At its core, machine learning in the insurance industry is about using smart algorithms to learn from your data. These systems sift through vast amounts of information to automate and sharpen key operations like underwriting, claims processing, and spotting fraud. Instead of just leaning on old-school actuarial tables and gut feelings, insurers can now use predictive models to make decisions that are faster, more accurate, and ultimately, more profitable. It’s a fundamental shift in how risk is managed.

Unlocking Your Competitive Edge with Machine Learning

Picture an underwriter who instantly holds the insights from every policy your company has ever written. Or a claims adjuster who can flag a fraudulent pattern that’s completely invisible to the human eye. This isn’t science fiction; it’s the practical power of machine learning (ML) in insurance today. It's not just a buzzword; it’s a real tool for growth.

The insurance business has always run on data. What’s different now is that ML gives us the engine to analyse that data at a scale and speed we couldn’t have imagined even a decade ago. It lets our systems learn from experience, find hidden connections, and get better and better at predicting what’s coming next.

Moving Beyond Traditional Methods

For years, insurance models have relied on broad, static buckets. A driver’s premium was based on their age, postcode, and car model – that's about it. Machine learning blows that out of the water by pulling in thousands of dynamic data points, from real-time driving habits collected via telematics to the tiny details in a person’s claims history. The result is a far more precise and individual risk profile.

Here’s an analogy: a traditional underwriter works with a map showing only the major cities. An ML-powered underwriter is using a high-resolution satellite image that shows every single road, building, and tree. Both can get you where you’re going, but one gives a much richer, more accurate picture of the terrain.

The real magic of machine learning is its power to transform historical data into predictive intelligence. It lets insurers get ahead of risk instead of just reacting to it.

This move from a reactive to a predictive stance is where the true competitive advantage lies. We're seeing this across the financial world, where the AI banking revolution and machine learning's transformation of finance is creating clear winners and losers.

Why This Matters for Your Business

In a crowded market, sticking to the old ways of doing things is a recipe for being left behind. Machine learning isn't some far-off concept anymore; it's a critical tool for any modern insurer that wants to do more than just survive. It lets you:

Improve Accuracy: Price your policies more fairly and profitably because you understand risk at a granular, individual level.

Boost Efficiency: Automate the repetitive, time-consuming tasks in claims and underwriting. This frees up your best people to focus on the complex cases that really need their expertise.

Enhance Customer Experience: Personalise every interaction and provide faster service, from the initial quote right through to a claim settlement.

By adopting this technology, your business gains a serious advantage. You’ll be building a more resilient, responsive, and data-driven operation that’s truly ready for what's next.

How Machine Learning Is Changing the Game in Insurance

When you peel back the layers, you can see how machine learning is making a real difference in the day-to-day grind of the insurance world. This isn't just about theory; it's where sophisticated algorithms get their hands dirty, solving practical problems and delivering tangible value. We're not just talking about tweaking old processes – ML is fundamentally rewriting the playbook for how insurers evaluate risk, manage claims, and connect with their customers.

By crunching thousands of data points in the blink of an eye, machine learning models bring a level of precision to the table that was simply out of reach before. This leads to operations that are more dynamic, fair, and ultimately, more profitable. From the moment a potential customer asks for a quote to the final cheque being cut for a claim, ML is working in the background, making the entire process smarter and more efficient.

More Accurate Underwriting and Pricing

Underwriting has traditionally been a game of averages, relying on broad demographic buckets and historical loss data to set premiums. Machine learning flips this on its head by enabling hyper-granular risk assessment. Instead of just looking at someone's age and postcode, an algorithm can sift through a massive variety of data, such as telematics from a car, satellite images of a property, or even public social sentiment, to build a risk profile that’s unique to the individual.

This deeper insight allows for pricing that’s not only fairer to the customer but also better for the insurer's bottom line. A genuinely safe driver can be rewarded with a lower premium based on their actual on-the-road behaviour, not just the statistics for their age group. This data-driven precision helps avoid underpricing risky policies or overpricing safe ones, which has a direct, positive impact on the loss ratio.

Smarter Fraud Detection

Insurance fraud is a massive, multi-billion-pound headache that ultimately drives up premiums for everyone. While a seasoned human adjuster is great at spotting obvious red flags, sophisticated fraud rings often use subtle, interconnected schemes that are almost invisible to the naked eye. This is where machine learning truly shines.

