Picture trying to run your business with a financial tool that just doesn't quite fit. You're constantly working around its limitations, trying to make a generic, off-the-shelf box do something it was never designed for. Now, imagine a tool built from the ground up, perfectly sculpted to your exact business needs.

That's the essence of custom fintech software development. It’s the process of creating bespoke financial technology that aligns perfectly with your specific challenges, customer demands, and the regulatory hoops you have to jump through.

Why Build Custom Financial Software?

Think about the difference between buying a suit off the rack and getting one custom-tailored. The department store suit is functional, sure, but it's often a little tight in the shoulders or too long in the sleeves. It's a compromise. A bespoke suit, on the other hand, is made for your precise measurements, using the fabric you want, in the style you love. It just works because it was made only for you.

Custom fintech development applies that same thinking to your technology. While pre-built software gives you a one-size-fits-all solution, a custom build is designed to handle your specific operational workflows, security protocols, and customer experience goals with absolute precision.

This tailored approach is why so many businesses are ditching generic solutions. They're looking for a real competitive advantage, the ability to innovate faster, and the agility to respond to market shifts before anyone else. If you're weighing the options, our deep dive into custom software vs. off the shelf software is a great place to start.

Gaining A Competitive Edge

With a custom solution, you can build features your competitors can only dream of because they're stuck with the limitations of their off-the-shelf software. Think about a unique lending algorithm that assesses risk more accurately, a highly personalised user dashboard, or a seamless integration with a niche partner service.

These aren't just bells and whistles; they're unique capabilities that translate directly into a better customer experience and a much stronger position in the market.

By creating proprietary technology, you're not just solving a problem; you're building a valuable business asset that sets your brand apart and fuels long-term growth.

This strategic move is what’s behind the explosive growth in the market. Canada's fintech sector, for example, has blossomed into a major global hub, and the numbers tell the story. The market is projected to skyrocket from its current size to USD 18.84 billion by 2033, a clear signal that specialised financial solutions are the future.

The Foundation Of Modern Finance

Ultimately, building custom fintech isn't just about the software itself. It’s about creating a secure, scalable, and incredibly effective engine for real business growth. Whether you're in payments, lending, or wealth management, these tailored systems are quickly becoming non-negotiable.

To really get a feel for the wide world of custom fintech, especially in complex areas like payment solutions, it helps to hear from seasoned industry pros like Payments Experts. Their insights can shed light on the nuances of building technology that truly performs.

Now, let's break down the practical differences between building your own solution and buying one off the shelf.

Custom vs Off-the-Shelf Fintech Software

This table gives a straightforward comparison to help you see the trade-offs at a glance.

| Feature | Custom Software | Off-the-Shelf Software |

|---|---|---|

| Functionality | Built specifically for your unique workflows and needs. | Generic features designed for a broad audience. |

| Scalability | Designed to grow and adapt with your business. | Limited scalability; may require costly upgrades or migration. |

| Integration | Seamlessly integrates with your existing systems and APIs. | Integration can be difficult, clunky, or impossible. |

| Competitive Edge | Creates unique features that set you apart from competitors. | You have the same features as every other company using it. |

| Initial Cost | Higher upfront investment in development. | Lower initial purchase or subscription cost. |

| Long-Term ROI | Higher ROI through efficiency, innovation, and asset ownership. | Ongoing subscription fees and potential hidden costs. |

| Control & Ownership | You own the source code and have full control. | You are licensing the software and are dependent on the vendor. |

While off-the-shelf software can get you up and running quickly, custom development is a long-term strategic investment in a tool that becomes a core asset for your business.

The Building Blocks: Essential Features of Modern Fintech Applications

Think of a custom fintech app not as a single product, but as a high-security digital headquarters. It needs more than just a slick interface; it requires an unbreachable foundation, an intelligent command centre, and an intuitive layout for everyone who uses it. These core features are the strategic solutions that elevate a simple app into a powerful financial tool.

Let's break down the essential features that form the backbone of any effective fintech software project. These aren't just trendy additions; they are the functional pillars that deliver security, efficiency, and a genuinely great user experience.

Secure User Authentication and Access Control

Before a single dollar moves, you need absolute certainty about who's on the other side of the screen. Think of user authentication as the digital vault door to your application. A simple username and password just don't cut it anymore; that lock is too easy to pick.

