Insurance claim automation is all about using smart technology, like Artificial Intelligence (AI) and Robotic Process Automation (RPA), to handle a claim from start to finish. It takes the entire process, from the first notice of loss right through to the final payout, and shifts it from slow, manual work to a slick, accurate digital workflow.

The New Reality of Insurance Claims

Think about the old way of filing a claim: stacks of paperwork, endless back-and-forth phone calls, and weeks spent waiting for an answer. That frustrating, labour-intensive model is quickly becoming a thing of the past. Today, the insurance industry is moving toward highly efficient, automated systems that deliver a faster, more reliable, and completely digital experience for everyone.

This shift isn't just about making things easier; it's a strategic move. Insurers in Canada are feeling the heat from a surge in claim volumes, caused by everything from extreme weather events to changing healthcare demands. Before we get into the nuts and bolts of automation, it helps to appreciate the old-school challenges by understanding how to navigate traditional home insurance claims.

To see just how different the two worlds are, let's break it down.

Manual vs Automated Claims at a Glance

This table shows the stark contrast between the old, hands-on approach and the modern, automated system. It's a clear picture of why the industry is making this change.

| Process Step | The Traditional Manual Approach | The Modern Automated Approach |

|---|---|---|

| First Notice of Loss (FNOL) | Phone calls, paper forms filled out by hand. | Digital submission via mobile app or web portal. |

| Data Entry | Staff manually keying in details from forms. | OCR and AI extract and populate data automatically. |

| Claim Triage | An adjuster reviews each file to assign priority. | Algorithms instantly categorise claims based on complexity. |

| Validation & Verification | Manual checks against policy documents. | AI cross-references policy rules in real-time. |

| Fraud Detection | Relies on adjuster experience and gut feeling. | Predictive analytics flag suspicious patterns instantly. |

| Payout Approval | Multiple levels of manual review and sign-off. | Automated approval for straightforward claims. |

| Communication | Phone calls and letters to update the claimant. | Automated SMS, email, and portal notifications. |

| Processing Time | Weeks, sometimes months. | Hours or days for simple claims. |

The benefits of automation are undeniable, moving the process from a slow, error-prone marathon to a quick and accurate sprint.

The Mounting Pressure on Canadian Insurers

The sheer volume of claims is staggering. In 2023, Canadian life and health insurers paid out a massive $36.6 billion in supplementary health claims alone. This puts immense operational strain on insurers, while fraudulent activities quietly drain millions from the system each year, hurting profits and pushing premiums higher for everyone.

In this climate, insurance claim automation becomes more than just a nice-to-have upgrade. It's a fundamental change in how claims are managed. By automating key parts of the process, insurers can hit several critical targets:

Slash processing times from weeks down to days, or in some cases, hours.

Drastically reduce human error in tedious tasks like data entry.

Pinpoint potential fraud with smart algorithms that never sleep.

Lift the customer experience with faster payments and clear, consistent communication.

For the modern insurer, automation isn't just a tool for efficiency. It's the engine that builds resilience, strengthens customer trust, and secures a competitive edge in a tough market.

Ultimately, the goal is to turn the claims department from a cost centre into a strategic powerhouse. This embrace of new technology is a major theme we've explored in our look at InsurTech trends in Canada for 2026. Getting started with automation is the first big step on that path.

Why Automation Is No Longer Optional

In a market moving at digital speed, sticking with traditional, manual claims processing is a losing game. It’s like trying to navigate a new city with a folded paper map while everyone else uses real-time GPS. The old way is simply too slow, too expensive, and too prone to human error to keep up.

This is why insurance claim automation isn't just about small efficiency boosts anymore. It’s a fundamental shift that turns your claims department from a cost centre into a strategic asset – one that actively drives growth and earns customer loyalty. The question has changed from whether you should automate to how fast you can get it done to stay in the race.

Making this leap is about building a more resilient, responsive, and profitable operation. The early movers are already setting a new standard for service, which makes a clear AI adoption in insurance strategy absolutely essential.

Drastically Reducing Operational Costs

The most immediate win from automation is a serious drop in operational spending. Think about it: manual claims handling is a massive time sink. Your team spends countless hours on repetitive work like data entry, document checks, and pulling up policy details.

Automation simply takes over these chores. Robotic Process Automation (RPA) bots can handle data input and validation around the clock, 24/7, without getting tired or making mistakes. This gives your skilled adjusters their time back, letting them focus on what they do best – managing complex cases and negotiating fair settlements.

