Before a single line of code is ever written, the success of your insurtech platform development is determined by the strength of its strategic foundation. This initial phase is all about transforming a big idea into a razor-sharp market opportunity, focusing on solving a real-world problem within the insurance industry.

Laying the Groundwork for Your Insurtech Platform

The first step has nothing to do with technology and everything to do with strategy. You need to dive deep into the current insurance landscape and find the friction points. Where are people getting stuck? Perhaps customers are frustrated with a claims process that feels like it’s from the past century. Or perhaps small businesses can't get the flexible underwriting they need. These frustrations are where you'll find your opening.

Forget about "disrupting insurance." Your real goal is to define a clear, compelling solution to a specific problem. For example, creating a platform for on-demand insurance for freelance photographers solves a precise pain point that traditional annual policies completely miss. That's tangible value.

Identifying Your Niche and Core Functionality

The most successful platforms don't try to serve everyone. The trick is to carve out a profitable niche where you can deliver an exceptional experience. This could mean targeting a specific demographic, focusing on a particular type of insurance like pet or cyber insurance, or even pioneering a unique distribution model.

Once you know who you're building for, you can map out the core functionalities for your Minimum Viable Product (MVP). These are the absolute must-have features that directly solve your customer's main problem.

At a minimum, you'll likely need:

User Onboarding & Profile Management: A frictionless way for users to sign up and manage their information.

Quote Generation Engine: A system that delivers instant, accurate quotes based on user inputs.

Policy Management Dashboard: A central spot for users to see their policy details, make changes, and access documents.

Secure Payment Gateway Integration: A rock-solid method for collecting premiums and handling payments.

This initial feature set becomes the backbone of your platform. It delivers immediate value to your first users and gives you a solid base to build on. Getting this right from the start is crucial, and it helps to be well-versed in mastering the software development cycle stages to ensure a structured approach.

Building a Strong Strategic Blueprint

With a clear vision for your niche and core features, the next move is to draft a detailed strategic blueprint. This document is much more than a feature list; it outlines your entire business model, maps the user journey, and details your initial technology considerations. It’s the north star for your entire insurtech platform development project.

This blueprint is especially vital in a market that’s growing as quickly as Canada's. The Canadian insurtech market started at USD 576.2 million in revenue in 2023 and is projected to explode to USD 11,395.4 million by 2030. That's a staggering 53.2% CAGR from 2024 to 2030, highlighting massive opportunities for developers building solutions for small businesses and startups.

A classic mistake I see is teams getting bogged down in bells and whistles before they've even nailed the core problem. A platform with a dozen half-baked features is far less valuable than one with three features that perfectly solve a critical customer pain point. Your blueprint is what keeps you focused.

This groundwork ensures every decision you make, from tech stack choices to marketing campaigns, is aligned with a single, coherent vision. It’s what turns a vague idea into an actionable plan and sets you up to build a product that your target market will actually want to use. To keep that edge, you'll also want to stay on top of emerging insurtech trends in Canada for 2026 that could shape your platform's evolution.

Mastering Canadian Regulatory and Compliance Requirements

When you're building an insurtech platform, treating compliance as an afterthought is a recipe for disaster. It isn't a box you tick at the end of a project; it needs to be baked into every decision you make from day one. I've seen projects get derailed by trying to bolt on compliance late in the game, and it's always more expensive and less effective.

Thinking "compliant-by-design" from the start is your best move. It means every feature, every line of code, and every user interaction is planned with Canadian regulations in mind. This approach doesn't just save you from crippling fines and costly rework; it builds the trust that is essential for both regulators and your customers.

Navigating PIPEDA and Data Privacy

In Canada, data privacy starts with the Personal Information Protection and Electronic Documents Act (PIPEDA). This is ground zero for any insurtech platform. You’re not just handling names and addresses; you're dealing with incredibly sensitive financial and health information.

PIPEDA is very clear: you need explicit, informed consent from users before you collect their data. This can't be buried in a long terms-of-service document. It needs to be a transparent part of your onboarding flow.

Your platform also has to respect a few key principles:

Purpose Limitation: You can only use customer data for the specific reason you collected it. If you want to use that data for something new, like marketing analytics, you have to go back and ask for permission again.

