Imagine having an expert team working around the clock, 24/7, to analyse risks, process claims, and answer customer questions in an instant. That’s the powerful reality of insurance automation using AI. It’s a shift that gives human teams intelligent tools to work faster and more accurately. This isn't about replacing people; it's about augmenting their abilities.

The New Reality of Insurance Automation Using AI

The insurance industry is at a major crossroads. The old ways of doing things, slow, paper-heavy workflows, are giving way to a more dynamic, data-driven model. This change is being pushed by two key forces: customers who now expect instant, digital-first service, and a pressing need for insurers to become more efficient to keep costs down and manage complexity.

Insurance automation using AI tackles these challenges head-on. It’s all about using smart systems to handle the repetitive, data-heavy tasks that once consumed the time of adjusters, underwriters, and service agents. This frees up your skilled professionals to focus on the complex, high-value work that demands empathy, critical thinking, and strategic judgment.

To get a solid grasp of the core concepts, it's helpful to understand what Intelligent Automation is and how different technologies come together to create smarter business processes.

Why This Shift Is Happening Now

The move toward AI-driven processes is picking up speed, but adoption isn't happening overnight. While many Canadian insurers are moving past the pilot stage, truly large-scale implementation is still a work in progress.

In fact, a recent analysis found that just 7% of insurance companies globally have successfully scaled their AI systems. Most are still experimenting with early use cases like claims automation.

This steady, if cautious, adoption is paving the way for a more responsive, intelligent, and ultimately more profitable insurance landscape. It’s a fundamental change from old-school manual work to smart, automated workflows.

The table below gives you a clear picture of just how different these two approaches are.

How AI Transforms Traditional Insurance Processes

This table breaks down the operational differences between the old manual methods and the new AI-powered approach across key insurance functions.

| Insurance Function | Traditional Manual Process | AI-Automated Intelligent Process |

|---|---|---|

| Claims Processing | Manual data entry, physical document review, and subjective damage assessment. Often slow and prone to human error. | Automated data extraction from photos and documents (FNOL), AI-driven damage assessment, and instant validation against policy rules. |

| Underwriting | Relies on historical data, static pricing models, and extensive manual review of applicant forms. | Dynamic, real-time risk assessment using vast datasets (telematics, IoT), predictive analytics for pricing, and automated policy issuance for standard risks. |

| Fraud Detection | Depends on experienced adjusters spotting red flags and manual investigation of suspicious claims. Often reactive. | Proactive fraud detection using machine learning algorithms to analyse claim patterns, network links, and behavioural data in real-time. |

| Customer Service | Call centres with long wait times, limited-hour support, and generic responses based on scripts. | 24/7 AI-powered chatbots for instant query resolution, personalised communication, and seamless hand-offs to human agents for complex issues. |

As you can see, the impact is significant. AI doesn't just speed things up; it introduces a new level of intelligence and precision to every step.

By automating routine functions, insurers can reallocate their most valuable resource, their people, to areas that truly define their competitive edge: building customer relationships and solving complex problems.

This strategic shift sets the stage for the specific applications we’ll dig into next, looking at how AI is fundamentally changing claims, underwriting, and fraud detection.

Core Applications Driving the Insurance Lifecycle

The theory behind insurance automation using AI is great, but where the rubber really meets the road is in its practical, day-to-day applications. This isn't some far-off concept; AI is already embedded across the insurance lifecycle, making processes faster, smarter, and far more efficient.

These aren't just minor tweaks to old systems. We're talking about fundamental upgrades to core operations. AI helps tackle those long-standing industry headaches, from painfully slow claims resolutions to imprecise risk assessments, by turning mountains of data into clear, actionable intelligence.

Let’s dig into the four main areas where AI is making the biggest waves today: claims, underwriting, fraud detection, and customer service.

Revolutionising Claims Processing with AI

For most customers, the claims process has always been the most frustrating part of insurance. It was a world of endless paperwork, long waits, and manual hand-offs that were magnets for errors and delays.

AI flips that script completely.

Picture this: a customer gets into a minor car accident. Instead of filling out a stack of forms, they just upload a few photos of the damage from their phone. In seconds, an AI model using computer vision analyses the images, assesses the damage, and estimates the repair costs with surprising accuracy.

