For small and medium-sized insurers, the idea of integrating artificial intelligence isn't some far-off, futuristic concept anymore. It's happening right now, and it's essential for keeping up. This is about making a fundamental shift from slow, manual, and reactive ways of working to automated, predictive, and proactive strategies. The goal is to use AI to get more efficient, deliver a better customer experience, and simply make smarter decisions backed by solid data.

Why AI Is No Longer an Option for Insurers

For decades, the insurance industry ran on time-tested principles. You could think of a traditional insurer as being a bit like a neighbourhood watch: relying on past experience, manual paperwork, and local knowledge to protect its community. That model worked well enough for a long time, but it’s struggling to keep pace in today's world.

An AI-powered insurer, on the other hand, operates more like a high-tech security firm. It uses predictive analytics to see risks before they even materialise, has automated systems monitoring everything 24/7, and provides instant, personalised service to its clients. This isn't just a minor upgrade; AI integration in insurance transformation is a complete reimagining of what an insurer can be.

The Pressures Forcing Change

So, what's pushing insurers to make this change? A few powerful forces are at play, making the old way of doing things a serious business risk.

Here are the key drivers:

Soaring Customer Expectations: People are now used to the slick, instant service they get from Amazon or Netflix. They expect the same from their insurer – fast quotes, anytime support, and claims settled in hours, not weeks.

Crippling Operational Bottlenecks: Manual data entry, endless underwriting reviews, and convoluted claims processing create huge delays and drive up costs. These old-school inefficiencies eat into profits and frustrate customers.

Intense Market Competition: New Insurtech start-ups, built on AI from day one, are jumping into the market. With lower overheads and slick digital platforms, they can offer competitive pricing and personalised policies that legacy insurers find hard to match.

The bottom line is this: insurers who don't modernise are going to be left behind, unable to compete on price, speed, or service. AI directly tackles the core operational headaches that have plagued the industry for years, turning them into real opportunities for growth.

This guide is your practical roadmap. We’ll break down the complexities into clear, actionable steps to help small and medium-sized insurers get started, harness the power of AI, and secure their place in the future of insurance.

Putting AI to Work in Your Insurance Operations

It’s one thing to talk about the theory behind AI, but the real magic happens when you see it delivering actual results. Let's move past the buzzwords and look at how AI is solving some of the biggest operational headaches for insurers.

Think about a typical car insurance claim. In the past, this was a marathon of phone calls, endless paperwork, and weeks of waiting. Today, AI is completely flipping that script, making the entire experience faster, more accurate, and far less painful for the customer.

Reshaping the Claims Journey

The new process kicks off the moment an accident happens. Your policyholder can pull out their smartphone, snap a few photos of the damage, and upload them directly to your app.

This is where AI-powered image recognition takes the stage. These models, trained on millions of accident photos, get to work instantly. They can assess the damage, figure out which parts need fixing or replacing, and spit out an initial cost estimate in minutes. Just like that, you've eliminated the long wait for an adjuster to even see the vehicle.

From there, AI chatbots can handle the communication. These bots are on call 24/7, providing real-time updates, answering common questions, and walking the policyholder through what comes next. This frees up your human agents to focus on the tricky, complex cases that truly need their expertise, all while keeping the customer in the loop.

AI doesn't just make the process faster; it makes it smarter. By automating the initial damage check and routine back-and-forth, insurers can settle claims in hours, not weeks. That's a huge win for customer satisfaction.

Finally, automated systems can process the claim documents, confirm policy details, and even trigger the payment to the repair shop or the policyholder. A journey that used to be full of friction is now a smooth, mostly automated workflow.

Creating Fairer and Faster Underwriting

Claims are just the beginning. AI is also completely changing how insurers weigh and price risk. Traditional underwriting has always relied on historical data and broad demographic buckets, a method that can sometimes feel like a blunt instrument, leading to imprecise pricing.