It also plugs the financial leaks caused by simple human error. One misplaced decimal point or an incorrect policy number can spiral into costly rework, overpayments, or compliance headaches. Automated systems follow the rules every single time, ensuring accuracy and consistency that directly strengthens your bottom line.

Accelerating Claims and Elevating the Customer Experience

For your customers, filing a claim is the moment of truth. It's when your promise is put to the test. A slow, confusing process at a stressful time can break that trust for good. Automation tackles this head-on by dramatically speeding up the entire claims journey.

By getting rid of manual bottlenecks, automation can shrink claim cycle times from weeks to just a few days, or even hours for simple claims. This isn't just about convenience; it's a powerful way to build lasting customer loyalty.

Picture a straightforward car insurance claim. The policyholder snaps a few photos of the damage with their phone and uploads them. An AI system instantly analyses the images, confirms the policy coverage, approves the repair estimate, and triggers the payment – all in a matter of minutes. That kind of seamless, fast experience turns a negative event into a positive one. As we explored in our custom software solutions guide, putting the user first is the key to creating systems people love.

Enhancing Accuracy in Fraud Detection and Risk Assessment

Beyond making things faster and cheaper, automation brings a new level of intelligence to your fraud detection and risk assessment. The traditional approach often leans on the gut feeling of an experienced adjuster, but no single person can possibly cross-reference every claim against millions of data points.

This is where AI and machine learning shine. These algorithms sift through massive datasets in real time, spotting subtle patterns and red flags that are invisible to the human eye. The system can flag a claim that shares characteristics with known fraud schemes, pointing your investigators exactly where they need to look. It’s a proactive defence that helps you stop losses before they happen. The right AI development services can deliver models that get smarter and more accurate with every claim they process.

The results are already here. Canadian insurers using AI-powered automation have reported a 30% reduction in operational costs and up to 50% faster claims turnaround times. These aren't just numbers; they solve core challenges in a market poised for growth, as detailed in this report on claims payout statistics. Ultimately, finding the right strategy and partner, something we know a thing or two about, can transform your claims operation into a genuine competitive advantage.

Understanding the Core Technologies

To really get what makes insurance claim automation tick, you have to look under the bonnet at the engine driving it all. Think of a modern claims platform not as a single piece of software, but as a highly coordinated team of specialists, each with a very specific job. Once you see how these different parts work together, it becomes clear how they can transform a tangled, manual process into something smooth and digital.

Understanding these foundational tools is the first step toward putting them to work effectively. For a wider perspective, it's useful to look at the different kinds of IT process automation software that provide the groundwork for these specialised insurance systems. Each piece of the puzzle is essential for building a claims workflow that's fast, smart, and accurate.

Robotic Process Automation: Your Digital Workforce

Imagine having a team of clerks who work at lightning speed, never make a typo, and never need a coffee break. That's essentially what Robotic Process Automation (RPA) brings to the table. These software "bots" are the tireless digital workers of your claims department, programmed to execute high-volume, repetitive tasks with perfect consistency.

RPA shines when it comes to rule-based work that doesn't need a human's touch or judgment. For example, a bot can be set up to:

Open an email with a First Notice of Loss (FNOL) form.

Pull out key details like the claimant's name, policy number, and the date of the incident.

Log in to your main claims system and kick off a new claim file.

Plug all that extracted data into the right fields.

This kind of grunt work is handled in seconds, freeing up your human adjusters from mind-numbing data entry. It lets them focus on the parts of the job that actually require critical thinking, problem-solving, and a bit of human empathy.

AI and Machine Learning: The Brains of the Operation

If RPA bots are the hands doing the work, then Artificial Intelligence (AI) and Machine Learning (ML) are the brains making the decisions. These aren't just about following simple rules; they're about making smart, predictive judgements based on data. They sift through mountains of historical claims information to spot patterns, predict likely outcomes, and flag weird anomalies that a person might easily overlook.

This intelligence is what powers the most critical functions in modern claims handling. An AI model can look at a new claim and instantly assess its complexity, flagging simple ones for straight-through processing while sending the really tricky cases to your most experienced adjusters. On top of that, ML algorithms are incredibly good at fraud detection, connecting the dots and spotting suspicious behaviours that scream "potential fraud." We get into this more in our post about AI integration in the insurance industry.

