach doesn't just prevent direct financial losses. It also protects the integrity of the whole system, making sure that funds go to legitimate claims.

BI Applications Across Insurance Functions

To pull it all together, here’s a quick look at how BI is applied across different departments to solve real-world problems.

| Insurance Function | Key Challenge | Business Intelligence Solution |

|---|---|---|

| Underwriting | Inaccurate risk assessment and outdated pricing models. | Analyzing diverse datasets (telematics, climate) for dynamic, precise risk pricing. |

| Claims Management | Processing delays, operational bottlenecks, and poor customer experience. | Real-time dashboards to monitor the claims pipeline, identify issues, and speed up settlements. |

| Fraud Detection | Sophisticated fraud schemes bypassing manual review processes. | Machine learning algorithms that detect subtle patterns and network anomalies across thousands of claims. |

| Customer Retention | High churn rates and a lack of insight into policyholder behaviour. | Predictive models to identify at-risk customers and personalized dashboards for targeted outreach. |

| Marketing & Sales | Inefficient campaign spending and difficulty identifying high-value leads. | Customer segmentation and campaign performance analysis to optimize marketing ROI and sales efforts. |

Ultimately, a strong business intelligence framework is the key to transforming these core functions from simple cost centres into powerful engines of efficiency and growth.

The Future of Underwriting with AI

While business intelligence is fantastic for showing what’s already happened, its real value in today's insurance world is found when it's paired with Artificial Intelligence. This partnership is a game-changer, transforming business intelligence in insurance from a simple reporting tool into a predictive powerhouse. AI doesn't just replace BI; it amplifies it, giving insurers the ability to forecast, simulate, and manage risk with a level of precision we’ve never seen before.

This combination is already redefining what’s possible in underwriting, opening the door to insuring risks that were once considered completely off-limits. It helps insurers break free from relying solely on static, historical data and adopt a much more dynamic, forward-thinking approach to assessing risk.

From Hindsight to Foresight

Think about it: traditional underwriting is built on past data, what has already happened. AI flips the script by creating predictive models that can run simulations of what could happen. When you feed these models into BI systems, your dashboards stop being rearview mirrors and start acting more like sophisticated GPS systems, showing you what’s likely coming up on the road ahead.

Let’s say an underwriter is looking at a property in a high-risk area. Instead of just pulling up past claims for the neighbourhood, an AI-powered BI system can:

Analyse real-time satellite imagery to check for things like vegetation density and how close it is to the home.

Simulate the potential impact of different weather events, like how wind patterns might affect a wildfire.

Factor in tiny details about the property itself, like the type of roofing material used or the amount of defensible space.

This creates a risk profile that is far more nuanced and accurate than anything historical data could provide on its own.

By integrating AI, business intelligence stops being about just reporting on the past and starts being about actively shaping a more profitable and resilient future. It's the difference between reacting to a storm and seeing it on the radar long before it arrives.

Insuring the "Uninsurable" Through AI and Data

This advanced capability is especially critical in markets dealing with growing risks from climate change. In areas prone to wildfires, floods, or hurricanes, traditional insurance models are starting to fail, often forcing insurers to pull out of entire regions. AI-powered BI offers a way back in, making it possible to underwrite these complex risks intelligently and sustainably.

We're already seeing this happen in California, where new companies are using AI to offer home insurance in wildfire-prone areas. For instance, the San Francisco startup Stand Insurance raised $35 million to grow its AI-driven model that uses remote sensing and detailed homeowner data to assess risk. Their AI simulates environmental stressors to create personalized risk mitigation plans, rewarding homeowners who take proactive steps with better coverage options. You can read more about how AI-powered insurance is expanding in risky markets.

This is a perfect example of how technology can create viable insurance markets where they were struggling to exist.

The New Underwriting Workflow

When you bring AI and BI together, you create a new, smarter underwriting workflow. It’s a continuous cycle of collecting data, analysing it, making predictions, and taking action, which allows the system to constantly learn and improve.

Data Ingestion: A steady stream of diverse data flows in, from IoT sensors and satellite feeds to telematics data and information provided by the customer.

AI-Powered Analysis: Machine learning algorithms sift through this mountain of data to spot hidden patterns, connections, and emerging risk factors that a human might miss.

Predictive Modelling: The system then generates predictive models that forecast the likelihood and potential severity of future claims for a specific policy.

BI Visualisation: Finally, all these complex insights are translated into clear, interactive dashboards that underwriters can use to make fast, well-informed decisions on pricing and coverage.

This shift from static analysis to dynamic forecasting isn’t just a small step forward; it’s a fundamental change in how insurers approach risk. By blending the deep analytical power of AI with the clear, actionable insights of BI, the insurance industry is building a more resilient and adaptive future. For anyone interested in the broader impact of this technology, our article on generative AI in the insurance industry offers some excellent additional context.

Your BI Implementation Roadmap

Getting started with a business intelligence project can feel a bit like planning a major expedition. You know where you want to go, a smarter, more efficient, data-driven organisation, but you need a reliable map to get there. A successful business intelligence in insurance project isn’t a single, massive leap; it's a series of well-planned, manageable phases that build on each other and deliver value along the way.