Data Minimisation: Only collect what you absolutely need. For example, asking for someone's marital status to generate a simple travel insurance quote is probably a compliance overstep.

Robust Security Safeguards: You are legally on the hook for protecting user data. That means strong encryption is a must-have, both for data sitting on your servers and for data moving across networks.

Meeting OSFI Standards and Financial Oversight

While PIPEDA handles data privacy, the Office of the Superintendent of Financial Institutions (OSFI) is the big player for financial stability. OSFI sets the rules for federally regulated insurers. Even if you’re a tech provider and not an underwriter, your insurance partners live by these rules, and they'll expect your platform to meet the same high bar.

OSFI’s guidelines dig deep into operational risk, cybersecurity, and how you manage third-party vendors. This means your insurtech platform needs rock-solid, documented processes for everything from responding to a data breach to vetting your API providers.

Think of your platform as an extension of your insurance partner's own operations. If your tech creates a vulnerability, it becomes their regulatory headache. Showing that you've aligned with OSFI's expectations from the get-go is critical for landing and keeping those partnerships.

This is where smart technology choices make a huge difference. You can see how innovation and compliance work together in our guide on AI insurance software development in Canada.

Embedding KYC and AML into Your Workflows

Nowhere is compliance more visible to the user than during onboarding. Know Your Customer (KYC) and Anti-Money Laundering (AML) checks aren't optional; they're mandated by the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

The goal here isn't to create a clunky, multi-step verification process that frustrates users. The smart approach is to weave these checks seamlessly into the sign-up experience using specialised APIs.

Here’s what that looks like in practice:

Identity Verification: A new user uploads a photo of their driver's licence. An integrated service instantly confirms its authenticity.

AML Screening: In the background, the user’s name and details are automatically checked against global sanctions and watchlists.

Risk Scoring: The platform assigns a risk score based on multiple data points, flagging any high-risk accounts for manual review.

This kind of integrated workflow is a win-win. It’s fast and frictionless for good customers, but it creates a strong, auditable trail that keeps regulators happy. It turns a compliance chore into a smooth, secure process that protects everyone involved.

Building a Resilient Insurtech Architecture and Tech Stack

The technology choices you make at the outset are more than just technical details; they are the very foundation of your insurtech platform. These decisions will directly dictate your platform's speed, its security posture, and, critically, its ability to grow with you. I’ve seen firsthand how a poorly planned architecture can saddle a promising company with technical debt, slowing innovation to a crawl. On the flip side, the right stack lets you move fast, adapt, and scale with confidence.

Why Microservices Are a Game Changer for Insurtech

For years, the go-to model was a monolithic architecture – one massive, single application where every component is tangled together. For a fast-moving field like insurtech, this approach is simply too rigid. A minor bug in the claims module could potentially take down the entire platform. Need to update the underwriting engine? That becomes a massive, high-stakes project.

This is exactly why microservices architecture has become the standard for modern platforms. Think of it like building with LEGO blocks instead of trying to carve everything from a single piece of stone. Each core function: policy management, claims processing, user authentication, and billing, is built as its own separate, independent service.

These services talk to each other through APIs but operate independently. The agility you gain is immense:

Independent Deployment: Your claims team can roll out a new feature without having to wait on the policy team. This drastically shortens the time it takes to get new ideas to market.

Technology Flexibility: You're not locked into one-size-fits-all technology. You can use a lightning-fast language like Python for your data-heavy risk analytics engine and a robust, enterprise-grade language like Java for the core policy administration service.

Improved Fault Isolation: If the billing service hits a snag, it won't crash the whole system. Other features, like quote generation, stay up and running, which means a much better and more reliable experience for your users.

Adopting a microservices approach is a strategic business decision, not just a technical one. It allows you to align your tech with your organisational structure, empowering smaller, focused teams to own their services and innovate without creating bottlenecks for everyone else.

Selecting Your Core Technology Stack

Once you've settled on an architectural pattern, it's time to pick the tools for the job. Let me be clear: there is no single "best" tech stack. The right choice always depends on your team's existing expertise, your specific performance needs, and your long-term vision. For a more detailed look at the options, our guide on enterprise application architecture patterns is a great resource.