This first step, known as First Notice of Loss (FNOL), is now incredibly fast. The AI can pull key data from the photos and the customer’s report, check it against the policy, and get the claim started automatically. If you want to dive deeper, we have a great guide on AI in insurance claims processing explained.

This shift brings huge benefits:

Faster Turnaround: Simple claims can be approved and paid in hours, not weeks. That's a massive win for customer satisfaction.

Better Accuracy: AI algorithms are consistent and objective, cutting down on the human errors that creep into manual data entry and subjective assessments.

Lower Operating Costs: By automating the routine stuff, claims adjusters are freed up to handle the complex, sensitive cases that genuinely need a human touch.

Sharpening the Edge in Underwriting

Underwriting has always been a blend of art and science, focused on weighing risk. But historically, it was done with a pretty limited set of data points – age, location, past claims. This often meant lumping people into broad categories that didn't really reflect their unique risk profile.

AI-powered underwriting changes the game by using a much richer, more dynamic stream of information. Machine learning models can analyse thousands of variables at once, from vehicle telematics and property IoT sensor data to even satellite imagery for assessing environmental risks.

This allows for incredibly precise and granular risk pricing. Instead of being put in a generic "risk bucket," a customer gets a personalised premium that truly reflects their individual level of risk. It’s not just fairer for the customer; it's also more profitable for the insurer, as it helps avoid underpricing risky policies.

Proactively Detecting and Preventing Fraud

Insurance fraud is a multi-billion-pound problem that ultimately drives up premiums for everyone. Traditionally, finding it was a reactive game of cat-and-mouse, where investigators looked for red flags after a claim was already paid.

AI provides a much more proactive defence. Machine learning models are trained on immense datasets of past claims, learning to spot the subtle and complex patterns that signal fraudulent activity.

AI can connect the dots between seemingly unrelated claims, identify organised fraud rings, and flag tiny inconsistencies in a submission that a human eye would almost certainly miss. This lets insurers step in before a fraudulent payout happens.

This move from reactive investigation to proactive prevention saves insurers a fortune and protects honest policyholders from paying for the cost of fraud.

Enhancing the Customer Service Experience

Today’s customers expect instant, 24/7 support. But staffing a call centre around the clock is expensive and often impractical. This is where AI-powered chatbots and virtual assistants have become an incredibly effective tool for improving customer interactions.

Forget the clunky, frustrating chatbots of the past. Modern intelligent assistants use Natural Language Processing (NLP) to understand what customers are asking and respond in a genuinely helpful, conversational way. They can handle a whole host of tasks on the spot.

Common AI-Driven Customer Service Tasks

Answering Policy Questions: Get immediate answers on coverage, deductibles, or payment dates.

Processing Simple Claims: Walk customers through the first steps of filing a minor claim.

Updating Account Information: Let customers change an address or phone number without waiting for an agent.

Scheduling Appointments: Set up calls with a human expert for more complex issues that need a personal touch.

The industry is clearly taking notice. A 2025 survey from Statistics Canada found that 12.2% of Canadian businesses now use AI in their operations. The finance and insurance sector showed the most significant jump in planned AI adoption, signalling a clear commitment to these kinds of automation investments. You can explore more about these AI adoption trends in Canadian business.

Understanding the Technology Behind Smart Automation

To really get a handle on insurance automation using AI, it helps to pop the bonnet and see what’s actually running the show. These aren’t just abstract ideas; they're real, practical tools working together to replicate, and often improve upon, what people do, especially for repetitive tasks.

Think of it as assembling a highly skilled digital team. Each technology has its own speciality, and when you combine them, you get a smart, cohesive system that can manage complex processes from beginning to end.

Let’s break down the key players in this tech ensemble. I’ll use some simple analogies to explain what each one brings to the table for smarter insurance operations.

The Core Components of AI Automation

The real magic happens when these different technologies are woven together. While Artificial Intelligence is the broad umbrella term, it's the specific disciplines underneath that deliver real-world results for insurers.

Here are the main technologies you'll come across:

Machine Learning (ML): This is the 'brain' of the operation. ML algorithms are designed to learn from data without needing explicit instructions for every scenario. Picture a seasoned underwriter who gets better at spotting risk with every policy they review. ML models do the same thing, but they can sift through millions of data points in seconds to predict outcomes, price risk accurately, or flag potential fraud.