AI-driven underwriting, on the other hand, can analyse thousands of data points at once. We're talking about everything from telematics data on driving habits and property records to local weather patterns. Machine learning models chew through this information to build a highly detailed and accurate risk profile for every single applicant.

This level of precision brings some clear advantages:

More Accurate Pricing: Policyholders get premiums that truly reflect their individual risk, rather than being lumped into a generic category.

Reduced Manual Work: Underwriters can stop drowning in routine data entry and focus their brainpower on the complex cases that demand human judgment.

Faster Quoting: Customers get accurate, personalised quotes in minutes, which makes for a much better first impression.

This move towards data-driven accuracy helps insurers build a healthier, more profitable book of business. For a closer look at the mechanics, you can get more details on insurance automation using AI here.

Proactively Detecting and Preventing Fraud

Fraud has always been a costly thorn in the industry's side. AI gives us a powerful new toolkit to fight back. Machine learning algorithms can sift through an insurer’s entire claims history, spotting subtle patterns and red flags that a human team would almost certainly miss.

These systems can flag suspicious links between claimants, repair shops, and medical providers, or pinpoint claims that just don't look right. A key area where AI can make a real difference is by adopting a biometric-first approach to reduce fraud risk, stopping financial losses before they happen. By flagging high-risk claims early, you can focus your investigative resources where they'll have the most impact.

In the Canadian insurance sector, this isn't just a passing trend; it's a massive shift. The digital insurance market is projected to hit USD 169.2 billion by 2026, with AI in claims, underwriting, and fraud detection leading the charge. For small and medium-sized insurers, this means affordable AI tools can help them update old systems, slash claims handling times by up to 30%, and compete with the big players.

Measuring the True Business Impact of AI

Putting money into new technology is a big move, and proving its worth means going beyond just saying it makes things "more efficient." To really justify bringing AI into your insurance operations, you have to connect the tools directly to the financial and operational numbers that actually matter to your business. It's about translating what AI does into a language everyone, from the operations team to the boardroom, can get behind.

The trick is to draw a straight line from specific AI applications to tangible key performance indicators (KPIs). When you can show exactly how a new automated system lowers a specific cost or speeds up a critical process, the value of that investment becomes crystal clear. This data-first approach shifts the conversation from abstract potential to concrete results.

Connecting AI to Core Insurance Metrics

Let’s get practical and look at how this works in two core areas of insurance: claims and underwriting. Each has its own set of metrics that can be seriously improved with the right AI tools.

For claims automation, the impact is immediate and measurable. When you use AI to analyse damage photos or process documents automatically, you aren't just saving time; you're actively lowering your Loss Adjustment Expense (LAE) Ratio – the metric that tracks the cost of investigating and settling claims. At the same time, that speed boost shortens your Claims Settlement Times, which is a huge driver of customer satisfaction.

When it comes to underwriting, the story is all about precision and profitability. An AI model that prices risk more accurately does more than just set fairer premiums.

It directly improves your Combined Ratio, the fundamental measure of an insurer's profitability, by making sure the premiums you collect are better matched to the risks you're taking on. This precision also helps clean up the application process, cutting down the Customer Acquisition Cost by making it faster and easier to bring new, profitable policyholders on board.

Mapping AI Tools to Business Outcomes

To make this truly practical, it helps to map the direct line from an AI function to its business benefit and the specific KPI you should be tracking. A structured approach ensures you're measuring what really matters and can clearly demonstrate the return on investment (ROI). Using predictive analytics can also offer much deeper insights into what to expect down the road. For more on this, you can explore how to apply predictive analytics in Canadian insurance operations.

The table below provides a clear framework for decision-makers looking to build a strong case for AI initiatives within their organisations.