This roadmap breaks that journey down into a practical, step-by-step guide. It's designed to help you navigate from the initial concept all the way to a full-scale rollout, ensuring your BI initiative is built on a solid foundation right from the start.

Phase 1: Define Your Business Goals

Before you even glance at a piece of technology, you have to answer a simple question: "What problem are we actually trying to solve?" A BI project without a clear business objective is like a ship without a rudder. It might have the best engine in the world, but it’s just going to drift.

Start by zeroing in on a specific, high-impact area. Are you aiming to cut claims processing time by 15%? Or maybe improve underwriting accuracy for a new product line? Perhaps the goal is to boost customer retention by spotting at-risk policyholders sooner.

Nailing down these goals is absolutely critical because it:

Ensures Alignment: It gets everyone, from the executive suite to the frontline users, on the same page and pulling in the same direction.

Measures Success: It gives you concrete key performance indicators (KPIs) to track, making it easy to show the ROI down the road.

Focuses Resources: It stops the project from becoming a sprawling, unfocused attempt to "do something with data."

Phase 2: Establish Strong Data Governance

Your BI system is only as good as the data you put into it. Period. Without a strong data governance framework, you run the risk of building your entire strategy on a shaky foundation of inconsistent, inaccurate, or insecure information. This phase is all about setting the rules of the road for your data.

Think of data governance as the quality control department for your information. It involves creating clear policies and procedures for how data is collected, stored, cleaned, and accessed across the organisation. A huge piece of this is making sure robust data protection measures are in place. For a deeper look into this vital area, you can explore our detailed guide on cybersecurity in the insurance industry.

A successful BI implementation is built on trust. If your team doesn't trust the data, they won't trust the insights, and the whole initiative will fail before it even gets off the ground. Data governance is how you build that trust.

Phase 3: Choose the Right Tools

With your goals defined and a data governance plan taking shape, it's time to pick the technology that will bring your vision to life. The market is packed with powerful BI tools like Tableau, Microsoft Power BI, and Qlik, and each has its own strengths.

The trick is to choose a platform that not only checks your technical boxes but also fits your team’s skills and your company’s budget. You need to consider things like ease of use for non-technical staff, whether it can scale with you as you grow, and how well it plays with the systems you already have.

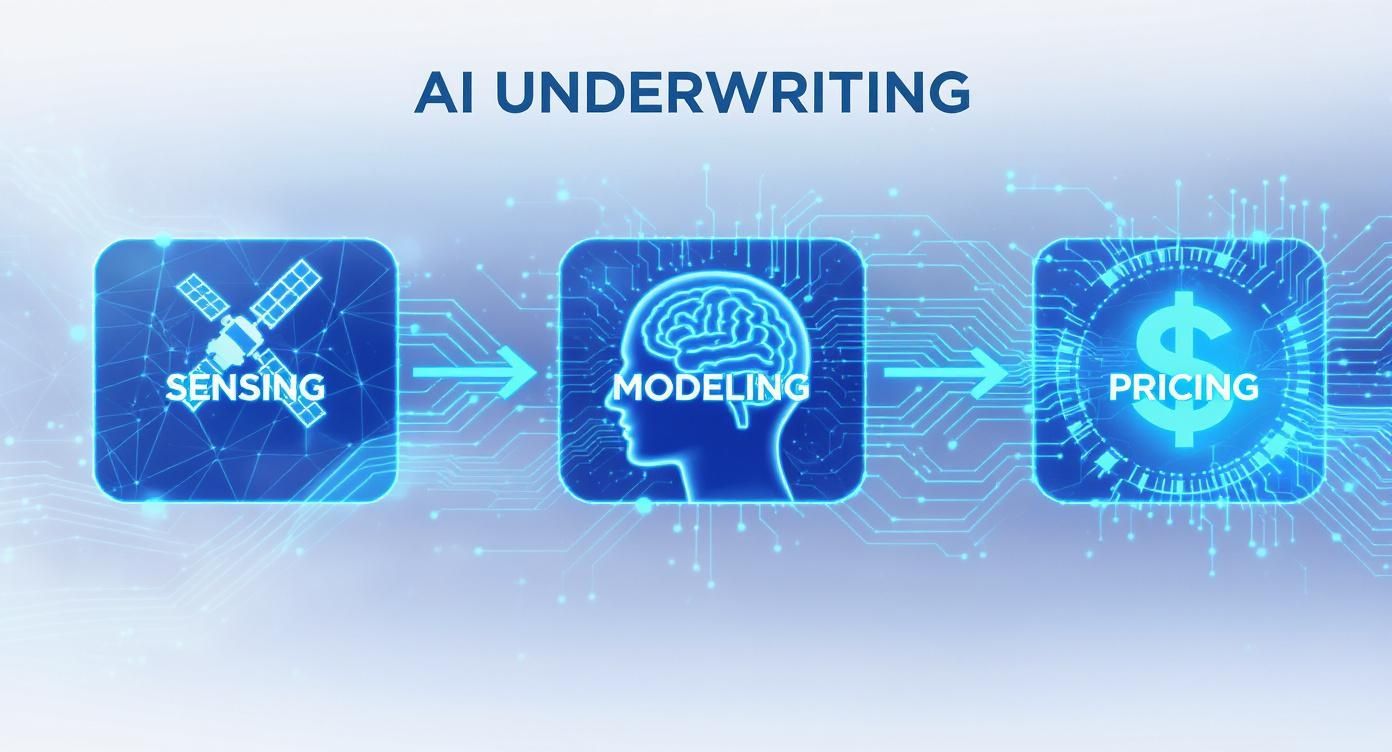

This entire process, from gathering data to modelling it and setting a price, is the engine of modern underwriting.