Natural Language Processing (NLP): Think of NLP as the system's ability to understand language; its 'eyes and ears' for text. This is what gives software the power to read and make sense of human language in documents like claim forms, customer emails, and medical reports. It’s how a system can digest a complicated claim submission and pull out the crucial details, just like a human expert would.

Computer Vision: This is quite literally the 'sight' of the AI system. Computer Vision allows machines to interpret and process information from images and videos. For example, when a policyholder uploads a photo of a damaged car, computer vision algorithms can analyse the image to identify dents, scratches, and broken parts, then give a solid assessment of the damage.

How These Technologies Work Together

These components rarely work alone. They're typically orchestrated to create a powerful, end-to-end workflow that tackles jobs that were once entirely manual. An equally important piece of this puzzle is Robotic Process Automation (RPA).

RPA acts as the 'digital hands' of the system. While AI provides the intelligence to make decisions, RPA bots are the workers that execute the repetitive, rules-based tasks – things like copying data from one system to another, logging into applications, or sending out standard emails.

Let’s walk through a typical claims process to see how they all collaborate:

A customer submits a claim via email, attaching a written description (as a PDF) and a few photos of the damage.

NLP gets to work, reading the email and the PDF to understand the context and extract key info like the policy number, incident date, and what happened.

Simultaneously, Computer Vision analyses the photos to assess the damage, classifying it as minor or severe and providing an initial estimate for repairs.

A Machine Learning model then takes all this information and compares it against historical claims data and the customer's policy to flag any potential red flags for fraud.

Finally, RPA bots take all this neatly structured data and automatically enter it into your core claims management system, update the customer's file, and trigger an automated acknowledgement email.

This synergy turns a multi-day manual process into a swift, automated workflow that can be done in minutes. Each technology plays its part perfectly, handling the piece of the process it does best.

You can learn more about how newer advancements are further shaping the industry in our guide to generative AI in the insurance industry. By understanding these building blocks, business leaders can more clearly see where insurance automation using AI can make a real difference in their own operations.

Building Your AI Automation Implementation Roadmap

Diving into AI-driven insurance automation can feel like a massive undertaking, but it doesn't have to be. The secret isn't a "big bang" overhaul. Instead, the smart play is a methodical, phased approach that lets you prove value quickly, build internal confidence, and scale your efforts in a way that makes sense for your business.

Think of it less like building a skyscraper overnight and more like laying a solid foundation, then adding one well-planned floor at a time. This minimises risk and makes sure every new capability rests on a proven success. A solid AI strategy for finance and insurance is your blueprint for creating a plan that truly aligns with your company's goals.

The most successful rollouts follow a simple but powerful mantra: start small, prove value, then scale thoughtfully. This breaks the whole project down into digestible stages, each with its own clear wins.

Phase 1: Discovery and Strategy

First things first: you need a plan. This phase is all about pinpointing the perfect starting point. You're hunting for the "low-hanging fruit" – those processes where AI can deliver a big impact without a ton of complexity. The goal is to get a quick win on the board to build momentum for the entire initiative.

Start by mapping out your current workflows, paying close attention to high-volume areas like claims and underwriting. Look for the biggest bottlenecks, the most mind-numbing repetitive tasks, and the spots where human error tends to creep in. This analysis will shine a spotlight on the best candidates for automation.

A fantastic place to begin is often the initial claims intake process, or First Notice of Loss (FNOL). Automating the data extraction from customer emails and online forms is a self-contained project that delivers immediate efficiency gains. Plus, it makes the customer experience better right from the very first interaction.

Phase 2: Pilot and Validation

Once you’ve zeroed in on a high-potential process, it’s time to run a small-scale pilot project. This is your chance to test the technology in a controlled environment, prove its worth with real-world data, and get crucial buy-in from key people across the organisation.

A pilot isn't just a tech test; it's a business case in action. You'll be tracking specific key performance indicators (KPIs) to show a clear return on investment.

Here’s what a successful pilot phase looks like:

Define Clear Success Metrics: Before you start, decide what a "win" looks like. Maybe it's reducing claim intake time by 50% or slashing manual data entry errors by 90%. Be specific.

Select a Small, Focused Scope: Don't try to automate an entire department at once. Focus only on the workflow you identified in Phase 1, like processing FNOL emails for a single product line.