Mapping AI Applications to Key Business Metrics

This table illustrates the direct link between specific AI applications in insurance and the key performance indicators (KPIs) they improve, helping businesses measure their return on investment.

| AI Application | Primary Business Benefit | Key Performance Indicator (KPI) to Track |

|---|---|---|

| AI Claims Automation | Reduced manual processing and faster settlements. | Loss Adjustment Expense (LAE) Ratio, Claims Cycle Time |

| AI-Powered Underwriting | More accurate risk assessment and pricing. | Combined Ratio, Loss Ratio, Customer Acquisition Cost |

| AI Fraud Detection | Early identification of suspicious claims patterns. | Fraud Detection Rate, Claims Denial Rate (for fraud) |

| Customer Service Chatbots | 24/7 support and instant query resolution. | Customer Satisfaction (CSAT) Score, First Contact Resolution Rate |

By focusing on these connections, you're not just buying technology; you're making a strategic investment in better, more profitable business outcomes.

Building Your AI Implementation Roadmap

Jumping into an AI project can feel overwhelming, but you don't need to rebuild your entire company from the ground up. For most small and medium-sized insurers, the best path forward is a practical, phased roadmap. This approach breaks the journey down into manageable chunks, letting you build momentum and show real value right from the start.

Instead of trying to launch a massive, company-wide AI system all at once, think of it like starting a small, controlled fire. You begin with a single, well-chosen log, that one process causing endless friction, and get it burning brightly before adding more fuel. This methodical strategy keeps risk low and builds internal confidence.

Phase 1: Discovery and Strategy

The first step isn’t about technology at all; it’s about finding the real pain points in your operations. The goal is to identify one specific back-office process that's repetitive, slow, and a constant source of frustration. Is it the manual data entry for new policy applications? Or maybe the initial triage of simple, low-value claims?

This process becomes the candidate for your pilot project. Choosing the right starting point is everything. It needs to be a process where success is easy to measure and has a clear, positive impact on a team's daily workload. A quick win here is the proof you need to get broader support for what comes next.

This is where you lay the foundation.

Identify the Bottleneck: Go talk to your teams. Where are the biggest delays and inefficiencies? Look for tasks that are rules-based and data-heavy – these are perfect candidates for automation.

Define Success: What does a win actually look like? Is it cutting the time to process a document from 15 minutes down to 15 seconds? Or is it boosting data accuracy by 95%? Set clear, simple metrics.

Secure Stakeholder Support: Get a key leader or team manager on board. Their enthusiasm is crucial for pushing the project forward and encouraging people to adopt the new tool.

Phase 2: Readiness and Preparation

Once you’ve picked your target process, the next phase is about getting your house in order. This means preparing your data and selecting the right tech without a huge upfront investment. Think of it as gathering your ingredients before you start cooking.

Your data is the fuel for any AI system. It doesn’t have to be perfect, but it does need to be accessible and reasonably organised. For a pilot project, you might only need to focus on a specific dataset, like all claims forms filed in the last 12 months.

The goal here is to create a clean, well-defined sandbox for your pilot. By concentrating on a single process, you avoid the monumental task of trying to organise all of your company's data at once.

This is also when you choose your technology. For a first project, you don't need a complex, enterprise-wide platform. Look for specialised tools or partners that offer solutions for your specific problem, like intelligent document processing or a simple claims-triage chatbot. A smaller, more targeted solution is almost always faster to implement and delivers a quicker return.