Today's fintech platforms rely on multiple layers of security to verify identities and guard sensitive information. This is how you build a trusted environment where users feel completely safe managing their financial lives.

Key methods include:

-

Multi-Factor Authentication (MFA): This is the standard. It forces users to provide at least two pieces of evidence to prove they are who they say they are, like a password plus a one-time code sent to their phone.

-

Biometric Verification: Using what makes a user unique, like their fingerprint or face, is one of the fastest and most secure ways to grant access.

-

Role-Based Access Control (RBAC): Crucial for business-focused platforms, RBAC ensures that people within an organisation can only see and do what’s relevant to their specific job, preventing internal data breaches.

Seamless Payment Gateway Integration

If authentication is the vault door, then the payment gateway is the central nervous system that makes every transaction happen flawlessly. This feature is the bridge connecting your app to various payment networks, allowing money to move smoothly, securely, and instantly.

A well-implemented payment gateway is practically invisible to the end-user but is absolutely critical to the platform's function. It has to manage everything from credit cards and bank transfers to digital wallet payments without a single hiccup. The success of any custom fintech software development project often comes down to how well it handles this flow of capital.

A fintech application without a robust payment gateway is like a bank without tellers. It might look impressive, but it fails at its most basic job: moving money securely and efficiently.

AI-Driven Analytics and Reporting Dashboards

In modern finance, data is the most valuable currency. But raw, unprocessed data is just noise. An AI-powered analytics dashboard is the command centre that translates mountains of complex data into clear, actionable insights. For a retail user, this might be a simple, visual breakdown of their spending habits.

For the business, these dashboards unlock tremendous strategic value. Imagine a custom lending platform using an AI tool to crunch thousands of data points in real-time. It can instantly refine its risk models, leading to smarter, faster, and more profitable lending decisions. This feature is what turns data from a liability into a competitive advantage.

Automated Compliance and Reporting Engines

The world of finance is a dense forest of regulations. An automated compliance and reporting engine is your expert guide, making sure you never step off the approved path. This feature automates the critical, time-sucking regulatory tasks that are so often prone to human error.

These engines are built to manage a host of requirements, including:

-

Know Your Customer (KYC): Automating the identity verification process to stop fraud before it starts.

-

Anti-Money Laundering (AML): Constantly monitoring transactions for suspicious activity and automatically flagging anything that looks out of place.

-

Regulatory Reporting: Generating and submitting the precise reports required by financial authorities, without manual intervention.

By weaving compliance directly into the software’s DNA, you drastically reduce risk and free up your team to focus on growing the business instead of drowning in paperwork. It’s a proactive approach that defines truly sophisticated fintech solutions.

Mastering Security and Regulatory Compliance

In the world of finance, trust is the ultimate currency. When you're building custom fintech software, security and compliance aren't just items on a checklist; they're the very foundation that trust is built on. Skipping this step is like building a bank vault with a wooden door; it completely misses the point.

This isn't just about meeting the bare minimum. It's about adopting a "compliance-by-design" mindset, where every architectural decision and every line of code is written with regulations and data protection in mind. This forward-thinking approach saves you from costly fixes down the road and ensures your product is market-ready and secure from day one.

Decoding Key Financial Regulations

The web of financial regulations can seem intimidating, but its purpose is straightforward: protect consumers and keep the financial system stable. Getting a handle on these rules is the first step to building software that works within the system, not against it.

Two of the most critical concepts you’ll encounter are:

-

Anti-Money Laundering (AML): These are the rules and procedures designed to stop criminals from washing dirty money through legitimate channels. In software terms, this means building transaction monitoring systems that can automatically flag suspicious activity.

-

Know Your Customer (KYC): This is all about verifying a customer’s identity. For a fintech app, it requires robust identity checks during the signup process to confirm users are who they say they are, which is your first line of defence against fraud.

Ignoring these isn't an option. The penalties are severe, making their proper integration a non-negotiable part of development.

Protecting Data with End-to-End Encryption

Think of end-to-end encryption as an unbreakable digital seal. It ensures that sensitive financial data, from personal details to transaction histories, is completely unreadable to anyone except the sender and the intended recipient. Even if a cybercriminal manages to intercept the data, all they’ll get is scrambled, useless code.

This protection needs to be applied everywhere:

-

Data in transit: Securing information as it travels between a user's phone and your servers.

-

Data at rest: Encrypting data that's stored in your databases or on cloud servers.