As the visual shows, a successful system captures raw information, uses intelligent models to understand risk, and ultimately produces a precise, data-backed price.

Phase 4: Launch a Pilot Project

Trying to boil the ocean is a classic recipe for failure. Instead of attempting a massive, company-wide rollout all at once, start with a focused pilot project. This approach lets you test your strategy on a smaller scale, work out the kinks, and show real value fast.

Pick a pilot that lines up with the business goals you defined back in phase one. For instance, you could build a dashboard for a single claims team to help them track their key metrics in real time.

A successful pilot project accomplishes several crucial things:

Proves the Concept: It provides a real-world example of how BI can solve a specific business problem.

Builds Momentum: A quick win generates excitement and helps get stakeholders on board for a bigger rollout.

Creates Champions: The team involved in the pilot becomes your internal advocates, helping to drive adoption across the rest of the company.

To help visualize this journey, here’s a quick summary of the key stages.

Key Stages of a BI Implementation Project

| Phase | Key Activities | Critical Success Factor |

|---|---|---|

| 1. Discovery & Strategy | Define business goals, identify pain points, and secure executive sponsorship. | A clear, measurable business objective. |

| 2. Data Governance | Establish data quality standards, access policies, and security protocols. | Widespread trust in the data's accuracy and integrity. |

| 3. Technology Selection | Evaluate and choose BI tools that align with technical needs and user skills. | Selecting a tool that users will actually adopt. |

| 4. Pilot Program | Launch a small-scale project to test the concept and demonstrate early value. | A tangible "quick win" that builds momentum. |

| 5. Full Rollout & Training | Scale the solution across the organisation and provide comprehensive user training. | Strong user adoption and change management. |

| 6. Ongoing Optimisation | Monitor KPIs, gather user feedback, and continuously refine dashboards and reports. | Treating BI as an evolving program, not a one-time project. |

By following this phased roadmap, you can de-risk your implementation and set your business intelligence initiative up for long-term, sustainable success.

Frequently Asked Questions

When it comes to bringing business intelligence into an insurance company, a lot of practical questions come up. Where do you even begin? What kind of results can you actually expect? And how is this really different from the reports we already get? Let's clear up some of the most common questions and give you straightforward answers.

Think of this as a quick guide to cut through the noise and get to the heart of what makes BI work in the real world of insurance.

What Is the First Step to Starting a BI Project in an Insurance Company?

Before you even think about technology, you have to start with a real business problem. What’s the one thing you’re trying to fix or improve? Maybe you want to slash claims processing times, get a better handle on underwriting accuracy for a specialty product line, or figure out why customers are leaving.

Pick one high-impact goal and focus on it. This clarity is everything. A targeted pilot project built around that single objective is the best way to demonstrate real value fast, prove the concept works, and get everyone on board for the bigger picture.

How Is Business Intelligence Different from Standard Reporting?

Standard reporting is like looking in your car's rearview mirror. It’s essential for seeing what’s behind you, like last quarter’s sales numbers or the total claims filed. It gives you a static picture of what’s already happened.

Business intelligence, on the other hand, is like having a state-of-the-art GPS with live traffic data. It doesn't just show you where you've been; it helps you understand why you hit that traffic jam and what the best route forward is.

BI is all about interactive dashboards, visual data exploration, and analytics that let you dig deep into the numbers. It allows you to spot trends as they emerge and find insights you can actually act on. It turns data from a historical record into a live tool for steering your business.

What Are the Most Important KPIs to Track on an Insurance BI Dashboard?

There’s no magic list of KPIs that works for everyone. The most important metrics depend entirely on which part of the business you're looking at. A great BI system lets you build dashboards tailored to each team, focusing on the numbers that drive their specific goals.

Here’s how that might look in practice:

For Underwriting: It's all about profitability and risk management. You’d be watching the loss ratio, combined ratio, and policy renewal rate like a hawk.

For Claims: The name of the game is efficiency and accuracy. Key metrics here are things like average claim settlement time, claim frequency, and the fraud detection rate.

For Sales & Marketing: Here, you’re focused on growth and customer value. The go-to KPIs would be customer acquisition cost (CAC), customer lifetime value (CLV), and the policyholder retention rate.

Ready to turn your data into a strategic asset? Cleffex Digital Ltd builds custom business intelligence solutions that provide the clarity and insight your insurance business needs to thrive. Discover how our innovative technology can solve your biggest challenges.