Gather Feedback and Iterate: Get the end-users, your claims handlers or underwriters, involved from day one. Their on-the-ground feedback is pure gold for refining the solution and making sure it actually helps them do their jobs better.

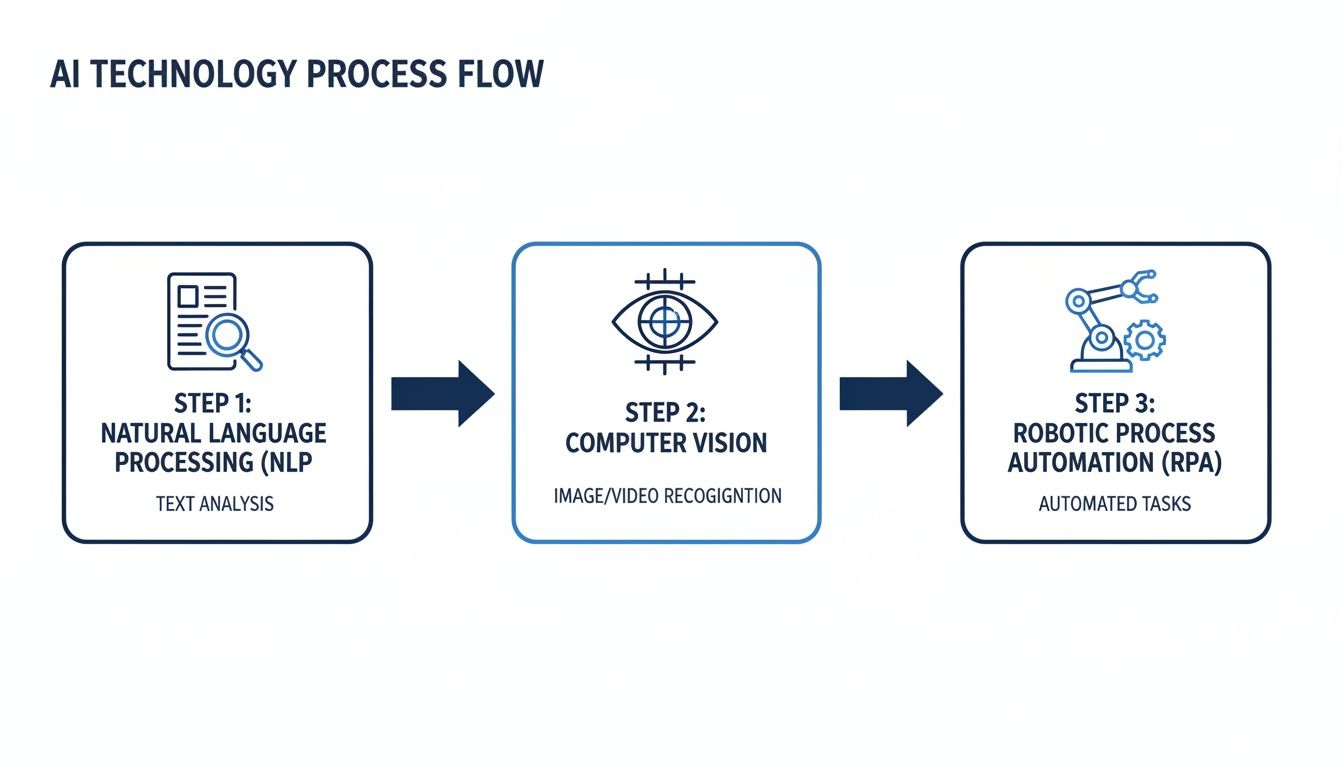

This diagram shows how different AI technologies like NLP, Computer Vision, and RPA often work in sequence to get a task done.

You can see how a system might first read documents, then look at visual evidence, and finally take action in your core systems – all automatically.

Phase 3: Scaling and Integration

With a successful pilot in the books and a business case that speaks for itself, you're ready to scale. This means gradually expanding the AI automation to other departments or product lines and integrating it tightly with your core insurance platforms.

This stage is as much about people as it is about technology. Getting the change management right is absolutely critical for smooth adoption and long-term success.

To scale effectively, you need to plan for:

Team Training: Get your staff trained up on how to work alongside their new AI assistants. This builds confidence and turns employees from sceptics into champions of the change.

