AI-powered SaaS development for insurance requires clarity long before a single line of code is written. Before you even think about writing code, the first and most critical step in building an AI SaaS platform for the insurance industry is to find a genuine, high-value problem that Canadian insurers are desperate to solve. It’s about moving past a general concept to lock down a rock-solid business case that promises a real return on investment. This ensures your platform becomes a must-have, not just a nice-to-have.

Finding Your Niche in the InsurTech Market

Building a successful AI SaaS product means doing your homework first. You need to zero in on a niche where your technology can make a significant, measurable impact. Simply building a tool and hoping someone buys it is a recipe for failure. For many mid-market insurers, the problem isn't a lack of data; it's the struggle to turn that data into actionable insights without sinking endless hours into manual work – an area where AI-powered SaaS development for insurance can deliver immediate value.

A crucial first step is to identify your target audience with precision. Are you building for personal lines carriers? Commercial property and casualty insurers? Or maybe you're focused on the unique challenges faced by managing general agents (MGAs)? Each of these segments has its own distinct pressures, workflows, and pain points.

Uncovering High-Value Problems

Stop guessing what insurers need and start asking. The best way to find a problem worth solving is to talk to the people on the front lines: underwriters, claims adjusters, and brokers. This discovery phase is foundational to AI-powered SaaS development for insurance, because real impact starts with real pain points.

Get specific with your questions to uncover their biggest operational headaches:

Where is manual data entry slowing down critical tasks like underwriting or claims validation?

Which processes are most vulnerable to human error, causing financial leakage?

How can customer interactions be improved with faster, more accurate service?

Often, the biggest opportunities aren't in the flashy, front-end tools. They’re hidden in the “boring” back-office operations where AI-powered SaaS development for insurance can quietly deliver massive efficiency gains. For example, think about an AI tool that can accurately pull and classify data from unstructured documents like broker submissions or First Notice of Loss (FNOL) reports. A tool like that could save an insurer thousands of person-hours a year. That’s a direct hit on the expense ratio, a metric every single insurance executive obsesses over.

The real gold in AI for insurance isn't always in complex predictive models. It's in solving the tedious, expensive, and time-sucking problems that chip away at profitability and frustrate customers.