Here’s a breakdown of the key pieces and some popular, battle-tested choices:

Backend Logic: This is the engine room of your platform. Python, with frameworks like Django or Flask, is fantastic for getting to market quickly and is the undisputed leader for AI and machine learning tasks. Java, often with Spring Boot, is a titan of performance and stability, making it a trusted choice for mission-critical financial applications.

Frontend Interface: This is what your customers actually see and touch. React is a powerhouse JavaScript library with a huge community, perfect for building sophisticated, dynamic user interfaces. Vue.js is often praised for being easier to pick up and offers excellent performance, making it a smart choice for MVPs where speed is key.

Database Management: How you store and access data is absolutely critical. SQL databases like PostgreSQL are the gold standard for structured data integrity – a must-have for transactional information like policies and payments. For more flexible needs, NoSQL databases like MongoDB are perfect for handling unstructured data, such as user profiles or analytics logs.

Embracing the Cloud for Scalability and Security

Let’s be honest, running on-premise servers is a relic of the past for any serious insurtech venture. Cloud platforms like Amazon Web Services (AWS) and Microsoft Azure are non-negotiable. They do the heavy lifting of managing infrastructure, which frees up your team to focus on what actually matters: building great features for your customers.

The shift to the cloud is a major trend among Canadian insurers. Many are moving core applications and data aggressively, even as they identify cloud security as a top concern. As PwC’s 2025 Digital Trust Insights Survey points out, the strategic advantages of agility and scale are just too compelling to ignore. You can find more on these trends in PwC's comprehensive analysis of the Canadian insurance market.

A crucial part of many insurtech platforms is making claims handling more efficient. The cloud provides the perfect environment for deploying the sophisticated AI tools needed for automated claims processing, which can dramatically speed up resolution times. Ultimately, your cloud setup, architecture, and tech stack must work together to create a platform that’s not just powerful today but also ready for whatever comes next.

Weaving It All Together: Essential Integrations for a Seamless Experience

An insurtech platform can't operate in a silo. Its real value emerges when it serves as a central hub, plugged into a wider ecosystem of specialised services. This is where Application Programming Interfaces (APIs) come in; they're the digital threads that let your platform talk to other systems in real time. Without them, you've just built a very powerful but isolated island.

Think of it like this: your platform's core code is the engine of a car. APIs are the transmission, the steering, and the electrical system. They take the engine's raw power and connect it to the wheels, the driver, and the lights, making everything work together to create a smooth, intuitive journey for both your customers and your internal teams.

Connecting to the Core: Policy Administration Systems

At the very heart of any insurance operation is the Policy Administration System (PAS). This is the official system of record, the single source of truth for everything from product rules and rating algorithms to endorsements and renewals. Your customer-facing platform absolutely must have a solid, two-way connection to a PAS.

Here’s a practical example: a customer wants a quote on your website. Your platform bundles up their information and shoots an API call over to the PAS. The PAS crunches the numbers using its complex rating engine and sends back the exact premium. Your platform catches it and displays it instantly. When the customer clicks "buy," another API call tells the PAS to finalise the transaction and officially issue the policy. It's a seamless dance between two systems.

This integration is non-negotiable for:

Live Quoting: You need to give customers accurate, up-to-the-minute pricing based on the insurer's latest rules. No guesswork.

Instant Policy Issuance: Policies can be created and bound immediately, with no manual steps slowing things down.

Customer Self-Service: Policyholders can view documents, make changes, or renew their coverage on their own time, and every change is instantly synced back to the PAS.

Thankfully, modern, cloud-based PAS providers like BriteCore are built with open APIs from the ground up, making this kind of integration much more straightforward.

Handling the Money: Payments and Identity Checks

A smooth and secure financial transaction isn't just a feature; it's a fundamental requirement. You have to integrate with trusted payment gateways to collect premiums safely and efficiently.

This is about much more than just sticking a "pay with credit card" button on a form. Leading payment APIs from providers like Stripe or Adyen manage the entire payment lifecycle. They handle the secure tokenisation of card details, process one-time and recurring subscription payments, and deal with the headaches of refunds and disputes. This not only takes a huge security burden off your shoulders but also gives customers a familiar and trustworthy checkout experience.