Optical Character Recognition: The Universal Translator

Let's be honest, insurance still runs on a mountain of paper, or at least, digital paper. We're talking handwritten forms, scanned repair shop invoices, and dense medical reports. Optical Character Recognition (OCR) is the tech that acts as a universal translator, turning all that messy, unstructured information into clean, structured data that a computer can actually use.

Think of OCR as the crucial bridge between the physical and digital worlds. It takes paper-based info, digitises it, and makes it instantly available to your automated systems, completely removing the manual data entry bottleneck.

A modern OCR tool, often beefed up with AI, can do more than just read text. It understands the context and layout of different documents. That means whether a claimant sends a crisp photo of an invoice or a blurry, scanned PDF, the system can still find and pull out the important stuff: line items, costs, provider details, and feed it right into the automated workflow.

Workflow Engines: The Project Manager

With all these other technologies doing their jobs, something needs to keep them all in sync. That's where a workflow engine comes in. It acts as the project manager, or maybe the conductor of an orchestra, for the entire operation. It's the system that makes sure every task happens in the right order and gets routed to the correct person or system at precisely the right time.

The workflow engine is where you define the business logic for the entire claims journey. It's what says, "Okay, once OCR extracts data from an invoice (Step 1), the AI model needs to validate it against the policy (Step 2), and only then can the RPA bot process the payment (Step 3)." This orchestration guarantees that every single claim follows a consistent, compliant, and efficient path from the moment it comes in to the moment it's closed.

Your Roadmap to Implementing Claim Automation

Jumping into a claim automation project can feel overwhelming, but thinking of it as a roadmap makes it much more manageable. When you break the journey down into clear, strategic phases, you can ensure every decision is deliberate, and every pound is well spent. It’s about building a system that truly aligns with your business goals, not just buying a piece of technology. This structured approach is something we champion for any major tech initiative, as we've detailed in our guide to building custom software solutions.