ML models are trained on vast oceans of historical claims data, learning to recognise the faint, complex patterns that often point to fraudulent activity. They can flag suspicious claims in real-time by picking up on anomalies like:

Network Links: Uncovering hidden webs of connections between claimants, auto body shops, and medical providers that span multiple claims.

Behavioural Patterns: Noticing unusual claim frequencies or odd timings that don't fit normal, expected behaviour.

Inconsistent Details: Cross-referencing every piece of information from documents, photos, and reports to catch conflicting details that a person might easily miss.

By automatically pushing these high-risk cases to the front of the queue, machine learning lets fraud investigation teams concentrate their expertise where it matters most. For a closer look at the nuts and bolts of this, this guide on machine learning fraud detection is a great resource.

Automating the Claims Journey

For any customer, the claims process is the moment of truth. It's often the most critical interaction they'll have with their insurer, but historically, it's also been slow, frustrating, and bogged down by manual work. Machine learning is stepping in to automate and accelerate huge chunks of this journey, from the first notice of loss right through to the final payment.

Take a car accident, for example. Computer vision models can now analyse photos of a damaged vehicle, instantly assess the extent of the damage, and generate a repair estimate. A task that used to take days of back-and-forth can now be handled in minutes. In the same way, Natural Language Processing (NLP) models can read and make sense of medical reports, police statements, and invoices, pulling out the crucial information needed to process a claim with little to no human input.

This automation doesn't just make for faster, happier settlements; it also dramatically cuts down on administrative costs.

To illustrate how these applications translate into direct business results, let's look at their impact across core insurance functions.

Machine Learning Impact Across Insurance Functions

This table summarises how machine learning is being applied to different areas of the insurance business and the primary benefits it delivers.

| Insurance Function | ML Application | Primary Business Benefit |

|---|---|---|

| Underwriting & Pricing | Hyper-granular risk profiling using diverse data sources. | Improved loss ratios and fairer, more competitive pricing. |

| Fraud Detection | Real-time anomaly and network link analysis on claims data. | Reduced financial losses from fraud and more efficient investigations. |

| Claims Processing | AI-driven damage assessment and document analysis (NLP). | Faster settlement times, lower operational costs, and better customer experience. |

| Customer Engagement | Predictive modelling for churn risk and personalised product recommendations. | Increased customer retention, loyalty, and higher lifetime value. |

As you can see, the benefits are clear and measurable, touching nearly every aspect of the insurance value chain.

Personalising the Customer Experience

In today's crowded market, customer loyalty is everything. Machine learning gives insurers the tools to move beyond the old "one-size-fits-all" mentality and create genuinely personalised experiences that build strong, lasting relationships.

By understanding individual customer needs and behaviours, machine learning allows insurers to become proactive advisors rather than just reactive service providers.

Algorithms analyse customer data to anticipate future needs, spot early warning signs of potential churn, and suggest the right products or services at the perfect time. For instance, an ML model could identify a policyholder who just had a child and proactively recommend an update to their life insurance coverage.

This personalised touch can be woven into every interaction. AI-powered chatbots can offer instant, 24/7 support for common questions, while self-service portals can provide customers with dashboards and recommendations tailored just for them. By making every touchpoint feel relevant and valuable, insurers can significantly boost customer satisfaction and keep them for the long haul. To dig deeper into how these models work, you might want to check out our guide on predictive analytics in Canadian insurance operations.

Your Blueprint for Implementing Machine Learning

So, where do you start? Bringing machine learning into your insurance operations isn't about flipping a switch overnight. It’s a methodical journey, and it all begins with the single most valuable asset you have: your data. Without a solid foundation of high-quality data, even the most sophisticated algorithm is completely useless.

Think of it this way: your data is the fuel for your ML engine. This includes everything from policyholder details and claims histories to customer service logs, and even external sources like weather reports or telematics from vehicles. Getting this part right is the absolute first, and most critical, step.

Getting Your Data Ready for Prime Time

Before any model can start spotting patterns or making predictions, your data needs a serious cleanup. In its raw form, data is often messy, inconsistent, and full of gaps. This initial, crucial process of cleaning and organising it is what we call data preparation or pre-processing.