Without a complete encryption strategy, you’re leaving your customers' most sensitive information dangerously exposed. For practical steps on how to lock down your application, our guide on strategies to enhance fintech app security offers a deeper dive into building a formidable defence.

In fintech, a data breach isn't just a technical failure; it's a catastrophic loss of customer trust that can be nearly impossible to recover from. Strong encryption is your first and best line of defence.

Navigating Canada-Specific Frameworks

If you're operating in Canada, you have to play by the local rules. The Canadian fintech scene is buzzing, and with the government pouring funds into AI and new consumer-driven banking laws taking shape, the regulatory environment is changing quickly.

Here are the key Canadian regulations to keep on your radar:

-

PIPEDA (Personal Information Protection and Electronic Documents Act): This is the federal law that dictates how private-sector organisations collect, use, and share personal information. Your software must be designed to get clear consent from users and manage their data according to PIPEDA’s principles.

-

Open Banking Framework: Canada is steadily moving towards a system where consumers can securely share their financial data with accredited third-party services. Custom software needs to be built with secure, flexible APIs to prepare for this shift and allow for safe, seamless data sharing.

For any fintech app, sticking to these stringent rules is essential. Getting a solid understanding by mastering compliance in the financial services industry will help ensure your software ticks all the necessary legal and ethical boxes. Being proactive about compliance isn't just good practice; it's fundamental to your long-term success.

Choosing the Right Technology Stack

Picking the right technology for your custom fintech software development project is a lot like choosing the engine for a new vehicle. You wouldn't put a small four-cylinder engine in a massive transport truck, nor would you need a V12 for a city scooter. The choice of technology, your "tech stack", has to be perfectly matched to what you're building, who you're building it for, and where you plan to go in the future.

Your tech stack is the collection of programming languages, frameworks, and tools that bring your application to life. Think of it as having a few key layers, each with its own critical job.

Understanding the Core Layers

Most fintech applications are built on three main layers that work in concert.

-

Frontend (The User Experience): This is everything your customer sees and touches: the dashboards they view, the buttons they click, and the forms they fill out. It’s the visual, interactive part of your platform. We often see frameworks like React or Angular used here because they are brilliant at creating smooth, responsive user interfaces that can handle complex financial data without feeling clunky.

-

Backend (The Business Logic): If the frontend is the shop window, the backend is the entire warehouse, security team, and logistics operation combined. This is where the real work gets done: processing payments, running algorithms, enforcing business rules, and keeping data secure. You'll find languages like Python, Java, or Node.js running the show, each picked for its specific strengths in performance, data science capabilities, or handling high-volume transactions.

-

Infrastructure (The Foundation): This is the physical (or, more likely, virtual) home for your application: the servers, databases, and networks it runs on. Today, cloud platforms like Amazon Web Services (AWS) or Microsoft Azure are the gold standard in fintech. They offer the security, reliability, and sheer power needed to scale an application from ten users to ten million without breaking a sweat.

If you want to go deeper into how these pieces fit together, our step-by-step guide to selecting the right tech stack offers a more detailed look to help you navigate these choices.

Matching Technology to Fintech Needs

In fintech, the "why" behind a technology choice is far more important than the "what." You don’t choose a technology because it's popular; you choose it because it's the right tool for a very specific job.

For example, Python is incredibly popular for fintechs venturing into AI and machine learning. Why? Because it has an amazing ecosystem of libraries built for data analysis, making it the perfect choice for developing sophisticated fraud detection systems or predictive credit scoring models. On the flip side, a high-frequency trading platform that needs to process transactions in milliseconds might lean on a language like Java for its raw speed and rock-solid performance.

The best technology stack isn't the trendiest one; it's the one that directly supports your business goals, security requirements, and scalability plans. Every choice should be a strategic decision, not a technical preference.

The following table breaks down some of the most common technology choices we see in the fintech space and why they're so often selected.