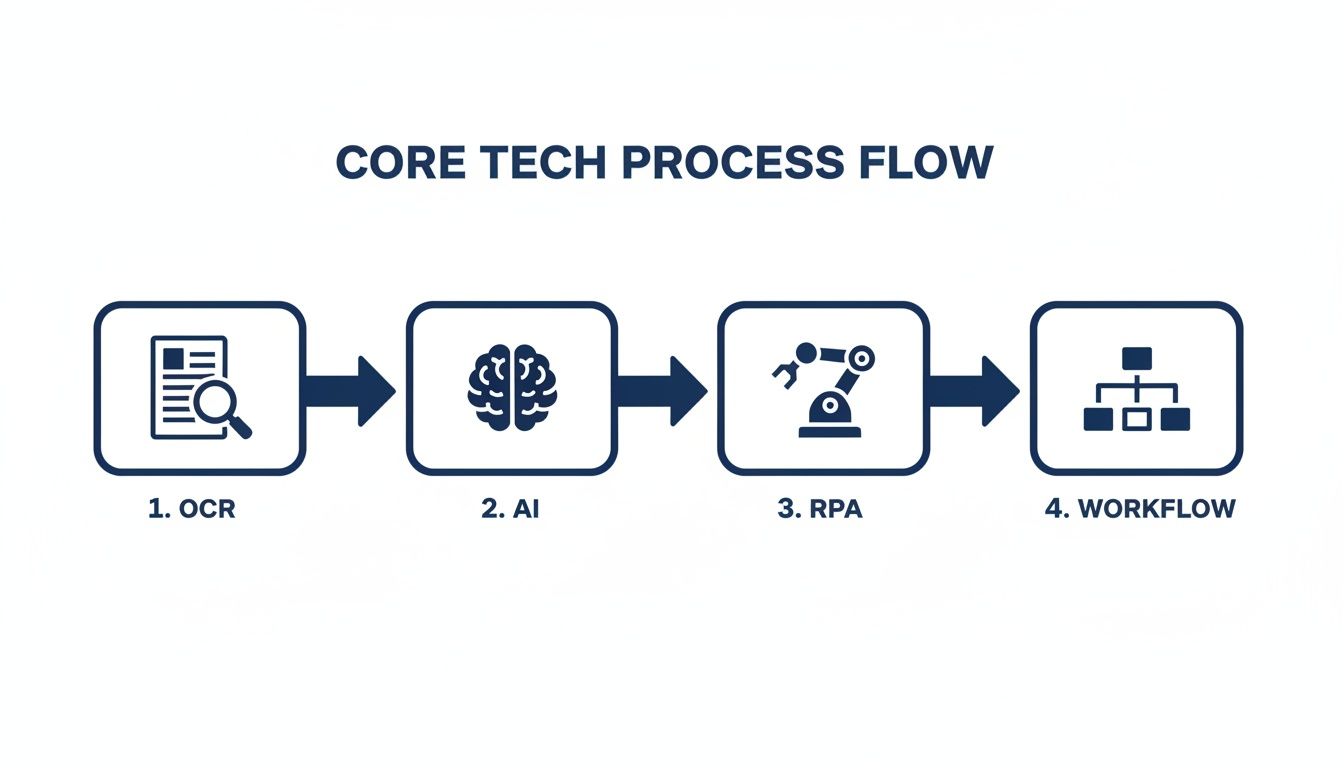

This diagram shows how the core technologies: OCR, AI, RPA, and Workflow, all work together to bring an automated claims process to life.

As you can see, it all starts with capturing the data (OCR), which is then handed off for smart decision-making (AI). A digital workforce (RPA) executes the tasks, while a workflow engine keeps everything moving smoothly.

Phase 1: Assessment and Strategy

The first step is all about discovery. Before you even think about writing code or signing contracts, you need a crystal-clear understanding of where you are right now. This means digging deep to find the real operational pain points in your current claims process.

Where are the biggest logjams? Is it the endless data entry from FNOL forms? Or maybe it's the hours your adjusters lose on repetitive, low-value checks? You need to put numbers to these problems. For instance, calculate the average time spent keying in data for each claim or track the associated error rate.

Once you have a solid grasp of the problems, you can set specific, measurable goals. Vague ambitions like "improve efficiency" won't cut it. You need concrete targets, such as "reduce claim cycle time by 30% for property damage claims under £5,000" or "cut manual data entry errors by 90% within six months." This groundwork ensures your automation efforts are laser-focused on solving real challenges and delivering tangible results.

Phase 2: Pilot Programme and Vendor Selection

With a solid strategy in hand, it’s time to test the waters with a pilot programme. Trying to roll out a massive, organisation-wide change from day one is a recipe for disaster. A much savvier approach is to pick a single, well-defined piece of your claims process for a proof-of-concept (POC).

This could be something like automating the intake and triage for a simple line of business, like auto glass claims. The pilot serves two crucial purposes: it demonstrates the real-world value of automation in your unique environment, and it lets you learn valuable lessons on a smaller, lower-risk scale.

This is also when you’ll choose your technology partner. Look for a vendor with a proven track record in insurance and a genuine understanding of the core technologies. The right partner won’t just sell you software; they'll collaborate with you to configure a solution that fits your specific needs and goals.

Phase 3: Scaled Implementation

After a successful pilot that has delivered a clear return on investment, you're ready to scale up. This is where you apply everything you learned from the POC and begin rolling out the automation solution to other parts of the organisation.

A critical piece of this phase is integration. Your new automation platform has to talk to your existing core systems, like your policy administration system (PAS) and billing platforms. Proper integration is what prevents the creation of frustrating data silos and ensures information flows seamlessly across your entire operation.

Successful implementation is as much about people as it is about technology. This phase must include comprehensive training for your staff, clear communication about how their roles will evolve, and a change management strategy to ensure everyone is on board.

This approach helps turn automation from a disruptive force into an empowering tool for your team.

Phase 4: Continuous Optimisation

Getting your automated system live isn’t the finish line; it’s the start of an ongoing cycle of improvement. In this final phase, the focus shifts to monitoring, measuring, and refining your automated workflows to squeeze every bit of value out of them over the long term.

This means tracking a specific set of Key Performance Indicators (KPIs) that connect directly back to the goals you set in Phase 1. These metrics give you the data-driven insights needed to spot opportunities for further enhancements. The Canadian insurtech ecosystem, with its more than 250 startups, is a constant source of innovation in this space, always pushing the boundaries of what’s possible. It’s this vibrant scene that helps explain why the market is projected to grow at a 6.09% CAGR through 2030. If you want to understand the forces driving this change, you can discover more about the Canadian insurtech landscape and its key players.

Regularly analysing performance data and making iterative tweaks ensures your automation system evolves right alongside your business, constantly delivering better efficiency and a superior customer experience.