This isn't a single step, but a series of vital tasks:

Data Cleansing: This is where we hunt down and fix inaccuracies, fill in missing information, and weed out duplicate records. The goal is to make sure your data is trustworthy.

Data Structuring: A lot of valuable information lives in unstructured formats, like an adjuster's handwritten notes or a customer's email. This step involves translating that into a structured format that a machine can actually read and analyse.

Feature Engineering: This is part art, part science. It’s about choosing and transforming the most important variables, or "features", that will help the model make accurate predictions. For example, simply turning a customer's birthdate into an 'age' field can make a world of difference.

High-quality, well-prepared data is the bedrock of any effective machine learning model. Investing time and resources here will pay significant dividends, leading to more accurate predictions and more reliable business insights.

I can't stress this enough: this stage often takes the most time in any ML project. Trying to cut corners here is a surefire way to get poor results.

Choosing the Right Tools for the Job

Once your data is in great shape, it’s time to pick the right machine learning model. Think of models as different tools in a toolbox, each one designed for a specific job. You wouldn't use a sledgehammer to drive a nail, and the same principle applies here.

Let's break down a few of the most common models used in insurance:

Regression Models: These are your go-to predictors. They're perfect for calculating a policy premium or forecasting the likely cost of a claim. They work by spotting the mathematical relationship between different variables to predict a numerical outcome.

Classification Models: When you need to put something into a category, these are the models you reach for. They answer "yes/no" or "which one?" questions, which makes them perfect for fraud detection (is this claim fraudulent or not?) or identifying customers who are at high risk of leaving.

Clustering Models: These algorithms are fantastic for discovery. They group similar data points together on their own, helping you find hidden customer segments you never knew existed or identify emerging types of risk.