A seamless payment process builds immense trust. When a customer enters their financial details, they expect a professional, secure interaction. A clunky or unreliable payment step is one of the fastest ways to lose a sale and damage your brand's credibility.

Right alongside payments comes the need to verify who your customer is – a critical compliance step. Manually checking documents is slow and full of potential for human error. Instead, integrating with KYC (Know Your Customer) and AML (Anti-Money Laundering) services automates the whole thing. When a user signs up, your platform can make a quick API call to a service like Trulioo or Onfido, which can verify government-issued IDs and check against global watchlists in a matter of seconds. What used to be a major bottleneck becomes just another smooth step in the onboarding flow.

Keeping in Touch: Automating Customer Communications

Finally, keeping customers in the loop is how you build lasting relationships. A smart insurtech platform development strategy must include API integrations for automated communications. Services like Twilio for SMS or SendGrid for email let you automatically fire off notifications based on specific events.

Just think about these real-world scenarios:

Policy Purchase: The moment a payment goes through, an automated email zips out with the policy documents attached.

Claim Submission: A user submits a claim in the app and immediately gets an SMS confirming it's been received, complete with a claim number.

Renewal Reminder: Thirty days before a policy expires, an automated email and maybe a follow-up SMS go out to remind the customer to renew.

These integrations make sure your communication is timely, consistent, and can scale to thousands of customers without breaking a sweat. It's the kind of professional touch that reassures people at critical moments, all without anyone on your team having to lift a finger.

Key Integration Types and Their Purpose

To build a truly connected platform, you need to bring together several types of third-party services. Each integration serves a distinct purpose, from managing core insurance functions to ensuring a secure and user-friendly experience. The table below breaks down the most critical integration categories.

| Integration Type | Core Function | Example Providers/APIs |

|---|---|---|

| Policy Administration System (PAS) | The central source of truth for policies, rating, and underwriting rules. | BriteCore, Socotra, EIS Group |

| Payment Gateway | Securely process one-time and recurring premium payments. | Stripe, Adyen, Braintree |

| Identity Verification (KYC/AML) | Automate identity checks to meet regulatory compliance and prevent fraud. | Trulioo, Onfido, Jumio |

| Customer Communications | Send automated transactional emails and SMS notifications. | SendGrid, Mailgun (Email), Twilio (SMS) |

| Claims Management | Connect to systems for handling First Notice of Loss (FNOL) and claim processing. | Guidewire, Duck Creek, Snapsheet |

| Data & Analytics | Pull in third-party data for risk assessment or connect to analytics platforms. | LexisNexis, Verisk, Google Analytics |

Choosing the right partners for these integrations is as important as writing your own code. The goal is to create a powerful, cohesive ecosystem where data flows freely and securely between all the essential components of your insurance business.

Launching Your MVP and Planning for Growth

It's easy to get carried away and try to build the perfect, all-singing, all-dancing platform right out of the gate. I've seen it happen countless times, and it's a common trap in insurtech platform development. A much more effective approach is to launch with a Minimum Viable Product (MVP).

This isn't about shipping a half-baked product. It’s about launching a razor-focused solution that does one thing exceptionally well for your ideal customer. By starting small, you can launch faster, gather crucial feedback from real users, and start bringing in revenue months earlier than you would otherwise. Think of the MVP as your solid foundation – lean, but incredibly valuable.

Defining Your MVP Scope

Getting your MVP scope right requires discipline. You need to ruthlessly identify the single most painful problem your insurtech platform solves. Let's say you're targeting gig workers who need on-demand liability coverage. Their core problem is the hassle of buying flexible, short-term insurance.

Your MVP's feature set should be built exclusively to solve that one problem, and nothing more.

Core Functionality: This would include a dead-simple sign-up process, a tool to select coverage by the hour or day, and a straightforward payment gateway integration. That’s it.

What to Leave Out: Forget the fancy user dashboard with historical analytics, multiple policy options, or a complex referral program. Those are great ideas for later.

The objective here is to build the simplest possible version of your product that someone will genuinely use and pay for. This lean strategy slashes your initial development costs and dramatically reduces the risk of building something nobody actually wants.