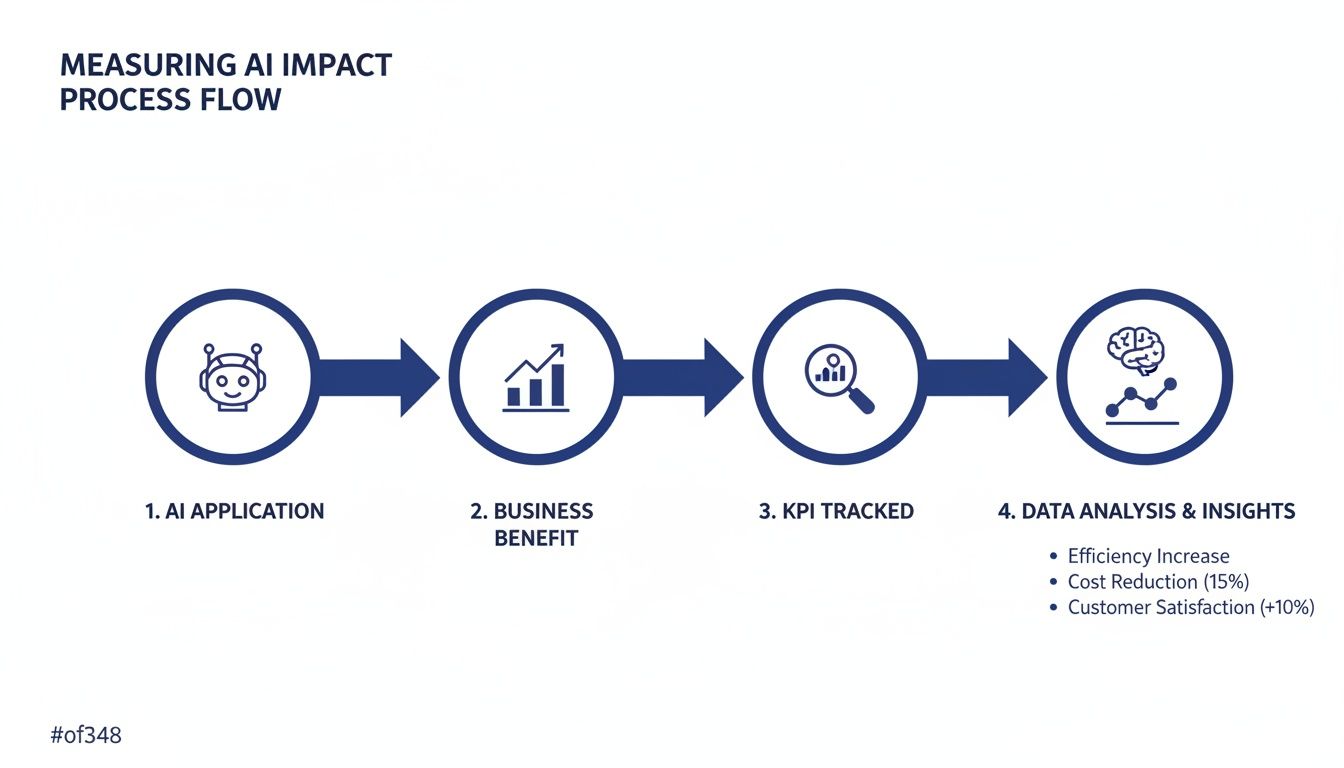

The diagram below shows how to connect your AI application to a clear business benefit and track its impact through specific KPIs.

This flow really drives home the importance of linking every AI tool to a measurable business outcome. It’s the only way to be sure your investments are delivering real value.

Phase 3: Pilot and Scale

With your process chosen and your data ready, it's time for a small-scale test. The pilot should be time-bound, maybe 30 to 60 days, with a small, dedicated group of users. This controlled experiment lets you work out any kinks and get real-world feedback without disrupting your entire operation.

During the pilot, keep a close eye on the success metrics you defined back in Phase 1. Is the AI tool actually delivering the speed and accuracy you hoped for? The results from this test will form the business case for a wider rollout.

Just as importantly, this phase is where you manage the human side of change. It’s your chance to show the team that AI is a tool to help them, not replace them. Involve them, provide training, and celebrate the small wins. This helps build a culture that embraces new technology instead of fearing it. A striking 73% of Canadian businesses have not yet explored AI, creating a huge opportunity for proactive insurers to gain a serious competitive edge. You can learn more about how Canadian insurers are succeeding with AI implementation.

Once your pilot proves successful, you can confidently create a plan to scale the solution to other teams or move on to tackling the next operational bottleneck on your list.