Popular Technology Choices for Fintech Development

| Component | Popular Technologies | Why It's Used in Fintech |

|---|---|---|

| Frontend (UI) | React, Angular, Vue.js | Excellent for building complex, data-heavy, and responsive user interfaces for dashboards and mobile apps. |

| Backend (Logic) | Python, Java, Node.js, Go | Chosen for performance, security, and specific strengths (Python for AI/ML, Java for enterprise stability, Node.js for speed). |

| Mobile | Swift (iOS), Kotlin (Android), React Native | Native languages offer the best performance and security, while cross-platform frameworks speed up development. |

| Database | PostgreSQL, MongoDB, Redis | SQL databases (PostgreSQL) ensure data integrity for transactions, while NoSQL (MongoDB) offers flexibility for user data. |

| Cloud/Infrastructure | AWS, Microsoft Azure, Google Cloud | Provide the scalability, security (PCI DSS compliance), and managed services essential for financial applications. |

| AI/Machine Learning | TensorFlow, PyTorch, Scikit-learn | Key for building fraud detection models, credit scoring algorithms, and personalised financial advice engines. |

Ultimately, the goal is to create a cohesive stack where each component complements the others, ensuring your final product is secure, scalable, and built for the long haul.

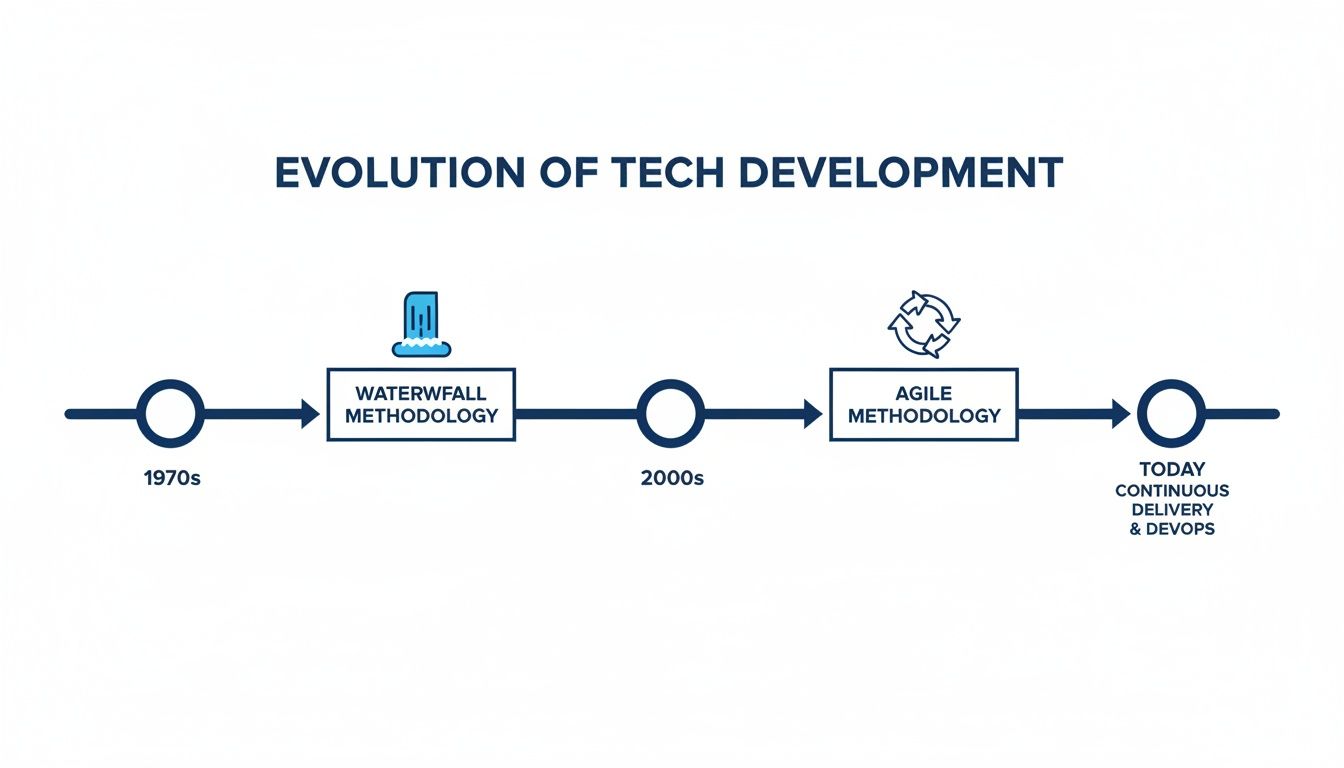

Choosing Your Development Methodology

Just as important as what you build with is how you build it. Your development methodology is the roadmap for your project, and the two main paths are Waterfall and Agile.