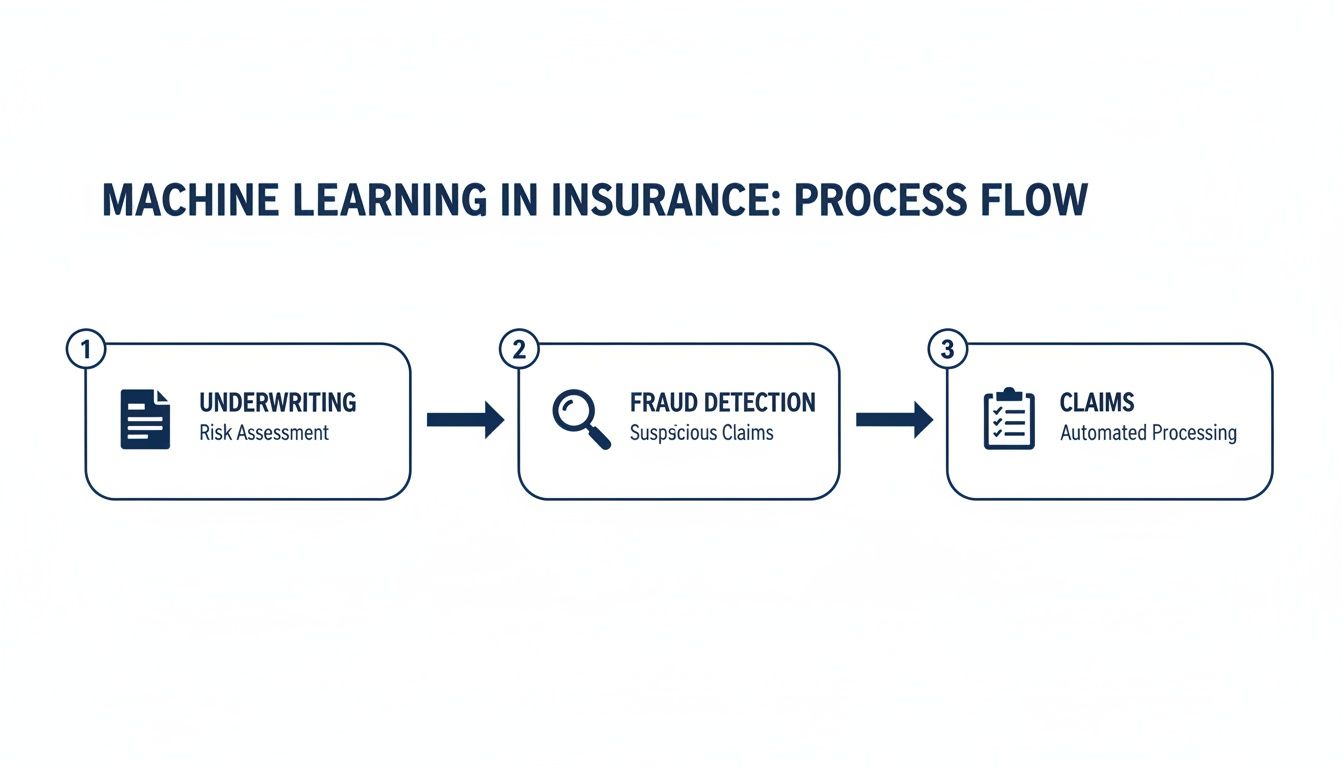

This flow chart gives a great visual of how these models fit into the core functions of an insurance business.

As you can see, machine learning weaves a thread through underwriting, fraud detection, and claims, creating a much smarter and more connected operation.

Start Small, Prove the Concept

The thought of a full-blown ML implementation can feel overwhelming, but you don’t have to do everything at once. The smartest way forward is to begin with a small, manageable pilot project. This lets you test the technology, prove its value, and build some internal excitement without making a massive, risky investment right out of the gate.

A good pilot project should tackle a specific, high-impact problem where you can get a clear win. For instance, you could build a simple model to flag potentially fraudulent claims for just one of your main policy types. The goal here is to show a tangible return on investment and learn lessons that will help you tackle bigger projects down the road.

Machine learning adoption is picking up speed in the Canadian insurance market, with some firms seeing predictive modelling improve their underwriting accuracy by as much as 30-40%. For smaller insurers, automated underwriting tools are a game-changer, slashing manual errors and accelerating the launch of new digital products. As you map out your own plan, our guide on AI insurance software development in Canada offers a deeper local context.

Navigating Ethical and Regulatory Challenges

Bringing a powerful tool like machine learning into a heavily regulated field like insurance isn't just a technical challenge; it's a massive responsibility. While the models can be incredibly accurate and efficient, they also open a can of worms filled with ethical and compliance issues. At the end of the day, insurance is built on trust. That trust can evaporate in an instant if customers suspect the decisions impacting their lives are unfair, arbitrary, or impossible to understand.

This is why just plugging in a high-performing algorithm and calling it a day isn't an option. Insurers have to build a solid framework around their ML systems that puts fairness, transparency, and accountability first. Getting this right isn't just about dodging fines; it’s fundamental to keeping customers and protecting your brand.

The Problem with "Black Box" Models

Many of the most effective machine learning models can feel like a "black box". You feed data in one end, a decision pops out the other, but the logic connecting the two is so complex that even the data scientists who built it can't fully explain it. In insurance, that’s a huge problem.

Think about it: if a customer is denied a policy or quoted a shockingly high premium, they have a right to know why. Regulators demand the same thing. If your answer is "the computer said so," you're facing serious legal and reputational blowback.

An insurer must be able to explain and justify every decision an algorithm makes, especially when it adversely affects a customer. Transparency is not an optional extra; it is a core requirement for building an ethical AI framework.

To get around this, the industry is leaning heavily into Explainable AI (XAI). These are techniques and types of models built specifically to make their decisions understandable to humans. So instead of just seeing a final risk score, an underwriter can see exactly which factors, like recent driving habits or a home's specific flood risk features, pushed the score up or down.

Tackling Algorithmic Bias and Ensuring Fairness

One of the biggest ethical minefields with machine learning in the insurance industry is algorithmic bias. An ML model is only as smart as the data it learns from. If your historical data reflects old, baked-in societal biases (perhaps in how claims were approved or who was considered "high-risk" decades ago), the model will learn those same unfair patterns and run with them.

This can lead to some seriously discriminatory outcomes, where certain groups get hit with higher premiums or denied coverage unfairly. And it can happen even if you’ve carefully removed sensitive data like race or gender. The model is smart enough to find proxies, like postcodes or job titles, and continue the biased pattern.

To fight this, insurers need to be proactive.