Choosing the Right Partners and Ensuring Governance

Bringing powerful AI into your operations isn't just a tech upgrade; it comes with serious responsibility. To get AI integration right, you have to strike a careful balance between pushing for innovation and maintaining solid governance and ethical oversight. Without a clear framework, even the most impressive technology can create new risks, damage customer trust, and put you in the regulators' crosshairs.

Think of it like this: a self-driving car needs more than a powerful engine to be safe. It needs guardrails on the road, clear traffic laws, and the ability for a human to take the wheel. Your AI systems need the same thing: a strong governance structure to guide their decisions and make sure they operate fairly and transparently.

Establishing Robust AI Governance

Good AI governance begins with being honest about the potential downsides, especially algorithmic bias. If your AI model learns from historical data that reflects old, human biases, it will almost certainly learn to repeat them. This can lead to seriously unfair outcomes in things like premium pricing or claims decisions.

The best way to guard against this is to implement a ‘human-in-the-loop’ system. This simple principle means that a human expert always reviews and signs off on the AI's recommendations for any critical decision. It acts as an essential safety net, keeping accountability where it belongs and allowing for the kind of common-sense judgement an algorithm simply can't replicate.

Building trust also comes down to how you handle data. As an insurer, you're the custodian of a massive amount of sensitive customer information, and protecting it is absolutely non-negotiable. We've written a detailed guide on this, which you can read here: AI and data privacy in insurance explained. Following the rules and being upfront with customers about how their data is used is fundamental to keeping them loyal.

An AI system is only as good as the rules it follows. Establishing clear ethical guidelines and compliance checks from day one isn't just about ticking a regulatory box; it's a core part of building a successful, sustainable business.

Selecting the Right Technology Partner

For a small or medium-sized insurer, the right partner can be the single biggest factor for success. The market is flooded with vendors promising the world, but they aren't all the same. The first step is finding someone who truly gets the unique challenges you face in the insurance industry.

A great partner doesn't just sell you a product; they act as a strategic guide. They should be willing to roll up their sleeves and really dig into your specific operational headaches before they even start talking about solutions. This focus on a custom fit, rather than a generic one-size-fits-all product, is what separates the good from the great.

When you're vetting potential partners, keep this checklist in mind:

Proven Industry Experience: Can they show you a track record of successful projects with other insurers like you? Ask for case studies and references that prove they understand insurance workflows and compliance.

Focus on Customisation: Is their first instinct to tailor a solution to your specific needs? A partner who leads with questions about your challenges is more likely to deliver real, tangible value.

Commitment to Ongoing Support: AI isn’t a ‘set it and forget it’ tool. You need a partner who will stick around to provide continuous support, monitor the models, and help you scale as your business grows.

Cultural and Collaborative Fit: Do you get a good feeling from them? Clear communication and a collaborative spirit are the bedrock of a strong partnership built on trust and a shared vision.

Here in Canada, this strategic approach is already paying off. A CGI study found that while 84% of Canadian insurers have internal AI strategies, only 51% have started applying them externally. That's a huge opportunity for growth. By teaming up with agile development firms, insurers are closing this gap, using AI to improve everything from risk modelling to claims automation, all while staying ahead of regulatory changes planned for 2025-2027. Making a well-informed, secure decision on your technology partner is one of the most important decisions you'll make for the future of your business.

Taking Your First Step Towards an AI-Powered Future

The idea of bringing AI into your insurance operations can feel like a massive undertaking, but the journey doesn't start with a giant leap. It begins with a single, smart step. Real modernisation is all about making small, incremental changes that build momentum, deliver quick wins, and show everyone in your organisation just how valuable this technology can be.

For most small and medium-sized insurers, the best places to start are the most obvious ones. Just think about all the repetitive, manual tasks that eat up your team's time and energy every single day. These are the perfect candidates for a first AI project because the return on your effort is almost immediate and incredibly clear.