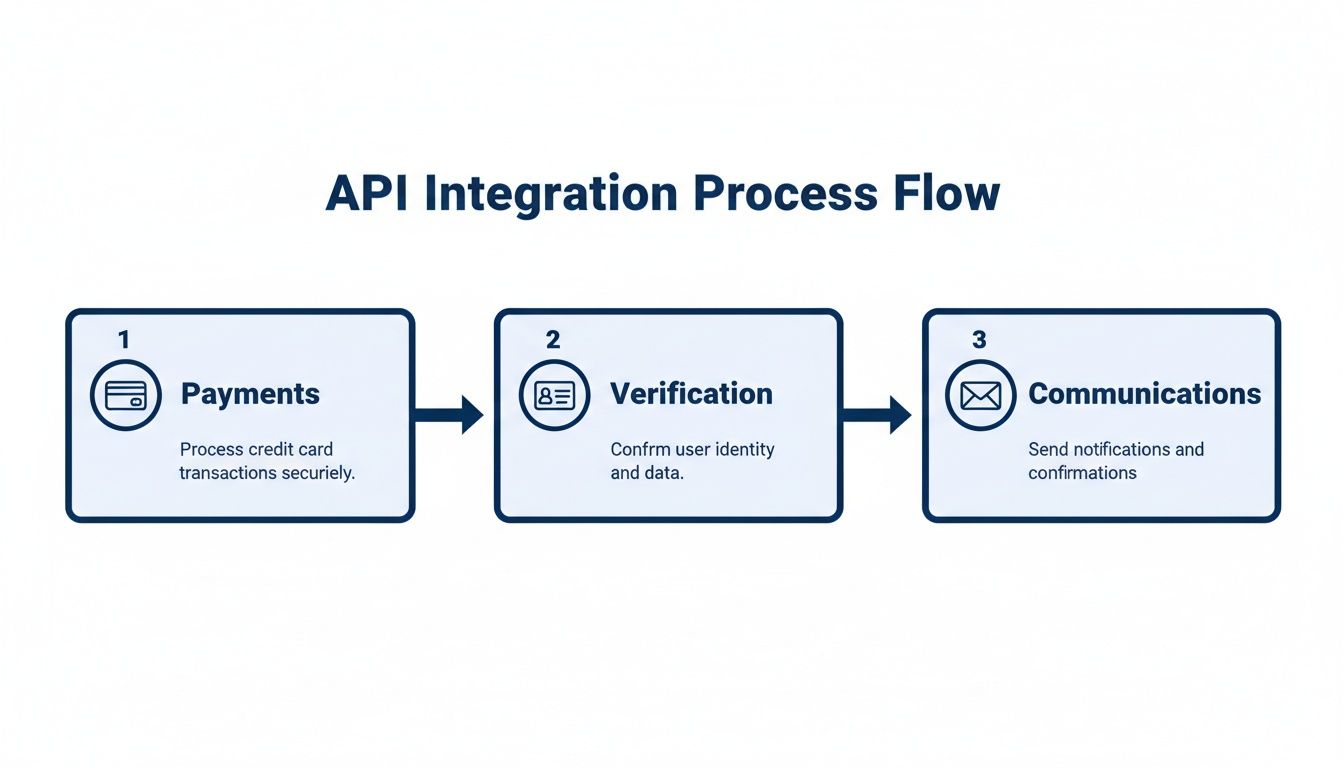

This diagram shows how essential API integrations, covering payments, verification, and communications, work together even in a stripped-down MVP.

As you can see, even a minimal product relies on a well-connected ecosystem to create a seamless experience from start to finish.

Creating a Phased Development Roadmap

Your MVP is just the first step. True growth comes from listening to your early users and continuously iterating on their feedback. A phased roadmap is your game plan for evolving the platform, but don't etch it in stone. Instead of a rigid five-year forecast, think in flexible development cycles or quarters.

Your roadmap should be a living document, outlining future features in order of priority. This keeps you agile and allows you to pivot based on real data, not just assumptions. For example, if your first batch of users is clamouring for a way to pause their coverage, that request should jump to the top of the list, ahead of your internal plan to add a new insurance product.

The most valuable insights you'll ever get won't come from a boardroom meeting; they'll come from watching your first ten customers interact with your MVP. Their confusion, their feature requests, and their workarounds are a goldmine of data that should directly shape your post-launch roadmap.