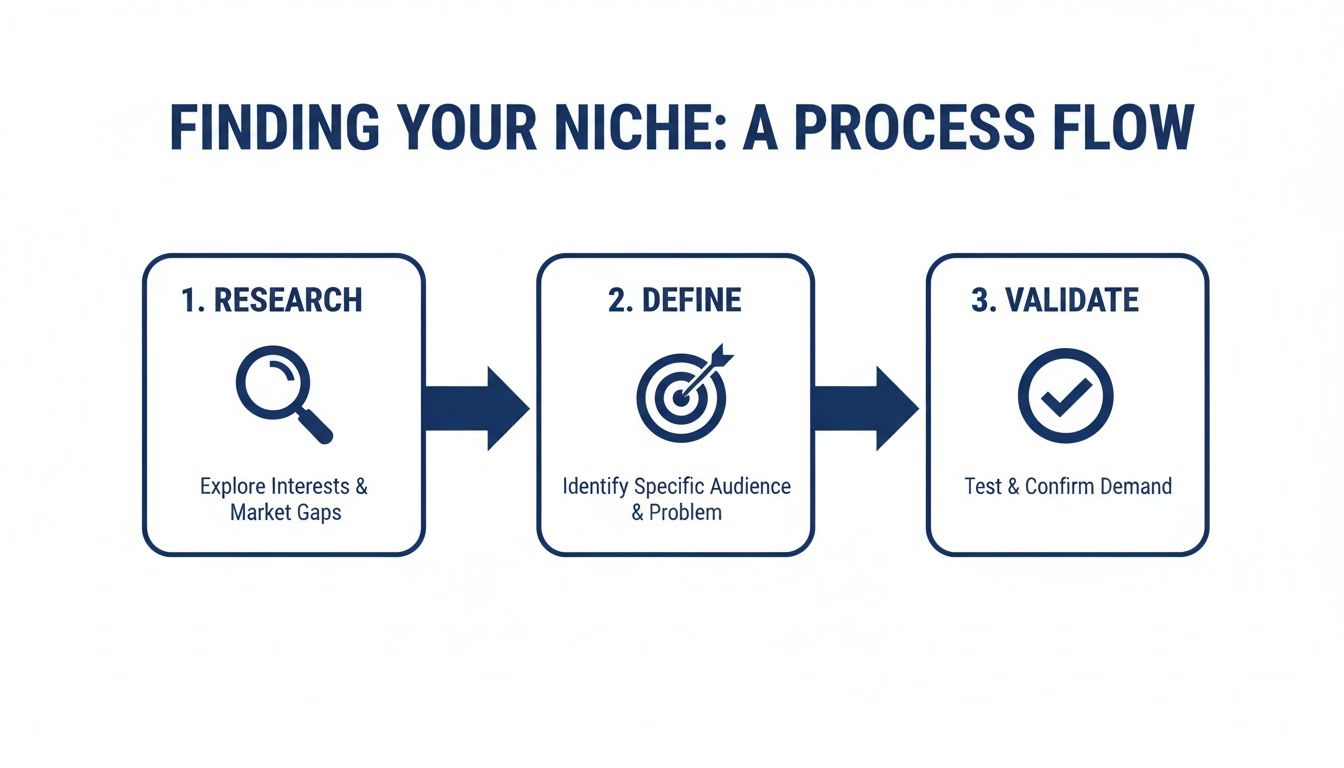

This simple flow is your roadmap to finding a viable niche.

Following this Research, Define, and Validate framework forces you to ground your project in real market demand, which dramatically lowers your risk right from the start.

To help you brainstorm, I've put together a table of high-impact AI use cases that are gaining traction in the industry right now. Each one targets a specific, costly problem.

High-Impact AI Use Cases in Insurance

| AI Use Case | Problem Solved | Target User | Key Success Metric |

|---|---|---|---|

| Automated Claims Triage | Inefficient initial claims routing and assessment leading to delays and high processing costs. | Claims Adjusters, Claims Managers | Reduction in claims cycle time; increased adjuster capacity. |

| Intelligent Document Processing | Manual data extraction from broker submissions, ACORD forms, and FNOL reports is slow and error-prone. | Underwriters, Data Entry Clerks | 90% reduction in manual data entry; improved data accuracy. |

| AI-Powered Fraud Detection | Difficulty identifying subtle patterns of fraudulent claims among thousands of legitimate ones. | Special Investigation Unit (SIU) | Increased percentage of fraudulent claims detected; reduction in false positives. |

| Dynamic Premium Pricing | Static pricing models fail to account for real-time risk factors, leading to uncompetitive quotes or underpricing. | Actuaries, Underwriting Managers | Improved loss ratio; higher quote-to-bind conversion rate. |

Looking at these examples, you can see how a well-defined AI solution directly maps to a tangible business outcome. That’s the key and it sits at the heart of effective AI-powered SaaS development for insurance.

The Scaling Gap in Canadian Insurance

The Canadian insurance market is more than ready for this kind of focused innovation. Right now, about 10.9% of insurance companies have started to implement AI technologies. But here's the catch: there's a huge gap between dipping a toe in the water and diving in.

Only 7% have managed to scale their AI systems across the organisation. That means roughly two-thirds of insurers are stuck in the pilot phase. This is a massive opportunity for SaaS developers building AI-powered SaaS development for insurance to offer scalable, enterprise-grade solutions that help these mid-market players cross that chasm.

Your value proposition needs to be dead simple. Don't sell "AI" – sell a solution. Instead of saying, "our platform uses natural language processing," say, "our platform cuts claims processing time by 30% by automating document analysis." This outcome-first framing is exactly what makes AI-powered SaaS development for insurance resonate with decision-makers who must justify every dollar of technology spend.

To build something that lasts, you also have to keep an eye on what's next. Staying informed on emerging InsurTech trends in Canada for 2026 will give you a strategic edge. By building this solid commercial foundation first, you ensure your platform is not just a technological marvel but a business necessity.