-

Waterfall: This is the traditional, step-by-step approach. You define all requirements upfront, then move through design, development, and testing in a strict, linear sequence. It’s like building a house from a finished blueprint – no changes allowed once construction starts.

-

Agile: This is a much more flexible, iterative process. The project is broken into small, focused cycles (often called "sprints"). At the end of each sprint, the team delivers a small, working piece of the product, gets feedback, and adapts the plan for the next cycle.

For the fast-moving world of fintech, Agile is almost always the superior choice. The financial markets, regulations, and customer expectations can shift in a heartbeat. An Agile approach lets you adapt to those changes, incorporate user feedback on the fly, and get a Minimum Viable Product (MVP) into the hands of real customers much faster. It turns the development process from a rigid march into a responsive, collaborative journey.

How to Budget Your Fintech Development Project

Figuring out the budget for your custom fintech software development project is more than just crunching numbers; it's about strategic planning. A solid financial roadmap makes sure your investment is directly tied to your business goals, helping you avoid nasty surprises and keeping things on track from the first idea to the final launch.

The first step is getting a handle on what actually drives the cost. The price of a custom fintech solution isn't just pulled out of thin air. It’s a direct reflection of the complexity, security, and specific features you need to build a product that's both competitive and compliant.

Core Factors Influencing Your Budget

A few key things will have a major impact on your overall investment.

-

Feature Complexity: It’s simple, really. A basic digital wallet for simple transactions will cost a lot less than a sophisticated platform that uses AI for analytics, supports multiple currencies, and includes biometric security. Every single feature adds development hours and technical layers.

-

Third-Party Integrations: Think about what your platform needs to connect with. Payment gateways? Credit bureaus? Stock market data feeds or your existing banking systems? Each of these API integrations takes careful planning, development, and a whole lot of testing, which all adds to the budget.

-

Security and Compliance Rigour: Fintech is one area where you absolutely cannot take shortcuts. Building systems that meet strict standards like PIPEDA, AML, and KYC requires specialised know-how and exhaustive testing. This adds to the cost, but it’s what makes your platform secure and ready for the market.

The sheer level of investment in Canadian fintech shows just how much value is placed on building strong, future-proof platforms. With billions flowing into the sector, much of it directed at digital assets and AI, it’s clear that companies understand the premium that comes with sophisticated tech. AI-powered fintechs, in particular, are pulling in serious early-stage funding. You can get more details on Canadian fintech investment trends at kpmg.com.

Choosing the Right Engagement Model

The way you decide to work with your development partner also plays a big role in your budget. Each model is designed for different types of project needs.

-

Fixed-Price: This works best for projects where the scope is crystal clear and isn't going to change. You agree on a single price for the entire project upfront. It offers predictability, but you lose a lot of flexibility.

-

Time and Materials (T&M): If you expect requirements to shift or evolve, this is the way to go. You pay for the actual time and resources used on the project. It gives you maximum flexibility but means you have to keep a close eye on the budget.

-

Dedicated Team: With this model, you essentially hire a full team of developers who work only on your project, acting as an extension of your in-house team. It's a great fit for long-term, complex projects that need deep integration and ongoing work.

Budgeting for a fintech project isn’t about finding the cheapest option. It’s about putting your resources to work effectively to build a secure, scalable asset that delivers a real return on investment.

This timeline shows how a project typically unfolds, moving in phases from the initial concept all the way to launch day.

What this really highlights is how an Agile approach lets you make progress in stages. You deliver value incrementally instead of waiting for one massive launch. By breaking the project down into manageable chunks: discovery, design, development sprints, testing, and deployment, you can manage your budget far more effectively and adapt to changes without throwing the whole project off course. A clear roadmap turns budgeting into a predictable, strategic process.

Finding the Right Fintech Development Partner

Picking a team for your custom fintech software development project is easily the most critical decision you'll make. This isn't just about hiring coders; it's about finding a strategic partner who will live and breathe your product's success. The right choice can be the difference between a market-leading application and a costly failure plagued by compliance headaches and security flaws.

The first step? Look beyond the price tag. While budget is always a reality, a partner's real worth is measured in their specialised experience. Any general software firm can build an app, but a fintech specialist understands the delicate balance between financial regulations, ironclad security, and earning user trust. That specific expertise is what saves you from expensive missteps and gets your product to market faster.

How to Properly Vet Potential Partners

You're not looking for a vendor; you're looking for a partner. To tell the difference, you need to ask sharp questions that go beyond the surface. Their answers will tell you everything you need to know about their experience and whether they're the right fit for your vision.