Finding Your Ideal Starting Point

To get the ball rolling and build confidence, consider one of these high-impact first steps:

Automate Document Intake: Imagine using an AI tool that can automatically read, sort, and pull key data from claims forms or new policy applications. A single change like this can slash countless hours of manual data entry and significantly cut down on human error.

Deploy a Customer Service Chatbot: You could implement a straightforward chatbot on your website to answer common questions – things like "What's the status of my policy?" or "How do I find my agent's contact info?". This frees up your human team to handle the more complex and valuable customer conversations.

These initial projects are so effective because they solve very specific, measurable problems. They essentially act as a proof-of-concept, demonstrating that AI isn't some intimidating beast, but a practical tool that can make everyone's work life a little easier.

The point of your first project isn't to overhaul the entire business overnight. It's to find one specific point of friction and prove that AI can make it smoother, faster, and more efficient.

So, here’s your first move. Sit down with your teams and do a simple internal audit to pinpoint the single biggest operational bottleneck you face. That bottleneck isn't a problem; it's your best opportunity to start your AI journey. Starting small and scaling smart is how you'll stay competitive and build a foundation for future growth.

Your Questions About AI in Insurance, Answered

Jumping into the world of AI always brings up a few practical questions, especially for small and medium-sized insurers. It's completely normal to wonder about the cost, how long it all takes, and whether you need to hire a whole new team. Let's tackle these common concerns head-on and show you that getting started with AI is more straightforward than you might think.

The goal here is to cut through the noise and give you clear, simple answers. Think of this as your starting point for making AI integration in insurance transformation feel like a manageable, and even exciting, next step.

How Much Does It Cost to Start with AI?

Let's get one myth out of the way: you don’t need a multi-million-pound budget to get started with AI. The cost is surprisingly flexible.

Instead of a massive, company-wide overhaul, think about starting with a small, focused pilot project. For instance, you could begin by automating document processing for just one claims team. A project like that costs a fraction of a full-scale deployment but delivers real, measurable value right away.

Many modern AI tools are now available on a subscription basis, which means you can avoid a huge upfront capital investment. This pay-as-you-go model lets you test the waters, prove the ROI, and then decide if you want to expand.

Do I Need a Team of Data Scientists?

While having a dedicated data science team is great for building custom AI models from scratch, it’s not a prerequisite to get going. Far from it.

Today’s AI platforms are often built for people who aren't data scientists. Many have "low-code" or "no-code" interfaces, meaning your existing IT team or even a tech-savvy business analyst can get them up and running.

For your first few projects, the smartest move is often to partner with a good technology vendor. They bring deep expertise to the table, handle the initial setup, and can even train your team along the way. It’s a great way to bridge any skills gap without a hiring spree.

The most important first step isn't hiring experts, but identifying a clear business problem that AI can solve. Technology partners can then help you apply the right solution without you needing to become an AI expert overnight.

How Long Does an AI Project Take?

The timeline really depends on the size of the project, but you can see results faster than you’d expect. A well-defined pilot project can start delivering value in as little as three to four months. A perfect example is setting up an AI-powered chatbot to answer common customer questions; it's a relatively quick win that immediately frees up your team.

A typical small project might look something like this:

Discovery and Planning (2-4 weeks): Nailing down the problem you want to solve and what success looks like.

Data Preparation and Setup (4-6 weeks): Getting your data organised and configuring the AI tool.

Pilot and Testing (4-6 weeks): Running a live test with a small, controlled group of users.

Review and Refinement (2 weeks): Looking at the results and tweaking the system before a wider rollout.

This step-by-step approach gets you a return on your investment quickly, building the confidence and momentum you need for bigger things.

For more answers to common questions about AI, you might also find this external resource helpful: AI in Insurance FAQs.

At Cleffex Digital Ltd, we specialise in creating custom AI solutions that solve real-world business challenges for insurers. We can help you identify the perfect starting point for your AI journey and build a practical roadmap for success. Cleffex.com.