Building a Secure and Compliant Technical Foundation

Let's be clear: when you're building an AI platform for the insurance industry, security and compliance aren't just features on a checklist. They're the absolute bedrock of your entire operation and a non-negotiable pillar of AI-powered SaaS development for insurance. Insurers are custodians of vast amounts of personally identifiable information (PII) and protected health information (PHI). A breach isn’t just a PR nightmare; it’s a direct path to legal and financial ruin.

This means you have to build security from the ground up. Every decision, from the cloud provider you choose to the way you structure your database, has to be made with a security-first mindset. You don't bolt a fortress on at the end; you build one from the very first stone.

Picking the Right Cloud Infrastructure

One of your first big calls will be choosing a cloud provider. While the big three: AWS, Azure, and Google Cloud, all have powerful offerings, each brings strengths that can directly influence the success of your AI-powered SaaS development for insurance strategy.

Amazon Web Services (AWS): This is the market veteran. AWS has an incredibly deep bench of services and battle-tested security tools. The huge talent pool familiar with AWS is also a major plus.

Microsoft Azure: If your target clients are large enterprises already running on Microsoft's stack, Azure is often the path of least resistance. They lean heavily into enterprise-grade security and have a strong compliance story, which can make your life easier during audits.

Google Cloud Platform (GCP): GCP really shines when it comes to data analytics and machine learning. Services like BigQuery and the AI Platform can give your models a serious performance edge.

A crucial point for Canadian operations is data residency. Keeping sensitive data within Canada's borders is table stakes for most insurers. All three major providers have Canadian data centres, but it's on you to configure your services to actually use them and enforce those boundaries.

Here's a common trap I've seen people fall into: assuming the cloud provider handles all compliance. They don't. The provider is responsible for the security of the cloud, but you are 100% responsible for securing what you build in the cloud. Understanding this shared responsibility model is non-negotiable.

Architecting for Growth and Integration

It can be tempting to build a monolithic application to get to market faster, but that's a short-term win that creates long-term pain. For AI-powered SaaS development for insurance, a microservices architecture is a much smarter play for an AI SaaS platform. By breaking your application into smaller, independent services, you can update, scale, or fix individual pieces, like your claims AI or underwriting model, without taking the whole system offline.

This modular design is especially vital when you need to connect with the legacy systems that run the insurance world. Many carriers still depend on core platforms like Guidewire or Duck Creek, and successful AI-powered SaaS development for insurance depends on playing nicely with these established ecosystems rather than trying to replace them outright.

Here's a practical game plan for tackling integration:

Use an API Gateway: This creates a single, managed front door for all requests, directing traffic to the right microservice. It simplifies everything and adds another layer of security.

Build an Anti-Corruption Layer: Think of this as a translator. It's a dedicated piece of software that sits between your modern application and the old system, converting data formats so the legacy structures don't "corrupt" your clean, modern design.

Communicate Asynchronously: Instead of direct, real-time calls that can fail if a legacy system is slow, use a message queue (like RabbitMQ or AWS SQS). This decouples your services, and keeps your AI-powered SaaS development for insurance platform fast, resilient, and responsive – even when older systems struggle.

This approach stops your cutting-edge AI platform from getting bogged down by the limitations of older systems.

Navigating Canada’s Regulatory Maze

In Canada, InsurTech compliance is a tricky mix of federal and provincial laws. You simply can't afford to get this wrong. For teams focused on AI-powered SaaS development for insurance, regulatory readiness must be designed in from the start. The key frameworks to plan for include the Personal Information Protection and Electronic Documents Act (PIPEDA) and, looking ahead, the Artificial Intelligence and Data Act (AIDA).

AIDA is a big deal. It’s set to impose new rules on "high-impact" AI systems, a category that will almost certainly include things like automated underwriting and claims decisions. This makes transparency, fairness, and explainability foundational elements of AI-powered SaaS development for insurance, not optional best practices. Getting a handle on cybersecurity in the insurance industry is critical to grasping the full picture.

Canadian insurance leaders know that while AI offers a massive competitive advantage, it also brings serious risks. In fact, a recent report found that only 32% of businesses feel their current insurance policies properly cover AI-related liabilities. This gap creates a strong opportunity for AI-powered SaaS development for insurance platforms that don’t just enable AI, but also help insurers manage regulatory exposure and compliance obligations.