Audit your data thoroughly to find and root out potential biases before you even start training a model.

Implement fairness testing as a regular part of your process. This means constantly checking to make sure the model's outputs aren't disproportionately hurting any protected group.

Keep humans in the loop. An expert should always have the ability to review and, if needed, override an algorithm's decision, especially in tricky or sensitive situations.

Fairness isn't a one-and-done task; it requires constant vigilance.

Staying Compliant with Data Protection Regulations

Insurers are custodians of a massive amount of personal, sensitive information. This makes compliance with data protection laws like PIPEDA in Canada or the EU's GDPR completely non-negotiable. These regulations put strict rules on how personal data can be gathered, processed, and used in automated decision-making. Developing a strategy for AI and data privacy in insurance isn't just good practice; it's a legal necessity.

This means every machine learning project has to be designed with a "privacy-first" mindset. You need crystal-clear data governance policies, rock-solid security for handling data, and clear pathways for customers to exercise their rights, like accessing or deleting their information. The penalties for getting this wrong aren’t just financial; they can cause a catastrophic loss of public trust.

Measuring Success and Choosing the Right Partner

Bringing machine learning into your insurance business is a major strategic move, not just a tech upgrade. So, how do you know if it's actually working? Beyond the initial buzz, you need to measure the real, tangible impact on your bottom line. It all starts with defining what success looks like and then tracking the right numbers.

This is about connecting the dots between a powerful new technology and concrete business results. It’s not enough to build a model with high predictive accuracy. The real test is whether that accuracy helps drive down costs, increase revenue, or make your customers happier. Without that link, even the most sophisticated algorithm is just a very expensive science project.

Defining Your Key Performance Indicators

Before you can even think about calculating your return on investment (ROI), you have to set clear, measurable Key Performance Indicators (KPIs). These need to be tied directly to the business problem you’re trying to solve. If your goals are fuzzy, your results will be too.

Think about it in practical terms across different parts of the business:

Claims Processing: The big ones here are average claim settlement time and cost per claim. A successful ML project should make both of those numbers drop.

Underwriting: Keep a close eye on your loss ratio. Better, data-informed underwriting should directly lead to a more profitable book of business.

Fraud Detection: You'll want to track the percentage of fraudulent claims identified before they're paid out, but also the reduction in false positives. This is key to catching more fraud without flagging and frustrating legitimate customers.

Customer Engagement: Look at metrics like your customer retention rate and Net Promoter Score (NPS). ML-powered personalisation should translate into more loyal and satisfied policyholders.

The real measure of any machine learning project is its power to move the needle on core business metrics. Tracking these KPIs gives you the hard evidence needed to justify the investment and expand your efforts.

By zeroing in on these kinds of outcomes, you get a crystal-clear picture of your ROI. A project that delivers a 15% reduction in claims processing costs or a 10-point improvement in your loss ratio speaks for itself and builds the business case for what’s next.

Finding the Right Technology Partner

Let's be realistic – most insurers don't have a fully-fledged data science team waiting in the wings. For many, the first steps into machine learning happen with an external partner. Picking the right one is probably the single most critical decision you'll make, as it sets the tone for the entire initiative. This isn't just about hiring a coder; it's about finding a strategic ally who gets your world.

Your partner needs to do more than just write good code. They have to speak the language of insurance and understand the complex web of regulations and ethical considerations you navigate every day. The best partners feel like an extension of your own team, guiding you from the initial idea all the way through to a live, working solution and beyond.

To help you sort through the options, we’ve put together a checklist of what to look for when choosing a technology partner for your ML project.

Vendor Selection Checklist for ML Development

This table breaks down the key criteria for vetting potential partners and explains why each one is so important for a project's success.

| Evaluation Criteria | What to Look For | Why It Matters |

|---|---|---|

| Proven Industry Experience | A portfolio of successful projects and case studies specifically within the insurance sector. | Insurance is a unique, highly regulated field. A partner with industry experience will understand your specific pain points and compliance needs without a steep learning curve. |

| Deep Technical Expertise | A skilled team with expertise in data science, machine learning engineering, and cloud infrastructure. | Building and deploying a robust ML model requires a diverse skill set. You need a partner who can handle the entire lifecycle, from data preparation to deploying a scalable solution. |

| Focus on Custom Solutions | A commitment to building a solution tailored to your specific business needs, not a one-size-fits-all product. | Your data and business challenges are unique. A custom solution ensures the model is optimised to solve your specific problems and deliver the maximum possible impact. |

| Collaborative Approach | A willingness to work closely with your internal teams, share knowledge, and act as a true strategic advisor. | A successful ML implementation requires buy-in across the business. A collaborative partner ensures your team is engaged and empowered throughout the process. |