To properly gauge the impact of your automation initiatives, it’s essential to track the right metrics. The table below outlines some of the most critical KPIs that insurers should monitor. These numbers provide a clear, data-backed view of how automation is affecting efficiency, cost, and customer satisfaction.

Key Metrics for Measuring Automation Success

| Metric Category | Key Performance Indicator (KPI) | What It Measures |

|---|---|---|

| Operational Efficiency | Claim Cycle Time | The average time from when a claim is opened (FNOL) to when it is closed. |

| Straight-Through Processing (STP) Rate | The percentage of claims processed from start to finish with no human intervention. | |

| Adjuster Caseload | The number of active claims managed by a single adjuster or claims handler. | |

| Cost Reduction | Cost Per Claim | The total operational cost associated with processing a single claim. |

| Manual Rework Rate | The percentage of claims that require manual correction due to errors. | |

| Accuracy & Quality | Data Entry Error Rate | The frequency of errors made during the initial data capture and entry process. |

| Leakage Reduction | The amount of money saved by preventing overpayments or fraudulent payouts. | |

| Customer Experience | Customer Satisfaction (CSAT) Score | A direct measure of policyholder satisfaction with the claims process. |

| Net Promoter Score (NPS) | The likelihood of policyholders to recommend your company to others. |

By keeping a close eye on these KPIs, you can move beyond simply implementing technology and start truly optimising your claims operation for long-term success.

Navigating Compliance and Security in Canada

As exciting as the efficiency gains from insurance claim automation are, they bring a heavy weight of responsibility with them. The Canadian insurance industry is a tightly regulated space, and weaving new technology into your claims process isn't something you can do lightly. This is about more than just plugging in fancy software; it's about embedding that software into a deep-rooted framework of trust, fairness, and legal integrity.

Get this wrong, and you're not just looking at a failed IT project. A misstep in compliance can lead to serious financial penalties, lasting damage to your reputation, and a catastrophic loss of the customer trust you’ve worked so hard to build.

Adhering to Canadian Privacy and Regulatory Standards

At the federal level, the Personal Information Protection and Electronic Documents Act (PIPEDA) is the law of the land for how private companies handle personal data. Every part of your automated system, from data intake to final decision, has to honour these principles. You must ensure data is collected and used only with clear consent and for the right reasons.

But it doesn't stop there. Each province has its own insurance regulators, and they're paying very close attention to how automated systems make decisions. They want to see fairness and transparency in action.

Here are the absolute must-haves on your compliance checklist:

PIPEDA Compliance: Every step in your automated workflow must meet federal privacy laws. No exceptions.

Provincial Oversight: You need to follow the specific rules set by provincial bodies to ensure consumers are treated fairly.

Data Residency: It’s critical to know precisely where your policyholder data lives, particularly if you’re using cloud platforms that might store data outside of Canada.

Audit Trails: Your system must keep a detailed, unchangeable record of every single action and decision. This isn't just good practice; it's your proof of compliance.

Safeguarding Data and Demystifying AI Decisions

Protecting your policyholders' information has to be your top priority. Automation naturally centralises massive amounts of sensitive data, which, frankly, makes you a much bigger target for cybercriminals. A rock-solid security strategy isn't negotiable. For a closer look at what this involves, our guide to cybersecurity in the insurance industry is a great resource. This means everything from end-to-end data encryption to constant vulnerability testing.

Just as important is solving the "black box" problem that often comes with AI. When your AI model flags or denies a claim, you absolutely must be able to explain why. This is what we call model explainability.

Regulators, auditors, and especially your customers will never accept "the computer said no" as a good enough answer. Every automated decision has to be traceable, understandable, and defensible.

This means that even as you bring in sophisticated AI development services, you can't lose sight of the logic behind the decisions. Building this kind of explainability into your models from day one is the key to ensuring your move toward AI adoption in insurance is a sustainable success. Focusing on these security and ethical foundations allows you to build a system that’s not only incredibly efficient but also completely trustworthy. That’s how you cement your reputation as a leader who does things the right way, which is a big part of who we are.

Putting It All Together: Your Path to Automation Success

We’ve walked through the what, why, and how of automating insurance claims. It’s clear this isn't just about shaving a few pounds off operational costs; it's about fundamentally changing how you work. We're talking about shrinking claim cycles from weeks to mere hours and creating the kind of smooth, responsive experience that keeps customers loyal. For any insurer in Canada today, this isn't just a "nice-to-have"; it's a must-have to stay competitive.