Your platform has to be engineered from the start to support these principles, making sure every single AI-driven decision can be traced, audited, and explained.

Getting the AI Right: Choosing and Implementing Your Models

With a secure technical foundation in place, we can get to the exciting part: building the intelligence that powers your entire platform. This is where AI-powered SaaS development for insurance truly comes to life. The machine learning (ML) models you choose will directly define what your product can do, how accurate it is, and ultimately, how much value it delivers to insurers.

One of the first big decisions you'll face is whether to use pre-built, off-the-shelf models or go all-in on building custom models from the ground up. There's no single right answer here; the best path depends entirely on your specific use case, budget, and how quickly you need to get to market.

Foundational Models vs. Custom Builds

Think of foundational models, like the ones you can access through Azure AI or AWS, as powerful, pre-trained engines. In AI-powered SaaS development for insurance, these models are invaluable for general-purpose tasks and for getting to market quickly. A pre-built Natural Language Processing (NLP) model, for instance, can start pulling insights from claims documents or customer emails almost right out of the box.

Custom models, on the other hand, are more like finely tuned race cars built for a specific track. They demand a serious investment in data collection, labelling, and training, but for AI-powered SaaS development for insurance, the payoff is often superior accuracy on highly specialised use cases. A custom computer vision model trained exclusively on images of vehicle hail damage will almost certainly run circles around a general-purpose one.

To help you decide, here’s a practical look at the trade-offs:

Speed to Market: Pre-built models give you a huge head start, letting you get a functional prototype into users' hands much faster.

Cost: Custom models require a bigger upfront investment in data scientists and the infrastructure to support them (MLOps).

Accuracy: For a niche insurance problem, a well-trained custom model will usually deliver more precise and reliable results.

Data Availability: If you don't have a large, high-quality dataset, a foundational model is often the only realistic place to start.

Often, the smartest approach in AI-powered SaaS development for insurance is a hybrid strategy. You can launch with a foundational model to get moving and then gradually refine it or replace it entirely with a custom version as you gather more of your own data.

Matching the Right Model to the Right Insurance Task

Choosing the right type of ML model is absolutely critical. You need to make sure its function aligns with the business problem you're trying to solve. I’ve seen teams try to use a regression model for a classification task, and it just leads to poor, unusable results.

Here are some common scenarios you’ll likely encounter when building an AI SaaS for insurance:

| Model Type | A Common Insurance Use Case | Why It's the Right Fit |

|---|---|---|

| Classification | Fraud Detection: Is this claim fraudulent or legitimate? | Perfect for sorting things into distinct categories (e.g., fraud/not fraud) based on learned patterns. |

| Regression | Premium Pricing: What's the expected loss for a new policy? | Ideal for forecasting a continuous number, like a claim cost or a customer's lifetime value. |

| Clustering | Customer Segmentation: Find groups of policyholders with similar risk profiles. | Works with unlabelled data to spot natural groupings, helping uncover hidden segments for marketing or underwriting. |

| Natural Language Processing (NLP) | Claims Analysis: Pull key details from adjuster notes or FNOL reports. | Specialised in understanding human language, turning mountains of unstructured text into structured, usable data. |

Getting a feel for the strengths of each model type is fundamental. For a deeper look, checking out resources on machine learning in the insurance industry can give you great context on how these tools are applied in real-world AI-powered SaaS development for insurance today.

A simpler, well-understood model that delivers consistent value is always better than a highly complex "black box" that no one on your team can explain or maintain. You should always prioritise reliability and interpretability, especially for high-stakes decisions like flagging fraud.

Why MLOps Can't Be an Afterthought

Getting a model into production isn't the finish line; it's just the start. This is where MLOps (Machine Learning Operations) comes in. In AI-powered SaaS development for insurance, MLOps is what keeps models accurate, reliable, and relevant over time. Without a solid MLOps strategy, even the best models will slowly lose their edge as real-world data changes.

A few MLOps practices are simply non-negotiable:

Continuous Monitoring: You need to actively track your model's performance on metrics like accuracy, precision, and response time. Set up alerts for "data drift," which happens when the data you're seeing in production starts to look different from the data the model was trained on.