Systems Integration: Work with your IT team or a specialist partner to make sure the AI solution talks seamlessly with your existing claims, policy, and billing systems. For a deeper dive, you can explore the specifics of AI insurance software development Canada.

Continuous Improvement: AI models aren't "set it and forget it." You need a process for monitoring performance, gathering ongoing feedback, and constantly refining the algorithms to make them more accurate and efficient over time.

By following this three-phase roadmap, you can de-risk your investment and build a powerful engine for insurance automation that delivers real, lasting value to your organisation.

Here is the rewritten section, crafted to sound completely human-written and natural.

Measuring Success and Proving Your Return on Investment

Putting AI to work in your insurance operations is more than just a tech project; it’s a serious business investment. And like any investment, you need to know if it's actually paying off. So, how do you measure the real-world impact? The key is to move past vague promises of "efficiency" and start tracking specific metrics that tie your AI tools directly to your bottom line.

To get buy-in and justify the spend, you have to show how this technology is changing your operations, your costs, and your relationships with customers for the better. This means you need a clear "before" picture to measure against. You're aiming to translate tech improvements into the language the entire business understands: pounds, percentages, and happier clients.

Key Performance Indicators to Track

To really prove the value of your AI initiatives, you’ll want to look at a mix of metrics covering operations, finances, and the customer experience. This gives you a complete picture of how automation is reshaping the business.

Here’s what you should be watching:

Reduction in Claims Cycle Time: How long does it take to go from that first call to a final settlement? This is a huge one. With AI, we’ve seen insurers slash this from weeks down to a matter of hours for straightforward claims.

Increase in Underwriting Accuracy: Compare the loss ratio on policies underwritten with AI's help versus the old manual way. A lower loss ratio is solid proof of more precise risk assessment.

Improvement in Customer Satisfaction (CSAT) Scores: Keep a close eye on customer feedback, especially around claims and general inquiries. Faster, clearer processes almost always lead to higher satisfaction.

Decrease in Operational Costs: This is where you can see direct efficiency gains. Calculate the drop in person-hours spent on repetitive work like data entry, checking documents, and answering routine questions.

Calculating Your Return on Investment

Calculating the ROI is what ultimately proves this was a smart move. A simple but effective way to do this is to weigh your total investment against both the direct money you've saved and the indirect financial benefits you've gained.

Your ROI calculation needs to include:

Direct Cost Savings: This is the easy part. Add up the reduced labour costs from tasks you've automated. For instance, if an AI now handles 80% of the initial data entry for claims, you can put a clear pound figure on those saved hours.

Indirect Financial Gains: Don't overlook these, as they're often just as significant. Think about the value of keeping more customers because of better service, the money saved by catching fraud before a payout, and the higher profits from smarter underwriting.

Total Investment Cost: Make sure you account for everything – software licences, implementation partners, integration work with your core systems, and the time and money spent on training your team.

ROI (%) = ( (Net Gain – Cost of Investment) / Cost of Investment ) * 100

This simple formula gives you a hard number that proves the financial sense behind your automation strategy.

The Proven Impact of AI Automation

The results from focused AI automation projects speak for themselves. We're seeing industry reports showing major productivity boosts – some cite gains of over 30% for service and operations teams using AI tools. Vendors are also showing huge drops in claims and underwriting turnaround times, especially when AI is connected to a modern core platform. The potential here is very real. You can learn more about recent AI trends in the insurance sector to get a sense of how others are cashing in on these benefits.

By tracking these KPIs and calculating a clear ROI, you can stop talking about insurance automation using AI as a future concept and start presenting it as a data-backed business necessity.

Choosing the Right Technology Partner for Your Business

Picking a technology partner for your AI automation project is a huge decision. Think of it less like buying software and more like hiring a key member of your team. The right partner will feel like an extension of your own crew, guiding you through the technical weeds and making sure the project actually delivers on its business promise. The wrong one? Well, that’s a recipe for expensive delays and a solution that never quite works the way you need it to.

The market for AI vendors is noisy and crowded, and it's easy to get lost in the buzzwords and slick demos. To cut through the noise, you need to zero in on what really matters for a successful, long-term partnership.