Start by digging into their portfolio. You want to see concrete proof that they’ve successfully built and launched applications in the same ballpark as yours.

Here’s what to focus on:

-

Proven Fintech Experience: Have they actually built payment gateways, lending platforms, or wealth management tools before? Don't be shy, ask for specific case studies and examples.

-

Regulatory Smarts: Ask them how they handle compliance with Canadian regulations like PIPEDA, KYC, and AML. You're listening for a confident, detailed answer, not a vague promise.

-

Security as a Default: What are their standard security practices? They should be able to talk comfortably about end-to-end encryption, regular penetration testing, and secure coding habits. It should be second nature to them.

A true strategic partner doesn’t just wait for you to give them instructions. They’ll challenge your assumptions, offer insights from their own experience in the trenches, and actively help you build a product that’s better, safer, and more competitive.

Evaluating Their Process and Communication Style

Finally, take a close look at how they actually work. A transparent, collaborative process is a huge green flag for a healthy partnership. You need a team that communicates clearly and often, acting as a seamless extension of your own.

Drill down into their workflow with these questions:

-

What's your development methodology? An Agile approach is almost always the best fit for fintech because it allows for flexibility as market needs or regulations shift.

-

How do you manage the project and keep me in the loop? Look for established routines like regular check-ins, clear communication channels, and a dedicated project manager.

-

What happens after we launch? The work isn't over when the app goes live. Ongoing maintenance, security patches, and updates are non-negotiable.

Choosing a development partner is a major commitment. By zeroing in on proven expertise, regulatory know-how, and a transparent process, you'll find a team that can transform your vision into a secure, compliant, and wildly successful fintech product.

Frequently Asked Questions

Jumping into a custom fintech software development project naturally brings up a lot of questions. We get it. To help clear things up, here are some straight-up answers to the questions we hear most often from business leaders. Think of this as your guide to setting realistic expectations for your project's timeline, budget, and potential bumps in the road.

How Long Does It Take to Build a Custom Fintech App?

This is the million-dollar question, and the honest answer is: it depends entirely on the complexity. If you're aiming for a Minimum Viable Product (MVP) with just the absolute must-have features, you're generally looking at a four to six-month timeline. This is a smart way to get your product into users' hands quickly and start learning from their feedback.

On the other hand, if you're envisioning a full-blown platform loaded with advanced analytics, complex third-party integrations, and deep compliance features, the timeline stretches. For something that robust, you should plan for anywhere from nine to eighteen months, sometimes longer. The key here is using an Agile approach, which lets you roll out core functionality first and then build on it in phases, delivering value at every step.

What Are the Biggest Risks in Custom Fintech Projects?

Every software project has its risks, but in the world of fintech, the stakes are considerably higher. From our experience, these are the three biggest pitfalls to watch out for:

-

Compliance Failures: Getting financial regulations wrong, like KYC (Know Your Customer) and AML (Anti-Money Laundering), isn't just a mistake; it can lead to massive fines and completely destroy your credibility.

-

Security Vulnerabilities: A single weak spot in your application's defences can be a gateway for cybercriminals, leading to catastrophic data breaches and financial theft. It’s a constant threat.

-

Uncontrolled Scope Creep: This is when "just one more feature" turns into ten, and suddenly your project is way over budget and behind schedule. It’s a classic project killer if not managed tightly.

The best way to sidestep these issues is to partner with a team that has been down this road before. An experienced fintech developer will bake compliance into the project from day one, run relentless security tests, and use a disciplined Agile process to keep the project scope focused and on track.

Can Custom Software Integrate with Our Existing Systems?

Absolutely, and this is one of the most powerful reasons to go custom in the first place. Your new fintech platform isn't meant to live on an island. Using modern APIs (Application Programming Interfaces), it can be built to talk seamlessly and securely with the systems you already rely on.

This could mean connecting to your core banking platform, syncing data with your CRM, or pulling information from your accounting software. That's why a detailed discovery phase at the very beginning is so important. It allows us to map out all these connections and ensure your new tool fits perfectly into your existing operational puzzle.

Ready to build a secure, scalable financial solution that gives you a real competitive edge? The team at Cleffex Digital Ltd specialises in custom fintech software development, turning complex challenges into powerful, market-ready applications. Start your project with us today.