Post-Launch Monitoring and Scaling

Once you’re live, the job isn’t done. The focus just shifts from building to monitoring, maintaining, and preparing for growth. How you handle this phase will determine the long-term success of your platform. I always tell teams to concentrate on three key areas.

Performance Monitoring: Keep a close eye on application performance, server response times, and API health with dedicated monitoring tools. Slow load times or constant errors are the quickest way to erode the trust you've built with your early adopters.

Security and Maintenance: The threat landscape is constantly evolving. You need a rock-solid process for regular security audits, vulnerability scanning, and applying patches immediately. Protecting sensitive customer data and staying compliant isn't optional.

Infrastructure Scaling: As your user base grows, your initial infrastructure will feel the strain. This is where a cloud-based architecture really shines. It allows you to scale resources like database capacity and processing power on demand, ensuring your platform stays fast and reliable as you go from ten users to ten thousand.

Your Top Insurtech Platform Questions, Answered

Jumping into insurtech platform development always kicks up a lot of questions. It’s only natural. You're thinking about timelines, costs, security, and the right tech to use. Getting solid answers to these questions is the first step toward making smart decisions and setting your project up for success.

Let's dig into some of the most common queries we hear from founders and project managers in this space.

How Long Does It Realistically Take to Build an Insurtech MVP?

There’s no magic number here, as the timeline for an insurtech Minimum Viable Product (MVP) really hinges on its complexity. But based on our experience, a focused MVP can usually be launched in four to eight months.

That window covers the whole initial sprint from idea to launch:

Discovery and strategic planning

UI/UX design and prototyping

Backend and frontend development

Essential integrations (like payments and basic KYC)

The first round of quality assurance and testing

For an MVP with the basics: user registration, a quote engine, and a straightforward payment gateway, this timeframe is quite achievable. However, if your vision includes more sophisticated features right out of the gate, like an AI-powered underwriting engine or automated claims logic, you're likely looking at a timeline closer to nine to 12 months.

The secret is to be ruthless about defining "minimum" and "viable." Get to market, get real user feedback, and then iterate.

What Are the Biggest Security Hurdles I Should Expect?

Given the sensitive personal and financial data involved, insurtech platforms are a prime target for security threats. Honestly, the biggest challenges fall into three buckets: protecting customer data, preventing fraud, and locking down all your third-party connections.

First, compliance with data protection laws like Canada's PIPEDA isn't optional. This means implementing serious, end-to-end encryption for all data, whether it’s sitting on a server or in transit. Strong user authentication, especially multi-factor authentication (MFA), should be considered a Day 1 requirement, not a feature to add later.

Security isn't a one-time task you can check off a list. Think of it as a continuous cycle. Regular security audits, penetration testing, and active monitoring are absolutely critical for finding and fixing vulnerabilities before someone else does.

Beyond just protecting data, you'll be fighting a constant battle against fraudulent claims. This is where sophisticated monitoring and analytics become your best friend. Also, remember that every single API connecting to a third-party service is a potential weak point. Securing those endpoints is just as vital as securing your own code.

What's the Real Cost of Building a Custom Insurtech Platform?

The cost to build a custom insurtech platform can swing pretty widely, but I can give you some ballpark figures to help with your initial budgeting. Here in Canada, a lean MVP will likely land somewhere between $75,000 and $250,000 CAD. This range depends heavily on the project's scope and the development team you work with.

That initial investment gets you the core features you need to launch and start signing up your first customers. If you're planning a full-scale platform with all the bells and whistles: think AI-driven analytics, deep automation, a dozen integrations, and dedicated mobile apps, the budget can easily climb north of $500,000 CAD.

What drives these costs? The main factors are:

The complexity of your business logic and underwriting rules.

The number and type of API integrations you need.

The level of regulatory and compliance features required.

Ongoing costs for hosting, maintenance, and support.

A common mistake is to only budget for the initial build. Successful insurtech platform development projects always account for the continuous improvement and scaling that inevitably happens after you go live.

Ready to turn your insurtech vision into a secure, scalable, and compliant reality? At Cleffex Digital Ltd, we specialise in building custom software solutions that solve real-world business challenges. Let's discuss how we can build your platform together.