Key Criteria for Selecting a Partner

First and foremost, you need a partner who gets the insurance business. A general-purpose AI company just won't understand the specific pressures and nuances of our industry. Their technology needs to be more than just clever; it has to be compliant, secure, and built to work within the realities of your current operations.

Here's what to look for when you're vetting potential partners:

Deep Insurance Industry Expertise: This is non-negotiable. Do they speak your language? Do they understand the difference between a first notice of loss and a subrogation claim? They need to have a genuine grasp of insurance workflows and Canadian regulatory requirements.

Proven Integration Capabilities: Let’s be realistic – most insurers run on a mix of modern and legacy systems. A potential partner has to show you, not just tell you, that they can connect their AI tools with your existing platforms. The last thing you want is a painful "rip and replace" project.

A Strong Focus on Security and Compliance: You're handling incredibly sensitive policyholder data, so there is absolutely no room for compromise here. The partner must demonstrate a serious commitment to security, backed by certifications like SOC 2, to protect your data and keep you compliant.

Off-the-Shelf Platforms vs. Custom-Built Solutions

One of the first big forks in the road is deciding between a ready-made platform and a completely custom-built solution. Neither one is inherently better; they just serve different needs, timelines, and budgets.

Choosing between a platform and a custom solution is really about balancing speed-to-market with your long-term strategic goals. You have to think about where your business is today, but also where you want it to be in five years.

Here’s a simple breakdown to help you weigh the options:

| Feature | Off-the-Shelf Platform | Custom-Built Solution |

|---|---|---|

| Speed | Much faster to get up and running, using pre-built modules. | Takes longer to deploy because it's built from scratch. |

| Cost | Lower cost to start, usually based on a subscription (SaaS) fee. | A significant upfront investment in development and design. |

| Customisation | You're limited to the features and settings the platform offers. | Built to fit your exact workflows and strategic differentiators. |

| Scalability | You're on the vendor's roadmap for future growth and features. | Can be designed to scale perfectly alongside your business. |

For many mid-market insurers, an off-the-shelf platform is a great way to get started with insurance automation using AI. It lets you score some quick wins and see a return on your investment sooner. But if you have highly unique processes or your goal is to build a true competitive moat, a custom solution, despite the higher initial cost, is likely the smarter play for the long run.

Your Top Questions About AI in Insurance, Answered

Jumping into a major operational change like AI-driven automation naturally brings up some questions. It's a big step. Here are straight-up answers to the most common concerns we hear from insurance pros, designed to clear up any lingering doubts.

Are We Making Our Claims Adjusters and Underwriters Redundant?

This is probably the number one question we get, and the answer is a firm "no." The real goal here isn't to replace your experts; it's to supercharge them.

Think about it: AI is fantastic at chewing through the high-volume, repetitive work: the data entry, the initial document reviews, the cross-referencing. This frees up your seasoned professionals to focus their brainpower on the tricky, high-judgement cases that actually require human expertise. It’s less about replacement and more about giving your team a powerful assistant to handle the grind.

AI doesn't replace experts; it gives them superpowers. By automating the routine, you empower your team to focus on the nuanced, high-value decisions that truly drive the business.

How Can We Be Sure Our Policyholder Data Is Secure?

Data security isn't just a feature; it's the foundation. Any AI partner worth their salt will have built their systems with security at the core. This means you should be looking for things like end-to-end encryption and rigid access controls as standard practice.

The real proof is in the compliance. When vetting a partner, ask about their certifications. A SOC 2 Type 2 report, for example, is a clear sign that they have established and audited processes for managing and protecting client data. Don't settle for anything less.

What's the Real Cost to Get Started?

The initial investment can swing wildly, and it really comes down to the path you choose.

An off-the-shelf platform is often the most accessible route. You're looking at a predictable monthly or annual subscription fee, which keeps the upfront cost manageable.

A custom-built solution is a much bigger initial spend on development, but in return, you get a system that's perfectly moulded to your unique processes.

Our advice? Start smart. Kick things off with a well-defined pilot project. This lets you prove the ROI and work out the kinks before you go all-in on a massive deployment.

At Cleffex Digital Ltd, we build intelligent automation solutions that deliver real, measurable results for insurers. We're here to guide you on your AI journey, from crafting the initial strategy to scaling for long-term growth. See how we can reshape your operations by visiting us at Cleffex.com.