Automated Retraining: Build pipelines to automatically retrain your models on fresh data at regular intervals. This is how they adapt to shifting market conditions and customer behaviours.

Versioning: Just like you version your code, you must version your models and the datasets they were trained on. This is your safety net, allowing you to roll back to a previous version if a new one starts misbehaving.

For more advanced tools, especially those using large language models, you'll want to explore techniques like mastering AI search chunking for RAG accuracy, which can make a huge difference in performance by optimising how the model finds information. A mature MLOps framework transforms AI-powered SaaS development for insurance from a one-off experiment into a continuously improving business capability.

Designing an Experience That Insurance Teams Will Actually Use

Let's be blunt: the most sophisticated AI on the planet is worthless if your users find it confusing or a pain to use. For the underwriters, claims adjusters, and brokers on the front lines, any new tool has to prove its value immediately. It can't force them to completely relearn a job they've been doing for years.

This is where user experience (UX) and user interface (UI) design become absolutely critical for AI-powered SaaS in insurance. They are the bridge between your complex algorithms and getting people to actually adopt and benefit from the technology.

The goal isn't to build something flashy. It's to design a system that slips so seamlessly into an insurance professional's daily grind that it feels like a natural extension of their own expertise. If an underwriter has to navigate ten different screens just to find an AI-generated risk score, they'll simply go back to their old spreadsheet. I've seen it happen.

Turning AI Insights into Usable Dashboards

One of the biggest mistakes I see is just dumping raw AI outputs onto the screen. An underwriter doesn't need to see a probability distribution curve from your model. What they need is a clear, colour-coded risk indicator with a simple, plain-language explanation of what’s driving that assessment.

Your design has to prioritise clarity and context above all else. Imagine a risk analysis dashboard for commercial property insurance. Instead of a data dump, it could feature:

A single, prominent "Composite Risk Score" (e.g., 78/100).

A bulleted list of the key contributing factors, like "Property located in a high-risk flood zone" or "Outdated electrical wiring flagged in inspection reports."

Actionable recommendations surfaced by the AI, such as "Suggest requesting an updated electrical inspection" or "Apply a 15% premium adjustment for flood risk."

This approach transforms a complex machine learning calculation into a straightforward decision-support tool. It answers not just "What's the risk?" but more importantly, "Why is it risky, and what should I do about it?"

Enhance Workflows, Don’t Replace Them

The most effective AI-powered SaaS development for insurance empowers existing processes; it doesn't try to bulldoze them and start from scratch. Your design must respect the deep institutional knowledge that insurance professionals bring to the table. Think of your SaaS platform as a trusted co-pilot, not an entirely new and unfamiliar vehicle.

Take a claims adjuster's workflow. An AI tool shouldn't just present a folder full of analysed documents. A much better approach is to integrate directly into their existing claims management system. The tool could automatically highlight suspicious phrases in a claimant's statement or flag inconsistencies between a repair estimate and photos of the damage, right where they're already working.

The real test for good UX in InsurTech is simple: does the user feel smarter and more efficient? The technology should fade into the background, making the professional the hero by amplifying their skills.

Key UX Considerations for Different Insurance Users

Different roles have different needs, and a one-size-fits-all interface will just end up frustrating everyone. Tailoring the experience is essential for getting buy-in across the organisation.

The table below breaks down what matters most to the key players in an insurance operation.

| User Role | Primary Goal | Essential UI Feature | Common Pain Point to Solve |

|---|---|---|---|

| Underwriter | Accurately assess and price risk. | An integrated risk dashboard with explainable AI insights. | Sifting through dozens of unstructured documents for critical data points. |

| Claims Adjuster | Validate and process claims efficiently and accurately. | A streamlined workflow with automated fraud alerts and document summaries. | Manually cross-referencing information across multiple systems and reports. |

| Broker/Agent | Find the best coverage for a client quickly. | A fast, intuitive quoting engine with AI-suggested coverage options. | Slow turnaround times from carriers on complex or non-standard quote requests. |

| Manager | Monitor team performance and identify bottlenecks. | A high-level analytics view with drill-down capabilities. | Lack of real-time visibility into operational efficiency and pending tasks. |

When you focus on these user-centric design principles, you start building trust from day one. When insurance teams see that your AI platform genuinely makes their difficult job easier, faster, and more accurate, adoption stops being an uphill battle and becomes a natural, welcome change.