At the end of the day, the right partner doesn't just hand you a piece of software. They empower your entire organisation to become more data-driven, helping you build internal skills and setting you up for long-term success with machine learning.

Where Do You Go From Here?

Getting started with machine learning in insurance isn't about throwing out decades of human expertise; it's about giving your best people superpowers. What was once a far-off idea is now a practical set of tools ready for any insurer looking to build a sharper, more customer-focused business. The payoff is real, impacting everything from back-office efficiency to the kind of customer experiences that build lasting loyalty.

This is your chance to turn your mountains of data from a storage problem into your biggest competitive advantage. But the path forward isn’t some massive, all-or-nothing leap. It starts with one smart, focused step.

Find a single, high-impact area in your business, perhaps it’s a bottleneck in your claims process or a segment where your underwriting could be more precise, and launch a small pilot project.

Think of machine learning as the next evolution in building a smarter, more resilient insurance business – one that’s ready for whatever comes next.

That first project is your learning ground. It’s where you prove the value and build momentum. By starting small and scaling what works, you put your organisation on a path to not just keep up, but to lead the way in a world that runs on data.

Frequently Asked Questions

Jumping into machine learning can feel like a massive undertaking, and it's natural for insurance leaders to have some big questions. Let's walk through a few of the most common ones I hear, with some straight answers to help you map out your next steps.

We'll cover everything from the practicalities of getting started to how this shift impacts your team, giving you a realistic picture of the road ahead.

How Much Data Do We Really Need to Get Started?

There's a persistent myth that you need a colossal, perfectly polished dataset before you can even think about ML. The truth is, you can often kick off a pilot project using the data you already have right now – a few years of historical claims or policy records can be a great starting point.

The trick is to start with a very specific, well-defined problem. For a focused pilot, a more modest dataset is usually enough to train a first model and prove the concept has legs. Honestly, the process of building that first model is one of the best ways to pinpoint exactly where your data gaps are, which helps you build a smarter data strategy for the long run.

The goal of a first project isn't just to build a perfect model; it's to learn. Starting with what you have is infinitely more valuable than waiting for a perfect dataset that may never show up.

This approach lets you prove the concept works and get the buy-in you need for bigger data collection and cleansing projects down the line. It's about getting on the field and playing, not waiting forever on the sidelines.

Will Machine Learning Replace Our Human Experts?

This is probably the most common and most important question I get. The reality is much more about collaboration than replacement. Think of machine learning in insurance as a powerful tool that augments, not replaces, your experienced professionals. It’s designed to take on the repetitive, data-intensive work that people find draining and time-consuming.

It’s like giving your underwriters and claims adjusters a superpower. By automating the routine analysis and flagging anomalies that need a closer look, ML models free up your team to apply their expertise to the most complex, nuanced, and high-value cases. Your people provide the critical thinking, ethical judgment, and customer empathy that no algorithm can ever truly replicate.

What’s a Realistic Timeframe for a First Project?

The timeline for a first ML project really depends on its scope and the state of your data. That said, a tightly defined pilot project, designed to prove a specific point, can typically go from an idea to a working prototype in about three to six months.

What does that initial phase look like?

Discovery and Planning: Nailing down the business problem and identifying the data sources you'll need.

Data Preparation: The often unglamorous but critical work of cleaning and structuring the data for the model.

Model Development and Training: Building and testing the first version of the algorithm.

Validation: Checking the model’s performance against real business outcomes to see if it’s actually working.

Taking this phased approach means you can score a tangible win relatively quickly. That builds momentum and gives you invaluable insights to guide the bigger, more ambitious projects that will follow.

Ready to see how machine learning can give your insurance business a genuine competitive edge? Cleffex Digital Ltd specialises in building custom software that solves your unique challenges. Start your journey with us today.