But knowing is one thing, and doing is another. The most critical step is turning this understanding into real-world action. And here’s a hard truth: the success of your automation project won't just come down to the software. It will hinge on the people you choose to guide you through the process.

Finding More Than a Vendor – Finding a Partner

Picking a company to help you is a major decision. You’re not just buying a piece of software off the shelf; you're looking for a strategic ally who gets the ins and outs of both technology and the Canadian insurance landscape. This relationship is what will carry you through the tough spots: the complex integrations, the compliance hurdles, and the inevitable challenges of change management.

A real partner has seen it all before. They bring a deep, practical understanding of AI adoption in insurance and have the technical chops to build something that actually works for you. They should be sitting at the table with you, figuring out how the technology aligns with your specific business goals. As we explored in our custom software solutions guide, this kind of close collaboration is what separates successful projects from the ones that never quite get off the ground.

Think of your implementation partner as an extension of your own team – someone who is just as invested in your long-term success as you are. They don't just hand you a platform; they provide the strategic advice needed to turn powerful tech into real, measurable results.

This means you need a team with proven experience in custom AI development services. They’re the ones who can build and tweak the system until it gives you a genuine leg up on the competition.

With the right partner, this whole process shifts from a simple transaction to a shared journey. They'll make sure your new system is not only technically solid but also perfectly positioned to drive growth, boost efficiency, and earn customer loyalty for years to come.

This is the kind of partnership we're built on. When you learn more about us, you'll find we’re not interested in just being another vendor. We're a team dedicated to seeing your business thrive by turning the promise of automation into your everyday reality.

Frequently Asked Questions

When insurers start exploring claim automation, a lot of practical questions come up. We get it. Taking this step is a big deal, so let's tackle some of the most common queries we hear from business leaders just like you.

What’s the First Step to Automating Claims?

Before you even think about technology, you need to look inward. The best place to start is with a deep, honest review of how you handle claims right now. Where are the real logjams? Is it the endless data entry at the start, the back-and-forth of validating a claim, or just keeping policyholders in the loop?

Once you’ve zeroed in on those pain points, you can set some clear, achievable goals. This discovery work is essential. It ensures you’re not just buying fancy software, but actually solving problems that are costing you time and money.

How Does Automation Handle Really Complicated Claims?

This is a great question. While automation is a superstar at handling simple, high-volume claims with straight-through processing, its job with complex cases is a bit different, but just as important. The goal isn't to replace your seasoned adjusters; it's to give them superpowers.

For a complex claim, the system does the grunt work. It gathers all the data, cross-checks the details, and neatly organises everything into a single file for a human expert to review. This frees up your best people to do what they do best: analyse, make tough judgment calls, and negotiate. It’s all about letting technology handle the admin so your experts can focus on the expertise.

Automation ensures your most skilled adjusters focus their efforts where they are needed most: on claims that require nuanced judgment, empathy, and negotiation. This blend of human and machine intelligence is key to an effective claims operation.

Can This Technology Plug Into Our Current Systems?

Absolutely. In fact, if it can't, you should walk away. Any worthwhile insurance claim automation platform is built to integrate smoothly with the systems you already rely on, like your policy administration system (PAS) or billing software.

This connectivity is non-negotiable. It stops important information from getting trapped in different departments and keeps everything flowing smoothly. A good technology partner will have plenty of experience linking modern platforms with older, legacy systems – a common hurdle we break down in our guide to custom software solutions. The new tools should feel like a natural extension of your existing IT setup, not a clunky add-on.

What Kind of ROI Can We Realistically Expect?

The return on investment from automating claims comes from a few different places. First, there are the hard cost savings. Insurers often slash operational costs by up to 30% by cutting down on manual work and catching errors that cause financial leakage.

But the ROI goes far beyond that. Think about speed and loyalty. When you process claims faster, you get happier customers who are more likely to stick around. Better fraud detection also directly protects your bottom line from losses. Embracing strategic AI adoption in insurance isn't just another line item on the budget; it's a direct investment in a more profitable and competitive future. With the right AI development services, you can build a system designed to deliver these returns. To see how we build these kinds of solutions, you can learn more about us and how we’re wired for our clients' success.

Ready to transform your claims processing and get ahead of the competition? At Cleffex Digital Ltd, we specialise in creating powerful automation solutions that deliver real results. Contact us today to schedule a consultation and start your journey towards a more efficient future.