Taking Your Product to Market and Getting Paid

So, you've built a fantastic AI platform. That's the first mountain climbed. Now for the next one: convincing an industry known for its cautious nature to actually buy it. In AI-powered SaaS development for insurance, your go-to-market (GTM) and pricing strategies are every bit as critical as your code, and they demand just as much careful planning.

When you're selling to insurers, you have to remember who's in the room. They're not buying "AI"; they're buying business outcomes. A winning sales story in AI-powered SaaS development for insurance rests on three pillars: a clear return on investment (ROI), bulletproof security, and airtight regulatory compliance. Ditch the tech jargon and start talking about boosting operational efficiency, slashing loss ratios, and giving them a real edge over the competition.

How Should You Price It?

Picking a pricing model isn't just about slapping a number on your service. It needs to make sense for how insurance companies operate and budget. In AI-powered SaaS development for insurance, the wrong pricing model can kill a deal before the demo.

Let's look at the common approaches in the InsurTech space:

Per-User Subscription: This one is easy to understand (e.g., $150 per underwriter, per month). It’s a good fit for tools used daily by a defined group of people. The downside? It can get really expensive for large teams, which might put a cap on how big your deals can get.

Usage-Based Tiers: This is a smart way to go because it ties your price directly to the value you create. Think pricing based on the number of claims processed or policies analysed. Insurers love this because the cost scales with their business, making it a much easier "yes" for an initial investment.

Platform Fee + Add-ons: Here, you offer a base subscription to get them in the door, with extra features like advanced fraud detection or sophisticated analytics available as paid add-ons. This gives you a lower barrier to entry and creates natural opportunities to grow the account over time.

Honestly, for most AI platforms, a hybrid model is the sweet spot. A modest base platform fee gives you predictable revenue, while usage-based pricing for the core AI functions ensures the client only pays for the value they're getting. It’s a win-win.

Selling a Story That Sticks

Your sales pitch has to anticipate and answer all the tough questions before they’re even asked. In AI-powered SaaS development for insurance, you need to build your story on hard data and tangible results, not just vague promises about what your AI could do.

Your tool doesn't just scan documents; it frees up underwriters to focus on high-value, complex risks. It doesn't just flag a claim; it directly protects the company's bottom line from millions in potential fraud. You have to frame every feature as a direct solution to a major business headache.

The best way to start is by getting a few pilot partners on board. Find a couple of forward-thinking, mid-market insurers and offer them a limited-time, low-cost trial. Your goal here isn't revenue; it's to create powerful, real-world case studies. A testimonial from a respected competitor showing a 25% reduction in claims processing time is worth more than any marketing brochure you could ever design.

When you finally get in front of the decision-makers, lead with the ROI. Have a conservative, easy-to-understand calculation ready to show them exactly how your platform pays for itself. Then reinforce that value with a clear explanation of your security controls and how your AI-powered SaaS development for insurance approach supports compliance with PIPEDA and the upcoming AIDA.

Finally, you need to know who you're selling to. The insurance market isn't a monolith. Some carriers are still dipping their toes in the water with small pilot budgets, while others are making serious investments. Some insurers are 'locked into pilots' with annual AI spending under $5 million, while a growing segment is engaging in 'broad experimentation at limited scale', investing between $5 million and $25 million annually. This signals a huge appetite for enterprise-ready AI platforms that can deliver undeniable financial returns. To dig deeper into this trend, you can learn about the latest findings in finance AI adoption.

Your GTM strategy has to be laser-focused on these bigger players, with a story that proves you’re not just another vendor – you’re a scalable, secure, and essential partner for their future.

Frequently Asked Questions About AI SaaS in Insurance

If you're building an AI SaaS platform for the insurance industry, you'll find that certain questions come up again and again. Whether you're in a boardroom with potential clients, pitching to investors, or even just aligning your own team, being ready for these tough questions is non-negotiable.

Having solid, well-thought-out answers doesn't just show you've done your homework; it builds the trust you need to get your project off the ground. Let's walk through the big ones.

How Do You Guarantee Our Data Is Secure and Private?

This is almost always the first question you'll get from an insurer, and for good reason. A data breach involving sensitive policyholder information is an existential threat. Your answer has to go beyond just listing technologies; it needs to show that security is baked into the very core of your company culture and platform design.

You need to convey a multi-layered security strategy that they can understand and trust.

Data Encryption: Start with the basics. Explain that all data, whether it's sitting in a database (at rest) or moving between systems (in transit), is locked down with industry-best encryption protocols like AES-256.

Strict Access Controls: Talk about your use of Role-Based Access Control (RBAC). The goal here is simple: people should only ever see the information absolutely essential to their job. An underwriter has no business accessing the same system logs as one of your DevOps engineers, and your platform enforces that.

Compliance by Design: In Canada, you need to show you’re on top of the regulatory landscape. Mention that your platform is built to align with PIPEDA from day one. It's even better if you can show you're forward-looking by designing for emerging rules like the Artificial Intelligence and Data Act (AIDA). This demonstrates you're a long-term partner, not just a vendor for today.

A great way to wrap this up is to talk about the principle of least privilege. It's a simple concept that resonates well: every component of your system, from a user account to a microservice, only has the bare minimum permissions it needs to function. This dramatically shrinks the potential attack surface.

What’s the Real Return on Investment Here?

Insurance is a numbers game. Executives live and die by their financial metrics, so vague promises about "efficiency" are going to fall flat. You need to draw a straight, quantifiable line from adopting your SaaS to a healthier bottom line.

Your entire ROI conversation should be framed in the language they speak every day.

Forget selling AI features. You're selling a lower expense ratio, a better loss ratio, and a faster path to profitable growth. That's what gets a deal signed.

Get specific and connect your product directly to their key performance indicators:

Operational Efficiency: Instead of saying "we save time," say, "Our platform automates 80% of the manual data entry in the underwriting submission process. That lets each of your underwriters handle 25% more policies without burning out or sacrificing quality."

Reduced Claims Leakage: Talk in dollars and cents. "In pilot programs with mid-sized carriers, our fraud detection model flagged an extra $1.2 million in suspicious claims annually, money that goes directly to protecting their loss ratio."

Faster Speed-to-Quote: Link speed to revenue. "Brokers using our tool can generate complex, accurate quotes in minutes, not days. For our early partners, that's translated to a 15% lift in their quote-to-bind ratios."

Using concrete numbers, even from early-stage pilots, makes the value real. It moves your solution from the "cost" column to the "investment" column in their minds.

How Will This Integrate with Our Core Systems?

Let's be realistic: no insurer is going to rip out their core systems like Guidewire or Duck Creek just for you. Your product has to play nicely in their existing, often complex, IT sandbox. This question is a test of your technical chops and your understanding of the real-world insurance environment.

A convincing answer will centre on flexibility and a modern, services-based approach. The term to use is microservices architecture, as it immediately signals that your platform is built for robust, independent, and maintainable integrations.

Drill down into your integration strategy:

Robust APIs: You need to offer a well-documented, secure REST API. This is the two-way street that allows their systems to both send data to your platform and pull critical insights back out.

The Anti-Corruption Layer: This is a more advanced technical concept, but it's powerful to mention. It's essentially a smart buffer you build between their legacy system and your modern application. It translates data formats on the fly, protecting your platform’s clean design from the quirks of their older systems.

Asynchronous Communication: Explain how you use tools like message queues. This ensures that even if one of their core systems is slow or temporarily down, your platform remains snappy and responsive for its users. It decouples the systems, so a problem on their end doesn't become a problem on yours.

Providing this level of technical detail shows them you've already thought through the messiness of enterprise IT. You're not just selling a product; you're providing a solution that won't create a massive integration headache for their team.

Ready to build an AI-powered platform that solves real problems for the insurance industry? The team at Cleffex Digital Ltd specialises in developing secure, scalable, and compliant software that delivers measurable ROI. Let's discuss how we can turn your vision into a market-leading solution. Explore our custom software development services today.